CBS News

How far will CD rates fall if the Fed cuts rates? Here’s what experts say

PHIL LEO/Getty Images

Inflation has been high for years now, and while it’s decreased quite a bit from its peak of 9.1% in June 2022, it’s still below the Federal Reserve’s target goal of 2%. To move the needle and curb spending further, the Fed has kept interest rates paused at a 23-year high at its last three meetings.

While that’s bad for consumers using credit cards, mortgages and loans, as higher rates mean paying more in interest on the money borrowed, it’s a boon for savers, resulting in hefty interest rates on savings accounts and certificates of deposit (CDs).

What goes up must come down, though, and at some point, the Fed is likely to make rate cuts once inflation is under control. While the Fed rate doesn’t directly impact the rates on savings accounts and CDs, the two generally move in the same direction. So the question remains: How long will these high CD rates last? And if the Fed does cut rates, how far will CD rates have to fall?

Find out the best CD options available to you today.

How far will CD rates fall if the Fed cuts rates? Here’s what experts say

Here’s what experts have to say about how far CD rates could fall if the Fed cuts rates.

CD rates will fall incrementally in the short term

Experts largely agree that CD rates are headed for a downturn — and that could potentially happen soon. According to the CME Group FedWatch Tool, the Fed may start cutting rates at its upcoming June or July meeting, though that may be less likely with the March inflation rate ticking back up to 3.5%.

When a rate cut happens, experts predict a 0.25-point drop. This should trickle down to CD rates with a roughly 0.25% drop as well, experts say.

“Based on current trends, the Fed is likely to start cutting rates this summer and reduce the target rate two to three times in 2024 — about a quarter of a point each time,” says Stacy Johnson, senior portfolio manager for TIAA. “However, they will adjust as needed if the data and trends change.”

That last point is key, as experts say it won’t be a steep downslide by any means — but rather a slow descent over time.

“The risks are balanced with regard to policy adjustments, and they plan to execute in a measured fashion,” says Jeff Krumpelman, chief investment strategist and head of equities at Mariner Wealth Advisors. “They can cut, but they can take their time doing so.”

Explore your top CD options online now.

Expect a bigger fall by the end of the year

If inflation trends downward in the future and the Fed stays on track with its three rate cuts, experts say a 0.75-point dip in CD rates is likely on the horizon — at least by the end of 2024.

“It has long made sense that the Fed cut rates three times and by a moderate 75 basis points this year,” Krumpelman says.

Don’t expect those dips to hit all CD terms equally though. Short-term CDs, which are more tightly tied to the Fed’s rate, “will fall far faster than longer-dated maturities,” he says.

They won’t bottom out, though. While experts predict the yield curve will invert later this year or early next — meaning longer-term CDs will once again start paying more than shorter-term ones — short-term CDs should still offer solid rates for those who use them.

“Shorter CD rates won’t collapse and will still offer far higher yields than the ones we experienced in 2021 and prior years,” Krumpelman says. “Even in 2025, we expect short CDs to pay more than 3%.”

The bottom line

With CD rates poised to fall in the future, you may want to open any new CDs you’re eyeing now. This will allow you to lock in today’s higher interest rates and ensure solid long-term returns. Just be sure you have a timeline in mind for when you’ll need the cash, as most CDs come with early withdrawal penalties.

“It’s important to time the CD maturity with your goal of when you need the money,” says Kendall Meade, a certified financial planner with SoFi. While it may seem strange to choose a long-term CD with lower rates, Meade says to remember: You’re locking that in for years.”

If you’re not sure when you’ll need the cash, consider laddering your CDs — or getting several accounts with different maturity lengths. Krumpelman recommends opening CDs “scattered across various years — some coming due in one, two, three, four, five, and six years. This is a moderate approach that minimizes your interest rate risk.”

CBS News

Exclusive discounts from CBS Mornings Deals

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Oklahoma attorney general says state schools superintendent cannot mandate students watch prayer video

The Oklahoma attorney general’s office responded after the state’s education superintendent sent an email this week to public school administrators requiring them to show students his video announcement of a new Department of Religious Freedom and Patriotism. In the video, he prays for President-elect Trump.

Ryan Walters, a Republican, announced the new office on Wednesday and on Thursday sent the email to school superintendents statewide. The new department will be within the state’s Department of Education. Walters said it would “oversee the investigation of abuses to individual religious freedom or displays of patriotism.”

“In one of the first steps of the newly created department, we are requiring all of Oklahoma schools to play the attached video to all kids that are enrolled,” according to the email. Districts were also told to send the video to all parents of students.

In the video, Walters says religious liberty has been attacked and patriotism mocked “by woke teachers unions,” then prays for the leaders of the United States after saying students do not have to join in the prayer.

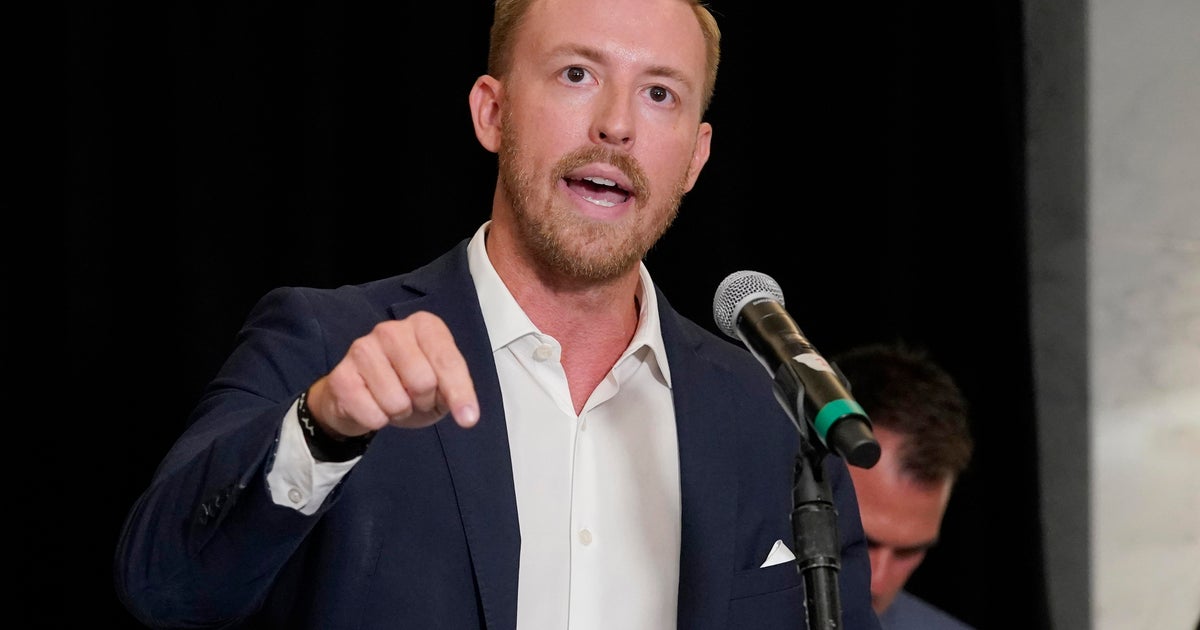

Sue Ogrocki / AP

“In particular, I pray for President Donald Trump and his team as they continue to bring about change to the country,” Walters said.

The office of state Attorney General Gentner Drummond issued a statement Friday saying Walters has no authority under state law to issue such a mandate.

“Not only is this edict unenforceable, it is contrary to parents’ rights, local control and individual free-exercise rights,” said the attorney general’s office spokesperson Phil Bacharach.

Multiple school districts have also said they had no plans to show students the video.

Walters, a former public school teacher elected in 2022, ran on a platform of fighting “woke ideology,” banning books from school libraries and getting rid of “radical leftists” who he claims are indoctrinating children in classrooms. He already faces two lawsuits over his June mandate that schools incorporate the Bible into lesson plans for students in grades 5 through 12. Several school districts have previously stated that they will disregard the mandate.

One of the lawsuits also notes that the initial request for proposal released by the State Department of Education to purchase the Bibles appears to have been tailored to match Bibles endorsed by now President-elect Donald Trump that sell for $59.99 each.

Earlier this week, Walters announced he had purchased more than 500 Bibles to be used in Advanced Placement government classes. The education department that the 500 Bibles are “God Bless the USA Bibles” and were ordered Thursday for about $25,000. They will arrive “in the coming weeks,” the department said.

CBS News

Kamala Harris raised more than $1 billion for her campaign. She’s still sending persistent appeals to donors after defeat.

Kamala Harris and the Democratic Party’s prodigious fundraising operation raised more than $1 billion in her loss to Donald Trump, but the vice president is still pushing donors for more money after the election.

Democrats are sending persistent appeals to Harris supporters without expressly asking them to cover any potential debts, enticing would-be donors instead with other matters: the Republican president-elect’s picks for his upcoming administration and a handful of pending congressional contests where ballots are still being tallied.

“The Harris campaign certainly spent more than they raised and is now busy trying to fundraise,” said Adrian Hemond, a Democratic strategist from Michigan. He said he had been asked by the campaign after its loss to Trump to help with fundraising.

The party is flooding Harris’ lucrative email donor list with near-daily appeals aimed at small-dollar donors — those whose contributions are measured in the hundreds of dollars or less. But Hemond said the postelection effort also includes individual calls to larger donors.

One person familiar with the effort and the Democratic National Committee’s finances said the Harris campaign’s expected shortfall is a relatively small sum compared to the breadth of the campaign, which reported having $119 million cash on hand in mid-October before the Nov. 5 election. That person was not authorized to publicly discuss the campaign’s finances and spoke on condition of anonymity.

But the scramble now underscores the expense involved in a losing effort and the immediate challenges facing Democrats as they try to maintain a baseline political operation to counter the Trump administration and prepare for the 2026 midterm elections. It also calls into question how Democrats used their resources, including hosting events with musicians and other celebrities as well as running ads in a variety of nontraditional spaces such as Las Vegas’ domed Sphere.

Patrick Stauffer, chief financial officer for the Harris campaign, said in a statement that “there were no outstanding debts or bills overdue” on Election Day and there “will be no debt” listed for either the campaign or the DNC on their next financial disclosures, which are due to the Federal Election Commission in December.

The person familiar with the campaign and DNC’s finances said it was impossible to know just where Harris’ balance sheet stands currently. The campaign still is getting invoices from vendors for events and other services from near the end of the race. The campaign also has outstanding receipts; for example, from media organizations that must pay for their employees’ spots on Air Force Two as it traveled for the vice president’s campaign activities.

Within hours of Trump picking Florida Republican Matt Gaetz for attorney general on Wednesday, Harris’ supporters got an appeal for more money for “the Harris Fight Fund,” citing the emerging Trump team and its agenda.

Gaetz, who resigned his House seat after the announcement, “will weaponize the Justice Department to protect themselves,” the email said. It said Democrats “must stop them from executing Trump’s plans for revenge and retribution” and noted that “even his Republican allies are shocked by this” Cabinet choice.

Another appeal followed Friday in Harris’ name.

“The light of America’s promise will burn bright as long as we keep fighting,” the email said, adding that “there are still a number of critical races across the country that are either too close to call or with the margin of recounts or certain legal challenges.”

The emails do not mention Harris’ campaign or its finances.

The “Harris Fight Fund” is a postelection label for the “Harris Victory Fund,” which is the joint fundraising operation of Harris’ campaign, the DNC and state Democratic parties. Despite the language in the recent appeals, most rank-and-file donors’ contributions would be routed to the national party, unless a donor took the time to contact DNC directly and have the money go directly to Harris or a state party.

The fine print at the bottom of the solicitation explains that the first $41,300 from a person and first $15,000 from a political action committee would be allocated to the DNC. The next $3,300 from a person or $5,000 from a PAC would go to the Harris for President “Recount Account.” Anything beyond that threshold, up to maximum contribution limits that can reach into the hundreds of thousands of dollars, would be spread across state parties.

Officials at the DNC, which is set to undergo a leadership change early next year, indicated the party has no plans to cover any shortfall for Harris but could not explicitly rule out the party shifting any money to the campaign.