CBS News

3 signs credit cards are ruining your finances (and how to fix it)

Getty Images

Amid persistent inflation, Americans are struggling under the weight of the current economic climate. Prices are rising across the board, from the grocery store to car insurance. Compounding the problem are high interest rates that are causing the cost of borrowing to skyrocket. For example, since 2021, the average credit card interest rate has soared from 16.45% to 22.63%, according to the most recent Federal Reserve data.

That’s bad news for many Americans who must rely on credit cards to help make ends meet. According to a recent Clever Real Estate survey, 61% of Americans are in credit card debt, and roughly half depend on their credit cards to pay living expenses. When bills and debt consume so much of your home budget, there’s little room left to save for a financial emergency or retirement.

If your credit card debt rises beyond your means to repay it, the impact it could have on your finances could be catastrophic. If your credit card debt is at a level you’re uncomfortable with, it’s time to resolve the issue before it ruins your finances.

Explore your top debt relief options now and start tackling your high-rate debt.

3 signs credit cards are ruining your finances (and how to fix it)

Here are three signs you might have too much credit card debt and tips to fix it.

Sign #1: You only make the minimum payments

Your credit card company gives you a grace period, usually between 21 to 25 days, to pay your balance in full. You won’t incur any interest charges if you pay off your entire balance within this period. However, if you only make your card’s minimum payment, usually around 1% to 3% of your balance, you must pay interest on the remaining balance.

“You’re in trouble if you can only make the minimum payments and can’t chip away at the balances,” Joseph Camberato, CEO at NationalBusinessCapital.com, says.

Camberato recommends controlling credit card debt before it gets out of hand.

“If you ignore credit card debt, that can really mess up your (credit) score. A good rule of thumb is to keep your credit card balance below 33% of your total limit.,” Camberato says.

High credit score achievers typically utilize less than 10% of their available credit.

Find out more about your credit card debt relief options here.

Sign #2: Your credit card debt is increasing

“It’s a bad sign if your credit card balances continue to increase despite making payments, which means your debt is growing uncontrollably,” says Leslie Tayne, a financial attorney at Tayne Law Group and author of Life & Debt.

If you find yourself in this situation, it may mean you are relying too heavily on credit cards to cover expenses, which can lead to a cycle of debt that’s hard to break. To regain control, create a strict budget that minimizes unnecessary spending. Also, consider increasing your income by volunteering for extra hours at work, requesting a wage increase if warranted or taking on a side hustle.

Sign #3: You’re falling behind on payments

“Another red flag is if you start missing payments,” says Camberato. “These are clear signs that your spending is outpacing your income.”

You may be able to get away with minimum payments while your credit balance continues to grow, but it could eventually lead to late or missing payments.

“Late payments and high balances can cause significant damage to your credit score, which makes it more difficult to get approved for credit in the future,” says Tayne. “And if you are approved, you’ll be more likely to pay high interest rates. Bad credit also makes it more difficult to rent an apartment, open utility accounts and even get certain types of jobs.”

4 strategies to tackle credit card debt

The first step to reduce your credit card debt is to cut discretionary spending to free up more money you can apply to your debt balances.

Start with recurring bills like seldom-used gym memberships or streaming services. And, consider shopping different car insurance companies to see if you can find similar coverage with lower premiums.

Next, consider your options, which may include the following:

Debt repayment strategies

The two most popular strategies are the debt avalanche and the debt snowball methods. The avalanche method focuses on paying off the debt with the highest interest rate, while the debt snowball method prioritizes paying off your lowest credit card balance first. You’ll likely save more money with the debt avalanche method, but you may prefer the snowball method if you think the momentum from quick wins will motivate you to keep going.

Debt consolidation loan

A debt consolidation loan allows you to combine all your credit cards into one personal loan you repay in fixed monthly payments for a specific term. The benefit of a debt consolidation loan is that you can get a lower interest rate and simplify your finances by replacing multiple payments with a single one.

Balance transfer credit card

With good credit, you may qualify for a balance transfer credit card with an introductory 0% APR for a specific period, usually up to 21 months. That could give you plenty of time to pay down debt interest-free, but be aware these cards usually come with an upfront balance transfer fee of 3% to 5% of the amount you transfer on average.

Credit card debt settlement

One way to lower your credit card balances is to call your creditor and negotiate for a lower balance. Alternatively, debt settlement companies can negotiate with your creditors on your behalf. Consider the pros and cons of pursuing this path and make sure you go with a reputable company, says Camberato.

“Do some research, read reviews, and make sure the company is legitimate. While some companies can help, others might do more harm than good. Some companies might tell you to stop paying your credit cards and pay their company instead and that leads to late payments and a wrecked credit score,” Camberato says.

The bottom line

There are some big signs to look for if you’re worried that your credit card debt is impacting your finances — but there are also some decent solutions to fix the issue. In addition to options like credit card settlement and debt consolidation, you might consider working with a credit counselor if you’re having trouble managing your finances and credit. These advisors can help you create a budget or debt management plan to help zero out your credit card debt.

CBS News

Social Security Fairness Act passes U.S. Senate

Legislation to expand Social Security benefits to millions of Americans passed the U.S. Senate early Saturday and is now headed to the desk of President Joe Biden, who is expected to sign the measure into law.

Senators voted 76-20 for the Social Security Fairness Act, which would eliminate two federal policies that prevent nearly 3 million people, including police officers, firefighters, postal workers, teachers and others with a public pension, from collecting their full Social Security benefits. The legislation has been decades in the making, as the Senate held its first hearings into the policies in 2003.

“The Senate finally corrects a 50-year mistake,” proclaimed Senate Majority Leader Chuck Schumer, a Democrat from New York, after senators approved the legislation at 12:15 a.m. Saturday.

The bill’s passage is “a monumental victory for millions of public service workers who have been denied the full benefits they’ve rightfully earned,” said Shannon Benton, executive director for the Senior Citizens League, which advocates for retirees and which has long pushed for the expansion of Social Security benefits. “This legislation finally restores fairness to the system and ensures the hard work of teachers, first responders and countless public employees is truly recognized.”

The vote came down to the wire, as the Senate looked to wrap up its current session. Senators rejected four amendments and a budgetary point of order late Friday night that would have derailed the measure, given the small window of time left to pass it.

Vice President-elect JD Vance of Ohio was among the 24 Republican senators to join 49 Democrats to advance the measure in an initial procedural vote that took place Wednesday.

“Social Security is a bedrock of our middle class. You pay into it for 40 quarters, you earned it, it should be there when you retire,” Ohio Senator Sherrod Brown, a Democrat who lost his seat in the November election, told the chamber ahead of Wednesday’s vote. “All these workers are asking for is for what they earned.”

What is the Social Security Fairness Act?

The Social Security Fairness Act would repeal two federal policies — the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) — that reduce Social Security payments to nearly 3 million retirees.

That includes those who also collect pensions from state and federal jobs that aren’t covered by Social Security, including teachers, police officers and U.S. postal workers. The bill would also end a second provision that reduces Social Security benefits for those workers’ surviving spouses and family members. The WEP impacts about 2 million Social Security beneficiaries and the GPO nearly 800,000 retirees.

The measure, which passed the House in November, had 62 cosponsors when it was introduced in the Senate last year. Yet the bill’s bipartisan support eroded in recent days, with some Republican lawmakers voicing doubts due to its cost. According to the Congressional Budget Office, the proposed legislation would add a projected $195 billion to federal deficits over a decade.

Without Senate approval, the bill’s fate would have ended with the current session of Congress and would have needed to be re-introduced in the next Congress.

CBS News

12/20: CBS Evening News – CBS News

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Saturday is the winter solstice and 2024’s shortest day. Here’s what to know about the official start of winter.

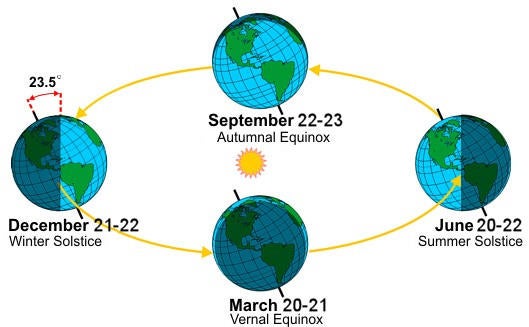

The 2024 winter solstice, the shortest day of the year, happens on Saturday, Dec. 21, in the Northern Hemisphere. The celestial event signifies the first day of winter, astronomically.

What is the winter solstice?

The winter solstice is the day each year that has the shortest period of daylight between sunrise and sunset, and therefore the longest night. It happens when the sun is directly above the Tropic of Capricorn, a line of latitude that circles the globe south of the equator, the National Weather Service explains.

The farther north you are, the shorter the day will be, and in the Arctic Circle, the sun won’t rise at all.

How is the day of the winter solstice determined?

The winter solstice occurs because of the Earth’s tilt as it rotates around the sun.

When the Northern Hemisphere tilts away from the sun, the nights last longer. The longest night happens on the solstice because the hemisphere is in its furthest position from the sun. That occurs each year on Dec. 21 or 22.

This year, it falls on Dec. 21 at 4:21 a.m ET, to be precise.

On the summer solstice, when the northern tilt is closest to the sun, we have the longest day, usually June 20 or 21.

National Weather Service

The solstices are not always exactly on the 21st every year because the earth’s rotation around the sun is 365.25 days, instead of 365 even.

Will days start getting longer after the winter solstice?

Yes. Each day after the solstice, we get one minute more of sunlight. It doesn’t sound like much, but after just two months, or around 60 days, we’ll be seeing about an hour more of sunlight.

When will winter officially be over in 2025?

The meteorological winter ends on March 20, 2025. Then, spring will last until June 20, when the summer solstice arrives.

How is the winter solstice celebrated around the world?

Nations and cultures around the world have celebrated the solstice since ancient times with varying rituals and traditions. The influence of those solstice traditions can still be seen in our celebrations of holidays like Christmas and Hanukkah, Britannica notes.

The ancient Roman Saturnalia festival celebrated the end of the planting season and has close ties with modern-day Christmas. It honored Saturn, the god of harvest and farming. The multiple-day affair had lots of food, games and celebrations. Presents were given to children and the poor, and slaves were allowed to stop working.

Gatherings are held every year at Stonehenge, a monumental circle of massive stones in England that dates back about 5,000 years. The origins of Stonehenge are shrouded in mystery, but it was built to align with the sun on solstice days.

Andrew Matthews/PA Images via Getty Images

The Hopi, a Native American tribe in the northern Arizona area, celebrate the winter solstice with dancing, purification and sometimes gift-giving. A sacred ritual known as the Soyal Ceremony marks the annual milestone.

In Peru, people honor the return of the sun god on the winter solstice. The ancient tradition would be to hold sacrificial ceremonies, but today, people hold mock sacrifices to celebrate. Because Peru is in the Southern Hemisphere, their winter solstice happens in June, when the Northern Hemisphere is marking its summer solstice.

Scandinavia celebrates St. Lucia’s Day, a festival of lights.

The “arrival of winter,” or Dong Zhi, is a Chinese festival where family gathers to celebrate the year so far. Traditional foods include tang yuan, sweet rice balls with a black sesame filling. It’s believed to have its origins in post-harvest celebrations.

Researchers stationed in in Antarctica even have their own traditions, which may include an icy plunge into the polar waters. They celebrate “midwinter” with festive meals, movies and sometimes homemade gifts.