CBS News

What is an adjustable-rate mortgage (ARM)?

Getty Images/iStockphoto

If you’re on the hunt for a new home, today’s high mortgage rates may be a cause for concern. After all, the higher your mortgage rate is, the higher your monthly payments will be. And, even a small difference in your rate could make a significant difference in the total amount of money you pay for your home in the long run.

The good news is that you may not have to deal with a high interest rate for the life of your mortgage. An adjustable-rate mortgage (ARM) could allow you to purchase your home at a lower rate now and let you take advantage of potential interest rate reductions in the future.

Find out your mortgage loan options online now.

What is an ARM loan?

An ARM loan differs from a fixed-rate mortgage loan in terms of the interest rate. A fixed-rate mortgage has an interest rate that stays the same over the life of the loan while an adjustable-rate mortgage has a variable interest rate that can change over time.

What’s unique about ARM loans is that they start with a period of fixed interest. That is followed by an adjustable-rate term in which the rate can change at certain times. Depending on the ARM loan you choose, the fixed-rate period will generally last from a year or two to 10 years. During that time, you’ll pay the fixed interest rate you agreed to when you purchased your home.

Once the fixed-rate period ends, the ARM loan enters an adjustable-rate phase, which lasts for the remainder of the loan. During the adjustable period of the loan, the lender can adjust your mortgage rate based on the wider rate environment. While it depends on the loan, the rate can typically be adjusted every six to 12 months on average.

For example, a 5/6 adjustable-rate mortgage is one with a five-year fixed-rate period followed by an adjustable rate that can change every six months. Or, a 7/1 ARM would have a fixed rate for seven years followed by an adjustable rate phase in which the rate can change once per year.

Compare your mortgage options today.

What is an ARM rate cap?

ARM loans typically also have rate caps tied to the adjustable-rate phase of the loan. These caps limit the increase or decrease that can be made to your rate.

For example, a 5/6 ARM loan with 2/2/5 caps:

- Has a five-year fixed period and the adjustment period allows for rate changes every six months

- Can be adjusted by a maximum of 2% for the first adjustment

- Can be adjusted by a maximum of 2% for the second adjustment

- Can be adjusted by 5% maximum in total over the life of the loan

For example, let’s say you borrow money with a 5/1 (2/2/5) ARM loan at a 6.5% fixed initial rate. In this case, your rate would stay at 6.5% for the first five years.

When the fixed period ends in year six, your interest rate could adjust in either direction by a maximum of two percentage points, increasing to a maximum of 8.5% or dropping to a maximum of 4.5% depending on market conditions. The following year, a similar rate change with a two percentage point maximum could occur.

But while the rate can adjust each year, the adjustment can never be more than 5% above or below the rate the mortgage started with. In this case, the 5% cap would mean the mortgage rate could range from 1.5% to 11.5% at any point during the adjustment period.

Benefits of choosing ARM loan over a fixed-rate mortgage

“In this economic climate, it’s important for buyers to explore all their mortgage options,” says Bill Banfield, EVP of capital markets for Rocket Mortgage. “There are a few reasons buyers are considering adjustable-rate mortgages (ARMs).”

These include:

- Lower initial fixed rates: “Typically, ARMs offer lower interest rates during a fixed period at the beginning of the loan term, say the first seven years, then the rate adjusts each year for the rest of the term,” says Banfield. So, you could start saving money immediately upon closing with an ARM.

- Variable rates: ARMs “can also be a good option if the buyer is confident mortgage rates will fall in the future,” Banfield says. And, an adjustable-rate loan may benefit you now because experts expect rates to fall soon.

- Lower initial monthly payments: Your ARM will likely come with a lower initial rate than a fixed-rate mortgage, so you’ll also likely have lower initial monthly payments than you would with a fixed-rate option.

- Qualification: It may be easier to qualify for an ARM than it is to qualify for a fixed-rate mortgage in certain cases.

Explore your options and learn whether an adjustable-rate mortgage loan is right for you.

The bottom line

If you’re concerned about today’s interest rates impacting your ability to buy a home, an ARM loan may be a compelling option to consider. And, experts expect that rates could decline in the future, so an ARM could allow you to take advantage of potential rate declines when they happen.

CBS News

12/20: CBS Evening News – CBS News

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Saturday is the winter solstice and 2024’s shortest day. Here’s what to know about the official start of winter.

The 2024 winter solstice, the shortest day of the year, happens on Saturday, Dec. 21, in the Northern Hemisphere. The celestial event signifies the first day of winter, astronomically.

What is the winter solstice?

The winter solstice is the day each year that has the shortest period of daylight between sunrise and sunset, and therefore the longest night. It happens when the sun is directly above the Tropic of Capricorn, a line of latitude that circles the globe south of the equator, the National Weather Service explains.

The farther north you are, the shorter the day will be, and in the Arctic Circle, the sun won’t rise at all.

How is the day of the winter solstice determined?

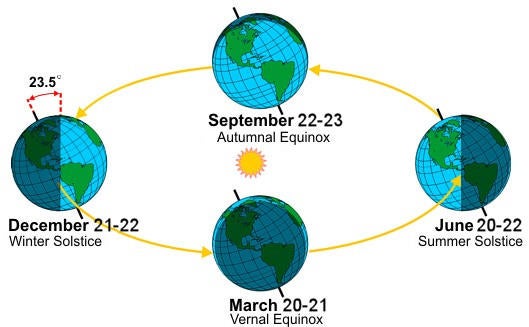

The winter solstice occurs because of the Earth’s tilt as it rotates around the sun.

When the Northern Hemisphere tilts away from the sun, the nights last longer. The longest night happens on the solstice because the hemisphere is in its furthest position from the sun. That occurs each year on Dec. 21 or 22.

This year, it falls on Dec. 21 at 4:21 a.m ET, to be precise.

On the summer solstice, when the northern tilt is closest to the sun, we have the longest day, usually June 20 or 21.

National Weather Service

The solstices are not always exactly on the 21st every year because the earth’s rotation around the sun is 365.25 days, instead of 365 even.

Will days start getting longer after the winter solstice?

Yes. Each day after the solstice, we get one minute more of sunlight. It doesn’t sound like much, but after just two months, or around 60 days, we’ll be seeing about an hour more of sunlight.

When will winter officially be over in 2025?

The meteorological winter ends on March 20, 2025. Then, spring will last until June 20, when the summer solstice arrives.

How is the winter solstice celebrated around the world?

Nations and cultures around the world have celebrated the solstice since ancient times with varying rituals and traditions. The influence of those solstice traditions can still be seen in our celebrations of holidays like Christmas and Hanukkah, Britannica notes.

The ancient Roman Saturnalia festival celebrated the end of the planting season and has close ties with modern-day Christmas. It honored Saturn, the god of harvest and farming. The multiple-day affair had lots of food, games and celebrations. Presents were given to children and the poor, and slaves were allowed to stop working.

Gatherings are held every year at Stonehenge, a monumental circle of massive stones in England that dates back about 5,000 years. The origins of Stonehenge are shrouded in mystery, but it was built to align with the sun on solstice days.

Andrew Matthews/PA Images via Getty Images

The Hopi, a Native American tribe in the northern Arizona area, celebrate the winter solstice with dancing, purification and sometimes gift-giving. A sacred ritual known as the Soyal Ceremony marks the annual milestone.

In Peru, people honor the return of the sun god on the winter solstice. The ancient tradition would be to hold sacrificial ceremonies, but today, people hold mock sacrifices to celebrate. Because Peru is in the Southern Hemisphere, their winter solstice happens in June, when the Northern Hemisphere is marking its summer solstice.

Scandinavia celebrates St. Lucia’s Day, a festival of lights.

The “arrival of winter,” or Dong Zhi, is a Chinese festival where family gathers to celebrate the year so far. Traditional foods include tang yuan, sweet rice balls with a black sesame filling. It’s believed to have its origins in post-harvest celebrations.

Researchers stationed in in Antarctica even have their own traditions, which may include an icy plunge into the polar waters. They celebrate “midwinter” with festive meals, movies and sometimes homemade gifts.

CBS News

12/20: CBS News Weekender – CBS News

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.