CBS News

Many Americans are wrong about key economic trends. Take this quiz to test your knowledge.

Americans have been notoriously glum about the country’s financial outlook in the post-pandemic years, with only one-third describing the economy as good in a CBS News poll earlier this year.

But increasingly, there’s a gap between how a large portion of Americans think the economy is performing and what key indicators show — a dissonance that some describe as a “vibecession.” In part, this disconnect reflects the limitations of economic measurement, which often doesn’t capture the financial realities facing millions of Americans.

That said, when asked about key economic trends and data, upward of half of Americans are getting the facts wrong about some basic financial issues, according to a new poll from Harris/The Guardian.

Think you have an accurate read on the state of the U.S. economy? Answer the following four questions to find out.

Is the U.S. in a recession?

A) Yes

B) No

Answer: The correct answer is B. As commonly defined by economists, a recession is a slump in economic activity, or when GDP is negative. As the GDP has been growing — fueled partly by strong consumer spending — at rates that have exceeded economists’ expectations, the U.S. economy is not in a recession.

What Americans believe: About 56% of those polled by Harris/The Guardian said that the U.S. is currently experiencing a recession.

How has the S&P 500 index performed in 2024?

A) Stocks are up for the year

B) The stock market is down for the year

C) The market is unchanged

Answer: The correct answer is A. The S&P 500 — a proxy for the broader stock market — has climbed 11% this year.

What Americans believe: About half of people polled by Harris/The Guardian said the stock market is down for the year.

How does the current unemployment rate compare with prior periods?

A) The unemployment rate is now near a 50-year low

B) The unemployment rate is near a 50-year high

C) The unemployment rate still hasn’t recovered from the pandemic

Answer: The correct answer is A. The jobless rate stood at 3.9% in April, near a 50-year low. Current unemployment numbers are also similar to levels experienced prior to the pandemic, indicating that jobs lost during the crisis have been recovered.

What Americans believe: About half say unemployment is near a 50-year high.

Is inflation increasing or decreasing?

A) Inflation is rising

B) Inflation is falling

C) Inflation isn’t changing

Answer: The answer is B. Inflation, which measures the rate of change in prices, has been declining since reaching a peak of 9.1% in June 2022. In the most recent CPI reading, inflation was 3.4% in April.

What Americans believe: About 7 in 10 responded that they believe inflation is rising, the Harris/Guardian poll found.

Are prices still rising? Yes. Although inflation — the rate at which prices are changing — is falling, prices are still moving higher. The decline in inflation simply means those price increases are moderating from the large increases experienced in 2022.

CBS News

Coal use hitting all-time high in 2024, which is on track to be hottest year ever, report says

World coal use is set to reach an all-time high in 2024, the International Energy Agency said Wednesday, in a year all but certain to be the hottest in recorded history.

Despite calls to halt humanity’s burning of the filthiest fossil fuel driving climate change, the energy watchdog expects global demand for coal to hit record highs for the third year in a row.

Scientists have warned that planet-warming greenhouse gases will have to be drastically slashed to limit global heating to avoid catastrophic impacts on the Earth and humanity.

Earlier in December, the European Union’s climate monitor Copernicus said 2024 was “effectively certain” to be the hottest on record — eclipsing the mark set just last year.

Published on Wednesday, the IEA’s “Coal 2024” report does, however, predict the world will hit peak coal use in 2027 after topping 8.77 billion tons this year.

But that would be dependent on China, which for the past quarter-century has consumed 30 percent more coal than the rest of the world’s countries combined, the IEA said.

China’s demand for electricity was the most significant driving force behind the increase, with more than a third of coal burnt worldwide carbonized in that country’s power plants.

Though Beijing has sought to diversify its electricity sources, including a massive expansion of solar and wind power, the IEA said China’s coal demand in 2024 will still hit 4.9 billion tones — itself another record.

Increasing coal demand in China, as well as in emerging economies such as India and Indonesia, made up for a continued decline in advanced economies.

However that decline has slowed in the European Union and the United States. Coal use there is set to decline by 12 and five percent respectively, compared with 23 and 17 percent in 2023.

With the imminent return to the White House of Donald Trump — who has repeatedly called climate change a “hoax” — many scientists fear that a second Trump presidency would water down the climate commitments of the world’s largest economy.

Coal mining also hit unprecedented levels by topping nine billion tons in output for the first time, the IEA said, with top producers China, India and Indonesia all posting new production records.

The energy watchdog warned that the explosion in power-hungry data centers powering the emergence of artificial intelligence was likewise likely to drive up demand for power generation, with that trend underpinning electricity demand in coal-guzzling China.

The 2024 report reverses the IEA’s prediction last year that coal use would begin declining after peaking in 2023.

At the annual U.N. climate change forum in Dubai last year, nations vowed to transition away from fossil fuels.

But its follow-up this year ended in acrimony, with experts warning that the failure to double down on that landmark pledge at COP29 in Azerbaijan risked jeopardizing efforts to fight climate change.

Set up in the wake of the 1973 oil crisis, the IEA presents itself as “the world’s leading energy authority.”

CBS News

Tennessee DA accused of firing multiple times at fugitive, hitting home with woman and her 3 children inside

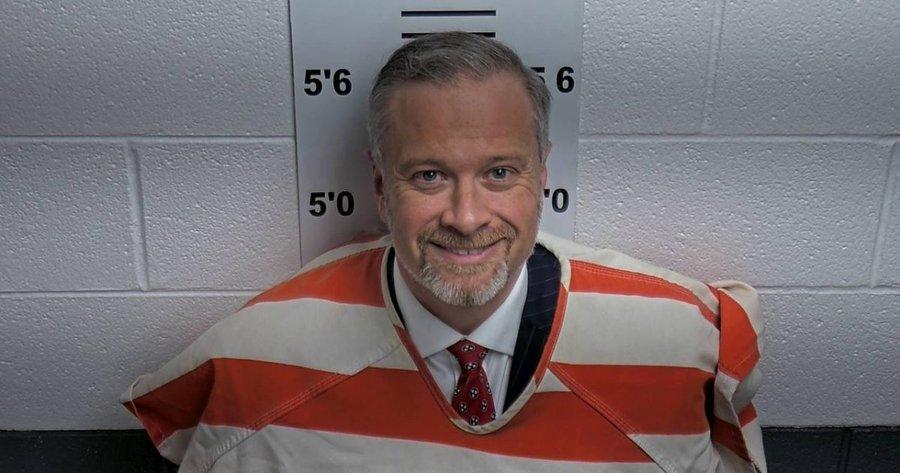

A district attorney in Tennessee is facing a reckless endangerment charge after shooting at a fugitive several times and hitting a home that had a woman and her three children inside.

The Tennessee Bureau of Investigation announced the grand jury charge Monday against District Attorney Chris Stanford. His district covers Van Buren and Warren counties.

The indictment says that as the incident unfolded in Smithville on Nov. 21, a bullet Stanford shot from his handgun went through a front porch patio chair, through an exterior wall and into the living room wall of the home. The woman and children weren’t hurt.

Smithville is about 60 miles southeast of Nashville.

The indictment says that Stanford fired the shot “unlawfully, intentionally and recklessly.” There was no immediate threat to him or others, he wasn’t aiming the handgun, and “just held it out and shot” without using the gun’s sights, the indictment adds.

Following his indictment, Stanford surrendered at the DeKalb County Jail and was released after posting a $10,000 bond, TBI said. A message left with Stanton’s office was not immediately returned Tuesday.

The Warren County Sheriff’s Office described the circumstances leading to the incident last month. In a social media post, it said authorities were pursuing suspects after finding three dead bodies at a house and at an adjacent building.

The suspects were sighted in DeKalb County, the sheriff’s office said. One of them was taken into custody without incident. Stanford and other law enforcement officials chased the other suspect, who was a passenger in a car, the office said.

While trying to help the suspect flee, the driver struck a homeland security officer with the car, the sheriff’s office said.

In a statement last month to CBS affiliate WTVF-TV, Stanford said he fired shots in response to the homeland security agent being hit. No one was shot when Stanford fired his gun. The homeland security officer was injured and taken to the hospital, according to a social media post by District Attorney Bryant Dunaway.

“The vehicle then drove toward me and others, accelerating quickly. I fired my service weapon in defense of myself and others at the scene. Based upon my training and the circumstances that presented themselves, I believe my actions were necessary and justified,” Stanford said.

Stanford also told the news station he has a state law enforcement certification to carry his weapon at all times.

The two suspects in the three deaths were taken into custody and charged with criminal homicide, while the driver, also taken into custody, faces felony evading arrest and aggravated assault charged, according to the sheriff’s office.

Stanford will make an appearance in court on Jan. 7, WTVF reported. Since he showed up at the scene and fired his weapon, he is now a witness and cannot prosecute the triple murder in his own county, the station reported.

CBS News

Accused mastermind of journalist’s murder wanted by Mexico — but U.S. has called him a “protected witness”

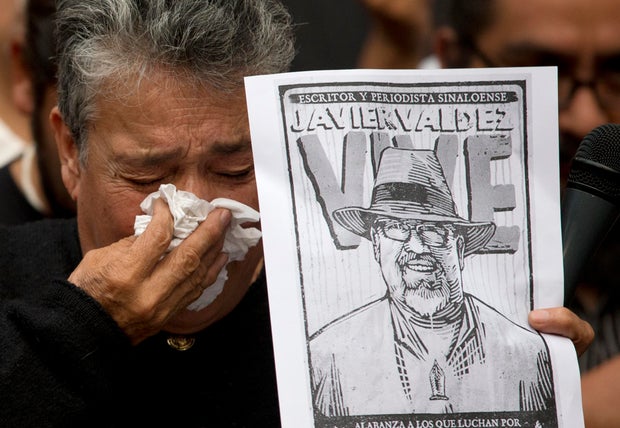

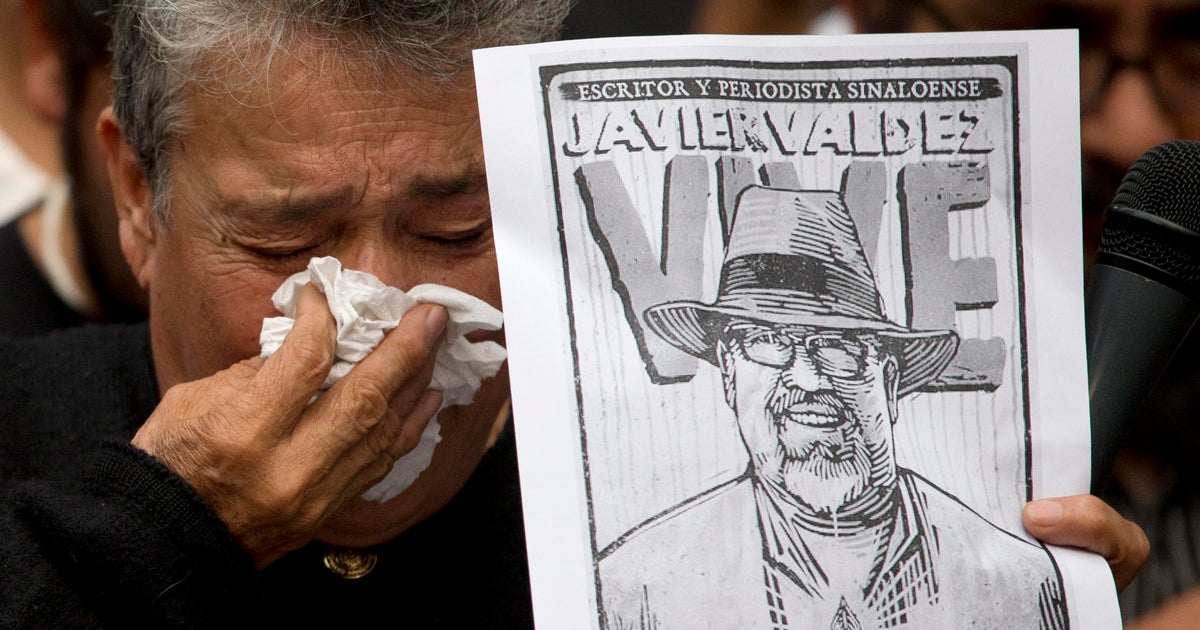

Mexico has asked the United States to extradite the suspected mastermind behind the murder of journalist Javier Valdez after he was arrested on drug charges, the attorney general said.

Damaso Lopez Serrano — who the Justice Department says is known as “Mini Lic” — is accused of ordering the 2017 killing of Valdez, an award-winning journalist and AFP contributor who covered the narcotics trade.

The alleged former high-ranking member of the Sinaloa Cartel was arrested on Friday in Virginia on charges of trafficking fentanyl. Lopez Serrano is the son of Damaso Lopez Nunez, who launched a struggle for control of the cartel following the arrest of its leader, Joaquin “El Chapo” Guzman.

Mexico’s Attorney General Alejandro Gertz described Lopez Serrano as the “mastermind” behind Valdez’s murder.

“We have already prosecuted the rest of the perpetrators and they are in jail,” he told a news conference.

Valdez was shot and killed in his car on May 15, 2017 in the Sinaloa state capital of Culiacan near the offices of his weekly newspaper Riodoce.

Enric Marti / AP

Investigators believe Lopez Serrano ordered the hit because he was angry about information published by Valdez about the Sinaloa Cartel’s internal power struggles.

Mexico has made several extradition requests for Lopez Serrano, who surrendered to U.S. authorities in July 2017 for drug trafficking and cooperated in exchange for a reduced sentence. At the time, the U.S. Drug Enforcement Administration said Lopez Serrano was “believed to be the highest-ranking Mexican cartel leader ever to self-surrender in the United States.”

He was released from prison on parole in 2022.

Gertz said that Mexico had asked “on countless occasions” for Lopez Serrano to be handed over, but Washington declined because he had become a “protected witness” and “was giving them a lot of information.”

He voiced hope that with Lopez Serrano’s latest arrest “there are more than enough reasons” for the United States to finally grant Mexico’s request.

Rebecca Blackwell / AP

Wracked by violence related to drug trafficking, Mexico is one of the world’s most dangerous countries for journalists, news advocacy groups say.

Reporters Without Borders says more than 150 newspeople have been killed in Mexico since 1994 — and 2022 was one of the deadliest years ever for journalists in Mexico, with at least 15 killed.

Media workers are regularly targeted in Mexico, often in direct reprisal for their work covering topics like corruption and the country’s notoriously violent drug traffickers.

Most recently, in October, gunmen killed a journalist whose Facebook news page covered the violent western Mexico state of Michoacan. Then less than 24 hours later, an entertainment reporter in the western city of Colima was killed inside a restaurant she owned.