CBS News

Economic outlook continues to improve, CBS News poll finds

Americans’ economic outlook continues to improve, even if it still isn’t great.

The number who see economic growth, or even a boom coming, has risen for the second consecutive month; the number who fear a recession is down again.

Ratings of the current economy are at their highest level in over two years; they’ve also been trending up, albeit slowly and are still mired in negative territory.

(This is the case despite the fact that more people say they’re seeing negative news stories about the economy than positive stories.)

As the economy’s ratings improve a bit, President Joe Biden’s rating for handling that economy have also edged back up. Though still net-negative, it’s now as high as it’s been since 2022. It’s not unusual for those measures to be at least somewhat related.

Ongoing concerns about Biden

However, on a more personal measure, voters continue to have widespread concerns about Mr. Biden and age-related issues, as they have voiced for some time.

Last week’s press conference and special counsel’s statement did not change them.

There is still the minority one-third of voters who think Biden would finish a second term if he wins one, and only a third who believe he has the cognitive health to serve. Those views are essentially the same as a few months ago.

(For context: just a quarter of Americans say they’ve heard a lot about the special counsel’s statement – perhaps owing to it occurring in a week that included that Super Bowl.)

Though neither Biden nor the Republican frontrunner Donald Trump fare especially well on views about their respective cognitive health, Biden does much worse by comparison.

There’s been no substantial change of late to the roughly one-third of Democrats who don’t think he should run again.

Americans back NATO

Donald Trump stirred controversy with statements about defending NATO countries, but nonetheless, the idea of the U.S. promising to help defend NATO from Russia draws very wide, bipartisan support.

Looking overseas at Ukraine, Israel

Sending military aid and weapons to Ukraine continues to enjoy majority support.

Beneath those overall numbers there are some partisan differences: Democrats show a big majority in favor, while Republicans are more divided, with a narrower majority against.

Mr. Biden’s handling of the Israel-Hamas conflict is still negative. Most Americans (and notably, a large majority of members of his own Democratic Party) want Mr. Biden to encourage Israel to either stop or decrease its military actions in Gaza.

It’s Republicans, by contrast, who’d have Biden encourage Israel to increase or continue their military actions.

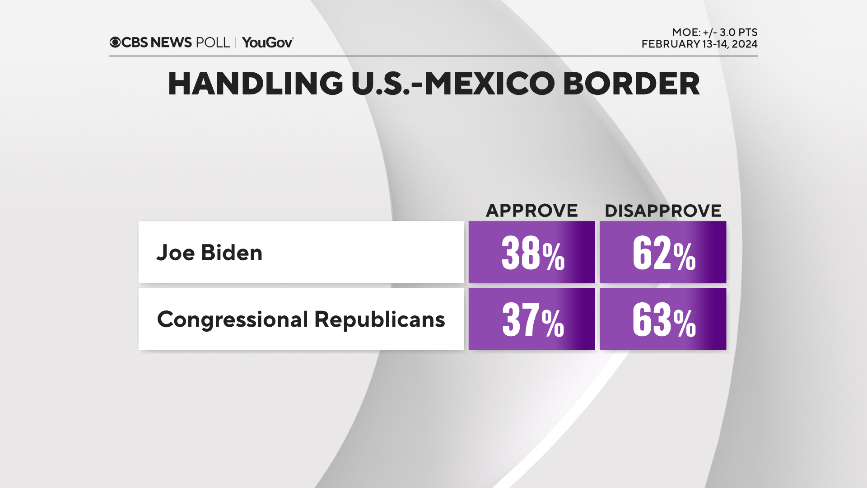

Negative ratings for Biden, congressional Republicans on the border

Both Mr. Biden and congressional Republicans continue to get negative marks for handling the U.S.-Mexico border, as a potential deal is reportedly stymied.

A big majority of Republicans say former President Donald Trump should have at least some say over what congressional Republicans do about the border now, including many who want him to have a lot of say.

This comes amid reports that congressional Republicans took cues from Trump to reject a deal, so it appears most of their party’s rank-and-file would want it that way.

Hearing more from Biden?

People would like to see more of Mr. Biden on balance, rather than less; the net effect would be to have him talk to the nation more than he currently does.

Although many want more, what they’ve seen so far isn’t necessarily boosting their views. Americans tend to think Mr. Biden’s appearances worsen, rather than bolster, views of his job performance. That’s heavily driven by Republicans. Democrats are net positive, but most don’t think those appearances change anything.

As has long been the case, Biden’s overall approval has been closely tied to the economy during his term and it has hovered in the low-40s range for years now; today, it’s at 42%, which is one point higher than last month.

This CBS News/YouGov survey was conducted with a nationally representative sample of 1,744 U.S. adult residents interviewed between February 13-14, 2024. The sample was weighted according to gender, age, race, and education based on the U.S. Census American Community Survey and Current Population Survey, as well as past vote. The margin of error is ±3.0 points.

CBS News

Beyoncé nominated for 11 Grammys

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Nov 8: CBS News 24/7, 1pm ET

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

4 smart home equity moves to make now that the Fed cut rates again

Getty Images/iStockphoto

While another Federal Reserve rate cut issued this week won’t be great for savers accustomed to earning high returns on their money, it will provide another boost to borrowers. Whether you were considering a mortgage, a personal loan or even just a credit card, a reduction to the federal funds rate helps, even if the amount of assistance will vary depending on the product.

One way it will help, perhaps in a significant fashion, however, is with home equity loans and home equity lines of credit (HELOCs). Because the home serves as collateral in these borrowing exchanges, rates on both items tend to be lower than other credit options. And with rate cuts now issued twice in the last three months, they’re poised to become even less expensive.

Still, home equity borrowing comes with some inherent risks, too. And borrowers should do all they can to avoid them. As such, there are some smart home equity moves to make now that the Fed has cut rates again. Below, we’ll break down four of them.

Start by seeing what home equity loan rate you could qualify for here.

4 smart home equity moves to make now that the Fed cut rates again

Rate cuts offer prospective home equity borrowers a unique chance to capitalize on their accumulated home equity, but they should approach this chance in a strategic and nuanced way. Specifically, they should consider the following moves now:

Monitor certain dates

If you opened a home equity loan at the start of this week and didn’t wait for the Fed to take action then you likely made a mistake. While the difference in rates over a few days was likely minor, every little bit helps, particularly when spread over an extended repayment period. It’s critical to monitor certain dates — like those surrounding a Fed rate cut or the next inflation report release — for opportunities to capitalize and to lock in a below-average rate. Fortunately, there are multiple upcoming dates in which borrowers can take advantage. But this will require a proactive approach and you’ll need to have your documentation ready and credit score in top shape to truly take advantage.

Explore your current home equity borrowing options online today.

Consider a HELOC over a home equity loan

A HELOC has a variable interest rate subject to drop now that the Fed has embarked on its new rate-cutting campaign. A home equity loan, meanwhile, has a fixed interest rate that will need to be refinanced in the future to exploit any rate declines. In today’s evolving rate climate, then, it’s worth considering a HELOC over a home equity loan, even if the latter’s current rate is slightly better than the former. Plus, HELOC rates will change independently each month on their own while home equity loan borrowers will need to pay closing costs to refinance their rates.

Don’t overborrow

It’s been a long time since rates were cut (September’s reduction was the first in more than four years). So it can be tempting to overborrow now that rates appear to be moving in the right direction. But that’s always a mistake, particularly when using your home equity. So avoid that temptation and crunch the numbers to make sure you’re only borrowing an amount that you can easily afford to repay.

Open it before the end of the year

Not sure if you should wait for home equity rates to fall further into 2025? If you’re planning on using the home equity for a home improvement project, you may want to open it before the end of the year, even with the possibility of additional rate cuts high right now. That’s because the interest on both home equity loans and HELOCs is tax-deductible if used for qualifying home repairs. If you wait until 2025, however, you’ll postpone this critical tax deduction until it comes time to file your return again in 2026. So consider opening it now, then, to position yourself for potential (and immediate) tax relief.

Learn more about your home equity loan options here.

The bottom line

Now could be a great time to access your home equity, with two rate cuts already issued this year and others likely in the near future. Borrowers should still take a smart approach, however. That involves monitoring certain calendar dates for opportunities to capitalize on a lower rate, considering a HELOC over a home equity loan, not overborrowing and opening it at the right time to potentially qualify for some specific tax benefits. By making these four smart home equity moves now, borrowers can better position themselves for financial success both in today’s cooling rate climate and over the full repayment period.