CBS News

5 smart alternatives to debt consolidation loans

Getty Images/iStockphoto

If you owe money on your credit cards, you may be looking for solutions to get rid of that high-interest debt. That makes sense, especially in today’s economic landscape, in which interest rates are elevated and persistent inflation is putting pressure on many people’s budgets. And, right now, the average credit card rate is over 21%, so between the compounding interest charges and higher costs of consumer goods, most people need to get rid of that type of debt.

In turn, you may be considering taking out a debt consolidation loan, which, in many cases, can be a smart solution to getting rid of high-rate debt. These types of loans can simplify your finances by combining multiple debts into one monthly payment. And, they typically have lower interest rates compared to credit cards, so they can cut down on the interest costs, too.

However, debt consolidation loans aren’t the right solution for everyone. For starters, you have to apply and be approved for this type of loan, and not everyone will qualify. And, there are risks, like taking on an even larger debt load and damaging your credit if you miss payments. Luckily, debt consolidation loans aren’t your only option. In fact, there are several smart alternatives to help you regain control of your finances.

Find out more about your debt relief options online today.

5 smart alternatives to debt consolidation loans

Here are some of the top debt consolidation loan alternatives to consider:

A debt management plan

A debt management plan is a formal agreement between you and your creditors to pay off your unsecured debts at reduced interest rates and fees. These plans are typically set up and administered by credit counseling agencies or debt relief services.

With a debt management plan, you make a monthly payment to the debt relief company, which then distributes the money to your creditors. Creditors are often willing to approve these plans because they’d rather receive a lesser payment on what you owe than get nothing if you file for bankruptcy.

The downside is that a debt management plan can negatively impact your credit score, at least initially, and most require you to close all of your credit card accounts. However, if you successfully complete the plan, it can help improve your credit over time.

Ready to get rid of your high-rate debt? Learn more about the debt relief solutions available to you here.

A home equity loan or HELOC

If you have built up significant home equity, you may be able to tap into it through a home equity loan or a home equity line of credit (HELOC). These secured loans typically offer much lower interest rates than credit cards or personal loans. And, right now, the average homeowner has a lot of home equity, about $193,000 of which can be borrowed against for debt consolidation or other purposes. So, if you’re looking for an alternative to debt consolidation loans, this could be a great time to consider home equity.

The obvious risk is that your home serves as collateral, so failing to repay the home equity loan or HELOC could lead to foreclosure. There are also fees and closing costs to consider. But between the average homeowner having high amounts of equity and the low average interest rates that these products offer, utilizing a home equity loan or HELOC could make a lot of sense today.

A debt settlement program

With debt settlement, you’ll negotiate with your creditors to accept a lump sum payment that’s lower than the total amount you owe. This option is typically reserved for those who are severely delinquent on their debts and facing potential bankruptcy.

You can try to negotiate settlements yourself or hire a debt settlement company to do it for you. These companies will instruct you to stop making payments to your creditors and instead save funds in a dedicated account. Once you’ve accumulated enough money, they’ll attempt to reach settlement agreements with your creditors.

While debt settlement can provide significant debt relief, it comes with risks. Your credit score will take a major hit, and you may owe taxes on any forgiven debt amounts. Creditors are also under no obligation to accept your settlement offers.

A balance transfer credit card

If you have good to excellent credit, a balance transfer credit card can be a powerful tool for debt consolidation. These cards offer a 0% (or very low) APR promotional period, typically ranging from 12 to 21 months, on balances transferred from other creditors. This gives you a window of time to pay off your debt without worrying about interest, as long as you make your minimum payments on time.

However, many of these cards charge fees for balance transfers, which can negate some of the savings you would have otherwise gained. The key is finding a card with no balance transfer fee or a low fee of around 3%. You should also have a plan to pay off the entire balance before the promotional APR expires and the regular APR kicks in.

A cash-out refinance

For homeowners with excellent credit, cash-out refinancing is another option for consolidating debt. This involves refinancing your current mortgage for more than you owe and taking the difference in cash to pay off other debts. Like home equity loans, your home serves as collateral for the debt. You’ll also pay closing costs, which can amount to thousands of dollars.

And, a cash-out refi may not make much sense in today’s rate environment, where mortgage rates are elevated — and many homeowners have mortgage loans with very low rates. So, refinancing to a mortgage loan with a higher rate than what you currently have will cost a lot more in the long run.

In turn, one of the alternatives listed above could make more sense than a cash-out refi in today’s economy.

The bottom line

Regardless of the debt consolidation alternative you choose, the key to long-term success is changing the overspending habits that led to your debt problems in the first place. Once you have a plan in place for tackling your high-interest debt, you should work to create a budget, build an emergency fund and live within your means to avoid repeating the cycle of debt in the future.

CBS News

Good enough to eat: Noah Verrier’s paintings of comfort food

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

A study to personalize nutrition guidance just for you

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

CBS News poll finds Trump starts on positive note as most approve of transition handling

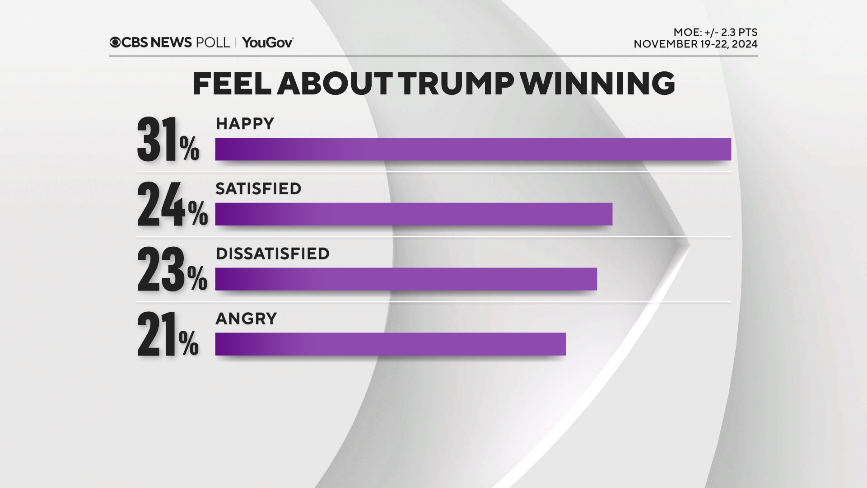

President-elect Donald Trump’s incoming administration starts off with mostly good will from the public: a majority of Americans overall are either happy or at least satisfied that he won and are either excited or optimistic about what he’ll do as president.

Trump’s handling of his presidential transition gets approval from most Americans overall and brings near-universal approval from his voters, along with a net-positive response about his selections for Cabinet posts, in particular, Sen. Marco Rubio, who is Trump’s pick to be secretary of state.

After inflation and the economy so dominated the election, Americans are more inclined to think his administration will bring down prices for food and groceries rather than raise them, and his voters overwhelmingly say that. Going into the election, his backers expected that, too.

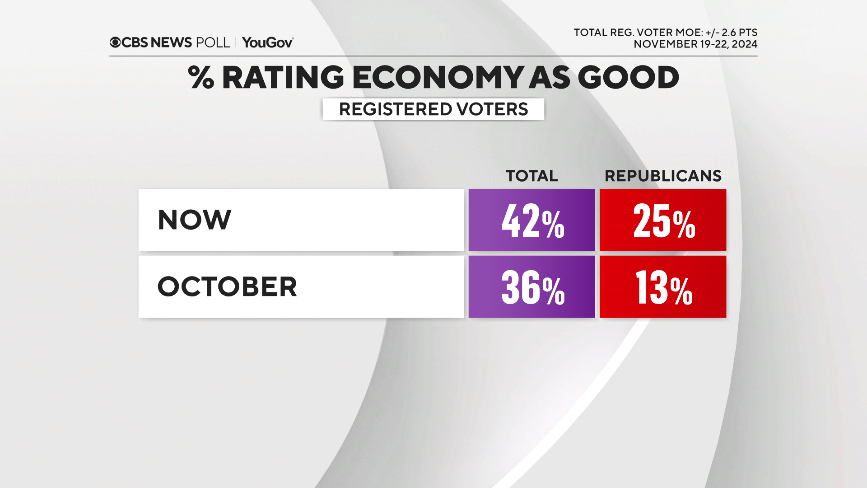

In a similar vein, Trump’s election already has some Republicans’ views of the economy improving.

Overall, Republicans today are more excited about what Trump will do as president now than they were in 2016 when he was first elected.

Democrats say they feel more scared about what Trump might do than they did in 2016, and a large majority of Democrats think as president he will threaten their rights and freedoms. But at the same time, there seems to be a sense of exhaustion, as fewer than half of Democrats feel motivated to oppose Trump right now.

Americans, and Democrats specifically, do think the Biden administration should work with the incoming Trump administration to ensure a smooth transition, and that congressional Democrats should work with Donald Trump on issues where they find common ground.

Trump and the economy

After winning comes expectations. There’s a net optimism about the incoming administration’s effect on food and grocery prices, especially among Trump’s voters. That comes as most Americans continue to say prices are currently rising. And inflation was a big factor in Trump winning in the first place.

It may be no surprise then that among many potential items for the incoming administration, Americans say plans to lower prices ought to be the top priority.

The percentage of Republicans who call the U.S. economy good, while still low, has gone up, as the percentage who call it very bad has dropped. That pushes voters’ overall evaluation of the economy slightly higher than it’s been this year — and further spotlights how much partisanship, along with optimism, always plays into these evaluations.

Trump selections of Cabinet and agency chiefs for his administration

Trump’s current selections for agency heads and Cabinet picks get rated overwhelmingly as good choices from Trump’s voters, and are net-positive as selections among Americans who have heard enough about them to say. (Many have not heard enough yet.)

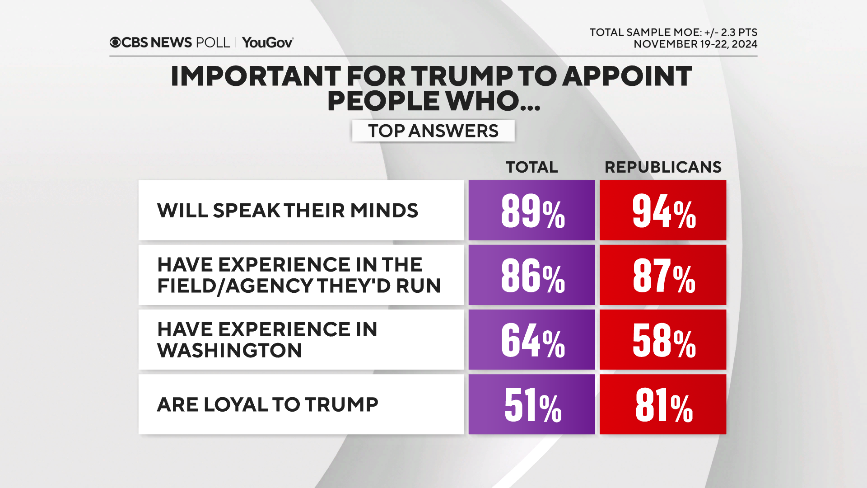

As a general rule, Americans want Trump to appoint people who’ll speak their minds and who have experience in the field or agency they’ll run. But in addition to those qualities, Republicans also want people who’ll be loyal to Trump.

A large majority of Republicans and Trump voters think Elon Musk should have at least some influence in the Trump administration. Americans overall are more split on that, largely along partisan lines.

Big majorities of Americans — and a slight majority of Republicans — would like to see the Senate hold hearings on his nominations, rather than let him make those appointments without it.

(Within self-identified Republicans, MAGA Republicans are relatively more inclined to say the Senate should skip the hearings.)

That sentiment holds whether or not people are told or reminded that the Constitution says the Senate should give advice and consent.

As a general matter, though, most of Trump’s voters and most Republicans do want Trump to have more presidential power this term than he did in his last. That sentiment is higher among Republican voters now than during the campaign.

Trump policies

On another economic front, Trump’s voters overwhelmingly favor the idea of tariffs: most of them don’t believe that will make prices higher. (For the third who believe tariffs will raise prices but support them anyhow, this is presumably a cost they’re willing to bear.)

For the public overall, opposition to tariffs goes hand in hand with the belief they’ll lead to higher prices.

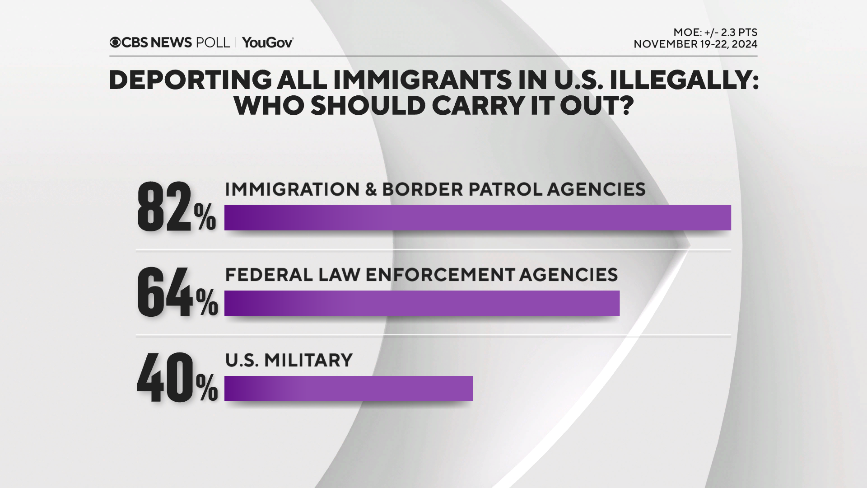

As was the case with voters throughout the campaign, most Americans would, in principle, approve of a new mass deportation program.

If the Trump administration does start a mass deportation program, most of the public would have it carried out by law enforcement or current immigration agencies — most would not have the U.S. military do it.

Elections and democracy

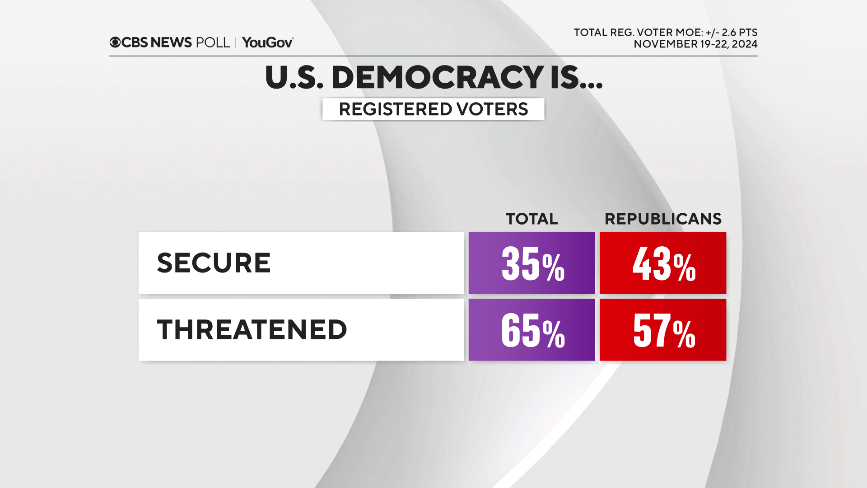

The 2024 results have shifted Republicans’ views of U.S. democracy and also returned some confidence to their view of U.S. elections. Few Republicans suspect fraud in 2024. They overwhelmingly did about 2020.

Following Trump’s victory, there’s been an increase in the number of Republicans who say democracy and rule of law is secure, though most Americans continue to say it is not.

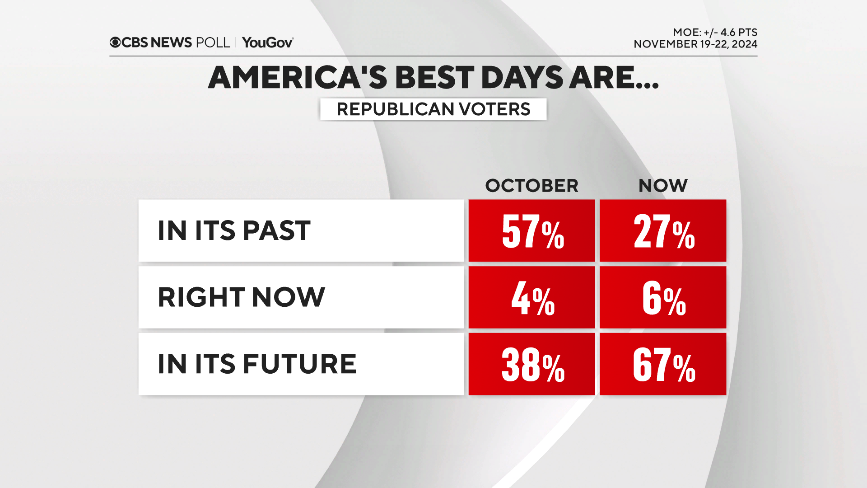

Looking ahead, there’s another shift along partisan lines. Throughout the campaign, Republicans said America’s best days were in its past, while Democrats felt they were in the future. These views are reversed now. After Trump’s win, most Republicans feel America’s best days are in its future.

This CBS News/YouGov survey was conducted with a nationally representative sample of 2,232 U.S. adults interviewed between November 19-22, 2024. The sample was weighted to be representative of adults nationwide according to gender, age, race, and education, based on the U.S. Census American Community Survey and Current Population Survey, as well as 2024 presidential vote. The margin of error is ±2.3 points.