CBS News

Consolidating debt with home equity: Pros and cons to consider

Getty Images/iStockphoto

There’s no question that credit card debt is expensive right now. Not only do credit cards typically come with high interest rates, but the recent Federal Reserve rate hikes have resulted in card rates climbing even higher. So if you’re carrying a balance on your credit cards, chances are that you’re paying a significant amount of interest on the charges.

And if you’re dealing with other types of debt as well, like personal loans or student loans, today’s elevated rate environment can make it costly to pay off what you owe. But the good news is that it doesn’t have to be. There are a few simple options for consolidating your debts, which could save you a lot of money in interest charges over time.

For example, if you’re a homeowner with equity in your home, you have the option of consolidating your debts into a home equity loan or a home equity line of credit (HELOC). And, doing so could provide some relief. However, as with any big financial move, there are a few important pros and cons to weigh before taking this route.

Compare today’s top home equity loan options online now.

Consolidating debt with home equity: Pros and cons to consider

Here are some key factors to think about when deciding if a home equity loan is the right debt consolidation strategy.

Pros of consolidating debt with home equity

Let’s start with the potential benefits:

Lower interest rates

The key advantage of using a home equity loan or HELOC to consolidate your debt is that home equity loans and HELOCs tend to have much lower interest rates than credit cards or personal loans. For example, right now, the average rate on a home equity loan is 8.59% (as of April 9, 2024) and the average HELOC rate is 9.04%.

Both rates are substantially lower than the average credit card rate, which is hovering near 22% currently. So, by rolling your high-interest credit card debt into a lower-rate home equity loan or HELOC, you may be able to benefit from significant interest savings over the life of the loan.

Find the best home equity loan rates available to you now.

Simplified payments

A major benefit of debt consolidation is streamlining your payments. Rather than juggling multiple monthly payments to different creditors, by using your home’s equity to consolidate your credit card debt, you’ll have just one consolidated payment to make each month. This can make it a lot easier to budget and stay on top of your debt.

Flexibility with repayment terms

Home equity loans come with more flexible repayment options compared to many other types of debt. When you choose this option, you can typically choose a loan term length that fits your budget and goals, whether that’s five years, 10 years or even longer. This allows you to find a payment schedule that works best for your financial situation.

For example, if you’re aiming to pay off the debt in a shorter timeframe, you could select a 5-year repayment term. This will result in higher monthly payments, but you’ll be debt-free sooner. Alternatively, if you want to keep your monthly costs lower, a 10- or 15-year loan term may be more suitable, though you’ll be in debt for a longer period.

This flexibility can be especially helpful if your financial situation is likely to change in the coming years, as you can adjust the repayment period accordingly. Just keep in mind that the longer the term, the more you’ll pay in total interest over the life of the loan.

Potential credit score improvement

Consolidating multiple debts into a single home equity loan could help improve your credit score over time. By simplifying your payments and reducing your overall credit utilization, which is the amount of available credit you’re using, you may see a positive impact on your credit profile. That’s because credit scoring models look favorably upon consumers who have paid down debt and are utilizing less of their available credit.

And, having a home equity loan on your credit report can be seen as more favorable than having several maxed-out credit cards. Lenders also view home equity loans as a more responsible form of debt, which can further boost your score. Just be sure to make your payments on time each month to get the full benefit.

Cons of consolidating debt with home equity

Now, let’s look at some of the potential downsides:

Risk of foreclosure

Perhaps the biggest risk of consolidating your debt with a home equity loan or HELOC is that by using your home as collateral, you’re putting your home at risk if you can’t afford the payments on your home equity loan. If you are unable to make your loan payments, it could potentially lead to foreclosure, which would be disastrous. This makes it crucial to carefully assess your ability to make the new, consolidated payment each month.

Longer repayment period

Home equity loans typically have longer repayment terms than credit cards or personal loans. While this can make the monthly payments more manageable and offer some flexibility in terms of your repayment schedule, it also means you’ll be in debt for a longer period of time.

Closing costs

Taking out a home equity loan or HELOC will come with closing costs, which can add up to hundreds or even thousands of dollars, depending on the lender fees, the amount you borrow and other factors. These upfront costs should be factored into your analysis, as the added expense could negate the potential interest savings in certain situations.

Reduced home equity

Every dollar you borrow against your home’s equity is a dollar that’s no longer available to tap into if you need it. This can impact your ability to borrow against your home’s equity in the future if you want to access funding for a small business you’re starting, pay for home renovations and repairs or cover another large expense.

Temptation to overspend

When you consolidate your debts into a single, lower-interest loan, it can be tempting to start racking up new credit card balances again. It’s crucial to break the cycle of overspending and stay disciplined with your new payment plan. Otherwise, you’ll be paying for both your new credit card debt and your consolidated debt each month, which could make it difficult financially.

The bottom line

Consolidating debt with a home equity loan is a major financial decision that requires careful thought and planning. But if done responsibly, it can be an effective way to simplify your payments, reduce interest costs and work toward becoming debt-free. As with any major financial decision, though, it’s important to weigh all of your options to determine the best course of action.

CBS News

Good enough to eat: Noah Verrier’s paintings of comfort food

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

A study to personalize nutrition guidance just for you

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

CBS News poll finds Trump starts on positive note as most approve of transition handling

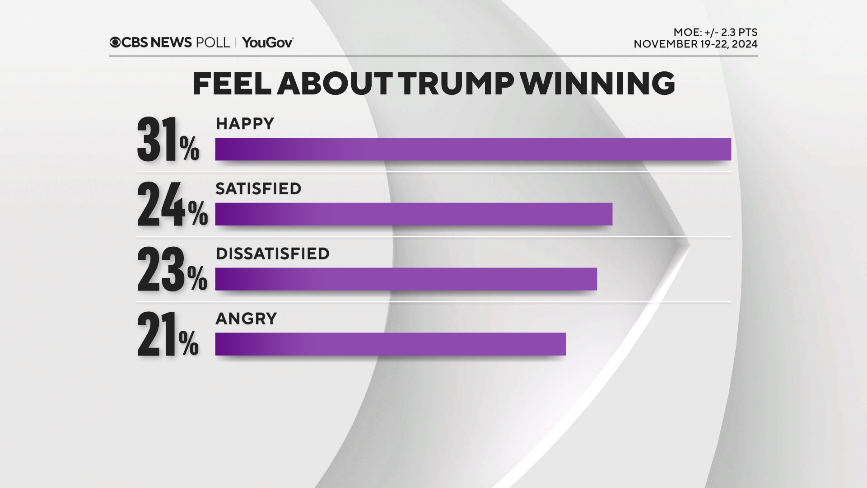

President-elect Donald Trump’s incoming administration starts off with mostly good will from the public: a majority of Americans overall are either happy or at least satisfied that he won and are either excited or optimistic about what he’ll do as president.

Trump’s handling of his presidential transition gets approval from most Americans overall and brings near-universal approval from his voters, along with a net-positive response about his selections for Cabinet posts, in particular, Sen. Marco Rubio, who is Trump’s pick to be secretary of state.

After inflation and the economy so dominated the election, Americans are more inclined to think his administration will bring down prices for food and groceries rather than raise them, and his voters overwhelmingly say that. Going into the election, his backers expected that, too.

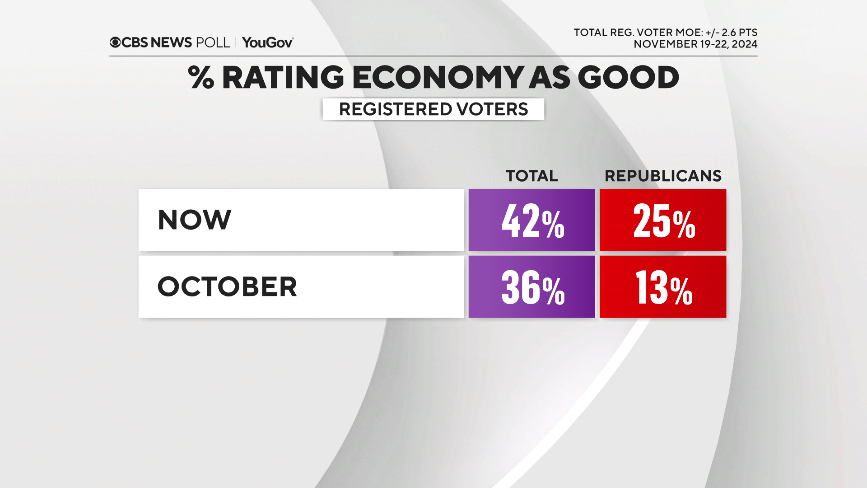

In a similar vein, Trump’s election already has some Republicans’ views of the economy improving.

Overall, Republicans today are more excited about what Trump will do as president now than they were in 2016 when he was first elected.

Democrats say they feel more scared about what Trump might do than they did in 2016, and a large majority of Democrats think as president he will threaten their rights and freedoms. But at the same time, there seems to be a sense of exhaustion, as fewer than half of Democrats feel motivated to oppose Trump right now.

Americans, and Democrats specifically, do think the Biden administration should work with the incoming Trump administration to ensure a smooth transition, and that congressional Democrats should work with Donald Trump on issues where they find common ground.

Trump and the economy

After winning comes expectations. There’s a net optimism about the incoming administration’s effect on food and grocery prices, especially among Trump’s voters. That comes as most Americans continue to say prices are currently rising. And inflation was a big factor in Trump winning in the first place.

It may be no surprise then that among many potential items for the incoming administration, Americans say plans to lower prices ought to be the top priority.

The percentage of Republicans who call the U.S. economy good, while still low, has gone up, as the percentage who call it very bad has dropped. That pushes voters’ overall evaluation of the economy slightly higher than it’s been this year — and further spotlights how much partisanship, along with optimism, always plays into these evaluations.

Trump selections of Cabinet and agency chiefs for his administration

Trump’s current selections for agency heads and Cabinet picks get rated overwhelmingly as good choices from Trump’s voters, and are net-positive as selections among Americans who have heard enough about them to say. (Many have not heard enough yet.)

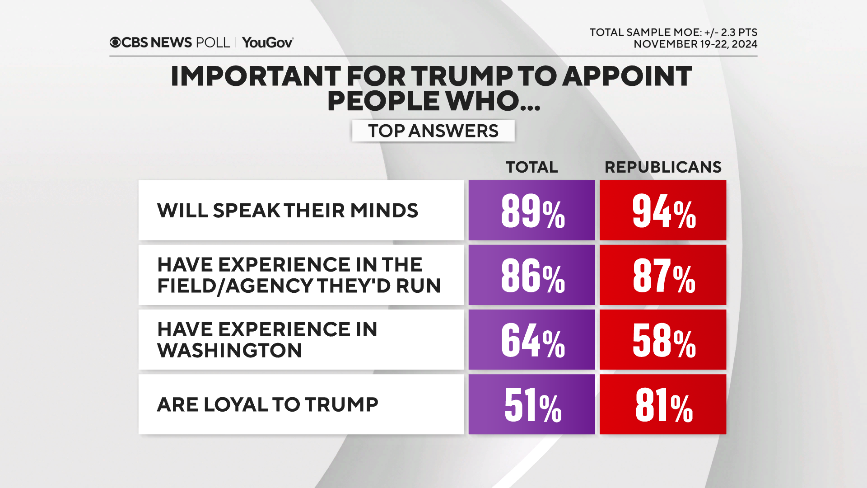

As a general rule, Americans want Trump to appoint people who’ll speak their minds and who have experience in the field or agency they’ll run. But in addition to those qualities, Republicans also want people who’ll be loyal to Trump.

A large majority of Republicans and Trump voters think Elon Musk should have at least some influence in the Trump administration. Americans overall are more split on that, largely along partisan lines.

Big majorities of Americans — and a slight majority of Republicans — would like to see the Senate hold hearings on his nominations, rather than let him make those appointments without it.

(Within self-identified Republicans, MAGA Republicans are relatively more inclined to say the Senate should skip the hearings.)

That sentiment holds whether or not people are told or reminded that the Constitution says the Senate should give advice and consent.

As a general matter, though, most of Trump’s voters and most Republicans do want Trump to have more presidential power this term than he did in his last. That sentiment is higher among Republican voters now than during the campaign.

Trump policies

On another economic front, Trump’s voters overwhelmingly favor the idea of tariffs: most of them don’t believe that will make prices higher. (For the third who believe tariffs will raise prices but support them anyhow, this is presumably a cost they’re willing to bear.)

For the public overall, opposition to tariffs goes hand in hand with the belief they’ll lead to higher prices.

As was the case with voters throughout the campaign, most Americans would, in principle, approve of a new mass deportation program.

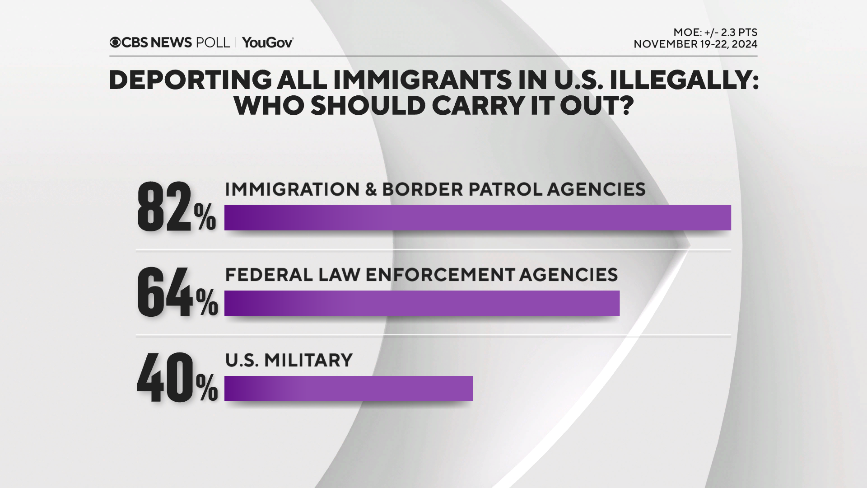

If the Trump administration does start a mass deportation program, most of the public would have it carried out by law enforcement or current immigration agencies — most would not have the U.S. military do it.

Elections and democracy

The 2024 results have shifted Republicans’ views of U.S. democracy and also returned some confidence to their view of U.S. elections. Few Republicans suspect fraud in 2024. They overwhelmingly did about 2020.

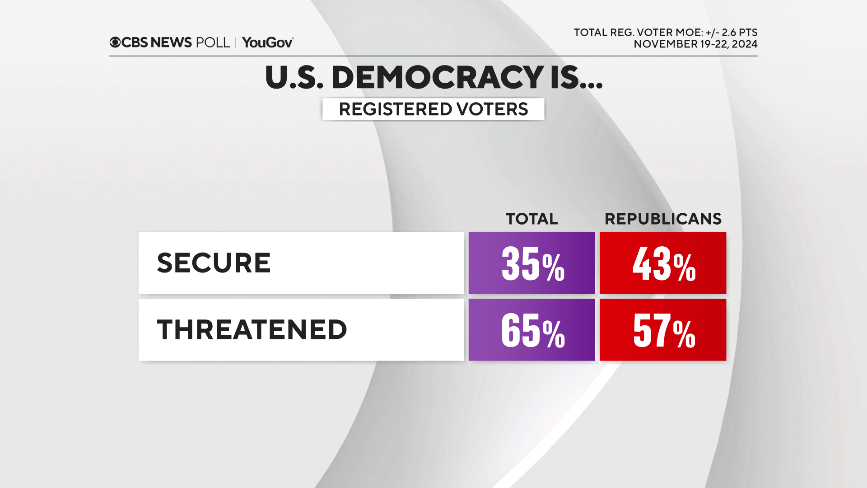

Following Trump’s victory, there’s been an increase in the number of Republicans who say democracy and rule of law is secure, though most Americans continue to say it is not.

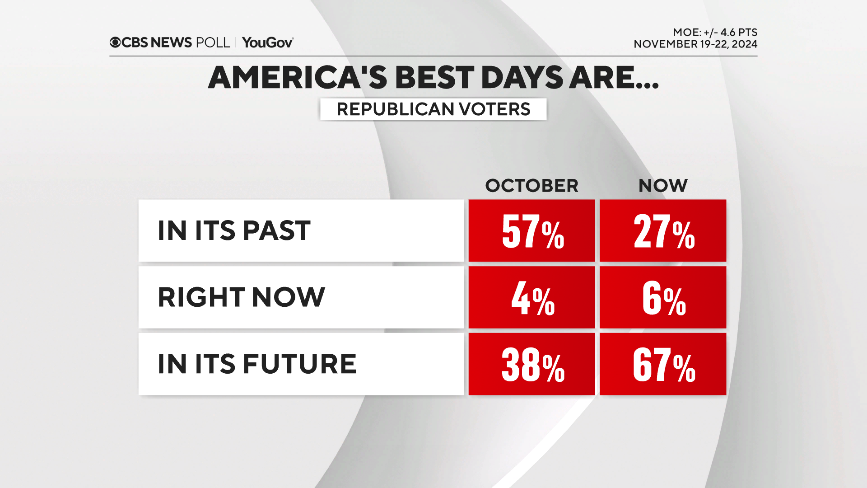

Looking ahead, there’s another shift along partisan lines. Throughout the campaign, Republicans said America’s best days were in its past, while Democrats felt they were in the future. These views are reversed now. After Trump’s win, most Republicans feel America’s best days are in its future.

This CBS News/YouGov survey was conducted with a nationally representative sample of 2,232 U.S. adults interviewed between November 19-22, 2024. The sample was weighted to be representative of adults nationwide according to gender, age, race, and education, based on the U.S. Census American Community Survey and Current Population Survey, as well as 2024 presidential vote. The margin of error is ±2.3 points.