CBS News

Notorious bombing fugitive Satoshi Kirishima reportedly dies after nearly half a century on the run in Japan

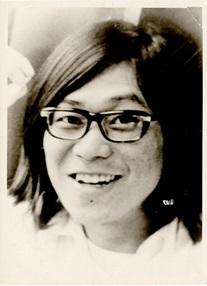

Long hair, youthful smile, thick glasses slightly askew: for decades, the black-and-white photo of one of Japan’s most wanted fugitives has been a ubiquitous sight at police stations nationwide. But after nearly 50 years Satoshi Kirishima — wanted over deadly bombings by leftist extremists in the 1970s — reportedly died Monday, days after local media said he had finally been caught.

National Police Agency

Last week, the 70-year-old revealed his identity after he admitted himself to hospital under a false name for cancer treatment, according to Japanese media.

The reports were a sensation in Japan, where his young face is so widely recognized that it has inspired viral Halloween costumes.

But police were still scrambling to conduct DNA tests when the man believed to be Kirishima died on Monday morning.

“Investigators looked into and eliminated past tips, but there is a very high possibility that this individual is actually Kirishima,” a police source told the Asahi newspaper.

Details are emerging of how Kirishima may have been hiding in plain sight for decades.

Born in Hiroshima in January 1954, Kirishima attended university in Tokyo, where he was attracted by radical far-left politics.

He joined the East Asia Anti-Japan Armed Front, one of several militant groups active in the era along with the once-feared Japanese Red Army or the Baader-Meinhof Group in West Germany.

The radical group is believed to be behind several bombings against companies in Japan’s capital between 1972 and 1975, the BBC reported. In 1974, eight people were killed in one attack carried out by the group at the headquarters of Mitsubishi Heavy Industries.

It operated in three cells, with fanciful names: “Wolf”, “Fangs of the Earth” and “Scorpion” — Kirishima’s outfit.

Alongside physical descriptors on Kirishima’s wanted posters — 160 cm tall (5 ft 3), “thick and rather large” lips, very short-sighted — is a summary of his crime, which is outline on Japan’s National Police Agency website.

In April 1975, the young radical allegedly helped set up a bomb that blasted away parts of a building in Tokyo’s upscale Ginza district. No one was killed.

He has been on the run ever since.

“I want to meet my death with my real name”

TV Asahi and the Japan Times reported he had lived a double life for years, working at a building contractor in the city of Fujisawa in Kanagawa region, under the alias Hiroshi Uchida.

He was paid in cash and went under the radar with no health insurance or driving license, the reports said.

At the nondescript office where the man reportedly worked, someone who knew him told TV Asahi that the suspect had “lost a lot of weight” compared to the wanted photo.

The man believed to be Kirishima began to receive treatment for stomach cancer under his own expense, the reports said.

It was at a hospital in the city of Kamakura that he finally confessed that he was 70-year-old Kirishima, they added.

Nine other members of the East Asia Anti-Japan Armed Front were arrested, the Asahi newspaper said.

But two 75-year-olds are still on the run after being released in 1977 as part of a deal by the Japanese Red Army, which had hijacked a Japan Airlines plane in Bangladesh.

Fusako Shigenobu, the female founder of the Japanese Red Army, walked free from prison in 2022 after completing a 20-year sentence for a 1974 embassy siege.

Shigenobu’s group carried out armed attacks in support of the Palestinian cause during the 1970s and 80s, including a mass shooting at Tel Aviv airport in 1972 that killed 24 people.

Kirishima, though, escaped justice, or so it seems.

“I want to meet my death with my real name,” he told staff at the hospital, according to NHK.

PHILIP FONG/AFP via Getty Images

CBS News

Mayorkas warns of “serious” consequences for Homeland Security if government shuts down

Washington — Homeland Security Secretary Alejandro Mayorkas warned Friday that his agency could suffer “serious” consequences if Congress fails to pass legislation funding federal agencies and averting a government shutdown in the next few hours.

In an interview with “Face the Nation with Margaret Brennan,” Mayorkas said many components of the Department of Homeland Security would be affected by a lapse in funding, including the Transportation Security Administration (TSA), FEMA and Border Patrol.

The homeland security chief added that a failure by lawmakers to pass a stopgap spending bill before Saturday would also mean staff at the Countering Weapons of Mass Destruction Office would be redirected to other parts of his department.

“The implications and the consequences are serious, especially when it comes to Homeland Security,” Mayorkas said.

He urged Congress to approve legislation that would keep government agencies operating before midnight, when a short-term extension enacted in September will expire.

House Speaker Mike Johnson unveiled earlier this week a legislative package negotiated with Democrats that would have extended government funding through March 14, provided more than $100 billion in disaster aid for states impacted by extreme weather events, and given members of Congress a pay raise, among other provisions.

But the proposal was swiftly met with pushback from some conservative Republicans, who balked at the size and scope of the 1,550 page deal. Crucially, it was also criticized by billionaire Elon Musk, an ally of President-elect Donald Trump, and then by the incoming president himself.

Trump and Musk torpedoed the package, with Musk taking to X, the social media platform he owns, to lambaste provisions of it. The president-elect further upended negotiations over a funding deal when he called on Republicans to address the debt limit — which is set to be reinstated Jan. 1 — in their plan.

Johnson unveiled a second measure Thursday, which would have funded the government for three months, suspended the nation’s borrowing limit until January 2027 and provided $110 billion in disaster relief. The more tailored legislation, which Trump backed, also included health care provisions, a one-year renewal of the farm bill and funding for rebuilding the Francis Scott Key Bridge in Baltimore, which collapsed in March.

But that package failed to pass the House with the necessary support after it was opposed by most Democrats and more than three dozen Republicans.

That defeat sent Johnson and GOP leaders back to the drawing board, with the prospect of a shutdown rising with each passing hour. Republicans are now discussing voting on three provisions of the package individually, sources familiar with the matter told CBS News: a clean extension of government funding; billions of dollars in disaster aid; and assistance to farmers.

Mayorkas told “Face the Nation” that a shutdown just before the holidays — when tens of millions of Americans are traveling — would mean TSA employees at airports throughout the country would be forced to work without pay. However, they would likely receive backpay after a shutdown ends, as has happened before after previous funding lapses.

“We’re going to have tens of thousands of TSA employees working an incredibly high volume of passenger traffic throughout our airports across the country, and they will be doing so keeping the American public safe without pay,” he said.

The Homeland Security secretary also said those impacted would include U.S. Border Patrol agents stationed along the U.S.-Mexico border.

“There are people in government service who are dedicating their talent and their energy to the well-being of the American people, who rely on their paychecks to make ends meet, and it is the holiday season, after all, but our men and women on the border will be guarding the border of the United States at no pay if funding doesn’t come through,” Mayorkas said.

The $110 billion in disaster assistance that will likely be included in a spending deal includes money for FEMA, which has been responding to the hurricanes that devastated the southeast this fall.

Mayorkas said that inaction by Congress would impact those states hit by the storms, including North Carolina and Florida.

“What FEMA will need to do, another significant impact of the failure to fund the federal government, is they will now need to delay — they’ll put on pause certain contracts, certain projects that are actually repairing communities devastated by extreme weather events, by tornados, by hurricanes, by fires, and that will delay the rebuilding of communities and really delay the ability to deliver for people who have suffered so much,” he said.

Mayorkas said a shutdown occurring over the holidays would force the Department of Homeland Security to “make difficult decisions now to delay projects.”

Lawmakers representing those storm-ravaged states have pushed for disaster relief to be included in any legislative package funding the government.

CBS News

Watch: White House takes questions on looming government shutdown

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

What to know about the government shutdown deadline threatening the U.S.

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.