CBS News

NASA shows off image “acquired by chance” of U.S. military’s abandoned “city under the ice” in Greenland

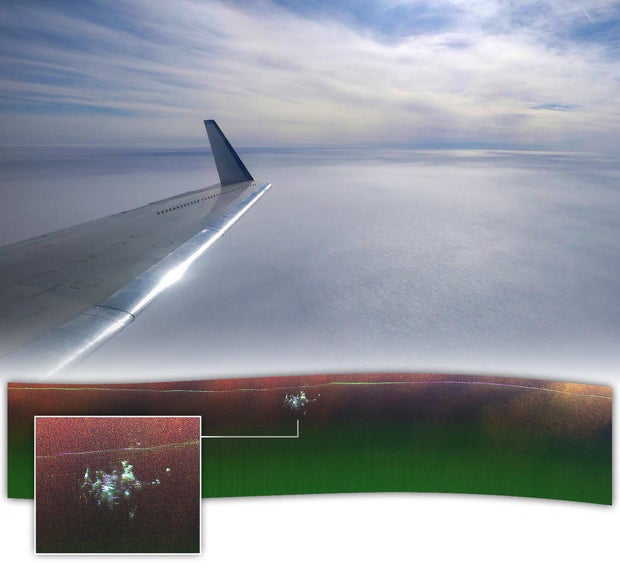

As NASA scientist Chad Greene flew over northern Greenland with a team of engineers in April, they never expected their radar to find something manmade buried deep within the ice. Greene and his team were flying above the Greenland Ice Sheet on a NASA Gulfstream III plane, scanning the barren expanse of ice that’s more than a mile deep in some areas, when their radar instrument picked up something unusual.

“We didn’t know what it was at first,” Greene said in a statement released by NASA’s Earth Observatory this week, along with new images of the discovery. “We were looking for the bed of the ice and out pops Camp Century.”

It turns out the team had stumbled upon an abandoned Cold War-era military base built by the U.S. Army Corps of Engineers in 1959. Nicknamed the “city under the ice,” the compound consists of a network of tunnels carved into the ice sheet. It was abandoned in 1967 and, over time, became buried about 100 feet below the surface as snow and ice accumulated.

The base was built as part of Project Iceworm, a then-secret plan to experiment with building a missile launch site under the Greenland Ice Sheet during the Cold War, when tension soared between the U.S. and the then-Soviet Union. Camp Century, a remote, nuclear-powered installation, was built to study the feasibility of such a project, but it was never realized and the base was decommissioned under the assumption it would be buried forever under the ice.

Pictorial Parade/Archive Photos/Getty

While the “city under the ice” had been picked up by previous radar scans, the instruments used on the NASA flight in April provided a more detailed, if unexpected, survey.

“In the new data, individual structures in the secret city are visible in a way that they’ve never been seen before,” said Greene, who works with NASA’s Jet Propulsion Laboratory.

Past scans had used a type of radar that points straight down at the ground and produces a two-dimensional scan of structures buried beneath the ice. Greene’s flight used NASA’s Uninhabited Aerial Vehicle Synthetic Aperture Radar, which is able to produce maps with “more dimensionality,” according to the agency.

A photo released by NASA on Monday showed the features of the base hidden deep under the ice, appearing as anomalies near the base of the ice sheet.

NASA Earth Observatory/Michala Garrison, Jesse Allen, Chad Greene

“Scientists have used maps acquired with conventional radar to corroborate estimates of Camp Century’s depth — part of an effort to estimate when melting and thinning of the ice sheet could re-expose the camp and any remaining biological, chemical, and radioactive waste that was buried along with it,” NASA’s Earth Observatory said in its article this week. “The scientific utility of the new UAVSAR image of Camp Century remains to be seen; for now, it remains a novel curiosity acquired by chance.”

A 2016 study of the abandoned base suggested that the facility could no longer be considered “preserved for eternity,” due to climate change increasing the rate at which Arctic ice is melting.

CBS News’ Walter Cronkite visited Camp Century for a tour of the still-under-construction facility for a program that aired in 1961. The camp’s commander, Captain Tom Evans, explained to him that the goals of the program were three-fold: “The first one is to test out the number of promising new concepts of polar construction. And the second one is to provide a really practical field test of this new nuclear plant. And, finally, we’re building Camp Century to provide a good base, here, in the interior of Greenland, where the scientists can carry on their R&D activities.”

CBS

The exact nature of that research and development work wasn’t discussed in Cronkite’s report for the CBS documentary show “The Twentieth Century.” (An abridged version of that report can be viewed at the link above.)

Speaking with 60 Minutes in 2016, as that show revisited Cronkite’s decades-old trip to Camp Century, producer Daniel Ruetenik said the trip was fascinating, and he marveled at the evolution of human interest in the vast, frozen expanse of the Greenland Ice Sheet.

“At the time [of Camp Century], the Cold War was considered to be the greatest threat to humanity,” Ruetenik said. “And now, the area has become a destination for climate scientists trying to study changes in the environment. So, it has a second purpose now.”

CBS News

Do you need good credit to enroll in a debt forgiveness program?

Getty Images

Managing a growing amount of credit card debt can be a stressful challenge — but it’s one that millions of Americans deal with each day. After all, the cost of essentials has increased drastically over the last few years, and that has forced many people to rely on short-term borrowing options, like credit cards, to help cover their necessary purchases. As a result, the average cardholder owes nearly $8,000 on their credit cards, and with the average card rate sitting at an all-time high of over 23%, it doesn’t take long for what was once a manageable amount of credit card debt to become an overwhelming burden.

When that happens, the idea of debt forgiveness — also known as debt settlement — may offer a glimmer of hope. These programs, which are offered by debt relief companies, can help lower your credit card debt by negotiating with your creditors to settle your debts for less than the full amount owed, providing a way to regain financial stability. And, in many cases, pursuing this type of debt relief can result in paying 30% to 50% less than what you currently owe, which means you could get substantial relief from your high-rate debts by taking this route.

But if you’ve been considering a debt forgiveness program, you might be under the assumption that, like traditional loans and credit products, these programs require a good credit score for enrollment. But do you really need good credit to take advantage of what debt forgiveness can offer? Below, we’ll explain what borrowers need to know.

Compare the debt relief options available to you here.

Do you need good credit to enroll in a debt forgiveness program?

There are certain eligibility criteria that you must meet to take advantage of this type of debt relief, but in general, no — your credit score does not determine your eligibility for debt forgiveness programs. In fact, many participants in these programs are already struggling with poor credit due to missed payments, high debt utilization or accounts in collections. Debt settlement companies understand this reality and are structured to assist those who are in financial distress.

What matters more than your credit score is whether you meet the other specific requirements for enrollment. Most debt settlement programs require participants to have a minimum amount of unsecured debt, such as credit card debt, medical bills or personal loans. This threshold often starts at about $7,500, although it can vary by debt relief provider. You must also be able to demonstrate genuine financial hardship, meaning you’re unable to meet your current debt obligations. This could stem from a loss of income, unexpected expenses or other financial setbacks.

Not all debts qualify for settlement, either. Secured debts, such as mortgages or car loans, are typically excluded from these programs — so if you’re trying to enroll with mostly secured debts, you may not qualify. Participants must also be prepared to make consistent monthly payments into a dedicated account that will be used to negotiate settlements with creditors. So while a good credit score isn’t necessary, a willingness to commit to the process is essential.

Learn more about debt forgiveness and your other debt relief options today.

How will debt forgiveness impact my credit score?

While a good credit score isn’t required as part of debt forgiveness, participating in a debt forgiveness program can have a significant impact on your credit score, so it’s important to weigh this consequence carefully. Enrolling in such a program may cause your credit score to drop initially. This happens because most debt settlement strategies involve stopping payments to creditors while the negotiations take place. As missed payments accumulate, your credit report will reflect delinquencies, which can lower your score.

When a settlement is reached, your creditor will typically report the debt as “settled” rather than “paid in full.” While this is better than leaving the debt unpaid, it’s still considered a negative mark on your credit report. Settled accounts can remain on your credit history for up to seven years, signaling to future lenders that you did not fulfill the original terms of your debt.

Despite these initial setbacks, debt settlement can pave the way for long-term financial recovery. Successfully resolving your debts reduces your overall debt burden, which can improve your debt-to-income ratio. Over time, as you rebuild positive credit habits, such as making on-time payments and keeping credit utilization low, your credit score can recover and even improve. The key, however, is to approach debt settlement as part of a larger financial strategy, not a quick fix.

The bottom line

While you don’t need good credit to enroll in a debt forgiveness program, you do need to understand the trade-offs. These programs are tools to help you regain control of your finances, but they come with short-term credit implications. If your primary goal is to resolve overwhelming debt and you’re willing to accept a temporary dip in your credit score, debt forgiveness may be worth considering.

Before committing to any program, take time to evaluate your financial situation, explore alternative solutions and consult with a reputable debt relief provider. By doing so, you can make an informed decision that aligns with your long-term financial goals.

CBS News

White House announces 3 Americans released in China

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Why pet insurance could be a great gift this holiday season

Getty Images/iStockphoto

Pet insurance can be a great way to reduce the rising costs of pet care. This specialized insurance type can cover dogs, cats and some exotic animals. Veterinarian visits, medications and even some surgical procedures can be covered with a pet insurance plan. And it can be done at a reasonable price point, depending on the health and breed of the animal in question. This allows pet owners to keep more of their money while also providing peace of mind by knowing that they’ll be protected during emergencies or accidents.

And, during this time of year, it can also be a smart gift to give the dog or cat owner in your life (premiums can be paid in advance for the year or every month). Below, we’ll break down three reasons why pet insurance could be a great gift this holiday season.

Not sure if pet insurance will be worth buying? Get a free price quote first here, now.

Why pet insurance could be a great gift this holiday season

Here are three reasons why a pet insurance policy may be worth buying for a family member or friend this year:

The price is reasonable

Accident and illness policies range from $383 annually for cats to $676 annually for dogs, according to the North American Pet Health Insurance Association (NAPHIA). That’s less than $60 a month for a policy that can easily save pet owners thousands of dollars that they otherwise would have had to pay on their own. And prices may be even lower than those averages, depending on the health of the pet, the age at which a policy was applied for, and the specific breed of the cat or dog. Like all insurance types, however, it’s critical to shop around to see which providers are offering the most cost-effective care – and which ones just seem to be.

Start shopping for pet insurance online today.

Waiting could cause prices to rise

If you wait to buy pet insurance next year or even during the 2025 holiday season, that could be a costly mistake. Pet insurance providers reward owners who act early with lower premiums and greater coverage options to choose from. Waiting for the pet to age and, thus, increase the likelihood of health issues, will come at a potentially expensive cost. And if the dog or cat develops pre-existing medical conditions before applying, they could risk being denied coverage in full. Securing a policy now, then, prevents these scenarios from becoming a reality.

The timing makes sense

Ahead of the colder, winter months in which dogs may be injured due to icy conditions and snowy weather, a pet insurance policy makes sense to secure now. With issues like frostbite, sprains and fractures due to slips, falls and more, locking in coverage today could be smart for when it may be needed in January or February. But it makes sense to apply for a plan now. There’s a waiting period of a few weeks (on average) between the time an application is approved and the time owners can access it. Being proactive, when coverage isn’t needed, could help owners complete this waiting period more easily than if they had applied post-injury.

The bottom line

A pet insurance policy for the pet owners in your life may not have been the first thing you thought of when compiling your holiday shopping list. But that doesn’t mean it can’t still be a thoughtful, inexpensive and valuable gift, either. By acting now you can potentially pay less for more coverage ahead of a time of year when many pet owners need additional medical protection. So start shopping for providers and policies now to learn more about this exciting gift opportunity.