CBS News

How much money do you need to retire? Here’s what experts recommend

Getty Images

Millions of Americans are currently preparing to retire and are therefore evaluating their financial health. But this is hardly news for many. The number of Americans receiving Social Security jumped by 10 million between 2012 and 2022 alone.

If you’re counting on Social Security to cover your retirement costs, you should know that those benefits will only get you so far. In most cases, you’ll need to have hefty savings in addition to your Social Security benefits.

So how much do you need to retire comfortably? There are several factors that should be taken into account when determining that number, according to experts. That said, there are some general rules you can follow. Below, we’ll break down how much you should have stowed away prior to retirement and how to increase that amount as you close in on your retirement date.

Start by reviewing your investment options here to better determine an exact figure.

How much should you save for retirement?

The exact amount you should have ready for retirement varies widely depending on the lifestyle you want to have (or maintain), your location, who you’re supporting and many other details. As such, it’s impossible to determine an exact, uniform figure for everyone. It really is a personal question. As David Rosenstrock, director at Wharton Wealth Planning, explains, “There’s no ‘one size fits all’ solution as to how much you need for retirement.”

Still, there are rough guidelines you can follow. Some experts say to have at least eight to 10 times your annual salary available to you once you enter retirement. Others say you need at least 65% to 80% of your pre-retirement income available to you each year.

There are also general savings recommendations by age, and, finally, there’s the 4% rule, too. “The 4% rule is a guideline stating that you should take out only about 4% of your retirement savings annually,” Rosenstrock says.

Learn more about saving for retirement here now.

How to determine how much you need to retire

To get a solid feel for how much you’ll need in retirement, there are a few steps you can take. First, estimate your retirement expenses. This should be relatively easy to do, although it helps to slightly overestimate than to come in too low.

“Consider your expected living costs during retirement, including housing, healthcare, food, transportation, leisure activities, and any other expenses you anticipate,” says Derek DiManno, a financial advisor at Flagship Asset Services. “Be realistic and account for inflation.”

From that number, subtract the benefits you already know are coming to you in retirement — things like Social Security benefits, pensions, investment returns, rental income and any other assets that could help make ends meet. That’s the funding gap you’ll need to make up.

“You may find out that there is a disconnect between your desired lifestyle and your ability to fund it,” Rosenstrock says. “When budgeting, it can be useful to break out your spending into needs and wants.” If you don’t want to compromise on either then plan on saving more now.

How to save more for retirement

If you don’t have enough stowed away for retirement, there are many ways to increase those funds, both early on in your career and as you inch closer to retirement age. You can do so by:

Using employer matches

If you’re young, then maximize your use of IRAs, 401(k)s, and employer-sponsored retirement plans, especially if they offer employer-matched contributions.

“Take advantage of employer matches,” DiManno says. “If your employer offers a retirement savings match, contribute enough to maximize the match. This effectively provides you with additional money toward retirement.”

Making catch-up contributions

If you’re on the older end — 50 or older, to be exact — you can actually start contributing more to your retirement accounts than other age groups are allowed (anywhere from $1,000 to $7,500 more). These “catch-up” contributions can help you grow your retirement funds quicker than other age ranges. “These limits will increase with inflation, allowing your savings to keep up with rising living costs,” Rosenstrock says.

Find out how much more you can invest for retirement here now.

Cutting expenses or downsizing

At any age, reducing your expenses can be a good way to pad your retirement funds. Canceling one subscription (or multiple), for example, might give you $10 per month and $120 per year to put in your retirement accounts. If invested early on, that amount could grow considerably by the time you retire.

You can also consider downsizing, particularly if you’re nearing retirement and don’t need as much space or real estate as you once did. “If your housing costs are substantial, downsizing to a smaller home or relocating to a less expensive area can free up funds that can be redirected towards retirement savings,” DiManno says.

Getting help from a professional

Mapping out a personalized plan is critical to a successful retirement. If you want to ensure your retirement funds are adequate, consider speaking to a financial advisor or investment professional. They can help you customize savings and investing strategies that fit your specific goals so that you don’t come up short. Learn more here now.

The bottom line

While million of people are set to retire soon, the individual needs of each person will vary in their retirement years. To get to one of the figures stated above consider taking a multi-pronged approach. This involves using employer retirement matches, making catch-up contributions (for those who qualify), cutting expenses, downsizing and getting help from professional services. By being proactive and taking these steps now you’ll better be able to enjoy a financially secure retirement.

CBS News

California Gov. Newsom defers clemency decision as incoming LA County district attorney reviews Menendez brothers case

California Gov. Gavin Newsom will defer his decision on the Menendez brothers’ clemency petition to allow for incoming Los Angeles County District Attorney Nathan Hochman to review the case, his office announced Monday.

“The Governor respects the role of the District Attorney in ensuring justice is served and recognizes that voters have entrusted District Attorney-elect Hochman to carry out this responsibility,” Newsom’s office said in a statement. “The Governor will defer to the DA-elect’s review and analysis of the Menendez case prior to making any clemency decisions.”

Lyle and Erik Menendez have spent roughly 35 years in state prison after they were convicted in their parents’ 1989 murder. Outgoing District Attorney George Gascón sent letters in support of the brothers’ clemency to Newsom after a Netflix show and documentary revived interest in the brothers’ case.

“I strongly support clemency for Erik and Lyle Menendez, who are currently serving sentences of life without possibility of parole. They have respectively served 34 years and have continued their educations and worked to create new programs to support the rehabilitation of fellow inmates,” Gascón said in a statement before losing his re-election bid.

In an interview, Hochman said if the case is not resolved by a Nov. 25 habeas petition hearing — when a judge will hear a motion requesting to vacate the first-degree murder convictions — he will review the case to determine whether or not to recommend resentencing.

Hochman, who will be sworn in on Dec. 2, indicated that he would petition the court for additional time to review the cast ahead of the resentencing hearing scheduled for Dec. 11.

“I wouldn’t engage in delay for delay’s sake because this case is too important to the Menendez brothers,” Hochman said in an interview earlier in November. “It’s too important to the victims’ family members. It’s too important to the public to delay more than necessary to do the review that people should expect from a district attorney.”

Such an analysis of the case would involve reviewing thousands of pages of prison files and transcripts of the months-long trials as well as speaking with law enforcement, prosecutors, defense counsel and victims’ family members, he added.

“Whatever position I ultimately end up taking, people should expect that I spent a long time thinking about it, analyzing the evidence,” Hochman said. “But my 34 years of criminal justice experience — involving hundreds of cases as a prosecutor and a defense attorney — allow me to work quickly and expeditiously in conducting this type of thorough review because I’ve done it in many, many cases before.”

After being arrested for their parents’ deaths in 1990, the Menendez brothers went through two trials where prosecutors argued that they murdered their parents because of greed. However, the siblings testified that they killed their parents in self-defense. The brothers told the jury about the alleged sexual abuse they said they experienced at the hands of their father during an emotional, highly publicized first trial.

Following closing arguments, the jurors spent roughly four days deliberating but failed to come to a unanimous decision. The judge declared a mistrial after the jury was unable to deliver a decision.

In the next and final trial, the presiding judge did not allow the defense to submit some evidence connected to the sexual abuse allegations. Prosecutors argued the brothers were lying about the allegations.

The second jury convicted Erik and Lyle Menendez of first-degree murder in 1995 and sentenced them to life in prison without the possibility of parole.

CBS News

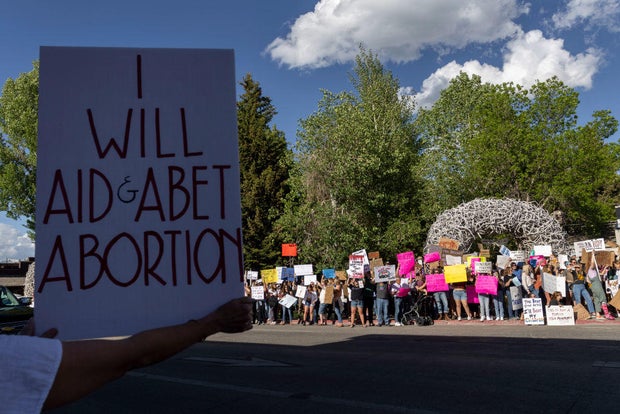

Wyoming abortion laws, including ban on pills to end pregnancy, struck down by state judge

A state judge on Monday struck down Wyoming’s overall ban on abortion and its first-in-the-nation explicit prohibition on the use of medication to end pregnancy in line with voters in yet more states voicing support for abortion rights.

Since 2022, Teton County District Judge Melissa Owens has ruled consistently three times to block the laws while they were disputed in court.

The decision marks another victory for abortion rights advocates after voters in seven states passed measures in support of access.

One Wyoming law that Owens said violated women’s rights under the state constitution bans abortion except to protect a pregnant woman’s life or in cases involving rape and incest. The other made Wyoming the only state to explicitly ban abortion pills, though other states have instituted de facto bans on the medication by broadly prohibiting abortion.

The laws were challenged by four women, including two obstetricians, and two nonprofit organizations. One of the groups, Wellspring Health Access, opened as the state’s first full-service abortion clinic in years in April 2023 following an arson attack in 2022.

“This is a wonderful day for the citizens of Wyoming — and women everywhere who should have control over their own bodies,” Wellspring Health Access President Julie Burkhart said in a statement.

NATALIE BEHRING / Getty Images

The recent elections saw voters in Missouri clear the way to undo one of the nation’s most restrictive abortion bans in a series of victories for abortion rights advocates. Florida, Nebraska and South Dakota, meanwhile, defeated similar constitutional amendments, leaving bans in place.

Abortion rights amendments also passed in Arizona, Colorado, Maryland and Montana. Nevada voters also approved an amendment in support of abortion rights, but they’ll need to pass it again it 2026 for it to take effect. Another that bans discrimination on the basis of “pregnancy outcomes” prevailed in New York.

The abortion landscape underwent a seismic shift in 2022 when the U.S. Supreme Court overturned Roe v. Wade, a ruling that ended a nationwide right to abortion and cleared the way for bans to take effect in most Republican-controlled states.

Currently, 13 states are enforcing bans on abortion at all stages of pregnancy, with limited exceptions, and four have bans that kick in at or about six weeks into pregnancy — often before women realize they’re pregnant.

Nearly every ban has been challenged with a lawsuit. Courts have blocked enforcement of some restrictions, including bans throughout pregnancy in Utah and Wyoming. Judges struck down bans in Georgia and North Dakota in September 2024. Georgia’s Supreme Court ruled the next month that the ban there can be enforced while it considers the case.

In the Wyoming case, the women and nonprofits who challenged the laws argued that the bans stood to harm their health, well-being and livelihoods, claims disputed by attorneys for the state. They also argued the bans violated a 2012 state constitutional amendment saying competent Wyoming residents have a right to make their own health care decisions.

As she had done with previous rulings, Owens found merit in both arguments. The abortion bans “will undermine the integrity of the medical profession by hamstringing the ability of physicians to provide evidence-based medicine to their patients,” Owens ruled.

The abortion laws impede the fundamental right of women to make health care decisions for an entire class of people — those who are pregnant — in violation of the constitutional amendment, Owens ruled.

Wyoming voters approved the amendment amid fears of government overreach following approval of the federal Affordable Care Act and its initial requirements for people to have health insurance.

Attorneys for the state argued that health care, under the amendment, didn’t include abortion. Republican Gov. Mark Gordon, whose administration has defended the laws passed in 2022 and 2023, did not immediately return an email message Monday seeking comment.

Both sides wanted Owens to rule on the lawsuit challenging the abortion bans rather than allow it to go to trial in the spring. A three-day bench trial before Owens was previously set, but won’t be necessary with this ruling.

CBS News

Two women told House panel Matt Gaetz paid them “for sex” via Venmo, their attorney says

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.