CBS News

Is a $50,000 HELOC worth it now?

TEERAYUT CHAISARN/Getty Images

Finding an affordable borrowing option has been challenging over the last few years. While rates have been dropping over the last couple of months, the cost of borrowing remains relatively high across the board. For example, the average credit card rate is currently sitting at a record high of over 23%, so if you opt to use this borrowing method, the interest charges will rack up quickly if you don’t pay off what you owe. And while personal loan rates are lower, they still average about 13% right now.

But while low-rate borrowing options are limited overall, there are two good options to consider if you’re a homeowner: home equity loans and home equity lines of credit (HELOCs). Both options allow you to tap into your home’s equity at relatively low rates, but HELOCs, in particular, have been a popular borrowing option recently. That’s because HELOCs offer borrowers a wide range of benefits that other loans don’t offer— and the average HELOC rate is just 8.70% currently, making it one of the most affordable options to consider.

Is it worth it to take out a $50,000 HELOC right now, though? Or would another borrowing option make more sense? That’s what we’ll discuss below.

See what HELOC interest rate you could qualify for here.

Is a $50,000 HELOC worth it now?

For many homeowners who need to borrow $50,000, a HELOC is a borrowing option worth considering in the current market. There are several key reasons why, including:

The payments could get lower over time

Unlike fixed-rate home equity loans, HELOCs come with variable rates, meaning that the interest rates on these credit lines adjust automatically in response to the broader rate environment. That can be a gamble when rates are expected to rise, as the payments could increase if rates climb upward. But that’s not what’s happening right now.

Inflation has been cooling over the last few months and interest rates have been dropping as a result. The Federal Reserve just slashed its benchmark rate again this week, and there are also expectations that additional rate cuts will be made in the near future. If that trend continues, the variable-rate nature of HELOCs could translate to lower monthly payments for borrowers. This makes HELOCs a compelling choice for those looking to minimize long-term interest expenses.

HELOCs offer lots of flexibility

HELOCs also offer inherent flexibility. Unlike a traditional loan, which provides a fixed lump sum of money, a HELOC functions as a revolving line of credit. This means that homeowners can draw from it as needed, only borrowing what they require and paying interest solely on the amount they use. For example, if a homeowner has a HELOC with a $50,000 credit limit but only needs $10,000 to fund a home repair project, they can access that amount without accruing interest on the full credit line.

A HELOC can also be used for almost any purpose. This flexibility allows homeowners to strategically use their HELOC over time without being locked into a single-purpose loan. For instance, the funds from a HELOC can be used for consolidating high-interest debt, such as credit card balances, to reduce monthly payments and total interest costs, but it can also be used for home improvements, medical expenses, education costs or even as a financial cushion for unexpected expenses.

Compare today’s best home equity borrowing rates now.

Most people will still have equity leftover

Another major advantage of opting for a HELOC with a $50,000 limit is that the average homeowner will still have a substantial amount of equity left over. Right now, the average homeowner currently holds about $330,000 in home equity, with about $214,000 of that equity being usable. This means that even after borrowing $50,000, most homeowners will retain significant value in their property.

This preserved equity provides a financial safety net and keeps options open for future borrowing or potential refinancing. Retaining a healthy portion of equity also helps protect homeowners in the event of market fluctuations, as having ample equity can reduce the risk of falling into negative equity (owing more than the home is worth). So for many, using a small portion of their equity for immediate provides a buffer should home values fluctuate or should they need to borrow more down the line.

The bottom line

In today’s unique economic environment, a $50,000 HELOC could be worth considering. After all, this type of borrowing offers a versatile and manageable way for homeowners to leverage their home’s value without losing significant equity or committing to a high-interest loan. That said, it’s important to ensure that you fully understand the possible risks and benefits that come with this type of borrowing so you know it’s the right move for you.

CBS News

“CBS Evening News” headlines for Thursday, Nov. 7, 2024

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Trump selects Susie Wiles as White House chief of staff, first woman ever in the role

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

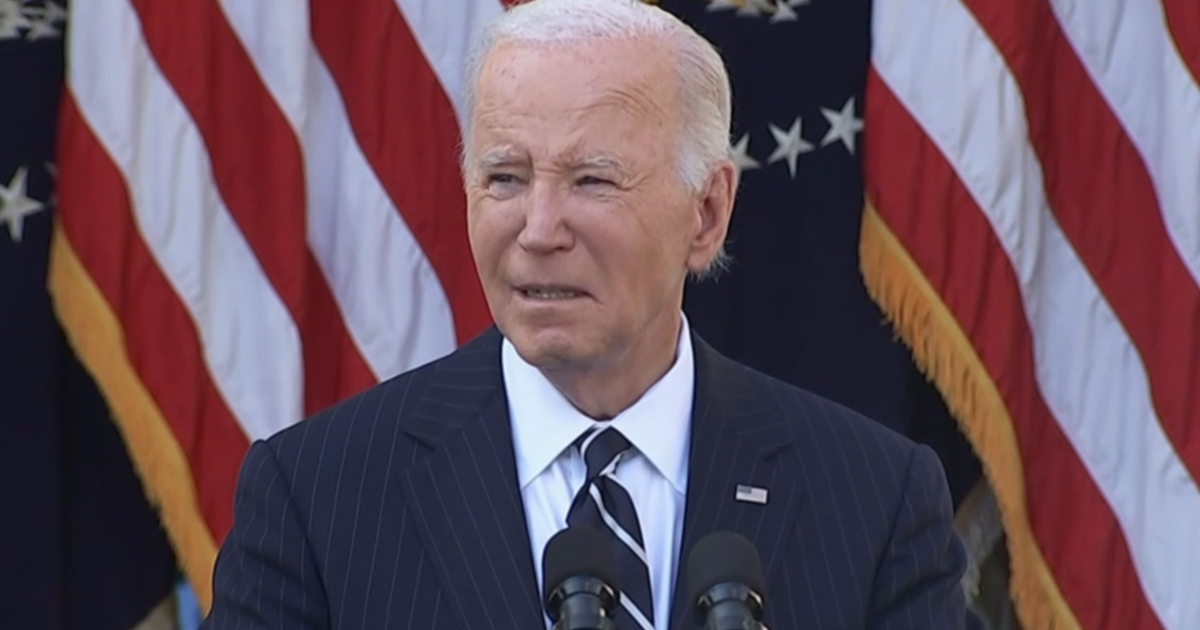

Judge declares Biden immigration program for spouses of U.S. citizens illegal

A federal judge on Thursday struck down a Biden administration program that would allow unauthorized immigrants married to American citizens to get legal status and a streamlined path to U.S. citizenship, declaring the policy illegal.

U.S. District Court Judge J. Campbell Barker, an appointee of President-elect Donald Trump, found the program violates U.S. immigration law, agreeing with a lawsuit filed by Texas and more than a dozen other Republican-led states.

The ruling is a major defeat for the outgoing Biden administration, which argued the policy, known as Keeping Families Together, promoted family unity among mixed-status households. When it was announced earlier this year, officials said roughly half-a-million undocumented immigrants were likely eligible for the program.

The Justice Department can appeal Thursday’s ruling, but the Keeping Families Together program is likely to be in the crosshairs of the incoming administration of Trump, who has vowed to dismantle President Biden’s immigration policies. Trump has separately vowed to seal and militarize the U.S.-Mexico border and oversee the largest mass deportation in American history.

Representatives for the White House and Department of Homeland Security did not immediately respond to requests for comment.

The Keeping Families Together initiative was announced by Mr. Biden in June, just weeks after he took a different executive action to sharply limit asylum along the U.S.-Mexico border.

The program would give work permits and deportation protections to undocumented immigrants who are married to American citizens and have lived in the U.S. for at least 10 years without committing serious crimes.

Most importantly, the policy would also allow these immigrants to apply for permanent residency, also known as a green card. After three years, green card holders married to U.S. citizens can apply for citizenship.

Immigrants who marry U.S. citizens are already eligible for a green card on paper. American immigration law, however, requires those who entered the U.S. illegally to leave the country and re-enter legally to be eligible for a green card. But leaving the U.S. after living in the country unlawfully for some time can trigger a 3 or 10-year exile, prompting many families to refrain from pursuing that option.

The Biden administration’s program would allow eligible immigrants to apply for a green card without having to leave the county by granting them an immigration benefit known as parole, which effectively cancels out their illegal entry.

In his ruling, Campbell Barker said the Biden administration did not have the legal authority to grant parole to unauthorized immigrants who are already in the U.S.