CBS News

Economic outlook continues to improve, CBS News poll finds

Americans’ economic outlook continues to improve, even if it still isn’t great.

The number who see economic growth, or even a boom coming, has risen for the second consecutive month; the number who fear a recession is down again.

Ratings of the current economy are at their highest level in over two years; they’ve also been trending up, albeit slowly and are still mired in negative territory.

(This is the case despite the fact that more people say they’re seeing negative news stories about the economy than positive stories.)

As the economy’s ratings improve a bit, President Joe Biden’s rating for handling that economy have also edged back up. Though still net-negative, it’s now as high as it’s been since 2022. It’s not unusual for those measures to be at least somewhat related.

Ongoing concerns about Biden

However, on a more personal measure, voters continue to have widespread concerns about Mr. Biden and age-related issues, as they have voiced for some time.

Last week’s press conference and special counsel’s statement did not change them.

There is still the minority one-third of voters who think Biden would finish a second term if he wins one, and only a third who believe he has the cognitive health to serve. Those views are essentially the same as a few months ago.

(For context: just a quarter of Americans say they’ve heard a lot about the special counsel’s statement – perhaps owing to it occurring in a week that included that Super Bowl.)

Though neither Biden nor the Republican frontrunner Donald Trump fare especially well on views about their respective cognitive health, Biden does much worse by comparison.

There’s been no substantial change of late to the roughly one-third of Democrats who don’t think he should run again.

Americans back NATO

Donald Trump stirred controversy with statements about defending NATO countries, but nonetheless, the idea of the U.S. promising to help defend NATO from Russia draws very wide, bipartisan support.

Looking overseas at Ukraine, Israel

Sending military aid and weapons to Ukraine continues to enjoy majority support.

Beneath those overall numbers there are some partisan differences: Democrats show a big majority in favor, while Republicans are more divided, with a narrower majority against.

Mr. Biden’s handling of the Israel-Hamas conflict is still negative. Most Americans (and notably, a large majority of members of his own Democratic Party) want Mr. Biden to encourage Israel to either stop or decrease its military actions in Gaza.

It’s Republicans, by contrast, who’d have Biden encourage Israel to increase or continue their military actions.

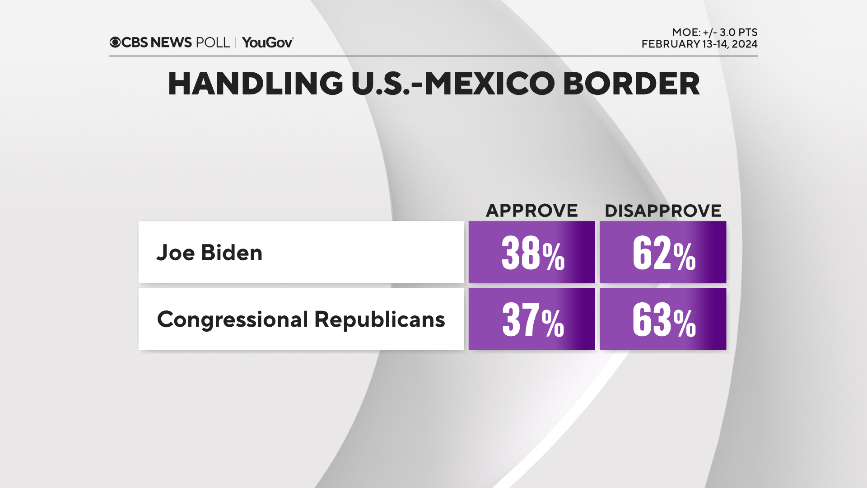

Negative ratings for Biden, congressional Republicans on the border

Both Mr. Biden and congressional Republicans continue to get negative marks for handling the U.S.-Mexico border, as a potential deal is reportedly stymied.

A big majority of Republicans say former President Donald Trump should have at least some say over what congressional Republicans do about the border now, including many who want him to have a lot of say.

This comes amid reports that congressional Republicans took cues from Trump to reject a deal, so it appears most of their party’s rank-and-file would want it that way.

Hearing more from Biden?

People would like to see more of Mr. Biden on balance, rather than less; the net effect would be to have him talk to the nation more than he currently does.

Although many want more, what they’ve seen so far isn’t necessarily boosting their views. Americans tend to think Mr. Biden’s appearances worsen, rather than bolster, views of his job performance. That’s heavily driven by Republicans. Democrats are net positive, but most don’t think those appearances change anything.

As has long been the case, Biden’s overall approval has been closely tied to the economy during his term and it has hovered in the low-40s range for years now; today, it’s at 42%, which is one point higher than last month.

This CBS News/YouGov survey was conducted with a nationally representative sample of 1,744 U.S. adult residents interviewed between February 13-14, 2024. The sample was weighted according to gender, age, race, and education based on the U.S. Census American Community Survey and Current Population Survey, as well as past vote. The margin of error is ±3.0 points.

CBS News

Iranian operative charged in pre-election scheme to assassinate Trump, other U.S. targets

An operative working for Iran’s Islamic Revolutionary Guard Corps told federal investigators that he was tasked in September with “surveilling, and, ultimately, assassinating” President-elect Donald Trump, according to court records unsealed Friday.

Prosecutors say Farhad Shakeri, who is believed to be residing in Iran, told investigators in a phone interview that unnamed IRGC officials pushed him to plan an attack against Mr. Trump last month. If the plan could not come together in time, the Iranian officials directed Shakeri to delay the plot until after the presidential election because the official “assessed that [Mr. Trump] would lose the election,” charging documents revealed.

Shakeri and two individuals living in the U.S. — Carlisle Rivera of Brooklyn, New York; and Jonathon Loadholt of Staten Island — were charged as part of a broad Iran-backed scheme to allegedly surveille and ultimately assassinate individuals inside the U.S. who opposed the Iranian regime.

FBI investigators wrote that Shakeri immigrated to the U.S. as a child from Iran, but was deported in 2008 after serving more than a decade in prison on robbery charges. They alleged the IRGC ultimately used Shakeri to recruit criminal contacts inside the U.S. to carry out specific operations like targeting an unnamed Iranian American journalist and activist living in New York.

In February, prosecutors alleged Shakeri paid Rivera and Loadholt about $1,000 to monitor the activist — who has spoken out against Iran’s regime — at an event at Fairfield University in Connecticut. The surveillance operations continued into March, according to court documents, when the pair allegedly traveled multiple times to the activist’s Brooklyn home. Text messages, security camera footage and cell site location data revealed their numerous trips.

“On or about April 1, 2024, 9 SHAKERI and RIVERA exchanged voice notes discussing RIVERA and LOADHOLT’ s efforts to locate and murder” the Iranian American, court records said.

“This b**** is hard to catch, bro,” Rivera allegedly said to Shakeri. “There ain’t gonna be no simple pull up, unless there[‘s] the luck of the draw.”

According to court records, Shakeri allegedly responded later, “you just gotta have patience and don’t, kicking, kick in the door is not an option because that’s a fail, that’s a fail maneuver. You gotta wait and have patience to catch her either going in the house or coming out, or following her out somewhere and taking care of it. Don’t think about going in. In is a suicide move.”

Investigators searched online accounts belonging to Rivera and Loadholt in the course of the federal probe and uncovered numerous images of firearms and other weapons.

In April, Shakeri agreed to pay Rivera and Loadholt $100,000 to “finish the work” and said he was tasked by the IRGC to hire individuals to assassinate the journalist. And by July, according to charging documents, the Iranians were growing impatient, instructing their U.S. assets to “take care of it already.”

The alleged plot to kill the activist did not succeed.

Rivera and Loadholt are not accused of being part of the plot to target Mr. Trump. They made their initial appearance in federal court on Thursday and were ordered detained, according to the Justice Department. Shakeri remains at large.

“We will not stand for the Iranian regime’s attempts to endanger the American people and America’s national security,” Attorney General Merrick Garland said in a statement.

The charges announced Friday are not the first brought against alleged operatives of the IRGC for plotting to kill Mr. Trump. Earlier this year, the FBI arrested Asif Merchant for planning to assassinate U.S. government officials, including potentially the president-elect. Merchant remains in custody and pleaded not guilty.

On at least five occasions between September and November, Shakeri participated in “voluntary telephonic interviews with FBI agents” in exchange for a sentence reduction for another individual serving time in the U.S, court records said.

During the interviews, he allegedly told the FBI of the IRGC’s desire to kill the Iranian American activist and target Israeli tourists in Sri Lanka with a mass shooting event. Shakeri also told investigators that the IRGC tasked him with surveilling two Jewish American citizens living in New York, but he did not provide the Iranian officials with information about the unnamed targets.

During the interview, Shakeri also allegedly told the FBI about the effort to target Mr. Trump.

In a statement, FBI Director Christopher Wray said, “The Islamic Revolutionary Guard Corps — a designated foreign terrorist organization — has been conspiring with criminals and hitmen to target and gun down Americans on U.S. soil and that simply won’t be tolerated.”

The charges and allegations announced Friday are part of broader posture by U.S. intelligence and law enforcement to publicly bring attention to Iran’s alleged efforts to quiet dissidents on U.S. soil and target U.S. government figures after the killing of IRGC General Qasem Soleimani by American forces in 2020. Mr. Trump and former members of his administration have been forced in recent years to increase his security due to the threats.

The Justice Department has charged numerous other defendants in recent years with acting on behalf of Iran by targeting outspoken dissidents living in the U.S.

Attorneys for Rivera and Loadholt were not immediately identified.

CBS News

Maps show drought and fire conditions in Northeast states

The Northeastern U.S. is experiencing ongoing drought conditions, which is helping to fuel an uptick in fire danger. For Friday, an elevated fire weather outlook was issued by the National Weather Service’s Storm Prediction Center for the area stretching from Massachusetts to the northern edge of Virginia and West Virginia.

CBS News

The threat with this elevated fire risk is due to winds picking up to 10-15 mph, with wind gusts upwards of 25-35 mph. Relative humidity levels are as low as 20% in some spots, as well. Red flag warnings have been issued into the evening hours of Friday across parts of the Northeast and New England.

CBS News

The weekly drought monitor came in on Thursday, and 57% of the Tri-State area of metro New York, New Jersey and Connecticut is under a moderate drought. Brushfires flared up along the New Jersey Palisades overnight while firefighters fought other blazes in southern New Jersey, and multiple wildfires have been burning in Massachusetts, where drought conditions range from moderate to severe.

CBS News

Here’s more on the conditions states in the region are facing:

For Massachusetts, 84% of the state is in MODERATE drought while 32% is in SEVERE drought. Boston received its last measurable rainfall on Oct. 30 of 0.18 inches. Boston’s average annual rainfall accumulation is 36.46 inches and the city has received 36.38 so far this year.

For Connecticut, 100% of the state is now in MODERATE drought, up from only 14% of the state at that level just last week. New Haven saw its last measurable rainfall back on Oct. 7 of 0.27 inches. (Technically it received 0.01 inches on Nov. 1 but that was not very significant.) Hartford, which receives an average of 40.25 inches of rainfall annually, has gotten 39.29 so far this year.

For New York, 85% of the state is ABNORMALLY DRY while 26% of the state is now in a MODERATE drought. New York City’s Central Park received its last measurable rainfall back on Sept. 29, with 0.78 inches. (Technically it got 0.01 inches on Oct. 29 but that was not significant either.) Central Park normally averages 42.38 inches of annual rainfall and has received 38.49 inches so far this year.

For New Jersey, 76% of the state is now under a SEVERE drought and it has worsened into an EXTREME drought in almost 20% of the southeastern section of the state. Newark Liberty International Airport had its last measurable rainfall on Sept. 29 of 0.39 inches. Newark receives on average 39.88 inches of rain annually and has received 34.82 so far this year.

For Pennsylvania, 22% of the state is now under a SEVERE drought with 4% in EXTREME drought. Philadelphia had its last measurable rainfall back on Sept. 29 of 0.11 inches. Philadelphia receives on average annual rainfall of 37.89 inches and has received 33.43 so far this year.

For Maryland, 53% of the state is now under a SEVERE drought with 4% in EXTREME drought. Baltimore saw its last measurable rainfall back on Oct. 1, with 0.35 inches. Baltimore averages 38.94 inches of rainfall annually and has only received 31.71 inches so far this year.

The dry conditions are not expected to last much longer in the Northeast, as the next chance of rain can come as early as Sunday night.

CBS News

When can a credit card company sue you for non-payment?

Getty Images

Credit cards can be a convenient way to manage expenses, but they also come with a serious responsibility to repay the borrowed funds on time. When a credit card account goes unpaid, it can result in late fees, penalty interest rates and damaged credit scores — and in certain cases, non-payment can lead to even more severe repercussions, like being sued for your unpaid debt. A lawsuit over unpaid credit card debt may sound extreme, but it’s a real possibility if your debts are left unaddressed.

The good news is that creditors don’t initiate lawsuits lightly — they typically attempt to work with the borrower first. But when these attempts fail and a credit card account remains delinquent, a lawsuit can be an option for creditors to pursue. Knowing when this step is likely to happen can help you take proactive measures to avoid such a scenario.

So when exactly can a credit card company sue you for non-payment? And what are the ways to resolve credit card debt without facing a lawsuit? Below, we’ll explain what you should know about when a credit card company can take legal action over unpaid debt and what strategies you can use to manage and reduce your debt load effectively.

Get rid of your delinquent credit card debt now.

When can a credit card company sue you for non-payment?

In general, a credit card company can sue you for non-payment once your account becomes severely delinquent, typically after 90 to 180 days of missed payments. When you initially miss a payment, the company will notify you and your account begins accruing late fees and possibly a higher penalty interest rate. As missed payments accumulate, the creditor’s collection efforts intensify. This can involve more frequent phone calls, letters and possibly offers to set up a payment plan.

If you’re unable to make a payment during this initial period, the account will likely be “charged off” or written off as a loss by the credit card company after 180 days of delinquency. At this stage, it’s common for the credit card company to sell the debt to a collection agency at a discounted rate — typically pennies on the dollar. At that point, the collection agency typically owns your debt.

Once a collection agency takes over your account, they have the right to pursue the debt on their own behalf. Collection agencies may contact you through calls, letters or other forms of communication to collect the balance. However, if the debt remains unpaid even after collection efforts, the collection agency may file a lawsuit. The decision to sue depends on several factors, including the amount owed, the collection agency’s policies and whether they believe legal action will yield repayment.

Receiving a lawsuit summons is typically the final warning that your debt has reached a critical stage. If the court rules in favor of the credit card company or collection agency, they may be granted a judgment that allows for methods like wage garnishment or property liens to recover the owed amount. Remember, though, that each state has a statute of limitations on debt, which is typically between three and 10 years. After that point, the creditor may no longer sue, although they can still attempt to collect it through non-legal means.

Find out how to lower your credit card debts today.

How to avoid a lawsuit over unpaid credit card debt

If you’re struggling with credit card debt, there are strategies available to avoid a lawsuit, including:

Contact your credit card company

When financial hardship makes it difficult to meet payments, one option is to contact your credit card company, as they may have hardship programs or alternative payment plans that can help. These programs can reduce interest rates, waive late fees or extend payment deadlines temporarily and addressing the issue early can prevent the account from escalating to collections or legal action.

Use debt relief to tackle what you owe

The following debt relief strategies could also be worth considering to avoid a lawsuit over unpaid credit card debt:

- Debt management: With a debt management plan, a credit counseling agency negotiates with your creditors to create a single, affordable monthly payment, often with reduced interest rates and fees.

- Debt settlement: With debt settlement (also known as debt forgiveness), the goal is to negotiate a lump-sum payment that’s less than the total owed, reducing your debt obligation.

- Debt consolidation loans: A debt consolidation loan through a bank or traditional lender may also be an option. This type of loan combines multiple credit card balances into a single loan, ideally with a lower interest rate, making monthly payments more manageable.

- Debt consolidation programs: When you enroll in a debt consolidation program, you work with a debt relief company to secure a debt consolidation loan through a third-party lender, allowing you to make one monthly payment at a lower rate.

The bottom line

Facing a lawsuit over unpaid credit card debt can be intimidating, but understanding when legal action is likely to happen can help you take control of your financial situation before it reaches that point. Early intervention, such as contacting your creditor or pursuing debt relief, can prevent your debt from escalating and help you manage repayment in a way that suits your financial needs. After all, taking the time to address unpaid credit card debt now can relieve stress and safeguard your financial future.