CBS News

Student loans for spring 2024: Everything borrowers should know

joan corominas/Getty Images

As 2023 comes to an end, many people are reviewing their finances. For some families, that includes looking at student loans for the upcoming spring 2024 semester. Borrowers may be debating issues like whether to take out federal student loans or private student loans for 2024 as well as trying to figure out issues like how and when to apply for student loans.

In this article, we’ll break down the important differences between federal vs. private student loans and when you might use one over the other.

Student loans for spring 2024: Everything borrowers should know

To understand which student loan is best for you it first helps to understand the differences between loan types.

What are federal student loans and how do they work?

Federal student loans can be a number of different types of fixed-rate loans provided by the federal government, depending on factors such as your financial situation and type of degree you’re getting.

For example, undergraduate students can get either Direct Subsidized Loans or Direct Unsubsidized Loans. Students who meet financial need requirements can get Direct Subsidized Loans, which cost less due to the Department of Education helping out with interest payments.

To apply for federal student loans, you need to submit your Free Application for Federal Student Aid (FAFSA) form. Even if you don’t qualify for financial aid in terms of lowering your financial responsibility for tuition, filling out FAFSA is how you qualify for other types of federal student loans. The deadline for the 2023-2024 academic year is June 30, 2024, though your state and/or college may have an earlier deadline, and it’s generally better to apply sooner than later if you haven’t already.

“With federal loans, even if you do not need the full amount you qualify for, you may want to consider taking it. Congress resets interest rates every June and there is a good chance we’ll see another increase in student loan rates,” says Joseph Reinke, CFA, founder of FitBUX.

“We are seeing a number of students have to take out credit card debt because they underestimated living expenses due to inflation. Therefore, taking a little extra in student loan debt now would be preferable to potentially having credit card debt. If you end up not needing the money, you have 120 days to refund the amount not needed back to the government and you are not charged origination fees or interest during that time,” adds Reinke.

What are private student loans are and how do they work?

Private student loans are provided by financial institutions like banks, as opposed to the federal government. These can similarly be used for education-related expenses. Applying for and qualifying for private student loans, however, differs from the federal student loan process.

“Private student loans are treated like other loans, such as mortgages and car loans. Credit scores, income, length of employment and other factors all matter here, whereas they generally don’t for federal loans,” explains Jack Wang, wealth advisor/college financial aid advisor at Innovative Advisory Group.

Private student loans typically do not have application deadlines the way that federal student loans do, but you likely want to check with your school about payment deadlines to make sure you have the funds to pay for the spring semester on time.

Typically, private student loans have variable interest rates, while federal student loans have fixed interest rates once you take them out. Interest rates and terms can vary significantly among different private student loan companies. Rates also depend on factors like your credit score and how much you want to borrow.

“In the past, I’ve seen some people try to ‘strategically’ take private variable rate loans with the idea that they would refinance post graduation to a fixed rate private loan. However, I do not recommend that. As those individuals found out, rates can go up, and when you go to refinance, the fixed rates may be a lot higher,” says Reinke.

You can easily find a private student loan online here now.

When federal student loans may be better

Federal student loans are often used first by borrowers, as these loans typically have lower interest rates and better repayment terms.

“Federal loans have more flexible repayment options than private student loans. For example, you can choose to use income-driven repayment plans instead of doing a traditional principal and interest loan. Therefore, they should be taken out first,” says Reinke.

Plus, the fixed rate of federal student loans gives you more certainty over costs.

“Private loans tend to be variable which means you can’t predict the cost post graduation and they can become very expensive,” says Reinke. FitBUX data shows that less than 5% of the time private loans are cheaper than federal loans in terms of having lower interest rates, he adds.

Federal student loans can also be preferable for those looking to adjust their repayment plans.

“People tend to focus on forgiveness, especially Public Service Loan Forgiveness, but the ability to change repayment plans at any time, for any reason, to provide financial flexibility is probably the most overlooked feature of federal loans,” says Wang.

When private student loans may be better

While federal loans should often be used first, sometimes students need to borrow more than what they receive from the federal government. For example, if your parents are unable to obtain what’s known as a Direct PLUS Loan, first-year undergraduates are limited to a maximum of $9,500 in federal student loans. So, if that’s the case for the spring 2024 semester, you might turn to private student loans as a supplement.

In some cases, private student loans can also be better than federal student loans, even if you or your parents qualify for enough funds from the federal government.

“Private loans can be preferable if the borrower/co-borrower qualifies for a lower interest rate than the rate on the federal loan. It can also be preferable If the intent is to have the student take over the loan eventually, via co-signer release, without having to refinance the loan later,” says Wang.

Still, it’s important to note that the variable rate of private student loans can create risk, as even if it’s cheaper now, it could get more expensive later on. But it’s possible that if you find a lower interest rate with a private lender you could make it work to your advantage by quickly paying off the loan.

“If you know 100% that you are paying off your loans post graduation and not using an income-driven repayment plan, and you happen to qualify for a lower rate, then you can use a private loan,” says Reinke.

Also, consider what your post-graduation employment will look like. “Private loans tend to be better for those who have stable incomes and finances, and who work and stay in the private sector so loan forgiveness is not a factor,” adds Wang.

Learn more about your private student loan options.

Know what you can borrow

Whether you choose federal or private student loans, or a combination of the two, it’s important to do your research. Your school’s financial aid office can be an important resource in terms of helping you apply for and qualify for student loans and you should also consider clarifying with them how much you can borrow.

“Ask your financial aid office what the certified amount is that you can take,” says Reinke, though note that some schools use a different term. “The certified amount is the dollar amount the university estimates tuition and cost of living will cost. They submit this number to the federal government. That is the most you can borrow from the federal government and private loans combined. Therefore, you should know that number so you can budget accordingly, because if you go over, you no longer have federal or private student loan options until the next year.”

Knowing this number is important because if you can’t borrow enough, you might need to make some adjustments, like finding more affordable housing while in school or working part time to avoid credit card debt. “We’ve seen this be a major problem for people over the past year because the certified amounts aren’t keeping up with real actual inflation. Therefore, know what this is ahead of time so you can plan,” adds Reinke.

CBS News

UNICEF executive director Catherine Russell says Gaza is a “hellscape for children”

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Sen. Mark Kelly says feds need to do a “better job” of letting Americans know “there’s a huge amount of misinformation” on election

Washington — Sen. Mark Kelly said Sunday that the federal government needs to do its part to inform Americans of the vast swath of election misinformation that’s being consumed on social media platforms like X, TikTok, Facebook and Instagram.

“It’s up to us, the people who serve in Congress and in the White House to get the information out there, that there is a tremendous amount of misinformation in this election, and it’s not going to stop on Nov. 5,” Kelly said on “Face the Nation with Margaret Brennan.”

Kelly, who sits on the Senate Intelligence Committee, said he’s seen these misinformation operations target not only his state of Arizona, but also other battleground states.

“There is a very reasonable chance I would put it in the 20 to 30% range, that the content you are seeing, the comments you are seeing, are coming from one of those three countries: Russia, Iran, China,” Kelly said.

CBS News

In a committee hearing last month on foreign threats to the 2024 election, Kelly presented screenshots of Russian-made web pages showing fabricated headlines designed to look like Fox News and The Washington Post, targeted at voters in battleground states.

“So my constituents in Arizona and others — they seek to influence the outcome of these elections, and that is absolutely beyond the pale,” Kelly said at the Sept. 18 hearing. “We’ve got to do something about it.”

Vice President Kamala Harris and former President Donald Trump each have the support of 49% of Arizona voters, according to CBS News’ battleground tracker as of Sept. 30.

In another battleground state, Pennsylvania, Trump returned Saturday to hold a rally in Butler three months after an attempted assassination on him. He was joined by members of his own party and billionaire Elon Musk, who said Trump was the only way to preserve democracy and warned of a last election if he does not win in November.

Speaking to CNN’s State of the Union on Sunday, Kelly called the social media mogul a hypocrite.

“He’s standing next to the guy that tried to overturn the 2020 election on Jan. 6, saying that this is somehow going to be the last election and they’re going to take away your vote,” Kelly said. “And you know, it just doesn’t pass the logic test.”

At the White House press briefing on Friday, President Biden – speaking from the podium for the first time since taking office – said he’s confident of a free and fair election but alluded to the 2021 insurrection at the Capitol in his concerns on whether it will be a peaceful transfer of power.

“The things that Trump has said and the things that he said last time out when he didn’t like the outcome of the election were very dangerous,” Mr. Biden said. “If you notice, I noticed that the vice-presidential Republican candidate did not say he’d accept the outcome of the election, and they haven’t even accepted the outcome of the last election.”

CBS News

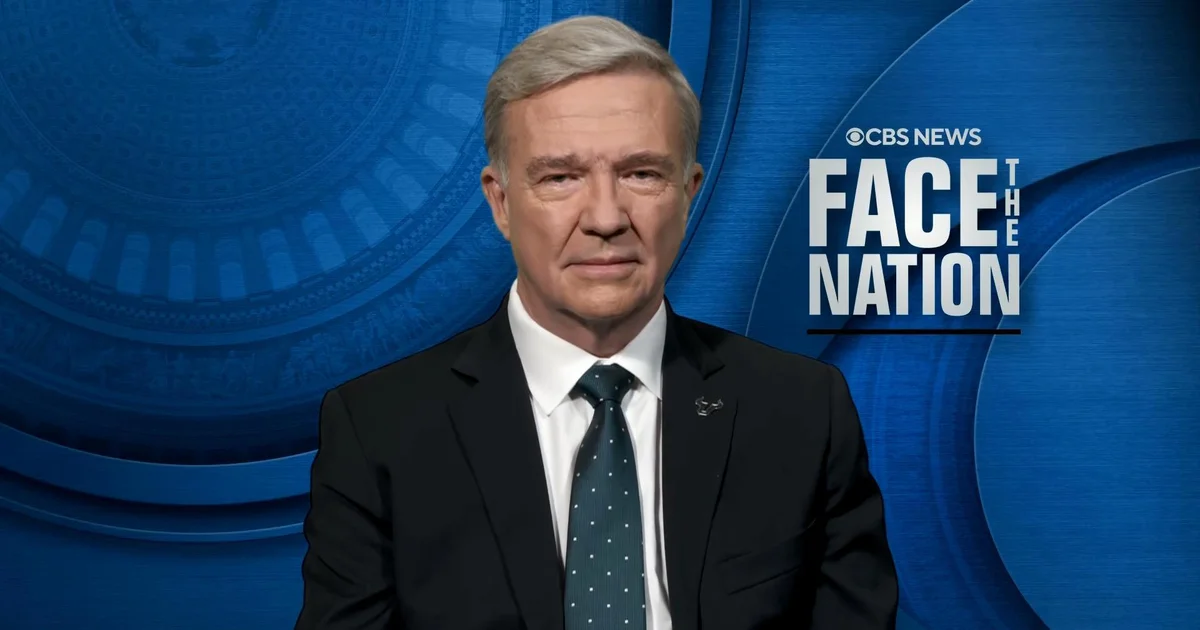

Ret. Gen. Frank McKenzie says Iran is the country that’s in a corner

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.