CBS News

Who qualifies for a credit card debt consolidation program?

Getty Images

With today’s credit card rates sitting at over 23%, it’s easy for any credit card debt you’re carrying to cause financial distress. As the compound interest charges accrue, the balance on your credit card grows, and over time, it can be increasingly difficult to pay off what you owe. Luckily, there are debt relief lifelines, like debt consolidation programs, that you can use to try and combat your high-interest credit card debt before it becomes impossible to pay off.

A debt consolidation program functions similarly to regular debt consolidation by rolling multiple credit card debts into a single loan, typically with a lower interest rate. This makes your monthly payments more manageable and potentially saves you thousands in interest charges over time. The big difference is that with a debt consolidation program, you’re working with a debt relief company to acquire the loan through one of its third-party lenders, which tend to have more flexibility in terms of their lending criteria.

Not everyone qualifies for these programs, though. Specific eligibility criteria must still be met, and understanding these requirements is the first step in determining whether this debt relief solution could work for your situation.

Find out more about your debt relief options here.

Who qualifies for a credit card debt consolidation program?

To qualify for a credit card debt consolidation program, you’ll typically need to meet certain financial and credit-related benchmarks. These requirements vary depending on the debt relief service and its lending partners, but some of the more common requirements include:

A minimum amount of unsecured debt

Most debt consolidation programs require applicants to have a minimum amount of unsecured debt, often between $7,500 to $10,000. This ensures that the program is worth the administrative effort and that consolidating debt makes financial sense for the borrower.

Take steps to get rid of your expensive credit card debt today.

A lower debt-to-income ratio

While debt consolidation programs are designed for individuals with financial challenges, your debt-to-income (DTI) ratio still plays a significant role in the approval process. Many programs accept higher DTIs than traditional lenders, but a ratio above 50% may signal excessive financial strain, making approval more difficult.

A decent credit score

A fair or decent credit score is often needed to qualify for these programs, though the lenders that debt relief companies work with are typically more flexible than traditional banks. Each debt relief company has its own minimum score requirements, but in general, a score in the mid-600s or higher improves your chances of approval. Borrowers with significantly lower scores may need to explore alternative debt relief options.

A steady income

A stable income is crucial for qualifying for a debt consolidation program. Lenders need assurance that you can commit to regular monthly payments throughout the term of the loan. As a result, you’ll likely need to verify your income by providing recent pay stubs, tax returns or bank statements.

High-rate credit card debt

While not necessarily a stringent requirement, debt consolidation programs are most effective for those carrying high-rate credit card debt. Consolidating these debts into a single loan with a lower interest rate can save thousands of dollars in interest charges over time.

What to do if you don’t qualify for a debt consolidation program

If you’re unable to meet the requirements for a credit card debt consolidation program, don’t panic — there are other strategies to tackle your financial challenges. Here are some alternatives to consider:

Debt management plans

A debt management plan, typically offered by credit counseling agencies, can be an excellent alternative. These plans involve negotiating lower interest rates with creditors and creating a structured repayment plan. Unlike consolidation loans, these plans don’t require a high credit score to qualify.

Debt settlement

Debt settlement (also known as debt forgiveness) involves negotiating with your creditors to reduce the total amount owed, generally in exchange for a lump-sum payment. This option can significantly lower your debt, but it may also negatively impact your credit score in the short term and may not be suitable for all situations.

Work directly with your creditors

You can also reach out to your creditors to explore any alternative payment arrangements that are available to you. For example, many credit card companies offer hardship programs that can temporarily reduce your interest rates or adjust payment terms, providing you some relief while you get your finances back on track.

Focus on budgeting and repayment strategies

If a formal debt relief program isn’t right for you, creating a budget and prioritizing repayment can also help you make progress. For example, using the debt snowball (paying off smaller balances first) or the debt avalanche (focusing on high-interest debts) methods can provide a structured approach to tackling your obligations.

The bottom line

Qualifying for a credit card debt consolidation program typically requires meeting specific criteria related to debt amount, income stability and creditworthiness. These programs can provide invaluable support for those looking to simplify their financial lives and reduce the cost of high-interest debts. However, if you don’t qualify, there are still numerous paths to achieving financial freedom. Whether through alternative debt relief solutions or a disciplined repayment strategy, taking proactive steps today can pave the way for a more secure financial future.

CBS News

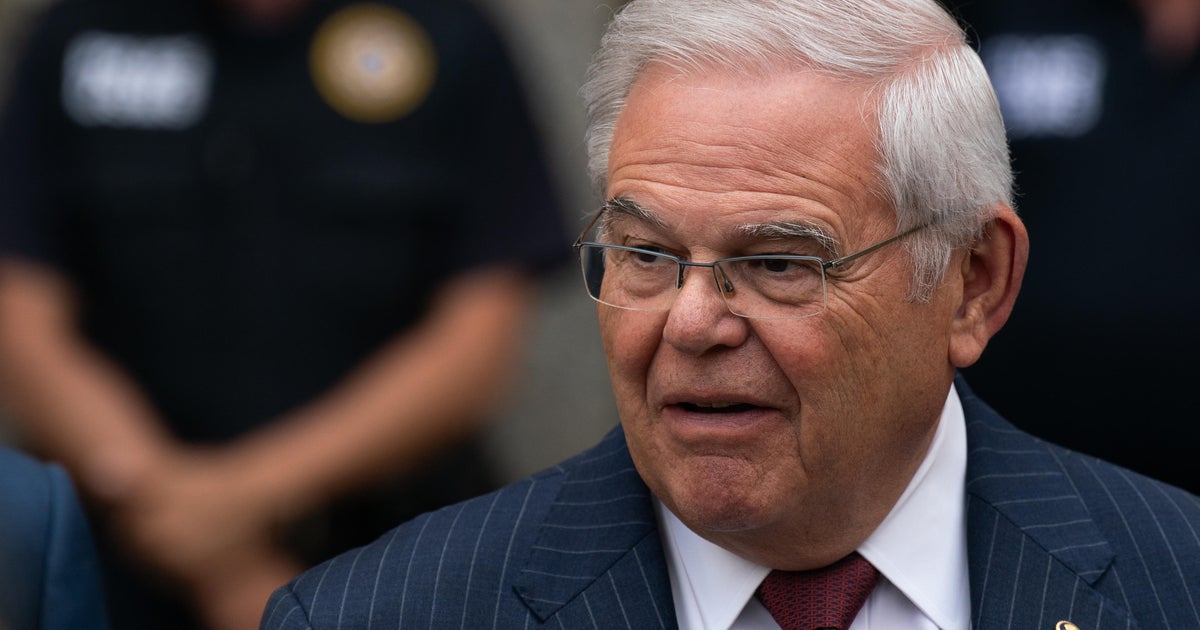

Ex-Sen. Bob Menendez seeks new trial, citing evidence prosecutors said was inadvertently provided to jury

Washington — Former New Jersey Sen. Bob Menendez asked a federal court in New York on Wednesday to throw out his conviction in a sprawling bribery scheme and grant him a new trial after prosecutors disclosed that the jury was inadvertently provided information during deliberations that it should not have been given.

The request from Menendez’s lawyers came in response to a letter prosecutors sent to the court on Nov. 13 revealing they had unintentionally loaded onto a laptop given to the jury during deliberations the incorrect versions of nine exhibits. Prosecutors said neither they nor Menendez’s lawyers, who inspected the exhibits on the laptop, noticed the error at the time.

Government lawyers told U.S. District Judge Sidney Stein that they did not believe the inclusion of the nine exhibits warranted upsetting Menendez’s guilty verdict, in part because “there is no reasonable likelihood any juror ever saw any of the erroneously less-redacted versions.” But Menendez’s lawyers told Stein in a separate filing that the improper disclosure was a “serious breach” by prosecutors and said a new trial was “unavoidable.”

The exhibits, they said, “exposed the jury to a theory of criminality that the government was barred from presenting under the Speech or Debate Clause — namely, that Senator Menendez made specific decisions with respect to military sales to Egypt in exchange for bribes.”

Under the Speech or Debate Clause of the Constitution, senators or House members “shall not be questioned” for “any speech or debate” in either chamber of Congress. Stein had ruled that certain material referencing arms sales and military aid to Egypt were legislative acts shielded by the clause.

Menendez’s defense team said the information disclosed to the jury contained the only evidence that tied him to the provision of military aid to Egypt, which was at the center of the bribery scheme the New Jersey Democrat was accused of engaging in.

They also lambasted prosecutors for attempting to “shift the blame,” calling it “factually and legally outrageous.”

Prosecutors said the court had “expressly prohibited” evidence of past legislative activity, including actions Menendez allegedly took as a senator about foreign aid to Egypt, and said the evidence at issue “squarely crossed that line … and allowed the jury to infer bribery from Senator Menendez’s legislative acts — exactly what the Speech or Debate Clause is meant to prevent.”

Prosecutors claimed that Menendez helped orchestrate a corrupt agreement through which he would work to secretly benefit the Egyptian government in exchange for lavish gifts including cash, gold bars, a Mercedes-Benz convertible, furniture and mortgage payments from three New Jersey businessmen.

He was convicted on 16 felony counts in July, including bribery, fraud and acting as a foreign agent.

Menendez’s two co-defendants in the case, Fred Daibes and Wael Hana, also separately asked the court to grant them new trials and toss out their convictions.

Menendez faced immense pressure to resign after he was indicted on federal bribery charges last year but resisted doing so until he was convicted. He stepped down from the Senate in August, a stunning capstone to a lengthy career in the upper chamber that included a position atop the Senate Foreign Relations Committee.

The former senator is set to be sentenced Jan. 29.

CBS News

FBI, NYPD issue terror threat memo head of Thanksgiving

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

What to consider when buying a home with someone else

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.