CBS News

White-coated candy recalled nationwide over salmonella risk

A range of white confectionary products sold nationwide is being recalled because the treats could be contaminated with salmonella, a potentially dangerous bacteria, an Iowa company said Monday.

The recalled items were sold in retailers including Dollar General, HyVee, Target and Walmart, Sioux City-based Palmer Candy stated in a recall notice.

U.S. Food and Drug Administration

The company was notified by its liquid coating supplier that there was potential for contamination from an ingredient potentially tainted with salmonella by one of the supplier’s suppliers, Palmer Candy said.

Salmonella can cause serious and sometimes fatal infections in the young, frail or elderly as well as in those with weakened immune systems, according to the notice posted by the Food and Drug Administration. It can also cause symptoms including abdominal pain, nausea, fever and vomiting in the otherwise healthy.

Food and Drug Administration

The recalled products comes in a variety of retail packaging, including bags, pouches and tubs.

Food and Drug Administration

People who bought any of the recalled products should return them to the place of purchase for a refund. Consumers with with questions can call (800) 831-0828 Monday through Friday from 8 a.m. to 5 p.m.

The recall includes the following products and best-by dates:

- Caramel Swirl Pretzels 4-ounce 12/28/2024

- Caramel Swirl Pretzels 6 -ounce 12/19/2024 and 01/19/2025

- Classic Yogurt Pretzels 28# 12/11/2024 – 01/08/2025

- Cookies & Cream Yummy Chow 14# 12/06/2024 – 01/08/2025

- Enrobed Pretzels Rods 8-ounce 01/22/2025

- Favorite Day Bakery White Funde Mini Cookies 7-ounce 04/04/2025, 04/05/2025 and 04/18/2025

- Frosted Munchy Medley Bowl 15-ounce 01/03/2025

- Frosted Patriot Frosted Pretzels 28# 01/02/2025 and 01/03/2025

- Frosted Pretzels 6-ounce 01/23/2025

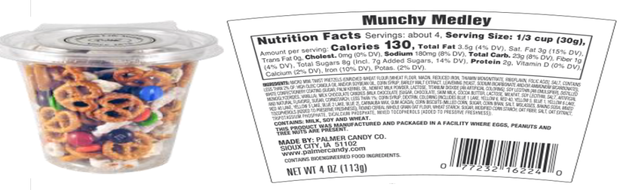

- Munchy Medley 15# 12/14/2024 and 01/03/2025

- Munchy Medley 4-ounce 12/27/2024, 12/28/2024 and 01/19/2025

- Munchy Medley 6-ounce 12/20/2024

- Munchy Medley To Go 4-ounce 12/25/2024 and 01/19/2025

- Patriotic Munchy Medley Bowl 15-ounce 01/19/2025

- Patriotic Pretzels 14-ounce 01/25/2025 and 01/26/2025

- Patriotic Pretzels 6-ounce 01/19/2025

- Patriotic Red, White & Blue Pretzel Twists 14-ounce 12/13/2024 and 01/15/2025

- Patriotic Snack Mix 13-ounce 01/19/2025 and 02/01/2025

- Patriotic White Fudge Cookies 7-ounce 04/23/2025

- Peanut Butter Snack Mix 12-ounce 11/13/2024 and 12/15/2024

- Peanut Butter Snack Mix To Go 4.5-ounce 01/18/2025

- Snackin’ With The Crew! Mizzou Munchy Medley 7-ounce 12/18/2024 and 12/19/2024

- Snackin’ With The Crew! Tiger Treats 7-ounce 12/18/2024 and 12/19/2024

- Star Snacks Chow Down 25# 12/06/2024 and 12/07/2024

- Strawberry Yogurt Coated Pretzels 10-ounce 01/05/2025 and 01/23/2025

- Sweet Smiles Yogurt Covered Pretzels 3.25-ounce 12/18/2024 – 01/04/2025

- Vanilla Yogurt Covered Pretzels 10-ounce 01/05/2024 and 01/22/2025

- Yogurt Pretzel 14# 12/14/2024 – 12/21/2024

- Zebra Fudge Cookies 7-ounce 03/13/2025, 04/01/2025 – 04/02/2025

CBS News

2 soldiers killed by landmine blast in Mexico day after 2 troops killed by booby trap in same region

A blast killed two Mexican soldiers in the second deadly incident this week involving an improvised landmine in a crime-plagued western state, authorities said Wednesday.

According to the El Universal newspaper, the soldiers were trying to deactivate the device when it exploded.

The blast happened late on Tuesday in Buenavista in Michoacan, the state prosecutor’s office said.

A military source who did not want to be named said that troops were looking for similar devices believed to have been planted in the area.

On Monday, a blast caused by another improvised landmine killed two Mexican soldiers and wounded five others in the same region. Before the explosion, the soldiers had discovered the dismembered bodies of three people, officials said.

The device was suspected to have been planted by members of a local criminal group waging a turf war with a bigger drug cartel, Defense Minister Ricardo Trevilla said Tuesday.

Six other soldiers had been killed by similar improvised devices since late 2018, he said.

Mexico is plagued by widespread drug-related violence that has seen more than 450,000 people killed since the government deployed the army to combat trafficking in 2006, according to official figures.

In the only previous detailed report on cartel bomb attacks in August 2023, the defense department said at that time that a total of 42 soldiers, police and suspects were wounded by IEDs in the first seven and a half months of 2023, up from 16 in all of 2022.

Overall, 556 improvised explosive devices of all types – roadside, drone-carried and car bombs – were found in 2023, the army said in a news release last year.

CBS News

Oklahoma set to execute man who killed girl, 10, during cannibalistic fantasy

Oklahoma is preparing to execute a man who killed a 10-year-old girl in what would be the nation’s 25th and final execution of the year.

Kevin Ray Underwood is scheduled to die by lethal injection on Thursday, his 45th birthday, at the Oklahoma State Penitentiary in McAlester. Underwood, a former grocery store worker, was sentenced to die for killing Jamie Rose Bolin in 2006 as part of a cannibalistic fantasy.

Underwood admitted to luring Jamie into his apartment and beating her over the head with a cutting board before suffocating and sexually assaulting her. He told investigators that he nearly beheaded the girl in his bathtub before abandoning his plans to eat her.

Sue Ogrocki / AP

Oklahoma uses a three-drug lethal injection process that begins with the sedative midazolam followed by a second drug that paralyzes the inmate to halt their breathing and a third that stops their heart.

During a hearing last week before the state’s Pardon and Parole Board, Underwood told the girl’s family he was sorry.

“I would like to apologize to the victim’s family, to my own family and to everyone in that room today that had to hear the horrible details of what I did,” Underwood said to the board via a video feed from the Oklahoma State Penitentiary.

The three board members in attendance at last week’s meeting all voted against recommending clemency.

Underwood’s attorneys had argued that he deserved to be spared from death because of his long history of abuse and serious mental health issues that included autism, obsessive-compulsive disorder, bipolar and panic disorders, post-traumatic stress disorder, schizotypal personality disorder and various deviant sexual paraphilias.

His mother, Connie Underwood, tearfully asked the board to grant her son mercy.

“I can’t imagine the heartache the family of that precious girl is living with every single day,” Connie Underwood said. “I wish we understood his pain before it led to this tragedy.”

But several members of Bolin’s family asked the board to reject Underwood’s clemency bid. The girl’s father, Curtis Bolin, was scheduled to testify to the board but became choked up as he held his head in his hand.

“I’m sorry, I can’t,” he said.

Prosecutors wrote in opposing Underwood’s clemency request that, “Whatever deviance of the mind led Underwood to abduct, beat, suffocate, sexually abuse and nearly decapitate Jamie cannot be laid at the feet of depression, anxiety or (autism).

“Underwood is dangerous because he is smart, organized and driven by deviant sexual desires rooted in the harm and abuse of others.”

In a last-minute request seeking a stay of execution from the U.S. Supreme Court, Underwood’s attorneys argued that he deserves a hearing before the full five-member parole board and that the panel violated state law and Underwood’s rights by rescheduling its hearing at the last minute after two members of the board resigned.

CBS News

Health insurers limit coverage of prosthetic limbs, questioning their medical necessity

When Michael Adams was researching health insurance options last year, he had one very specific requirement: coverage for prosthetic limbs.

Adams, 51, lost his right leg to cancer 40 years ago, and he has worn out more legs than he can count. He picked a gold plan on the Colorado health insurance marketplace that covered prosthetics, including microprocessor-controlled knees like the one he has used for many years. That function adds stability and helps prevent falls.

But when his leg needed replacing in January after about five years of everyday use, his new marketplace health plan wouldn’t authorize it. The roughly $50,000 leg with the electronically controlled knee wasn’t medically necessary, the insurer said, even though Colorado law leaves that determination up to the patient’s doctor, and his has prescribed a version of that leg for many years, starting when he had employer-sponsored coverage.

“The electronic prosthetic knee is life-changing,” said Adams, who lives in Lafayette, Colorado, with his wife and two kids. Without it, “it would be like going back to having a wooden leg like I did when I was a kid.” The microprocessor in the knee responds to different surfaces and inclines, stiffening up if it detects movement that indicates its user is falling.

Alana Adams

People who need surgery to replace a joint typically don’t encounter similar coverage roadblocks. In 2021, 1.5 million knee or hip joint replacements were performed in United States hospitals and hospital-owned ambulatory facilities, according to the federal Agency for Healthcare Research and Quality, or AHRQ. The median price for a total hip or knee replacement without complications at top orthopedic hospitals was just over $68,000 in 2020, according to one analysis, though health plans often negotiate lower rates.

To people in the amputee community, the coverage disparity amounts to discrimination.

“Insurance covers a knee replacement if it’s covered with skin, but if it’s covered with plastic, it’s not going to cover it,” said Jeffrey Cain, a family physician and former chair of the board of the Amputee Coalition, an advocacy group. Cain wears two prosthetic legs, having lost his after an airplane accident nearly 30 years ago.

AHIP, a trade group for health plans, said health plans generally provide coverage when the prosthetic is determined to be medically necessary, such as to replace a body part or function for walking and day-to-day activity. In practice, though, prosthetic coverage by private health plans varies tremendously, said Ashlie White, chief strategy and programs officer at the Amputee Coalition. Even though coverage for basic prostheses may be included in a plan, “often insurance companies will put caps on the devices and restrictions on the types of devices approved,” White said.

That means that a patient’s costs can also fluctuate significantly, depending on that person’s coverage specifics, the plan’s restrictions and even geographic cost differences.

An estimated 2.3 million people are living with limb loss in the U.S., according to an analysis by Avalere, a health care consulting company. That number is expected to as much as double in coming years as people age and a growing number lose limbs to diabetes, trauma and other medical problems.

Fewer than half of people with limb loss have been prescribed a prosthesis, according to a report by the AHRQ. Plans may deny coverage for prosthetic limbs by claiming they aren’t medically necessary or are experimental devices, even though microprocessor-controlled knees like Adams’ have been in use for decades.

Cain was instrumental in getting passed a 2000 Colorado law that requires insurers to cover prosthetic arms and legs at parity with Medicare, which requires coverage with a 20% coinsurance payment. Since that measure was enacted, about half of states have passed “insurance fairness” laws that require prosthetic coverage on par with other covered medical services in a plan or laws that require coverage of prostheses that enable people to do sports. But these laws apply only to plans regulated by the state. Over half of people with private coverage are in plans not governed by state law.

The Medicare program’s 80% coverage of prosthetic limbs mirrors its coverage for other services. Still, an October report by the Government Accountability Office found that only 30% of beneficiaries who lost a limb in 2016 received a prosthesis in the following three years.

Cost is a factor for many people.

“No matter your coverage, most people have to pay something on that device,” White said. As a result, “many people will be on a payment plan for their device,” she said. Some may take out loans.

The federal Consumer Financial Protection Bureau has proposed a rule that would prohibit lenders from repossessing medical devices such as wheelchairs and prosthetic limbs if people can’t repay their loans.

“It is a replacement limb,” said White, whose organization has heard of several cases in which lenders have repossessed wheelchairs or prostheses. Repossession is “literally a punishment to the individual.”

Adams ultimately owed a coinsurance payment of about $4,000 for his new leg, which reflected his portion of the insurer’s negotiated rate for the knee and foot portion of the leg but did not include the costly part that fits around his stump, which didn’t need replacing. The insurer approved the prosthetic leg on appeal, claiming it had made an administrative error, Adams said.

“We’re fortunate that we’re able to afford that 20%,” said Adams, who is a self-employed leadership consultant.

Again, out-of-pocket costs – even if the patient has health insurance and a doctor’s prescription – can be cost-prohibitive because of the plan’s co-insurance requirements as well as coverage caps or other limitations.

Leah Kaplan doesn’t have that financial flexibility. Born without a left hand, she did not have a prosthetic limb until a few years ago.

Growing up, “I didn’t want more reasons to be stared at,” said Kaplan, 32, of her decision not to use a prosthesis. A few years ago, the cycling enthusiast got a prosthetic hand specially designed for use with her bike. That device was covered under the health plan she has through her county government job in Spokane, Washington, helping developmentally disabled people transition from school to work.

But when she tried to get approval for a prosthetic hand to use for everyday activities, her health plan turned her down. The myoelectric hand she requested would respond to electrical impulses in her arm that would move the hand to perform certain actions. Without insurance coverage, the hand would cost her just over $46,000, which she said she can’t afford.

Working with her doctor, she has appealed the decision to her insurer and been denied three times. Kaplan said she’s still not sure exactly what the rationale is, except that the insurer has questioned the medical necessity of the prosthetic hand. The next step is to file an appeal with an independent review organization certified by the state insurance commissioner’s office.

A prosthetic hand is not a luxury device, Kaplan said. The prosthetic clinic has ordered the hand and made the customized socket that will fit around the end of her arm. But until insurance coverage is sorted out, she can’t use it.

At this point, she feels defeated. “I’ve been waiting for this for so long,” Kaplan said.

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF — the independent source for health policy research, polling and journalism.