CBS News

Drug cartel reeling in huge profits with illegal fishing of red snapper in the Gulf of Mexico, U.S. says

For years, U.S. authorities and fishermen have been complaining about illegal fishing for red snapper in the Gulf of Mexico, and now it’s been revealed who is behind the lucrative trade: a Mexican drug cartel.

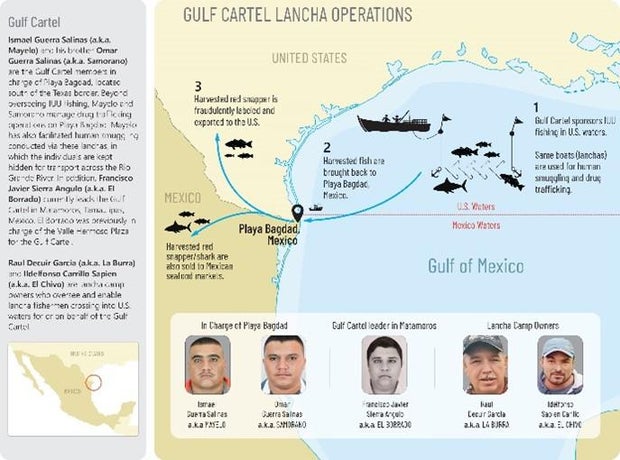

The U.S. Treasury Department announced sanctions Tuesday against members of the Gulf drug cartel, which operates in the border cities of Reynosa and Matamoros, across from McAllen and Brownsville, Texas.

While commercial fishing and drug cartels may seem like an unlikely combination, it makes perfect sense for a criminal organization.

The department says the cartel uses fishing boats to facilitate drug and migrant smuggling; along the way, the boats catch tons of red snapper, a commercially valuable but vulnerable species. The boats often launch from Playa Bagdad, east of Matamoros, on the Gulf coast.

“The Gulf Cartel engages in the illicit trade of red snapper and shark species through ‘lancha’ operations based out of Playa Bagdad,” the department said. “Apart from their use for IUU (illegal, unregulated or unreported) fishing in U.S. waters, lanchas are also used to move illicit drugs and migrants into the United States.”

To add insult to injury, these Mexican boats, often based out of Playa Bagdad, sell their catch in Mexican border cities, where they are sometimes shipped into Texas for resale in the U.S. market.

This occurs while U.S. fishermen had to respect strict seasonal limits or closures designed to protect fish populations.

“As the fishing of red snapper and shark species is under strict limits in the United States, and therefore those species are more abundant in U.S. waters, Mexican fishermen cross into U.S. waters to fish via these lanchas,” the department said.

“They then bring their catch back to lancha camps into Mexico, where the product is ultimately sold and, oftentimes, exported into the United States,” it continued. “This activity earns millions a year for lancha camps. In addition, it also leads to the death of other marine species that are inadvertently caught” on the long lines of baited hooks the boats use.

U.S. Treasury Department

The Treasury announced Tuesday it was designating five individuals linked to the cartel for illegal fishing — Ildelfonso Carrillo Sapien (a.k.a. “El Chivo”), Raul Decuir Garcia (a.k.a. “La Burra”), Ismael Guerra Salinas (a.k.a. “El Comandante”), Omar Guerra Salinas (a.k.a. “Samorano”), and Francisco Javier Sierra Angulo (a.k.a. “El Borrado”).

History of illegal fishing

This isn’t the first time cartels have been involved in illegal fishing in Mexico. Experts say other drug cartels are involved in the prohibited gillnet fishing for totoaba in the Gulf of California, also known as the Sea of Cortez, threatening the world’s most endangered porpoise, the vaquita marina.

Those designated under Tuesday’s sanctions – which block any of their U.S. assets – include Gulf cartel local bosses in Playa Bagdad, as well as two owners of fishing camps there.

The illegal fishing problem became so severe that in 2022, the U.S. government prohibited Mexican fishing vessels from entering U.S. ports on the Gulf of Mexico, arguing the Mexican government had not done enough to prevent its boats from illegally fishing in U.S. waters.

Mexican fishing boats in the Gulf “are prohibited from entering U.S. ports, will be denied port access and services,” the National Oceanic and Atmospheric Administration wrote in a report in 2022. According to a Sept. 10, 2024 NOAA bulletin, those restrictions remain in place.

Small Mexican boats frequently use prohibited long lines or nets to haul in snapper in U.S. waters, which can harm other marine life, such as sharks.

NOAA said in a previous report that the U.S. Coast Guard apprehended dozens of Mexican boats in the Gulf, including repeat offenders who had been interdicted multiple times since 2014.

It noted the United States imported nearly five tons of fresh and frozen snapper from Mexico in 2018, raising concerns that “these imports may have included fish harvested illegally in U.S. waters.”

U.S. targeting cartels recently

In recent months, the U.S. Treasury has imposed sanctions on cartels for a variety of reasons — from drug trafficking to fuel theft to time share scams.

In October, the U.S. sanctioned senior members of the armed wing of a Mexican drug cartel that operates on border territories in and around Chihuahua, Mexico. The cartel has also been linked to the 2019 ambush that killed nine Americans in Mexico.

In September, the U.S. sanctioned a man known as “The Tank” who allegedly leads the fuel theft arm of Mexico’s hyper-violent Jalisco New Generation cartel.

In July, the U.S. imposed sanctions on a group of Mexican accountants and firms allegedly linked to a timeshare fraud ring run by the Jalisco cartel in a multi-million dollar scheme targeting Americans.

The month before that, U.S. officials announced economic sanctions against eight targets affiliated with a Mexican drug cartel, La Nueva Familia Michoacana, accused of fentanyl trafficking and human smuggling. Among the leaders targeted was an alleged assassin named Uriel Tabares Martinez. According to the Treasury Department, he is known as “El Medico” (“The Doctor”) for the violent and surgical manner in which he tortures and kills those who cross the high-ranking members of the cartel.

CBS News

How much equity can you borrow with a HELOC?

Getty Images

American homeowners are sitting on a significant amount of home equity in today’s market, with the average homeowner having approximately $330,000 in equity right now. This substantial cushion provides opportunities for homeowners to access affordable financing through home equity products, like home equity loans and home equity lines of credit (HELOCs), which have become increasingly attractive as other borrowing options grow more expensive.

The stark contrast in borrowing costs compared to other options makes home equity financing particularly appealing right now. For example, personal loan rates have jumped significantly over the last couple of years, and rates on this type of borrowing now average 12.31% — a sharp increase from the average rate of 8.73% in May 2022. Credit card rates have climbed even higher and are sitting at a record-breaking average of over 23%. These high rates have led many borrowers to look for more affordable alternatives.

Against this backdrop, home equity borrowing stands out as one of the most cost-effective financing options available. Home equity loan rates currently average 8.40%, while HELOCs offer similar affordability at an average rate of 8.56%. But while home equity borrowing is one of the best borrowing routes to take right now, there are limits to how much you can borrow. So how much of your home equity can you tap into with a HELOC? That’s what we’ll explore below.

Start comparing the top home equity borrowing rates available to you now.

How much equity can you borrow with a HELOC?

Most lenders allow homeowners to borrow up to 85% of their home’s value across all mortgage loans combined, including both their primary mortgage and any home equity borrowing. This is known as the combined loan-to-value ratio (CLTV). To determine how much equity you can access through a HELOC, you’ll need to subtract your current mortgage balance from 85% of your home’s value.

For example, consider a homeowner who has the average amount of equity ($330,000). If their home is worth $500,000 and they have a remaining mortgage balance of $170,000, here’s what that calculation would look like:

- Maximum borrowing potential (85% of $500,000) = $425,000

- Subtract current mortgage: ($170,000)

- Available equity for HELOC = $255,000

As a result, these numbers can vary significantly based on your specific situation. Here are a few more examples to consider:

For a $750,000 home with a $400,000 mortgage balance:

- 85% of value = $637,500

- Minus mortgage = $237,500 available for HELOC

For a $300,000 home with a $150,000 mortgage balance:

- 85% of value = $255,000

- Minus mortgage = $105,000 available for HELOC

It’s important to note that while these calculations show the theoretical maximum, lenders will also consider other factors like your credit score, income and debt-to-income ratio when determining your actual HELOC limit. As with most other types of borrowing, the better your full financial picture is, the more flexibility you’ll generally have in terms of the amount you’re approved to borrow.

See what HELOC interest rate you could qualify for today.

Can I borrow more with a home equity loan?

While home equity loans and HELOCs are structured differently, they typically have comparable borrowing limits. Both products generally adhere to the same 85% CLTV maximum that lenders use to protect themselves against default risk. However, individual lender policies can vary significantly.

For example, some lenders may offer more conservative limits, only allowing borrowing up to 80% CLTV. Others might extend borrowing up to 90% CLTV for highly qualified borrowers with excellent credit scores and strong income profiles. The key difference between these products isn’t in how much you can borrow, but rather in how you access the funds and repay them.

When choosing between a HELOC and a home equity loan, the decision should focus on your specific needs rather than trying to maximize borrowing capacity. A HELOC comes with a variable rate and offers flexibility with a revolving credit line you can draw from as needed, while a home equity loan provides a lump sum with fixed monthly payments. Both options can provide access to roughly the same amount of equity, just with different terms and repayment structures.

The bottom line

Regardless of which option you choose and how much you borrow, it’s important to remember that borrowing against your home equity is a significant financial decision. While current market conditions make home equity borrowing particularly attractive from a cost perspective, it’s still crucial to have a solid plan for using and repaying the funds. After all, your home serves as collateral for these loans, making it crucial that you borrow responsibly and stay within your means to avoid putting your property at risk.

CBS News

California bombing suspect on FBI most wanted list arrested after 21 years on run

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Remembering Jean Rather, wife of former CBS News anchor Dan Rather

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.