CBS News

Should seniors get a home loan during retirement? Here’s what experts think

Getty Images

Mortgage interest rates are hovering above 7% on average for conventional 30-year mortgage loans right now. That’s significantly higher than what mortgage rates were during the early years of the pandemic — and nearly three times as high as rates were when they hit a new record low of 2.65% in January 2021. And, while people are still buying homes with rates elevated, home purchases aren’t closing at nearly the same pace they were the last few years.

But buying a home is already a big investment, whether rates are at record lows or are hovering well above it like they are today. And, while making that move might make sense for some, that doesn’t mean that buying a home with a home loan is the right move for every senior. Here’s what the experts think about whether seniors should buy a home with a mortgage loan during retirement.

Explore today’s best mortgage loan rates online here.

Should seniors get a home loan during retirement? Here’s what experts think

Legally, seniors are free to buy a home with a mortgage loan if they so choose — and lenders aren’t allowed to discriminate against them, as the Equal Credit Opportunity Act prohibits lenders from discriminating against applicants based on race, sex, religion, age, marital status and other factors. Because of this, seniors and other groups can apply for a mortgage without worrying about if they’ll get denied based on their age.

“Financially stable retirees who can count on a consistent income source may choose to take out a home loan,” Jones says. “Many retirees are selling a home and can utilize the earnings to either buy all-cash or take out a smaller home loan, both of which would reduce ongoing living expenses.”

And, age isn’t a determining factor in whether you can repay your mortgage, Michele Albohn, a certified mortgage advisor at Compass Mortgage, says.

“There is no reason why a senior cannot apply for a mortgage,” Albohn says. “You do not have to prove that you will live 30 years to pay off the mortgage. [But] whether or not a senior should take out a mortgage is an individual decision.”

What does matter, however, is that you have a provable source of income and can show how you’ll be able to repay your home loan, which are important factors in terms of qualifying for a mortgage. But income is more than just your pay stub.

“Income is an important consideration in getting approved for a loan, but this income doesn’t necessarily have to come via employment,” Jones says. “Retirement accounts, pension payments [and] other income sources would all be considered in a loan application.”

You can use a number of income sources during the mortgage application process, whether it’s a part-time job, Social Security, disability, investment income, alimony or something else entirely. Because of this, you don’t need to work a full-time job to buy a home. But you will generally need to meet other requirements.

“Lenders consider retiree borrowers using the same set of considerations as working borrowers,” says Hannah Jones, a Senior Economic Research Analyst at Realtor.com. “Credit score, outstanding debt, assets and income are all considered for loan approval.”

Lenders also look at your debt-to-income ratio, or DTI ratio, to determine whether you’d be a good fit for a mortgage. Your DTI is determined by adding up all of your monthly debt, which is then divided by your gross monthly income.

While lenders have different DTI requirements, the lower your DTI, the less risky you typically are to lenders. So, it can help to keep your DIT below 50% (but 43% or less is preferable) and have a decent chunk of savings or an exceptional credit score to show your financial responsibility.

Find out more about your mortgage loan options now.

Why a home loan might not be the best move for every senior

Buying a home in retirement might be a good idea in some situations, but that doesn’t mean it’s the right move for everyone.

“Seniors should avoid home loans significantly affecting their savings if their retirement income can’t comfortably cover the payments,” Mindy Price, a real estate broker at eXp Realty. “It’s crucial to tread carefully and avoid excessive debt, especially considering the possibility of unforeseen health or financial changes.”

But even if you have a steady income during retirement, it’s important to ensure that you can afford a home loan and the regular payments tied to it.

“Retirees shouldn’t stretch themselves financially to take on a home loan,” Jones says. “Many retirees no longer hold a mortgage on their existing home, so they should consider the lifestyle impact of a monthly housing payment.”

The bottom line

Buying a home with a mortgage loan is possible as a senior in retirement, but what makes sense for one borrower may not make sense for the next. So, be sure to weigh all of your potential options to determine what, if any, route makes the most sense for you.

And, if you take this route, it’s important to calculate all your potential retirement income, Albohn says, to make sure you’re able to repay the home loan. You may also want to talk to a mortgage broker or advisor who can help you determine whether taking out a home loan during retirement is a good fit.

CBS News

Couple charged for allegedly stealing $1 million from Lululemon in convoluted retail theft scheme

A couple from Connecticut faces charges for allegedly taking part in an intricate retail theft operation targeting the apparel company Lululemon that may have amounted to $1 million worth of stolen items, according to a criminal complaint.

The couple, Jadion Anthony Richards, 44, and Akwele Nickeisha Lawes-Richards, 45, were arrested Nov. 14 in Woodbury, Minnesota, a suburb of Minneapolis-St. Paul. Richards and Lawes-Richards have been charged with one count each of organized retail theft, which is a felony, the Ramsey County Attorney’s Office said. They are from Danbury, Connecticut.

The alleged operation impacted Lululemon stores in multiple states, including Minnesota.

“Because of the outstanding work of the Roseville Police investigators — including their new Retail Crime Unit — as well as other law enforcement agencies, these individuals accused of this massive retail theft operation have been caught,” a spokesperson for the attorney’s office said in a statement on Nov. 18. “We will do everything in our power to hold these defendants accountable and continue to work with our law enforcement partners and retail merchants to put a stop to retail theft in our community.”

Both Richards and Lawes-Richards have posted bond as of Sunday and agreed to the terms of a court-ordered conditional release, according to the county attorney. For Richards, the court had set bail at $100,000 with conditional release, including weekly check-ins, or $600,000 with unconditional release. For Lawes-Richards, bail was set at $30,000 with conditional release and weekly check-ins or $200,000 with unconditional release. They are scheduled to appear again in court Dec. 16.

Prosecutors had asked for $1 million bond to be placed on each half of the couple, the attorney’s office said.

Richards and Lawes-Richards are accused by authorities of orchestrating a convoluted retail theft scheme that dates back to at least September. Their joint arrests came one day after the couple allegedly set off store alarms while trying to leave a Lululemon in Roseville, Minnesota, and an organized retail crime investigator, identified in charging documents by the initials R.P., recognized them.

The couple were allowed to leave the Roseville store. But the investigator later told an officer who responded to the incident that Richards and Lawes-Richards were seasoned shoplifters, who apparently stole close to $5,000 worth of Lululemon items just that day and were potentially “responsible for hundreds of thousands of dollars in loss to the store across the country,” according to the complaint. That number was eventually estimated by an investigator for the brand to be even higher, with the criminal complaint placing it at as much as $1 million.

Richards and Lawes-Richards allegedly involved other individuals in their shoplifting pursuits, but none were identified by name in the complaint. Authorities said they were able to successfully pull off the thefts by distracting store employees and later committing fraudulent returns with the stolen items at different Lululemon stores.

“Between October 29, 2024 and October 30, 2024, RP documented eight theft incidents in Colorado involving Richards and Lawes-Richards and an unidentified woman,” authorities wrote in the complaint, describing an example of how the operation would allegedly unfold.

“The group worked together using specific organized retail crime tactics such as blocking and distraction of associates to commit large thefts,” the complaint said. “They selected coats and jackets and held them up as if they were looking at them in a manner that blocked the view of staff and other guests while they selected and concealed items. They removed security sensors using a tool of some sort at multiple stores.”

CBS News contacted Lululemon for comment but did not receive an immediate reply.

CBS News

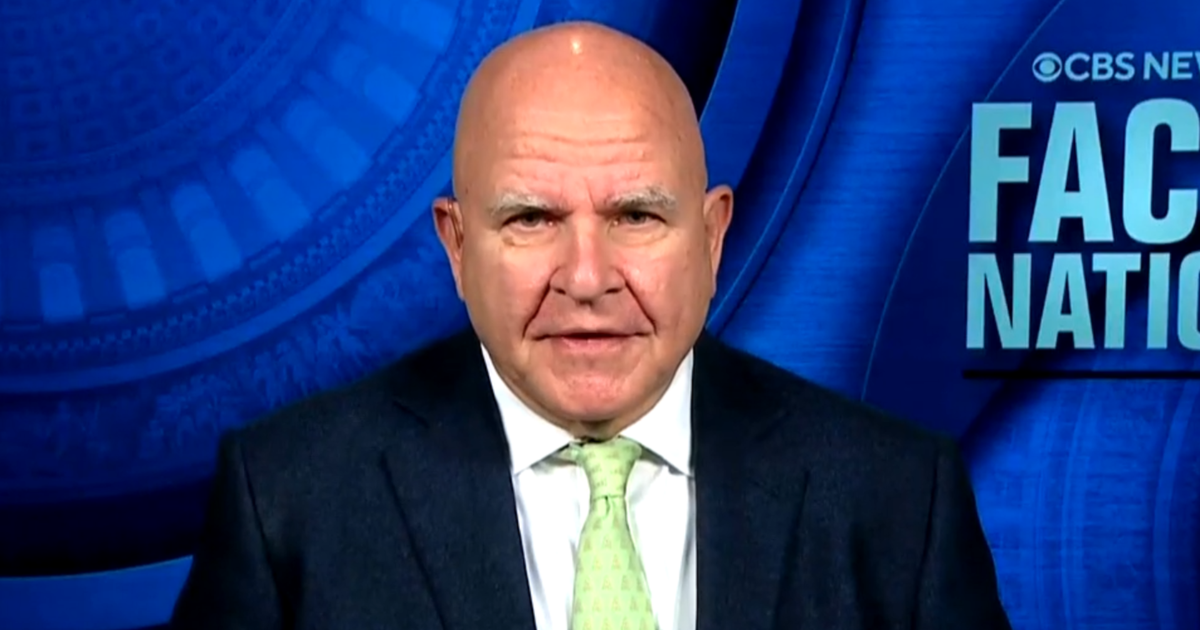

Former Trump national security adviser says next couple months are “really critical” for Ukraine

Washington — Lt. Gen. H.R. McMaster, a former national security adviser to Donald Trump, said Sunday that the upcoming months will be “really critical” in determining the “next phase” of the war in Ukraine as the president-elect is expected to work to force a negotiated settlement when he enters office.

McMaster, a CBS News contributor, said on “Face the Nation with Margaret Brennan” that Russia and Ukraine are both incentivized to make “as many gains on the battlefield as they can before the new Trump administration comes in” as the two countries seek leverage in negotiations.

With an eye toward strengthening Ukraine’s standing before President-elect Donald Trump returns to office in the new year, the Biden administration agreed in recent days to provide anti-personnel land mines for use, while lifting restrictions on Ukraine’s use of U.S.-made longer range missiles to strike within Russian territory. The moves come as Ukraine marked more than 1,000 days since Russia’s invasion in February 2022.

Meanwhile, many of Trump’s key selection for top posts in his administration — Rep. Mike Waltz for national security adviser and Sens. Marco Rubio for secretary of state and JD Vance for Vice President — haven’t been supportive of providing continued assistance to Ukraine, or have advocated for a negotiated end to the war.

CBS News

McMaster said the dynamic is “a real problem” and delivers a “psychological blow to the Ukrainians.”

“Ukrainians are struggling to generate the manpower that they need and to sustain their defensive efforts, and it’s important that they get the weapons they need and the training that they need, but also they have to have the confidence that they can prevail,” he said. “And any sort of messages that we might reduce our aid are quite damaging to them from a moral perspective.”

McMaster said he’s hopeful that Trump’s picks, and the president-elect himself, will “begin to see the quite obvious connections between the war in Ukraine and this axis of aggressors that are doing everything they can to tear down the existing international order.” He cited the North Korean soldiers fighting on European soil in the first major war in Europe since World War II, the efforts China is taking to “sustain Russia’s war-making machine,” and the drones and missiles Iran has provided as part of the broader picture.

“So I think what’s happened is so many people have taken such a myopic view of Ukraine, and they’ve misunderstood Putin’s intentions and how consequential the war is to our interests across the world,” McMaster said.

On Trump’s selections for top national security and defense posts, McMaster stressed the importance of the Senate’s advice and consent role in making sure “the best people are in those positions.”

McMaster outlined that based on his experience, Trump listens to advice and learns from those around him. And he argued that the nominees for director of national intelligence and defense secretary should be asked key questions like how they will “reconcile peace through strength,” and what they think “motivates, drives and constrains” Russian President Vladimir Putin.

Trump has tapped former Rep. Tulsi Gabbard to be director of national intelligence, who has been criticized for her views on Russia and other U.S. adversaries. McMaster said Sunday that Gabbard has a “fundamental misunderstanding” about what motivates Putin.

More broadly, McMaster said he “can’t understand” the Republicans who “tend to parrot Vladimir Putin’s talking points,” saying “they’ve got to disabuse themselves of this strange affection for Vladimir Putin.”

Meanwhile, when asked about Trump’s recent selection of Sebastian Gorka as senior director for counterterrorism and deputy assistant to the president, McMaster said he doesn’t think Gorka is a good person to advise the president-elect on national security. But he noted that “the president, others who are working with him, will probably determine that pretty quickly.”

CBS News

Sen. Van Hollen says Biden is “not fully complying with American law” on Israeli arms shipments

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.