CBS News

3 surprising credit card debt forgiveness costs to know

Getty Images

Credit card debt is a growing crisis nationwide, with the total amount of credit card debt now sitting at an all-time high of $1.14 trillion, up nearly 6% from one year ago. As the total amount of credit card debt has been climbing, so has the number of late payments and maxed-out credit card accounts, illustrating the financial burden this type of debt can have on cardholders.

One major factor driving this crisis is the high-rate environment. The average credit card interest rate is almost 23% currently, which can significantly increase the cost of borrowing. Inflation also had a major impact on the cost of goods and services over the last few years, leaving people cash-strapped. And in this high-rate, high-cost environment, even those making regular payments can quickly fall behind.

For cardholders in dire financial straits, credit card debt forgiveness (also known as debt settlement) could be a lifeline. Debt forgiveness allows you to reduce your outstanding card balances by settling your debt for a lower amount. While it varies, debt forgiveness could reduce what you owe by 30% to 50%, offering significant relief. However, there are some surprising costs tied to this approach.

Frustrated with your expensive credit card debt? Find out how debt relief could help now.

3 surprising credit card debt forgiveness costs to know

Before pursuing credit card debt forgiveness, it’s important to know these hidden expenses.

Debt relief company fees

One of the most significant costs associated with credit card debt forgiveness are the fees charged by debt relief companies. While debt settlement can be pursued on your own, in many cases, cardholders will use a debt relief company to act as the intermediary between themselves and their creditors to secure the lower payoff amount. While their services can be valuable, they aren’t free.

Debt relief companies typically structure their fees as a percentage of the total debt balance or the amount of debt forgiven. This percentage generally ranges from 15% to 25% of the original debt amount. For example, if you have $20,000 in credit card debt and the company negotiates a 40% reduction, bringing your balance down to $12,000, you might still owe the debt relief company up to $5,000 in fees.

It’s important to note that these fees are charged in addition to the reduced balance you’ll need to pay your creditors. So while you may see a significant reduction in what you owe to credit card companies, the overall savings might not be as substantial once you factor in the debt relief company’s cost.

Learn more about the debt relief strategies available to you today.

Income tax implications

Another credit card debt forgiveness cost comes in the form of potential tax liabilities. When a creditor forgives a portion of your debt, the IRS generally considers the forgiven amount to be taxable income. This can come as a shock to those who assume that debt forgiveness equates to a clean financial slate.

For example, if you have $30,000 in credit card debt and $15,000 is forgiven through debt settlement, you may need to report that $15,000 as income on your tax return. Depending on your tax bracket, this could result in a significant tax bill come April.

Receiving a large sum of “income” from forgiven debt could also push you into a higher tax bracket, potentially affecting other aspects of your financial life, such as eligibility for certain deductions or credits. So, it’s crucial to factor in the potential tax implications as part of the overall cost-benefit analysis of debt forgiveness.

Higher borrowing costs

While credit card debt forgiveness can provide immediate relief from overwhelming balances, it often comes with a long-term cost in the form of higher borrowing costs. This is primarily due to the negative impact that debt settlement can have on your credit score.

When you settle a debt for less than the full amount owed, it’s typically reported to credit bureaus as “settled” rather than “paid in full.” This notation can remain on your credit report for up to seven years and can significantly lower your credit score. The exact impact varies depending on your credit profile, but it’s not uncommon to see drops of 100 points or more.

A lower credit score translates directly into higher borrowing costs. This affects not just future credit card applications but also mortgage rates, auto loan rates and insurance premiums. While these higher costs are often temporary, as credit scores can recover over time with responsible financial behavior, they still represent a significant consideration.

The bottom line

While credit card debt forgiveness can help you get rid of your high-interest debt, it’s important to approach this option with an understanding of its costs. The fees charged by debt relief companies, the potential tax implications and the long-term impact on borrowing costs can significantly reduce the net benefit of debt settlement. So before pursuing debt forgiveness, you may want to explore other options such as credit counseling, debt consolidation or negotiating directly with creditors, to determine what makes the most sense for you.

CBS News

Abortion rights support didn’t always translate into Harris support —CBS News poll analysis

Note: Exit poll percentages may have updated since this post.

In the 2024 election, 10 states had abortion-related measures on the ballot — and Americans voted in favor of protecting abortion access in seven of them.

But support for these ballot measures outpaced support for Kamala Harris, who made abortion rights a hallmark of her campaign.

In two key battlegrounds — Arizona and Nevada — voters backed measures that added the right to abortion to their state’s constitution, but nonetheless, Harris trails Donald Trump in the vote count in these states. CBS News has projected Nevada for Trump and Arizona currently leans Republican.

Here’s what the exit polls tell us about voters who “split their ticket:”

Voters favored abortion rights but the economy mattered more

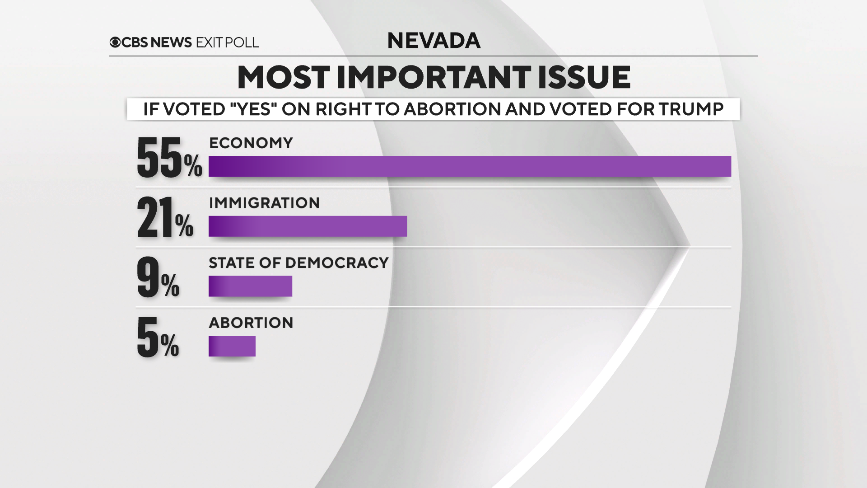

Most people who voted “yes” on abortion-related measures — Proposition 139 in Arizona and Question 6 in Nevada — also voted for Kamala Harris, but about a quarter of these voters backed Donald Trump.

For this group of voters, the economy was their top issue when voting for president. A majority described their finances as worse off compared to four years ago, so abortion rights mattered to them, but when it came to voting for president, other issues mattered to them more. These voters were also looking for a candidate who would bring needed change.

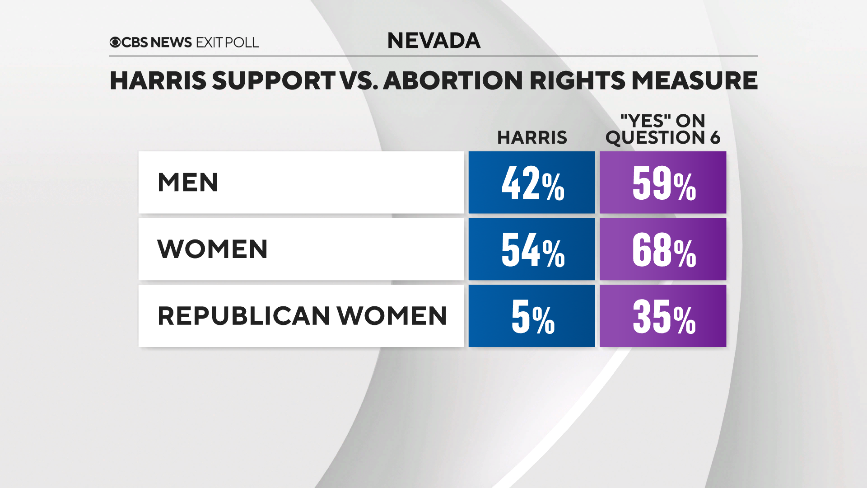

Across nearly every major demographic group in Nevada, more voted for the right to abortion referendum than they did for Harris, according to exit polls. This includes both men and women, younger voters and independents.

Kamala Harris made an appeal to Republicans, particularly Republican women, often on the issue of abortion rights, but few voted for her. A third of Republican women in Nevada voted “yes” on the right to abortion, but Harris had just single-digit support from these voters.

We see the same pattern among Latino voters, too, a group Harris lost ground with relative to Joe Biden in 2020. Majorities of Latino men and women in Nevada voted in favor of the state’s abortion ballot measure, but fewer of them backed Harris.

In CBS News pre-election polling, we found that Harris’ campaign argument that Trump would try to put a national abortion ban in place did not resonate with most voters outside the Democratic Party. Voters were more apt to believe Trump would leave the matter of abortion to the states, so this may have been on the minds of the voters who backed abortion rights in their own state but also backed Trump.

The CBS News exit poll interviewed thousands of voters across the country at more than 200 polling locations on Election Day and in the weeks leading up to Election Day in order to capture those who cast a ballot early. Edison Research conducted this poll for the National Election Pool.

CBS News

Who might fill Trump’s Cabinet?

With Republicans taking control of the Senate, many of President-elect Trump’s Cabinet nominees are likely to face an easy path to confirmation, even some who may be controversial.

Here are some of the possible people Trump is considering or has chosen for critical Cabinet posts and top White House jobs.

White House chief of staff

Susie Wiles

Alex Brandon / AP

The day after he was declared president-elect, Trump announced his campaign co-chair Susie Wiles would be his chief of staff. Wiles, an experienced political operative based in Florida, will be the first woman in U.S. history to fill the role. Chief of staff is not a Senate-confirmed position, but it is a prestigious position often considered to be part of the Cabinet.

By Kathryn Watson

Secretary of State

A source with knowledge of the discussions says GOP Sen. Bill Hagerty of Tennessee is under consideration for secretary of state, but so are a number of other candidates.

Andrew Harnik / Getty Images

Hagerty was the U.S. ambassador to Japan under Trump from 2017 until 2019, when he stepped aside to run for his current Senate seat.

By Margaret Brennan

Secretary of Defense

Former Secretary of State Mike Pompeo, 60, has been floated as a contender to lead the Defense Department, according to two sources familiar with the process.

/ Getty Images

Pompeo already has extensive experience in the Trump administration and in dealing with Trump himself. He was both secretary of state and CIA director in the first Trump administration. He served as a cavalry officer patrolling the Iron Curtain prior to the Berlin Wall falling, before enrolling in Harvard Law School. He also served in Congress from 2011 to 2017.

By James LaPorta and Robert Costa

Treasury secretary

Vincent Alban/Bloomberg via Getty Images

Scott Bessent, the founder of a Connecticut-based hedge fund, Key Square Group, is a leading contender for Treasury secretary, and he’s been making a full-court press for the post, according to a source deeply involved in transition planning. Bessent has outside advocates building the case for him to Trump.

Drew Angerer / Getty Images

Trump’s former U.S. Trade Rep. Robert Lighthizer is also being floated for treasury secretary.

By Bob Costa, Major Garrett and Olivia Rinaldi

Commerce secretary

Linda McMahon, who served as small business administrator in Trump’s first term and is a former WWE CEO, is a top contender to lead the Department of Commerce, multiple sources familiar with discussions about the role say.

Andrew Harrer/Bloomberg via Getty Images

“It is hers if she wants it,” one senior Trump official said, adding that she is close to Trump and he trusts her.

McMahon also is co-chairwoman of the pro-Trump super PAC America First Policy Action, and is helping run the transition team with Trump’s friend, Howard Lutnick.

By Major Garrett and Fin Gomez

CIA Director

ANDREW HARNIK/POOL/AFP via Getty Images

Former U.S. Rep. John Ratcliffe, the former Director of National Intelligence under the first Trump administration, is a top name being floated for CIA director, according to several sources familiar with the discussions.

By Major Garret and Robert Costa

RFK Jr.

Robert F. Kennedy Jr. is being floated by some Trump allies to serve as the next head of the Department of Health and Human Services, multiple people close to the president-elect’s campaign say. Kennedy is scheduled to meet with Trump’s senior team next week, but a role in the administration is still unclear, according to a Trump source familiar with the discussions.

REBECCA NOBLE / Getty Images

The hope among Kennedy’s backers that he could be nominated to lead the department has grown in recent days after Republicans cemented control of the Senate.

Kennedy ran for president as an independent but dropped out of the race in August and endorsed Trump.

By Fin Gomez and Alex Tin

Trump’s family members

As of yet, it’s unclear whether any of Trump’s family members will work in his administration. In his first term, both daughter Ivanka Trump and son-in-law Jared Kushner worked in the White House, but they’ve taken a step back from involvement in their father’s political work.

CBS News

Queen Camilla to miss U.K.’s annual Remembrance events, palace says; Princess Kate expected to attend

Queen Camilla will miss Britain’s annual remembrance weekend events to honor fallen service personnel while she recovers from a chest infection, Buckingham Palace said Saturday.

The wife of King Charles III was due to join the royal family at a “Festival of Remembrance” at London’s Royal Albert Hall on Saturday night. The 77-year-old was also scheduled to honor the war dead at the Remembrance Sunday ceremony at the Cenotaph war memorial, a major event for Britain’s royals, the next day.

Kirsty Wigglesworth / Getty Images

“Following doctors’ guidance to ensure a full recovery from a seasonal chest infection, and to protect others from any potential risk, Her Majesty will not attend this weekend’s Remembrance events,” the statement said, adding that she was greatly disappointed.

Charles and his daughter-in-law Kate, the Princess of Wales, who both announced earlier this year that they had been diagnosed with cancer, are expected to attend the twin events.

The king was diagnosed with an undisclosed form of cancer in February but he has gradually returned to public duties after receiving treatment, and recently completed a trip to Australia and Samoa.

Kate underwent her own treatment for an unspecified type of cancer that was detected after abdominal surgery earlier in the year. She said in September that it has been a difficult year but expressed relief that she has completed chemotherapy.