CBS News

Trader Joe’s pulls fresh basil from shelves in 29 states after salmonella outbreak

Trader Joe’s has pulled Infinite Herbs-branded basil from its shelves in 29 states after a salmonella outbreak has left 12 people sickened.

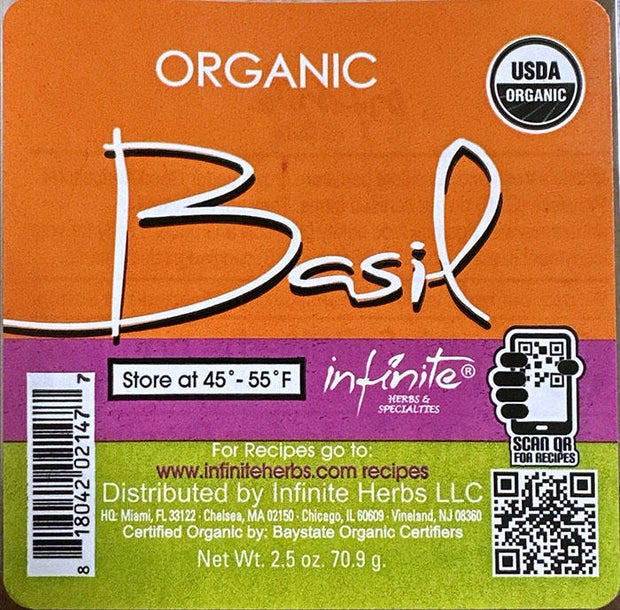

The organic basil was sold in 2.5-ounce clamshell-style plastic containers, according to a Wednesday statement from the Centers for Disease Control and Prevention. The health organization said people who bought the basil shouldn’t eat it, but should instead throw it out or return it to Trader Joe’s.

FDA

Seven of the 12 people who were sickened after eating the basil had bought or likely bought the product at Trader Joe’s, according to the statement. Meanwhile, the U.S. Food and Drug Administration said Wednesday that the people who have fallen ill are spread across seven states: Florida, Georgia, Minnesota, Missouri, New Jersey, Rhode Island and Wisconsin.

One person has been hospitalized, the agencies added.

Salmonella poisoning can cause serious illness, especially in young children, the elderly and those with weakened immune systems. Symptoms of infection usually occur within 12 hours to three days after eating contaminated food, and include diarrhea, fever and abdominal cramps.

In a statement posted to its website, Infinite Herbs CEO Grego Berliavsky said the company has voluntarily recalled some 2.5-ounce packages of fresh organic basil sold between February 1 through April 6 with UPC 8 18042 02147 7 because of the potential it could be contaminated with salmonella.

“I am heartbroken at the thought that any item we sold may have caused illness or discomfort,” Berliavsky wrote.

FDA

The basil has been pulled from Trader Joe’s stores in 29 states as well as Washington, D.C., and should no longer be available for sale. The states impacted are:

- Alabama

- Connecticut

- Delaware

- Florida

- Georgia

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maine

- Maryland

- Massachusetts

- Minnesota

- Missouri

- Nebraska

- New Hampshire

- New Jersey

- New York

- North Carolina

- Ohio

- Pennsylvannia

- Rhode Island

- South Carolina

- Tennessee

- Virginia

- Vermont

- Wisconsin

Trader Joe’s said in a statement that people who purchased the basil may return it to the store for a refund. Customers can also call Trader Joe’s at (626) 599-3817 or email customer service here.

CBS News

CDC confirms first severe bird flu case in the U.S.

A person in Louisiana has the first severe illness caused by bird flu in the U.S., the Centers for Disease Control and Prevention announced Wednesday.

Officials determined the patient had exposure to sick and dead birds in backyard flocks, though an investigation into the source of the infection in the state is ongoing. This is also the first case of H5N1 bird flu in the U.S. that has been linked to exposure to a backyard flock, a news release noted. Officials have not shared details on the patient’s symptoms.

The case was first confirmed by health officials Friday, adding to the total of 61 reported human cases of H5 bird flu reported in the United States. Another severe case of H5N1 has been reported in a teen in British Columbia.

A release from the Louisiana Department of Health Wednesday added the patient, a resident of southwestern Louisiana, is currently hospitalized. Until now, the H5N1 cases in the U.S. have been mild, including conjunctivitis and upper respiratory symptoms.

“While the current public health risk for the general public is low, people who work with birds, poultry or cows, or have recreational exposure to them, are at higher risk,” the state’s health department added.

Mild illnesses have been seen in dairy and poultry workers who had close contact with infected animals. In two cases, no known source of the illnesses have been identified, which has worried infectious disease experts about the possibility of human-to-human transmission, which could trigger a pandemic.

CBS News

Houston father desperate for help after wife recovering from C-section, kids deported to Mexico

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Are gold ETFs a good investment now that the price is dropping?

Getty Images

Gold has long served as a safe-haven asset for investors during times of economic uncertainty and market volatility, which is a large part of why it has been so popular over the past year. Thanks to that uptick in gold interest, the price of gold has been climbing throughout much of 2024 — hitting multiple record highs and surpassing $2,700 per ounce at one point late in the year. That price trend has been shifting lately, though, and over the last few weeks, there have been significant fluctuations in gold prices, with the price of gold dropping over the last few days in particular.

With gold’s price currently sitting at under $2,650 per ounce, today’s lower price is prompting many investors to reassess their positions in gold-related investments — including gold exchange-traded funds (ETFs). These investment vehicles, which track the price of gold without requiring physical ownership of the precious metal, have become increasingly popular among retail and institutional investors alike. Much of the appeal of gold ETFs lies in their simplicity and accessibility. Unlike physical gold, these funds can be easily bought and sold through standard brokerage accounts, offering investors a convenient way to gain exposure to gold price movements.

But while the current price dip could present a good opportunity to buy into gold at a discount, it makes sense to remain cautious about any type of investment right now. So is investing in gold ETFs still a good strategy now that the price of gold is slipping?

Find out how to add gold to your portfolio today.

Are gold ETFs a good investment now that the price is dropping?

When gold prices drop, it can create opportunities for investors to buy at a lower cost, potentially increasing their returns if prices rebound. Gold ETFs provide an easy way to capitalize on this strategy. Unlike physical gold, ETFs can be traded on stock exchanges just like equities, offering liquidity and convenience. They also eliminate the need for storage and security concerns associated with owning physical gold.

There are also a few other reasons to consider investing in gold ETFs despite the current price drops. For starters, gold ETFs offer an efficient way to implement dollar-cost averaging during price dips. By regularly investing fixed amounts, investors can potentially lower their average purchase price over time. This strategy can be particularly effective during periods of price volatility, allowing investors to accumulate positions at various price points.

And while gold prices may be dipping now, it’s unlikely that today’s lower prices will remain the status quo over the longer term. Gold prices have historically rebounded and grown over longer time horizons, so while the current price may be lower than it was a few weeks ago, it could represent a good entry point for long-term investors. That’s particularly true if the fundamental factors supporting gold prices remain intact, such as inflation concerns, currency devaluation risks and global economic uncertainties.

However, investors should consider that there are risks to investing in gold ETFs. One issue is that gold ETFs are subject to market volatility and may not provide immediate returns — so it’s important to make any investing decision based on your unique investment goals and strategy. Gold also generates no income or dividends, making it a pure price appreciation play. The opportunity cost of holding gold ETFs also becomes more significant in high-rate environments where yield-generating investments become more attractive.

Diversify your investments by adding gold to your portfolio now.

Who should invest in gold ETFs now?

While investing in gold ETFs may not make sense for all investors right now, it could be particularly suitable for certain types. For example, investors who need to diversify their portfolios may find gold ETFs attractive, as gold has historically shown a low correlation with traditional asset classes like stocks and bonds. So, the current price drop could present an opportunity to achieve portfolio diversification at more favorable prices.

Risk-conscious investors who are looking to hedge against inflation, currency risks or geopolitical uncertainties might also want to consider adding gold ETF exposure. After all, with the uptick in inflation over the last few months, gold’s historical role as a store of value remains relevant right now, despite the potential for short-term price volatility. Long-term investors might also find current prices attractive in terms of building strategic positions.

However, short-term traders and income-focused investors may want to exercise caution when it comes to gold ETFs. Gold’s price volatility can make short-term trading challenging, while the lack of yield may not align with income-oriented investment objectives.

The bottom line

The current drop in gold prices presents an intriguing opportunity for investors who are interested in gold ETFs, but it’s essential to weigh the potential risks and rewards of this type of gold investing carefully. Gold ETFs offer a convenient and liquid way to gain exposure to gold, making them a viable option for many investors, but they are just one of several ways to invest in this precious metal. Whether or not gold ETFs are the right choice for you will ultimately depend on your investment objectives, risk tolerance and overall portfolio strategy, so before you buy in, do your homework to make sure your decision aligns with your long-term goals.