CBS News

3 reasons to tap into your home equity ahead of summer

Getty Images

Summer is closing in fast and that’s exciting news for many. With summer vacations likely around the corner and more time to spend with school-age children, there can be quite a bit to look forward to this time of year.

But what if you have a pressing financial need this summer?

Maybe you need to complete home repairs before summer showers set in. Or, maybe you need to get rid of high interest debt to free up money in your budget for summertime spending. There’s a seemingly endless list of other expenses you may need to cover this summer.

No matter what your financial need is, your home equity may offer the funding you’re looking for at a competitive interest rate. And, tapping into your home equity ahead of summer could be a wise decision.

Find out how affordable it can be to tap into your equity now.

3 reasons to tap into your home equity ahead of summer

Here are three smart reasons to tap into your home equity before the start of summer:

Financial needs are high

Inflation cooled in April, meaning that the prices of goods and services didn’t grow quite as fast in the month as they did in March. But, April’s 3.4% inflation rate is still too high for comfort. As the cost of goods and services continues to head up, your need for funding may only grow.

Tapping into your home equity is one way to get your hands on the funding you need to absorb today’s higher cost of living. And, since home equity loans and lines of credit typically come with lower interest rates than other borrowing options, payments on these financial products may be more affordable than payments on credit cards or personal loans.

Use your home equity to ease the burden of today’s inflationary environment today.

Summer is a smart time to complete home repairs and renovations

If your home needs repairs, or you’re considering making renovations to it, summer is a smart time to get started. After all, summer comes with longer daylight hours, giving you (or those you hire) more time in the day to get repairs and renovations done.

And, if you use your home equity to cover the cost of repairs or renovations, you could enjoy tax benefits. As long as you use the money you borrow to improve the home you used as collateral for the loan or line of credit, you may be able to write the interest you pay off when you file your taxes.

Rates could tick up following the June Fed meeting

Inflation cooled in April, but not by much. Keep in mind that March’s inflation rate was 3.5% – just one-tenth of a point higher than April’s 3.4% inflation rate. And, the Federal Reserve’s inflation goal is 2%, which is significantly lower than either of the readings above.

If inflation continues to come in significantly above the Fed’s 2% target, the central bank could decide to take action. And, if the Fed does take action to combat inflation, it could increase interest rates further – only increasing the cost of borrowing.

“If you can tap into the home’s equity prior to a Fed interest rate hike, it is always advised,” explains Colby Van Sickler, founder and CEO of the wealth management firm, F3 Wealth Management. “Once the Fed bumps interest rates, home equity loans will follow immediately.”

The Fed will meet to discuss monetary policy on June 11 and June 12, 2024. Tapping into your home equity now, before any potential rate hike, could save you money in the long run.

Don’t wait for rates to increase. Lock in your home equity loan interest rate now.

The bottom line

With summer just around the corner, now may be an advantageous time to tap into your home equity. As inflation concerns continue, the potential for a future rate hike only grows. Moreover, summer is a great time to take care of home repairs and renovations. And, if you use your home equity to do so, you could enjoy tax benefits. Learn more about your home equity borrowing options now.

CBS News

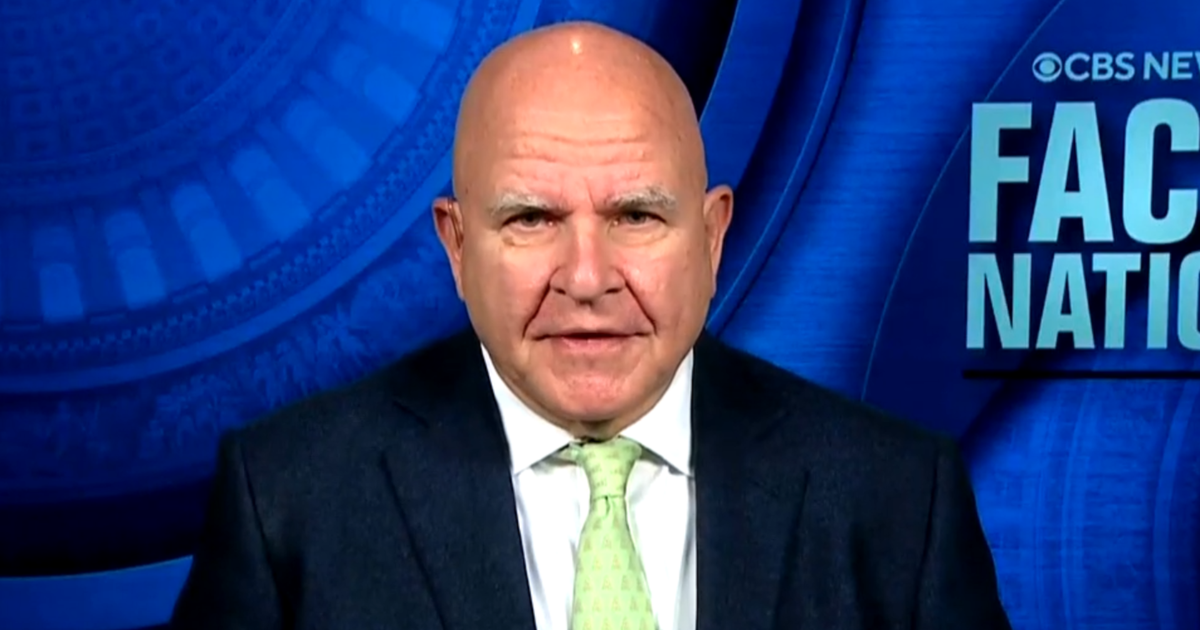

Former Trump national security adviser says next couple months are “really critical” for Ukraine

Washington — Lt. Gen. H.R. McMaster, a former national security adviser to Donald Trump, said Sunday that the upcoming months will be “really critical” in determining the “next phase” of the war in Ukraine as the president-elect is expected to work to force a negotiated settlement when he enters office.

McMaster, a CBS News contributor, said on “Face the Nation with Margaret Brennan” that Russia and Ukraine are both incentivized to make “as many gains on the battlefield as they can before the new Trump administration comes in” as the two countries seek leverage in negotiations.

With an eye toward strengthening Ukraine’s standing before President-elect Donald Trump returns to office in the new year, the Biden administration agreed in recent days to provide anti-personnel land mines for use, while lifting restrictions on Ukraine’s use of U.S.-made longer range missiles to strike within Russian territory. The moves come as Ukraine marked more than 1,000 days since Russia’s invasion in February 2022.

Meanwhile, many of Trump’s key selection for top posts in his administration — Rep. Mike Waltz for national security adviser and Sens. Marco Rubio for secretary of state and JD Vance for Vice President — haven’t been supportive of providing continued assistance to Ukraine, or have advocated for a negotiated end to the war.

CBS News

McMaster said the dynamic is “a real problem” and delivers a “psychological blow to the Ukrainians.”

“Ukrainians are struggling to generate the manpower that they need and to sustain their defensive efforts, and it’s important that they get the weapons they need and the training that they need, but also they have to have the confidence that they can prevail,” he said. “And any sort of messages that we might reduce our aid are quite damaging to them from a moral perspective.”

McMaster said he’s hopeful that Trump’s picks, and the president-elect himself, will “begin to see the quite obvious connections between the war in Ukraine and this axis of aggressors that are doing everything they can to tear down the existing international order.” He cited the North Korean soldiers fighting on European soil in the first major war in Europe since World War II, the efforts China is taking to “sustain Russia’s war-making machine,” and the drones and missiles Iran has provided as part of the broader picture.

“So I think what’s happened is so many people have taken such a myopic view of Ukraine, and they’ve misunderstood Putin’s intentions and how consequential the war is to our interests across the world,” McMaster said.

On Trump’s selections for top national security and defense posts, McMaster stressed the importance of the Senate’s advice and consent role in making sure “the best people are in those positions.”

McMaster outlined that based on his experience, Trump listens to advice and learns from those around him. And he argued that the nominees for director of national intelligence and defense secretary should be asked key questions like how they will “reconcile peace through strength,” and what they think “motivates, drives and constrains” Russian President Vladimir Putin.

Trump has tapped former Rep. Tulsi Gabbard to be director of national intelligence, who has been criticized for her views on Russia and other U.S. adversaries. McMaster said Sunday that Gabbard has a “fundamental misunderstanding” about what motivates Putin.

More broadly, McMaster said he “can’t understand” the Republicans who “tend to parrot Vladimir Putin’s talking points,” saying “they’ve got to disabuse themselves of this strange affection for Vladimir Putin.”

Meanwhile, when asked about Trump’s recent selection of Sebastian Gorka as senior director for counterterrorism and deputy assistant to the president, McMaster said he doesn’t think Gorka is a good person to advise the president-elect on national security. But he noted that “the president, others who are working with him, will probably determine that pretty quickly.”

CBS News

Sen. Van Hollen says Biden is “not fully complying with American law” on Israeli arms shipments

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Rep.-elect Sarah McBride says “I didn’t run” for Congrees “to talk about what bathroom I use”

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.