CBS News

How the Fed rate cut can help you tackle credit card debt

Getty Images

This week, the Federal Reserve made headlines by conducting its first rate cut of 2024. While most analysts expected a modest 25 basis point reduction, the Fed surprised markets with a more significant 50 basis point cut, lowering its benchmark interest rate to a range of 4.75% to 5%.

This rate cut is welcome news for borrowers, as the Fed’s interest rate decisions influence the rates offered on various types of loans, from mortgages to auto loans. When the central bank lowers its rate, borrowing typically becomes cheaper. And in a time when debt is a growing burden for many Americans, any reduction in borrowing costs can make a big difference.

One group that could see big benefits from this rate cut is those carrying credit card debt. The total credit card debt nationwide now sits at a record high of $1.14 trillion and about 20% of cardholders maxed out, so millions of Americans could see some much-needed relief. But credit card rates don’t always fall significantly following a Fed rate cut, so how can the Fed’s decision help you tackle your card debt?

You have lots of options for tackling your high-rate card debt. Find out more here.

How the Fed rate cut can help you tackle credit card debt

There are a few ways the Fed rate cut could make it easier to get rid of your high-rate credit card debt, including:

By making it less expensive to consolidate debt

One possible outcome of the Fed rate cut is the potential to make debt consolidation more affordable. Debt consolidation involves taking out a new loan to pay off multiple existing debts, ideally at a lower interest rate. With the Fed’s rate cut, personal loans and debt consolidation loans — two popular tools for debt consolidation — may become more attractive options.

With average rates of about 12.5%, personal loans are already one of the most affordable borrowing options available, and these loans could see a further decrease in their interest rates, making them an even cheaper route for consolidating credit card debt. Similarly, the loans offered by debt consolidation programs might offer more competitive terms in the wake of the rate cut. So, by using one to tackle your debt now, it could be much cheaper to pay off what you owe.

Explore the debt relief options available to you now.

By making home equity borrowing cheaper

Another potential way the Fed rate cut can assist in tackling credit card debt is by making home equity borrowing more affordable. Home equity loans and home equity lines of credit (HELOCs) are typically offered at lower interest rates compared to credit cards, as they are secured by your home. And with the Fed’s rate cut, these already competitive rates could become even more attractive.

If you’re carrying significant amounts of card debt or need to roll multiple card debts into one loan, these borrowing products could allow you to access higher amounts than the average personal loan. That said, it’s important to approach this strategy with caution. You’re putting your property at risk if you’re unable to make payments, so it’s essential to have a solid repayment plan before pursuing this option.

By potentially lowering variable APRs on existing credit cards

While the impact may not be immediate or drastic, the Fed rate cut could lead to a slight reduction in the variable APRs on existing credit cards. Most credit cards have variable interest rates that are tied to the prime rate, which is influenced by the Fed’s benchmark rate.

As the prime rate decreases following the Fed’s cut, credit card issuers may lower their variable APRs accordingly. While this reduction might be modest, even a small decrease in your credit card’s APR can lead to savings over time, especially for those carrying large balances. It’s important to note, though, that these rate adjustments aren’t automatic or guaranteed.

Other options for tackling high-rate credit card debt

While the Fed rate cut opens up new possibilities for managing credit card debt, it’s worth exploring other available debt relief options:

- Debt management: A debt management plan can help lower your interest rates or reduce card fees while giving you a clear plan for paying off your debt, making the process cheaper and more efficient.

- Debt forgiveness or settlement: This option involves negotiating with creditors to settle your debts for less than what you owe, which could reduce your total balance by 30% to 50% or more in some cases.

- Negotiating with creditors: Some credit card companies may be willing to lower your interest rate or waive certain fees if you explain your financial hardship and have a history of on-time payments.

- Bankruptcy: As a last resort, bankruptcy can provide a fresh start for those overwhelmed by debt, but it also has long-lasting consequences.

The bottom line

While the Fed’s recent rate cut may not directly slash credit card interest rates, it does create a more favorable environment for tackling credit card debt. By potentially making debt consolidation and home equity borrowing more affordable, and possibly leading to slight reductions in variable APRs, the rate cut offers avenues for cardholders to address their debt more effectively. Combined with other debt relief strategies, this economic shift could provide the opportunity to work toward a debt-free future.

CBS News

Built-to-rent communities a growing U.S. trend amid sky-high housing costs

As housing costs skyrocket and the demand for affordable homes surges, builders across the U.S. are constructing entire blocks of single-family homes specifically designed for renters. These so-called built-to-rent communities can offer another option for those who want a home but cannot afford to buy one.

Texas resident Richard Belote says his rented home 90 minutes from Houston is a “good stepping stone, because interest rates are “just too high to manage.” Despite saving diligently to buy a home, he and his fiancee feel priced out of their house hunt.

“Just really kind of crossing our fingers that those rates go down,” he said.

Belote is far from alone.

A July CNN poll found 86% of renters say they can’t afford to buy a home and 54% say they believe it’s unlikely they’ll ever be able to. However, another poll found 81% of renters want to own a residence in the future.

“House prices have gone up by more than 40% in just four years,” said CBS News business analyst Jill Schlesinger. “There are a lot of people out there who really, really want to be in homes, and they just can’t afford to get there,” Schlesinger said.

Built-to-rent communities began in Phoenix during the Great Recession to meet that demand. They are higher density and smaller cottage-sized homes — a literal cottage industry now spreading in cities across the Sunbelt, including Phoenix, Atlanta and Dallas.

Brent Long leads the build-to-rent expansion for Christopher Todd Communities in Arizona. He says the renters range in age from Gen Z to Baby Boomers.

“It’s really renters by choice and renters by need,” Long said.

When asked if the concept goes against a more traditional view of buying a home to achieve the American Dream, Long said, “I don’t think it takes it away. It solves some issues that are out there in terms of affordability, availability.”

Cassie Wilson rents by choice in Phoenix, Arizona. She says the “perfect” arrangement allows her to enjoy many amenities without the homeownership responsibilities.

“I can live here in a house that is fully up kept by someone else. I would like to buy a house out here. But on the flip side, I still want to travel,” Wilson said.

Though a growing industry, these built-to-rent communities made up only 7.9% of new residential constructions last year, according to Arbor Realty Trust.

Arizona housing advocates warn that the properties are not enough to push prices down, but welcome anything that helps to address the housing shortage.

Back in Texas, Belote said he wakes up every morning and enjoys his backyard with the dogs and his cup of coffee. It’s a home-sweet-home as he waits for a break in the housing market.

CBS News

Israel launches strikes targeting Hezbollah in Lebanon

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Sword with markings of ancient pharaoh Ramses II unearthed in Egypt, archaeologists say

Egyptian archaeologists unearthed a sword earlier this month which was marked by ancient pharaoh Ramses II, Egypt’s Ministry of Culture and Tourism said.

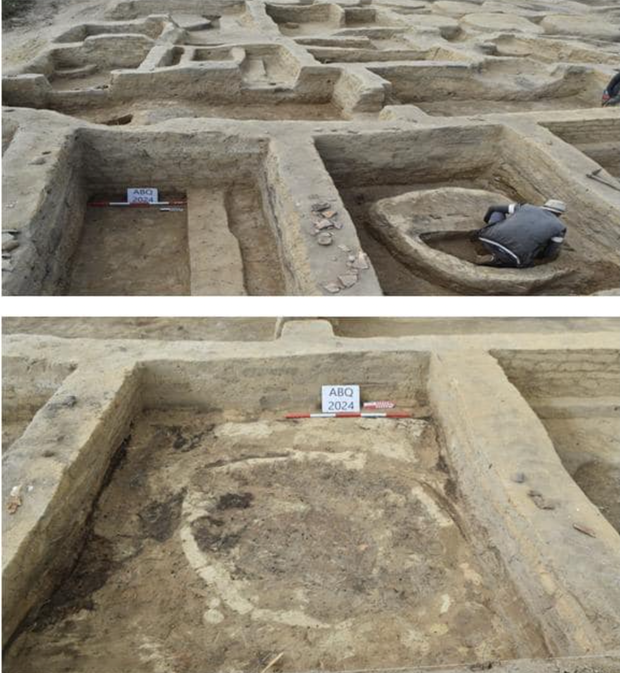

The bronze sword with engravings of the cartouche of the Egyptian king was buried for more than 3,000 years in an ancient military fort known as Tell Al-Abqain, located in the Beheira Governorate in northeast Egypt, south of Alexandria, the Egyptian government said in a Sept. 6 news release.

Known as Ramses the Great, the pharaoh ruled Egypt from 1279 B.C. to 1213 B.C. and is credited with expanding Egypt’s reach as far as modern day Syria to the east and Sudan to the south. A Nineteenth Dynasty pharaoh, Ramses’ influence and riches spread throughout Egypt as evidenced by archaeologists’ recent finds detailing his long-lost empire.

Egypt Ministry of Culture and Tourism

Archaeologists found a temple in 2017 dedicated to the pharaoh in the Badrashin area in Giza. Last year, 2,000 rams’ heads were found at the temple of Ramses II, which Egyptologists said showed the endurance of his impact.

Part of a statue of the great king — his head and chest — were found in the Temple of Kom Ombo during a project to protect the site from groundwater.

Al-Abqain — where the sword was discovered in mud barracks — also housed soldiers and contained warehouses for weapons, food and supplies, said Dr. Ahmed Saeed El-Kharadly, who led a group of archaeologists excavating the area. Large pottery remnants containing fish and animal bones and crock pots used for cooking were found along with personal items such as ivory, agate jars, and red and blue beads.

The fortress was situated to protect Egypt’s northwestern border from attacks by Libyan tribes and Sea Peoples, the Egyptian government said.

Egypt Ministry of Culture and Tourism

Archaeologists said they also uncovered a cow buried in the barracks. Cows were an ancient Egyptian symbol of power, abundance and prosperity.

There were also two blocks of limestone, one of which had a hieroglyphic inscription of King Ramses II.