CBS News

10 signs your credit card debt is out of control

Getty Images

In today’s economic landscape, credit card debt can quickly spiral out of control. Interest rates are high, but the average credit card rate is much higher than most other borrowing options and is exceeding 21% right now. This means that unpaid credit card balances can grow rapidly, making it increasingly difficult to catch up. When you add in the revolving nature of credit card debt, which allows you to continually borrow up to your credit limit, it’s easy to find yourself trapped in a cycle of debt.

And, the detrimental effects of having excessive credit card debt are numerous. For starters, it can lead to a lower credit score, making it harder to secure loans or favorable interest rates in the future. And, high credit card debt levels can also force you to allocate a large portion of your income to debt repayment, which can significantly hinder your long-term financial goals, like saving for retirement or purchasing a home.

Recognizing when credit card usage is becoming problematic can be challenging, though. After all, many people don’t realize they’re in too much debt until they’re already facing serious financial difficulties. However, there are warning signs that can indicate your credit card debt is growing out of control. By being aware of these red flags, you can take action before the situation becomes unmanageable.

Worried about your credit card debt? Find out about your debt relief options here.

10 signs your credit card debt is out of control

Here are some big signs to watch for that indicate your credit card debt may be spiraling out of control:

You’re only making minimum payments

Consistently paying only the minimum amount due is a clear indicator that you’re struggling to manage your credit card debt. This practice may keep your credit card payments current, but it allows interest to accumulate rapidly, potentially leading to a debt trap.

For example, if you have a $5,000 balance with an 18% APR and only make minimum payments (the interest charges and 1% of the balance) — which would be about $125 per month — it could take nearly 23 years to pay off the debt. It would also cost you over $6,900 in interest during that time.

Find out how the top debt relief companies could help you get rid of your credit card debt now.

Your credit utilization ratio is high

If you’re using more than 30% of your available credit, it could be a sign that you are overreliant on credit cards and could be headed for trouble. A high utilization ratio not only indicates potential financial stress but also negatively impacts your credit score. So, for example, if you have a $10,000 credit limit and your balance is consistently over $3,000, it’s time to reassess your credit usage.

You’re using one card to pay off another

The practice of using one credit card to pay off another, commonly known as “kiting,” is a dangerous cycle that can quickly lead to mounting debt across multiple cards. Borrowing money from one card, typically with a cash advance, and using that money to make the payments on another card is also a clear indicator that you’re unable to meet your financial obligations with your current income.

You’re regularly maxing out your cards

Consistently reaching your credit limit suggests you’re living beyond your means and relying too heavily on credit. And, this behavior isn’t just a red flag. It can also lead to over-limit fees and higher interest rates, making your card debt more expensive and further exacerbating your debt problem.

You’re missing payments or paying late

If you’re unable to make credit card payments on time, it’s a strong indication that your debt has become unmanageable. Late payments not only incur fees but also damage your credit score, making it harder to access affordable credit in the future.

Your credit score is declining

High credit card balances and missed payments can significantly impact your credit score, signaling growing financial distress. For example, a drop of 50 points or more over a short period could be a clear signal that your credit card usage is becoming problematic.

You’re using credit cards for everyday expenses

Relying on credit to pay for basic necessities like groceries or utility bills often indicates a cash flow problem. While using credit cards for daily expenses can be part of a rewards strategy, it becomes concerning when you’re unable to pay off these charges in full each month.

You’re avoiding looking at your statements

If you find yourself dreading your monthly credit card statements or ignoring them altogether, it’s likely because you’re aware of the growing problem but feel overwhelmed. This avoidance behavior can lead to missed credit card payments and further financial complications.

You’re considering a cash advance

Turning to high-interest cash advances is often a last resort and a clear sign of financial distress. Cash advances typically come with higher interest rates than regular credit card purchases and often start accruing interest immediately, making them an expensive form of borrowing.

Your debt-to-income ratio is above 40%

If your monthly debt payments exceed 40% of your gross monthly income, it’s a strong indicator that your debt load is becoming unsustainable. This high debt-to-income ratio leaves little room for savings or unexpected expenses, potentially leading to a cycle of increasing debt.

What to do about your credit card debt

If you recognize several of these signs in your own financial situation, it’s crucial to take action promptly. Fortunately, there are several options available for addressing out-of-control credit card debt, including:

- Work with a debt relief company on solutions: These companies can negotiate with creditors on your behalf to potentially reduce your debt or create a more manageable credit card debt repayment plan. However, be cautious and research thoroughly, as not all debt relief companies are the same, and if you’re going to pay fees to get rid of your credit card debt, you’ll want to ensure that you’re working with the best experts possible.

- Consolidate your debt on your own: When you consolidate your debt, you typically take out a debt consolidation loan or a personal loan to pay off what you owe, combining multiple high-interest debts into a single, lower-interest payment. This approach can simplify your debt repayment and potentially save you money on interest.

- Seek help from a non-profit credit counseling agency: These organizations offer free or low-cost financial education and can help you develop a debt management plan when you’re struggling to pay off your credit card debt. They may also negotiate with creditors to lower interest rates or waive certain fees.

- Consider a debt snowball or avalanche method: These solutions are do-it-yourself debt repayment strategies. The snowball method involves paying off the smallest debts first for psychological wins, while the avalanche method focuses on tackling the highest-interest debts first to save more money over time.

- Explore bankruptcy as a worst-case scenario: While bankruptcy should be considered only after exhausting other options, it can provide a fresh start for those stuck with unmanageable debt. However, it has long-lasting consequences on your credit and financial future, so be sure to weigh those as part of the decision-making process.

The bottom line

Regardless of which approach you choose, the key is to act decisively if you recognize one or more of the signs outlined above. The longer you wait to address your credit card debt, the more challenging it becomes to regain control of your finances. Remember, seeking help is not a sign of failure but a proactive step towards financial health. And, with determination, discipline and the right strategy, it’s possible to overcome even seemingly insurmountable credit card debt and get your finances back on track.

CBS News

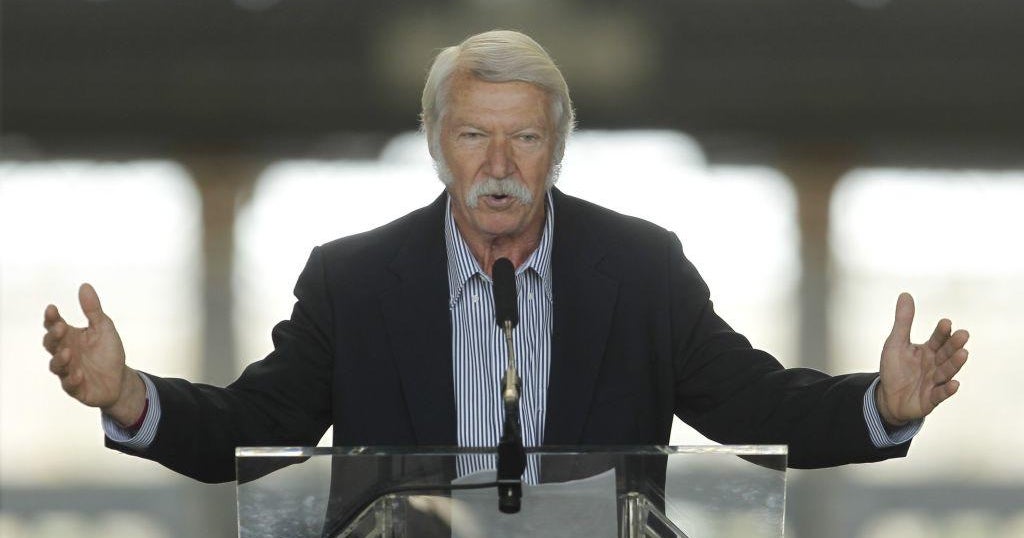

Bela Karolyi, polarizing U.S. gymnastics coach, dies at 82

Bela Karolyi, the charismatic if polarizing gymnastics coach who turned young women into champions and the United States into an international power, has died. He was 82.

A spokesperson for USA Gymnastics confirmed to CBS News by email that Karolyi died Friday. No cause of death was given.

Karolyi and wife Martha trained multiple Olympic gold medalists and world champions in the U.S. and Romania, including Nadia Comaneci and Mary Lou Retton.

Ron Jenkins/Fort Worth Star-Telegram/Tribune News Service via Getty Images

“A big impact and influence on my life,” Comaneci, who was just 14 when Karolyi coached her to gold for Romania at the 1976 Montreal Olympics, posted on Instagram.

The Karolyis defected to the United States in 1981 and over the next 30-plus years became a guiding force in American gymnastics, though not without controversy. Bela helped guide Retton — all of 16 — to the Olympic all-around title at the 1984 Games in Los Angeles and memorably helped an injured Kerri Strug off the floor at the 1996 Games in Atlanta after Strug’s vault secured the team gold for the Americans.

Karolyi briefly became the national team coordinator for USA Gymnastics women’s elite program in 1999 and incorporated a semi-centralized system that eventually turned the Americans into the sport’s gold standard. It did not come without a cost. He was pushed out after the 2000 Olympics after several athletes spoke out about his tactics.

It would not be the last time Karolyi was accused of grandstanding and pushing his athletes too far physically and mentally.

During the height of the Larry Nassar scandal in the late 2010s — when the disgraced former USA Gymnastics team doctor was effectively given a life sentence after pleading guilty to sexually assaulting gymnasts and other athletes with his hands under the guise of medical treatment — over a dozen former gymnasts came forward saying the Karolyis were part of a system that created an oppressive culture that allowed Nassar’s behavior to run unchecked for years.

Still, some of Karolyi’s most famous students were always among his staunchest defenders. When Strug got married, she and Karolyi took a photo recreating their famous scene from the 1996 Olympics, when he carried her onto the medals podium after she vaulted on a badly sprained ankle.

CBS News

Mike Tyson says he has “no regrets” after losing boxing match to Jake Paul

Despite losing his boxing match to Jake Paul, Mike Tyson in a social media post Saturday said he had “no regrets” to getting “in ring one last time.”

The boxing legend was defeated by social media star Jake Paul in a highly anticipated fight on Friday night with an age difference of over three decades between the two contenders.

Netflix said Saturday that 60 million households worldwide tuned in to watch the match. The two fighters went eight full rounds, with each round two minutes long. Paul defeated Tyson by unanimous decision and the 27-year-old upset boxer and 58-year-old former heavyweight champion hugged afterward.

Paul was expected to earn about $40 million from the fight, and Tyson was expected to take around $20 million for the fight, according to DraftKings and other online reports.

Getty Images

Tyson said on his social media that “this is one of those situations when you lost but still won. I’m grateful for last night.”

The fight almost didn’t happen after Tyson experienced an ulcer flare-up while on a plane in March. He addressed his illness Saturday, writing that he “almost died in June.” He said he had eight blood transfusions and “lost half my blood and 25lbs in hospital and had to fight to get healthy to fight so I won.”

Tyson retired from boxing in 2005 after a 20-year career. He last fought in a 2020 exhibition match against former four-division world champ Roy Jones Jr.

“To have my children see me stand toe to toe and finish 8 rounds with a talented fighter half my age in front of a packed Dallas Cowboy stadium is an experience that no man has the right to ask for. Thank you,” he said.

Alex Sundby and

contributed to this report.

CBS News

In their final meeting, Xi tells Biden he is “ready to work with a new administration”

In their final meeting, China’s leader Xi Jinping told U.S. President Biden that his nation was “ready to work with a new administration,” as President-elect Donald Trump prepares to take over.

The two leaders gathered Saturday on the sidelines of the annual Asia-Pacific Economic Cooperation summit. Mr. Biden was expected to urge Xi to dissuade North Korea from further deepening its support for Russia’s war on Ukraine. It marked their first in-person meeting since they met in Northern California last November.

Without mentioning Trump’s name, Xi appeared to signal his concern that the incoming president’s protectionist rhetoric on the campaign trail could send the U.S.-China relationship into another valley.

“China is ready to work with a new U.S. administration to maintain communication, expand cooperation and manage differences so as to strive for a steady transition of the China-U.S. relationship for the benefit of the two peoples,” Xi said through an interpreter.

LEAH MILLIS/POOL/AFP via Getty Images

Mr. Biden, meanwhile, spoke in broader brushstrokes about where the relationship has gone and reflected not just on the past four years, but on their long relationship.

“Over the past four years, China-U.S. relations have experienced ups and downs, but with the two of us at the helm, we have also engaged in fruitful dialogues and cooperation, and generally achieved stability,” he said.

Mr. Biden and Xi, with top aides surrounding them, gathered around a long rectangle of tables in an expansive conference room at Lima’s Defines Hotel and Conference Center.

There’s much uncertainty about what lies ahead in the U.S.-China relationship under Trump, who campaigned promising to levy 60% tariffs on Chinese imports.

Bobby Djavaheri, president of Los Angeles-based Yedi Houseware Appliances — which manufactures its products in China — told CBS News in an interview this week that such tariffs “would decimate our business, but not only our business. It would decimate all small businesses that rely on importing.”

Trump has also proposed revoking China’s Most Favored Nation trade status, phasing out all imports of essential goods from China and banning China from buying U.S. farmland.

Already, many American companies, including Nike and eyewear retailer Warby Parker, have been diversifying their sourcing away from China. Shoe brand Steve Madden says it plans to cut imports from China by as much as 45% next year.

White House national security adviser Jake Sullivan said Biden administration officials will advise the Trump team that managing the intense competition with Beijing will likely be the most significant foreign policy challenge they will face.

It’s a big moment for Mr. Biden as he wraps up more than 50 years in politics. He saw his relationship with Xi as among the most consequential on the international stage and put much effort into cultivating that relationship.

Mr. Biden and Xi first got to know each other on travels across the U.S. and China when both were vice presidents, interactions that both have said left a lasting impression.

“For over a decade, you and I have spent many hours together, both here and in China and in between. And I think we’ve spent a long time dealing with these issues,” Mr. Biden said Saturday.

But the last four years have presented a steady stream of difficult moments.

The FBI this week offered new details of a federal investigation into Chinese government efforts to hack into U.S. telecommunications networks. The initial findings have revealed a “broad and significant” cyberespionage campaign aimed at stealing information from Americans who work in government and politics.

U.S. intelligence officials also have assessed China has surged sales to Russia of machine tools, microelectronics and other technology that Moscow is using to produce missiles, tanks, aircraft and other weaponry for use in its war against Ukraine.

And tensions flared last year after Mr. Biden ordered the shooting down of a Chinese spy balloon that traversed the United States.