CBS News

How empty office buildings are setting cities on a doom loop | 60 Minutes

Despite some large companies calling for a return to the office following the pandemic, remote work has taken root with a large segment of the workforce, leaving office spaces empty and real estate executives reeling.

But it’s not just the real estate industry that is impacted. The effects of vacant office space could ripple through the economy because many buildings are financed through short-term loans from banks. If real estate firms are unable to make rent money from commercial tenants, they may default on their loans, increasing the risk for banks.

That’s what led real estate company RXR to default on a $240 million bank loan at 61 Broadway in New York City. With half his office tower sitting vacant, RXR chief executive Scott Rechler says it was “time to face reality.”

“This post-COVID world of higher interest rates, the changing nature of how people work and live, we’re not going back to where we were,” Rechler said. “And it’s going to be turbulent.”

What’s happening in office buildings

With remote and hybrid work hardening from trend to new normal, office occupancy rates are at an all time low. More than 95 million square feet of New York City office space is currently unoccupied –the equivalent of 30 Empire State Buildings.

As tenants shrink their office footprint, office landlords are confronting the fact that some of their buildings have become obsolete, if not worthless. By some estimates the price of office buildings has tanked by as much as 40% since the pandemic. At Columbia Business School, real estate professor Stijn Van Nieuwerburgh has modeled out the impact of hybrid work on pricing. He calls it a “train wreck in slow motion.”

“And this is just the beginning. And the reason it’s just the beginning is because there’s a lot of office tenants that have not had to make an active space decision yet,” Van Nieuwerburgh said. “‘Do I want to renew this space? Do I want to vacate? Maybe I sign a new lease for half as much space.’ This is what tenants have been doing for the last three years.”

Marc Holliday, CEO of SL Green Realty — New York’s biggest office landlord, and 60 Minutes’ landlord — considers work from home to be “one of the biggest societal problems we’re facing right now.”

“I think that it’s bad for business. It’s bad for cities. It’s bad for people,” he said.

Refinancing no longer a given for office loans

Work-from-home has also been a drag for real estate companies like SL Green, who have seen shares tumble since the pandemic, even as they pay down their building loans. Commercial real estate is a world built on loans –big ones– and the assumption is that those loans can be refinanced, with little friction, every 5 to 10 years, but that’s not the case anymore.

To complicate matters for office building owners, interest rates have spiked to historic highs, and now the mortgage is coming due: $1.5 trillion in commercial real estate loans expire in the next two years, according to analysts.

Banks used to be willing to lend real estate companies more for buildings, Van Nieuwerburgh said. Now office owners will be forced to either pay out of pocket to make up the difference or walk away.

“And to make matters worse, interest rates are now much higher. Interest rates have essentially doubled,” he said. “So the cost of that new mortgage, even if you can get one, will be much higher.”

Office building troubles bleed into the banking sector

Commercial real estate plays a huge role in the typical bank’s business, according to Van Nieuwerburgh.

“And I’m talking mostly about these smaller and medium size, maybe regional banks,” Van Nieuwerburgh said. “They have a lot of exposure. That is their bread-and-butter activity. About 30% of all their loans are commercial real estate loans.”

Van Nieuwerburgh sees it as a potential crisis.

In December, nationwide office loan delinquency rates were around 6% — almost four times what they were a year ago — but banks have been reluctant to write down those losses.

David Aviram from Maverick Real Estate keeps tabs on the debt on every office building in New York City and buys distressed debt on the cheap. He says New York is awash in billions worth of commercial real estate loans at risk of not being paid.

“We know that there’s this buildup of bad debt in the system, but it’s not being dealt with just yet,” he said. “And it’s in large part because the banks have been kicking the can down the road as best they can, trying to push this off as far as they can.”

What does that mean?

“It means that banks are entering into extensions on a lot of their bad loans, which essentially changed their classification from a nonperforming loan, a loan that’s in distress, to a performing loan, a healthy loan, even though they haven’t received a pay down on the loan and the collateral value on that loan continues to drop,” Aviram said.

The “urban doom loop”

It all makes for a familiar tune –a downturn in real estate, made worse by bad loans, contaminates banks and, potentially, the entire economy. Echoes of the global financial crisis of 2008 are hard to ignore. Whether the trouble with offices ends in a simple pricing correction or becomes a systemic crisis, likely there’s pain coming for building owners, banks and for cities themselves.

“In the long run, property taxes on those buildings will also fall by 40%. And these commercial property tax revenues are an important component of the budget of local governments, which means less money for police departments, public safety, less money for sanitation, trash collection,” Van Nieuwerburgh said. “And some people are going to decide that, you know, the quality of life has deteriorated too much and they want out. And, in fact, that’s what we’ve seen.”

According to Van Nieuwerburgh, America’s 10 largest cities have lost about 2 million residents in the last three years. That also means their tax base is smaller.

“And now the cycle continues,” Van Nieuwerburgh said. “And we end up in something that we have called an urban doom loop.”

Searching for solutions

In an effort to bring new life to empty office buildings, some developers, like Tony Park and Elad Dror of PD Properties, are working to turn their buildings into apartments that will rent at market price. But less than half of New York office space is zoned for conversion.

Before the pandemic, the pair had been eyeing a building near New York City’s Penn Station. They didn’t get very far, though they offered the owner $80 million. In September, Park and Dror got the building for less than half their original offer. Now they have plans to convert the place into a residential building.

“Anything that is not an office,” Park said.

For Van Nieuwerburgh, the reimagining of office space can, and should be ambitious, combining public and private money and ideas for what to do with old office space.

“We no longer have to live where we work,” Van Nieuwerburg said. “And that’s a very transformational idea. And I believe society is only at the beginning of realizing the full potential of that idea.”

CBS News

Couple charged for allegedly stealing $1 million from Lululemon in convoluted retail theft scheme

A couple from Connecticut faces charges for allegedly taking part in an intricate retail theft operation targeting the apparel company Lululemon that may have amounted to $1 million worth of stolen items, according to a criminal complaint.

The couple, Jadion Anthony Richards, 44, and Akwele Nickeisha Lawes-Richards, 45, were arrested Nov. 14 in Woodbury, Minnesota, a suburb of Minneapolis-St. Paul. Richards and Lawes-Richards have been charged with one count each of organized retail theft, which is a felony, the Ramsey County Attorney’s Office said. They are from Danbury, Connecticut.

The alleged operation impacted Lululemon stores in multiple states, including Minnesota.

“Because of the outstanding work of the Roseville Police investigators — including their new Retail Crime Unit — as well as other law enforcement agencies, these individuals accused of this massive retail theft operation have been caught,” a spokesperson for the attorney’s office said in a statement on Nov. 18. “We will do everything in our power to hold these defendants accountable and continue to work with our law enforcement partners and retail merchants to put a stop to retail theft in our community.”

Both Richards and Lawes-Richards have posted bond as of Sunday and agreed to the terms of a court-ordered conditional release, according to the county attorney. For Richards, the court had set bail at $100,000 with conditional release, including weekly check-ins, or $600,000 with unconditional release. For Lawes-Richards, bail was set at $30,000 with conditional release and weekly check-ins or $200,000 with unconditional release. They are scheduled to appear again in court Dec. 16.

Prosecutors had asked for $1 million bond to be placed on each half of the couple, the attorney’s office said.

Richards and Lawes-Richards are accused by authorities of orchestrating a convoluted retail theft scheme that dates back to at least September. Their joint arrests came one day after the couple allegedly set off store alarms while trying to leave a Lululemon in Roseville, Minnesota, and an organized retail crime investigator, identified in charging documents by the initials R.P., recognized them.

The couple were allowed to leave the Roseville store. But the investigator later told an officer who responded to the incident that Richards and Lawes-Richards were seasoned shoplifters, who apparently stole close to $5,000 worth of Lululemon items just that day and were potentially “responsible for hundreds of thousands of dollars in loss to the store across the country,” according to the complaint. That number was eventually estimated by an investigator for the brand to be even higher, with the criminal complaint placing it at as much as $1 million.

Richards and Lawes-Richards allegedly involved other individuals in their shoplifting pursuits, but none were identified by name in the complaint. Authorities said they were able to successfully pull off the thefts by distracting store employees and later committing fraudulent returns with the stolen items at different Lululemon stores.

“Between October 29, 2024 and October 30, 2024, RP documented eight theft incidents in Colorado involving Richards and Lawes-Richards and an unidentified woman,” authorities wrote in the complaint, describing an example of how the operation would allegedly unfold.

“The group worked together using specific organized retail crime tactics such as blocking and distraction of associates to commit large thefts,” the complaint said. “They selected coats and jackets and held them up as if they were looking at them in a manner that blocked the view of staff and other guests while they selected and concealed items. They removed security sensors using a tool of some sort at multiple stores.”

CBS News contacted Lululemon for comment but did not receive an immediate reply.

CBS News

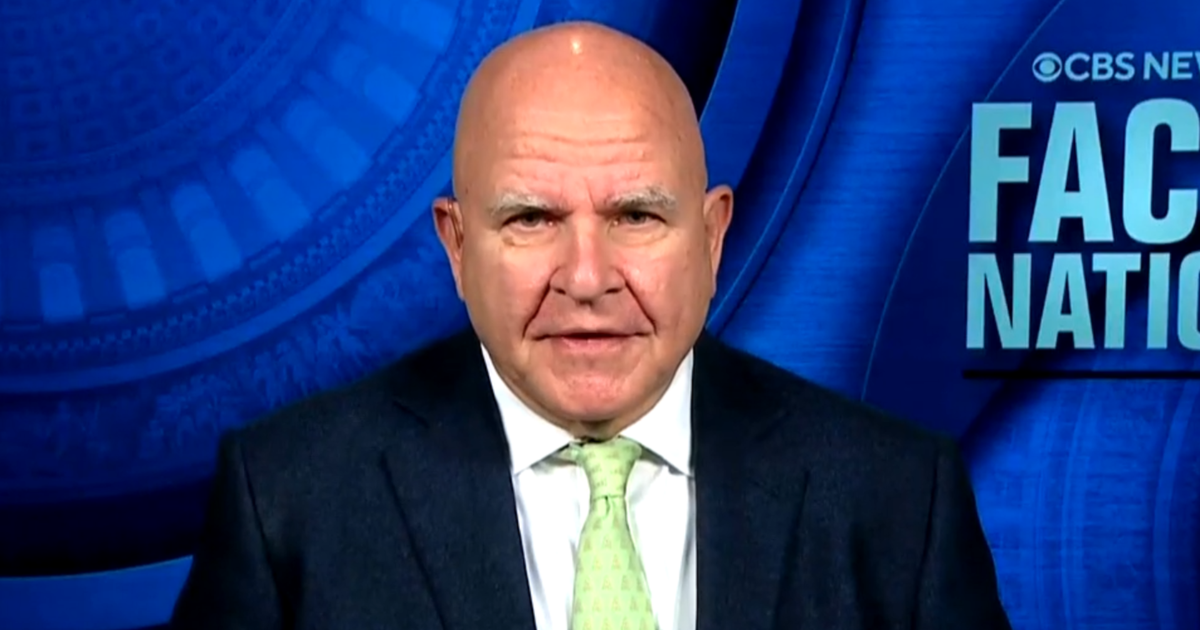

Former Trump national security adviser says next couple months are “really critical” for Ukraine

Washington — Lt. Gen. H.R. McMaster, a former national security adviser to Donald Trump, said Sunday that the upcoming months will be “really critical” in determining the “next phase” of the war in Ukraine as the president-elect is expected to work to force a negotiated settlement when he enters office.

McMaster, a CBS News contributor, said on “Face the Nation with Margaret Brennan” that Russia and Ukraine are both incentivized to make “as many gains on the battlefield as they can before the new Trump administration comes in” as the two countries seek leverage in negotiations.

With an eye toward strengthening Ukraine’s standing before President-elect Donald Trump returns to office in the new year, the Biden administration agreed in recent days to provide anti-personnel land mines for use, while lifting restrictions on Ukraine’s use of U.S.-made longer range missiles to strike within Russian territory. The moves come as Ukraine marked more than 1,000 days since Russia’s invasion in February 2022.

Meanwhile, many of Trump’s key selection for top posts in his administration — Rep. Mike Waltz for national security adviser and Sens. Marco Rubio for secretary of state and JD Vance for Vice President — haven’t been supportive of providing continued assistance to Ukraine, or have advocated for a negotiated end to the war.

CBS News

McMaster said the dynamic is “a real problem” and delivers a “psychological blow to the Ukrainians.”

“Ukrainians are struggling to generate the manpower that they need and to sustain their defensive efforts, and it’s important that they get the weapons they need and the training that they need, but also they have to have the confidence that they can prevail,” he said. “And any sort of messages that we might reduce our aid are quite damaging to them from a moral perspective.”

McMaster said he’s hopeful that Trump’s picks, and the president-elect himself, will “begin to see the quite obvious connections between the war in Ukraine and this axis of aggressors that are doing everything they can to tear down the existing international order.” He cited the North Korean soldiers fighting on European soil in the first major war in Europe since World War II, the efforts China is taking to “sustain Russia’s war-making machine,” and the drones and missiles Iran has provided as part of the broader picture.

“So I think what’s happened is so many people have taken such a myopic view of Ukraine, and they’ve misunderstood Putin’s intentions and how consequential the war is to our interests across the world,” McMaster said.

On Trump’s selections for top national security and defense posts, McMaster stressed the importance of the Senate’s advice and consent role in making sure “the best people are in those positions.”

McMaster outlined that based on his experience, Trump listens to advice and learns from those around him. And he argued that the nominees for director of national intelligence and defense secretary should be asked key questions like how they will “reconcile peace through strength,” and what they think “motivates, drives and constrains” Russian President Vladimir Putin.

Trump has tapped former Rep. Tulsi Gabbard to be director of national intelligence, who has been criticized for her views on Russia and other U.S. adversaries. McMaster said Sunday that Gabbard has a “fundamental misunderstanding” about what motivates Putin.

More broadly, McMaster said he “can’t understand” the Republicans who “tend to parrot Vladimir Putin’s talking points,” saying “they’ve got to disabuse themselves of this strange affection for Vladimir Putin.”

Meanwhile, when asked about Trump’s recent selection of Sebastian Gorka as senior director for counterterrorism and deputy assistant to the president, McMaster said he doesn’t think Gorka is a good person to advise the president-elect on national security. But he noted that “the president, others who are working with him, will probably determine that pretty quickly.”

CBS News

Sen. Van Hollen says Biden is “not fully complying with American law” on Israeli arms shipments

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.