CBS News

The 4 best places to put your savings right now

Getty Images

Inflation remains as stubborn as ever and continues to prop up interest rates. The Federal Reserve aggressively raised interest rates 11 times in 2022 and 2023 in an effort to curb inflation. More recently, the Fed has paused interest rate changes at its last five meetings as inflation has slowly ticked up in 2024.

The resulting elevated interest rates have burdened borrowers with higher monthly payments due to the higher cost of borrowing. On the other hand, the increased rates have also allowed savers to enjoy considerably higher yields. Since 2023, annual percentage yields (APYs) with top savings accounts and certificates of deposit have outpaced inflation.

Fortunately, a wide range of savings options are available to capitalize on higher yields. However, these options are not all created equal, so it’s wise to learn how they work to determine the best fit for you. Here are the best places to park your savings right now.

Explore your best savings options online and start earning more today.

The 4 best places to put your savings right now

If you have money to put away in savings, one of these options could be a smart move today:

Certificates of deposit

Certificates of deposit (CDs) are a type of deposit account you can open with a bank or credit union for a fixed rate of return over a specific period. CDs offer higher yields than traditional savings accounts in exchange for your agreement to keep the funds locked in the account for the CD term, which typically ranges from one month to five years or longer.

And therein lies the rub for some account holders. If you withdraw funds from your account before its maturity date, you may incur an early withdrawal penalty or lose out on potential earnings.

If you think you may need to access your savings, you can opt for a no-penalty CD that allows you to do so without penalty, but these accounts typically earn a lower yield than traditional CDs. Alternatively, you could employ a CD ladder strategy. In this case, you’d open several CD accounts with different terms to have more regular access to your funds without incurring penalties.

CDs are ideal if you’re looking to lock in a high yield, especially if you anticipate interest rate cuts. The Fed recently indicated it will lower the federal funds rate multiple times in 2024. However, the prevailing consensus among rate-watchers suggests that elevated interest rates are delaying any cuts until later in the year.

Find out the top rates you could earn on your savings now.

High-yield savings accounts

Like CDs, high-yield savings accounts (HYSAs) are federally insured deposit accounts that offer higher yields than traditional savings accounts. According to the Federal Deposit Insurance Corporation (FDIC), traditional savings accounts are earning a paltry 0.46% on average. By contrast, many of April’s best high-yield savings accounts provide yields between 4.35% and 6%. Given that the Bureau of Labor Statistics reported the March inflation rate at 3.5% year-over-year, saving in a top-earning high-yield savings account may help to preserve your money’s value against inflation.

Unlike CDs, high-yield savings accounts are highly liquid, meaning you can withdraw money from your account at any time without paying for early withdrawal penalties. Still, check your bank or credit union’s policies before opening an account, as some limit withdrawals and transfers to six per month.

If you want the flexibility to access your money in a financial emergency while still earning a high yield, an HYSA may make sense. Keep in mind, however, high-yield savings accounts have a variable interest rate that could fluctuate at any time.

Money market accounts

Money market accounts (MMAs) are another savings option that generally delivers a higher yield than a traditional savings account. These accounts combine the benefits of savings and checking accounts. They provide a safe, interest-earning place to stash your cash while offering limited check-writing capabilities and debit card transactions.

MMA accounts are also federally insured up to $250,000 per account, per depositor, and they’re often utilized for a specific purpose such as a home maintenance fund. In this case, your money could earn interest but you’d have the flexibility to write a check or use your debit card to pay for property taxes or a contractor’s services.

Treasury bills

The savings options discussed to this point are each federally insured by $250,000 per account. If you want to save an even larger sum, you might consider U.S. Treasury bills, or T-bills, as they are commonly known.

T-bills are short-term bonds backed by the U.S. Treasury Department with terms between four weeks and one year. These bills are short-term debt obligations often sold in denominations of $1,000, but they’re offered through TreasuryDirect.gov in denominations of $100. Current T-bill rates hover around 5.00%. As of April 19, 2024, a four-week T-bill earns a 5.28% rate, while 52-week T-bills earn 4.91%. Once the T-bill matures, you’re eligible to receive the fixed interest rate.

T-bills may be worth considering if you’re looking for government backing for your funds that exceed FDIC limits. It’s relatively easy to purchase these bills on the TreasuryDirect website or buy and sell them through a broker or investment bank.

The bottom line

Before parking your money in one of the options listed above, it’s wise to consider your savings timeline and whether you might need access to your funds. If you need the option to withdraw funds, a high-yield savings account or money market account will be more flexible than a CD or T-bill since the latter options earn the most when funds reach their maturity date.

On the other hand, if you want to lock in a fixed rate now, a short- or long-term CD or T-bill could give you the rate guarantee you’re looking for. Remember, if interest rates rise, your CD or T-bill could earn less than the market. Of course, the opposite is true, if interest rates drop, you’ll earn more interest at your locked rate.

CBS News

Woman gives emotional testimony in Idaho abortion ban case

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Palestinians hope Trump will end the war in Gaza

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

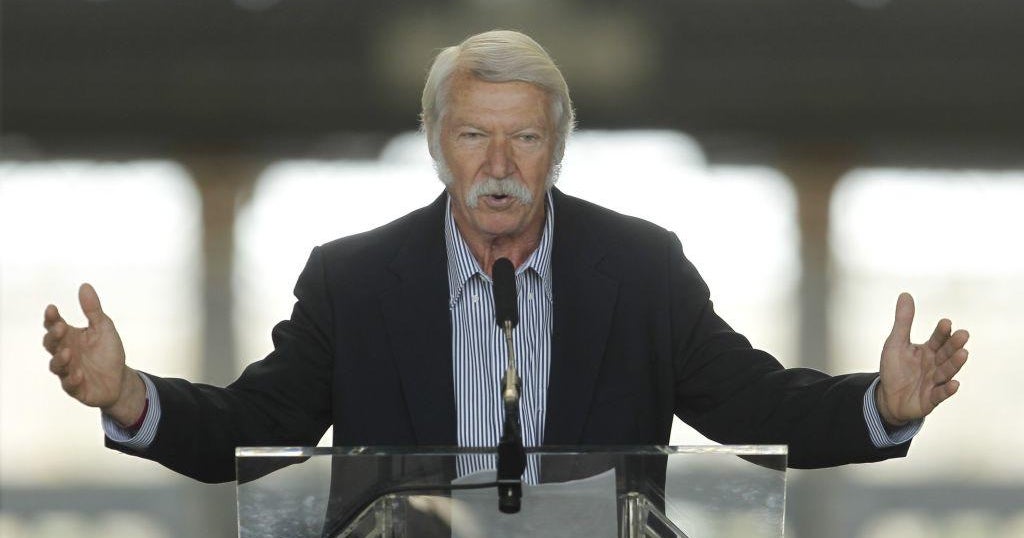

Bela Karolyi, polarizing U.S. gymnastics coach, dies at 82

Bela Karolyi, the charismatic if polarizing gymnastics coach who turned young women into champions and the United States into an international power, has died. He was 82.

A spokesperson for USA Gymnastics confirmed to CBS News by email that Karolyi died Friday. No cause of death was given.

Karolyi and wife Martha trained multiple Olympic gold medalists and world champions in the U.S. and Romania, including Nadia Comaneci and Mary Lou Retton.

Ron Jenkins/Fort Worth Star-Telegram/Tribune News Service via Getty Images

“A big impact and influence on my life,” Comaneci, who was just 14 when Karolyi coached her to gold for Romania at the 1976 Montreal Olympics, posted on Instagram.

The Karolyis defected to the United States in 1981 and over the next 30-plus years became a guiding force in American gymnastics, though not without controversy. Bela helped guide Retton — all of 16 — to the Olympic all-around title at the 1984 Games in Los Angeles and memorably helped an injured Kerri Strug off the floor at the 1996 Games in Atlanta after Strug’s vault secured the team gold for the Americans.

Karolyi briefly became the national team coordinator for USA Gymnastics women’s elite program in 1999 and incorporated a semi-centralized system that eventually turned the Americans into the sport’s gold standard. It did not come without a cost. He was pushed out after the 2000 Olympics after several athletes spoke out about his tactics.

It would not be the last time Karolyi was accused of grandstanding and pushing his athletes too far physically and mentally.

During the height of the Larry Nassar scandal in the late 2010s — when the disgraced former USA Gymnastics team doctor was effectively given a life sentence after pleading guilty to sexually assaulting gymnasts and other athletes with his hands under the guise of medical treatment — over a dozen former gymnasts came forward saying the Karolyis were part of a system that created an oppressive culture that allowed Nassar’s behavior to run unchecked for years.

Still, some of Karolyi’s most famous students were always among his staunchest defenders. When Strug got married, she and Karolyi took a photo recreating their famous scene from the 1996 Olympics, when he carried her onto the medals podium after she vaulted on a badly sprained ankle.