Kare11

University of Minnesota Board of Regents select new president

Dr. Cunningham, who holds a medical doctorate, is currently vice president for research and innovation at the University of Michigan.

MINNEAPOLIS — The University of Minnesota’s Board of Regents has voted to select Dr. Rebecca Cunningham to serve as the 18th president of the university.

Cunningham, who holds a medical doctorate from Jefferson Medical College, is currently the vice president for research and innovation at the University of Michigan, where she’s served on the faculty of the Univ. of Michigan’s Schools of Public Health and Medicine since 1999.

Dr. Cunningham was selected unanimously by the board in a 12-0 vote, following interviews with fellow finalists Dr. Laura Bloomberg, the current president of Cleveland State University, and Dr. James Holloway, provost and executive vice president for academic affairs at the University of New Mexico.

If terms of a contract are accepted and finalized, Cunningham would succeed Joan T.A. Gabel, who left the U of M in 2023.

Watch the latest local news from the Twin Cities and across Minnesota in our YouTube playlist:

WATCH MORE ON KARE 11+

Download the free KARE 11+ app for Roku, Fire TV, Apple TV and other smart TV platforms to watch more from KARE 11 anytime! The KARE 11+ app includes live streams of all of KARE 11’s newscasts. You’ll also find on-demand replays of newscasts; the latest from KARE 11 Investigates, Breaking the News and the Land of 10,000 Stories; exclusive programs like Verify and HeartThreads; and Minnesota sports talk from our partners at Locked On Minnesota.

Kare11

Man isn’t expected to survive after getting shot while hunting

Officials, who identified the hunter as Jace Srur, of Dilworth, say his injuries are “life-threatening” and “non-survivable.”

MOORHEAD, Minn. — A 34-year-old man who was shot in the head by a stray bullet hunting while hunting near Moorhead on Saturday isn’t expected to survive, according to officials.

In an update on Tuesday, the Clay County Sheriff’s Office said the injuries are considered “life-threatening” and “non-survivable.” Officials identified the hunter as Jace Srur, of Dilworth.

Authorities were called to the area of 4600 90th Avenue North just before 8 a.m. Saturday on a report of a shooting. When deputies arrived, they found Srur with a gunshot wound to his head. Crews on scene gave him first aid until ambulance crews arrived and transported him to a hospital by Airmed. The incident remains under investigation.

A second, unrelated hunting incident was reported hours later in Lee Township. Officials with the Norman County Sheriff’s Office said a 37-year-old man sustained “non-life-threatening” injuries after being shot once while out hunting.

Kare11

Some Minnesota residents get medical debt wiped

The city of Saint Paul is using funds from the American Rescue Plan to cancel roughly $110 million in medical debt for residents.

ST PAUL, Minn. — In its first round of medical debt relief, the city of Saint Paul wiped out nearly $40 million of debt for 32,000 people.

“Residents will receive a surprise notice in the mail that their medical debts totaling just shy of $40 million have been purchased by the city and completely abolished,” Saint Paul mayor Melvin Carter announced in a press conference on Tuesday. “Every day, millions of Americans face the impossible choice between paying medical bills and covering their basic needs. Nearly half of all bankruptcies are linked to medical debt and nearly 50% of adults have delayed or skipped care due to debt.”

According to the Kaiser Family Foundation, an analysis of government data shows Americans across the country owe at least $220 million in medical debt. In Minnesota, the organization estimates about 330,000 people have medical debt.

Under Carter’s Medical Debt Reset Initiative, the city of Saint Paul is using funds from the American Rescue Plan to cancel roughly $110 million in medical debt for people who meet certain income requirements.

There is no method of applying for forgiveness. People who meet the required criteria are automatically considered for debt relief.

The city is partnering with the national nonprofit organization, Undue Medical Debt, to buy and cancel debt from local healthcare facilities. Fairview patients were the first to get their debts forgiven in this round.

“Last year, we shared that all of our major hospital systems in the state have signed on to do this with us,” Carter explained. “So, Fairview has gone first and we expect the rest to follow shortly.”

“There’s no reason why this should stop at Saint Paul,” Minnesota Attorney General Keith Ellison said. “There’s no reason why this policy should not be extended throughout the state of Minnesota because Minnesotans, in fact, are struggling under the weight of medical debt. Medical debt they did not ask for, they did not plan for.”

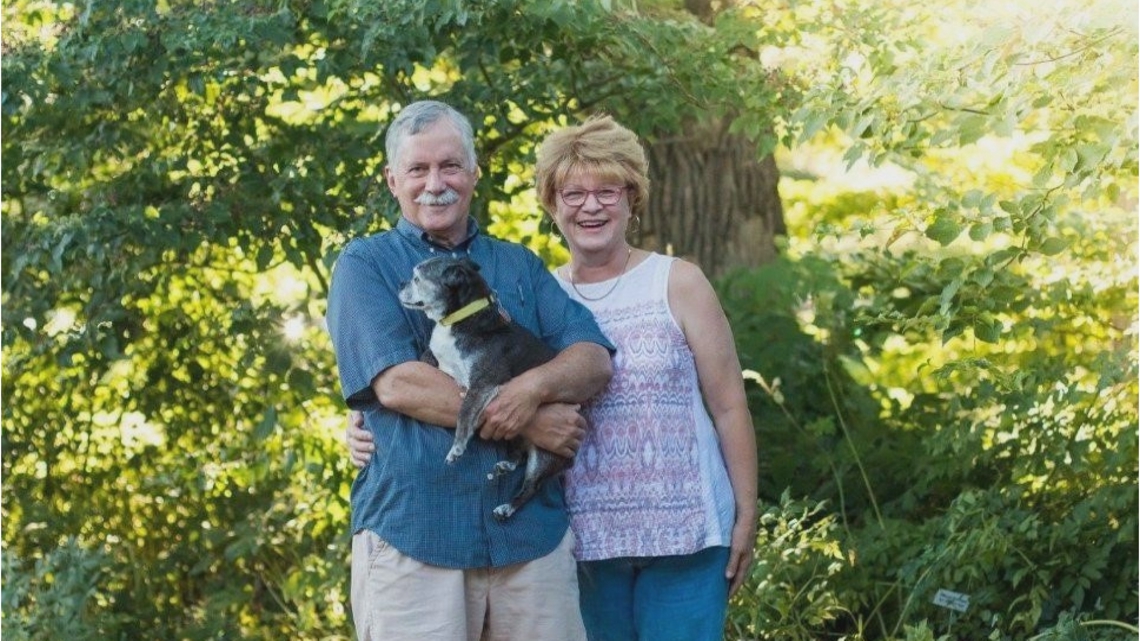

Walt Myers, a lifelong Minnesota resident, veteran and cancer survivor, said he knows what it’s like to “be under a cloud of medical debt.” After his wife Sue passed away from breast cancer five years ago, Myers said he began to receive medical bills for his late wife’s in-home hospice care. The bills began to accumulate and far surpassed the maximum $4,000 out-of-pocket expenses he was prepared to pay under his medical plan.

“I felt very lost in the medical billing hell that I found myself in,” Myers said.

He soon began working with Cancer Legal Care, an organization dedicated to assisting cancer patients and survivors with any legal needs.

“With the help of my former employer, we came up with a possible solution that we thought might work,” Myers recalled. “We contested the charges and then we waited. After almost a month of waiting, we heard back from the insurance company, and what ultimately turned out to be $135,000 dollars of medical debt had entirely been forgiven. Every penny, it was gone.”

Myers said he was stunned. “I was incredibly relieved and I don’t know how else to describe this, but to me, it was a life-changing event,” he said. “Maybe as a result of all of this, we’ll be able to hear a few more life-changing stories.”

The average amount of debt forgiven per person is $268, according to the mayor’s office. The largest amount canceled during this round of relief is $105,000.

Kare11

Minnesotan’s story sheds light on the impact of medical debt

Walt Myers of Lakeville faced $135,000 in medical bills after his wife, Sue, died of breast cancer in 2019.

LAKEVILLE, Minnesota — St. Paul Mayor Melvin Carter has announced that nearly $40 million in medical debt will be wiped out for 32,000 St. Paul residents.

The city has partnered with the nonprofit Undue Medical Debt to make it happen.

During Tuesday’s press conference, Walt Myers of Lakeville shared his story. While Myers is not personally benefiting from St. Paul’s announcement, he knows firsthand how medical debt can impact someone’s life.

“Nobody knew what to do. It was medical billing hell,” Myers said.

Myers inherited $135,000 in medical bills after his wife, Sue, died in March 2019.

Sue was 39 years old when she was diagnosed with breast cancer.

“I can tell you the exact moment my life changed forever. We were sitting on the couch watching TV downstairs and she touches the the base of her left breast and she says, ‘Does that feel weird to you?'”

Myers said his wife battled cancer for more than two decades before entering hospice care in January 2019.

“The hospice team came in and they were amazing. They took just exceptional care of her,” Myers said. “It was always her wish and our wish as a family to stay in the house as long as possible and, you know, up in the bedrooms is where she passed away.”

Prior to Sue’s death, Myers was getting explanation of benefits (EOB) letters.

“It was six to seven pages, both sides, and unless you know exactly what you’re looking for… I’d defy anybody to figure out what it is they’re telling you,” Myers said. “Then came the insurance medical $135,000 out-of-network bill.”

Myers recalled a social worker who once mentioned Cancer Legal Care — a nonprofit that provides free legal care to Minnesotans affected by cancer.

“I just retired… had a celebration of life for my wife, trying to console my kids, and had this medical debt hanging over my head that was just brutal. I was actually afraid to go to the mailbox and see what was in it,” Myers said.

Cancer Legal Care connected with Myers’ former employer and it kept going up the chain.

“We pled our case and waited and about a month later we get a response from the insurance company saying my $135,000 bill was forgiven. So a life-changing moment,” Myers said.

It led to Myers volunteering for Cancer Legal Care. While Myers has never considered himself a public speaker, he suddenly found himself front and center at press conferences sharing his story as part of a push to get the Minnesota Debt Fairness Act passed.

The new law took effect in Minnesota on Oct. 1. Among other things, medical debt can no longer be automatically transferred to one’s spouse. It also cannot be used to deny medically necessary care or be reported to credit reporting agencies. You can read the full list of changes, here.

“A very meaningful thing. Hopefully, people won’t ever be touched by that but if they’re in a situation where they are, they’re going to be very thankful for this new law,” he said.

Myers went on to say, “I can tell you that my wife would be absolutely delighted to know that after five and a half years of her passing, she’s still helping people.”