CBS News

Inflation is sticking around. Here’s what that means for interest rate cuts — and your money.

The war against inflation was never going to be easy, but the latest consumer price index data demonstrates just how tough a fight the Federal Reserve is facing. In the months ahead, the outcome of that battle will have major implications for your finances.

New labor data shows that U.S. prices in March rose 3.5% from a year ago, hotter than economists expected and the third straight month that inflation has accelerated. Gasoline prices and rent contributed over half the monthly increase, the government said on Wednesday.

The upshot: The Fed’s ongoing campaign to tame inflation is far from over. That has left consumers and investors wondering if the central bank, who until recently were widely expected to cut its benchmark interest rate in June, could push back that timeline several months, or even into 2025.

Fed Chairman Jerome Powell has underscored that policy makers are closely monitoring inflation data to assess their progress in nudging it back toward their 2% annual rate, its level prior to the pandemic-fueled surge in prices. A premature move to cut the federal funds rate risks uncorking additional inflationary pressures, he has warned.

Addressing those concerns, another Fed official said last week that the central bank might not cut rates at all in 2024 “if we continue to see inflation moving sideways.”

Why is inflation inching higher?

Two main factors contributing to stronger-than-expected inflation in March were gasoline prices and rent. Rising prices at the pump stems partly to growing U.S. demand, according to the AAA, which said the current national average of $3.62 a gallon is about 6.6% higher than a month ago.

Gas prices are also rising because of mounting geopolitical tensions in Russia and the Middle East, with Brent crude earlier this month surging beyond $90 a barrel and the U.S. benchmark topping $86.

Rents also remain sticky amid the nation’s tight housing supply. A few other items also contributed to the acceleration, including car insurance, which surged a whopping 22.2% from a year earlier. Insurers have been hiking premiums to offset their rising costs due to extreme weather and the higher cost of new automobiles.

Why could that impact the Fed’s decision to cut rates?

Hiking interest rates is the Fed’s most effective weapon against inflation. That’s because businesses and consumers put the brakes on spending when it costs more to borrow money, and that effectively dampens demand for goods and services, which in turn can help lower inflation.

But with inflation so far refusing to dissipate in 2024, economists say the Fed has less of a reason to cut rates, at least in the near term.

What is the current Federal Reserve interest rate?

The current federal funds rate — what banks charge each other for short-term loans — is in a range of 5.25% to 5.5%.

The Fed has hiked its rate 11 times since March 2022 in its battle to curb inflation. That’s made it more expensive to borrow money, with rates for credit cards, mortgages and other loans sharply rising over the last two years.

When will the the Fed cut rates in 2024?

Prior to Wednesday’s inflation report, most economists had penciled in the Fed’s June 12 meeting as the likely date for its rate cut in four years. Economists had also predicted several cuts over the rest of 2024.

But due to the latest inflation reading, those experts are pushing back their forecasts.

“June is probably off the table” for a rate cut, noted Elyse Ausenbaugh, global investment strategist at J.P. Morgan Global Wealth Management, in an email.

If the Fed doesn’t cut in June, policy makers are unlikely to reduce rates until September because little economic data is released between their June and July meetings that could alter their thinking, noted Ryan Sweet, chief U.S. economist at Oxford Economics, in a research note on Wednesday.

How could a delayed rate cut impact your money?

The initial impact was felt Wednesday in the stock market, with Wall Street sending shares sharply lower.

Expectations the Fed would soon cut rates had fueled a 20% surge in the S&P 500 since Halloween. That’s because lower rates would help bolster spending from consumers and corporations, which in turn would encourage investors to pay higher prices for stocks, bonds, cryptocurrencies and other investments.

But with that looking less likely in the near-term, investors pulled back on Wednesday. If rate cuts come later in 2024 than expected, consumers could face higher borrowing costs for a longer period. Auto loans, credit card rates and other loans are based on the Fed’s benchmark rate, so a higher rate means that consumers won’t get a break anytime soon.

Mortgage rates, which are hovering at about 7%, are also influenced by the Fed benchmark rate, although they also reflect other factors, like bond yields and inflation. Rates for home loans are likely to be unchanged in the near-term due to factors like the strong job market and housing demand, according to Lawrence Yun, chief economist at the National Association of Realtors.

Is there an upside to interest rates remaining high?

If there’s a silver lining, it’s for savers given that some high-interest savings accounts, certificates of deposit and other savings vehicles now offer interest rates of 5% or more. If the Fed delays cutting rates, it’s likely savers will be able find favorable rates for longer in 2024.

That means consumers could sock away some cash in a high-interest savings account or CD and earn a rate that’s 1.5 percentage point to 2 percentage point higher than the current inflation rate. That’s better than leaving the money in a checking account that might be providing little to no interest, which effectively erodes the value of your money due to the impact of inflation.

CBS News

Uncovering America’s deep-rooted love for baseball

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

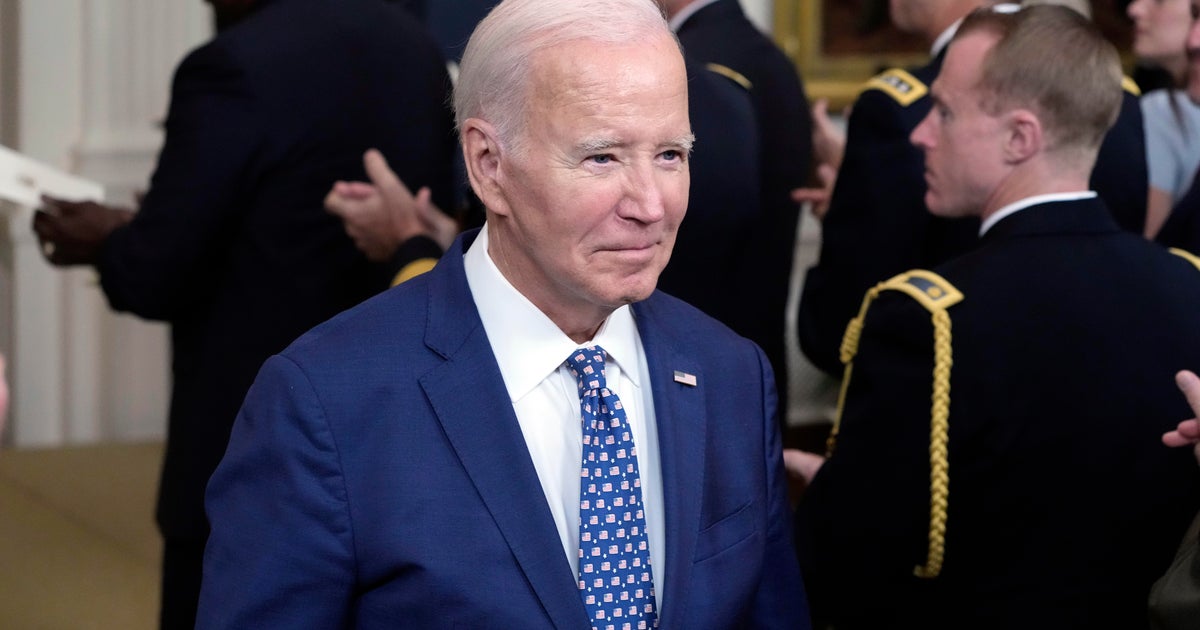

Watch Live: Biden awards Medal of Honor to 2 Union soldiers who hijacked train behind enemy lines

Washington — President Biden is awarding posthumous Medals of Honor on Wednesday to two Army privates who were a part of a plot to hijack a train and destroy Confederate infrastructure during the Civil War.

The president will honor Philip Shadrach and George Wilson for their “gallantry and intrepidity” in carrying out a covert operation called the “Great Locomotive Chase,” which played out 200 miles behind Confederate lines in Georgia in 1862, the White House said.

“In one of the earliest special operations in U.S. Army history, Union Soldiers dressed as civilians infiltrated the Confederacy, hijacked a train in Georgia and drove it north for 87 miles, destroying enemy infrastructure along the way. During what later became known as the Great Locomotive Chase, six of the Union participants became the Army’s first recipients of the newly created Medal of Honor,” a White House official said.

The operation was hatched by James Andrews, a Kentucky-born civilian spy and scout. He proposed penetrating the Confederacy with the goal of degrading their railway and communications lines to cut off Chattanooga, Tennessee, from Confederate supplies and reinforcements.

Andrews, together with 23 other men, infiltrated the South in small groups, coming together north of Atlanta. On April 12, 1862, 22 of the men commandeered a locomotive called The General and ventured north, tearing up railroad tracks and cutting telegraph wires as they went. The men became known as the Andrews’ Raiders.

Shadrach, originally from Pennsylvania and orphaned at a young age, was just 21 when he volunteered for the mission. On Sept. 20, 1861, he left home and enlisted in a Union Army Ohio Infantry Regiment. Wilson, born in Ohio, was a journeyman shoemaker before he enlisted in a Union Army’s Ohio Volunteer Infantry in 1861. He also volunteered for the Andrews’ Raid.

After the operation, both men were captured, convicted as spies and hanged.

“It is unknown why Private Shadrach and Private Wilson were not originally recommended for the Medal of Honor,” a White House official said. “Both were deserving in 1863, and on July 3, 2024, by order of the President of the United States both will be posthumously awarded the Medal of Honor.”

The ceremony comes as questions mount over Mr. Biden’s future as the presumptive Democratic nominee for president, with his public appearances under intense scrutiny following his halting performance at last week’s presidential debate. After the Medal of Honor ceremony, the president is meeting with Democratic governors to address their concerns and chart his path forward.

How to watch Biden present the Medal of Honor

- What: President Biden awards the Medal of Honor

- Date: July 3, 2024

- Time: 4:45 p.m. ET

- Location: White House

- Online stream: Live on CBS News in the player above and on your mobile or streaming device.

CBS News

Why Joey Chestnut is banned from 2024 Nathan’s Hot Dog Eating Contest

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.