CBS News

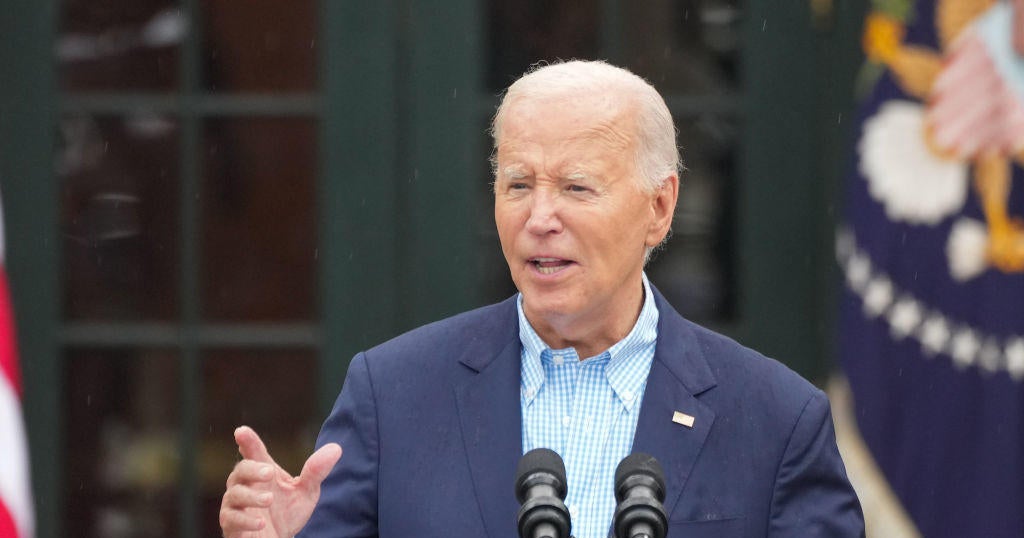

Biden heads to Wisconsin to kick off critical weekend for 2024 campaign

Washington — President Biden is set to travel to the battleground state of Wisconsin on Friday for a campaign rally, marking the start of a crucial weekend for his reelection bid as he seeks to assuage concerns about his fitness for a second term sparked by his startling debate performance just over one week ago.

In addition to the campaign event in Madison, Wisconsin, on Friday afternoon, Mr. Biden will tape an interview with ABC’s George Stephanopoulos, which the network said will air in full Friday night. The president will also head to Philadelphia for another campaign event on Sunday, capping the July 4 holiday weekend with a visit to a second battleground state.

The president’s appearances are coming under new scrutiny following his poor showing against former President Donald Trump, the presumptive Republican nominee, in the first general election debate on June 27. Mr. Biden blamed his performance on a busy travel schedule leading up to the face-off with Trump, saying during a campaign event Tuesday that he “almost fell asleep” on stage after making two trips to Europe in June.

In a pair of radio interviews that aired Thursday, Mr. Biden admitted he had a “bad debate” and that he “screwed up.”

Mr. Biden’s campaign and the White House sought to brush off concerns about his lackluster performance by insisting he had a cold and that the debate fiasco was simply a “bad night.” As part of efforts to quiet concerns about Mr. Biden and his age, he and Vice President Kamala Harris participated in a call with campaign staff on Wednesday, and they met with 20 Democratic governors at the White House later that evening. Mr. Biden also spoke with the Democratic leaders of the House and Senate, as well as other key allies on Capitol Hill.

The president has maintained the same message throughout the outreach, according to participants: he is in the race to defeat Trump and will not be pushed out.

“I learned from my father, when you get knocked down, just get back up, get back up,” Mr. Biden told “The Earl Ingram Show,” which airs in Wisconsin, in the radio interview Thursday. “And you know we’re going to win this election, we’re going to just beat Donald Trump.”

Amid the assurances, two House Democrats have openly called on Mr. Biden to withdraw from the presidential race: Reps. Lloyd Doggett of Texas and Raúl Grijalva of Arizona. Others, meanwhile, have publicly urged the president to take steps to prove to voters, elected Democrats and party donors that he is fit for a second term in the White House.

CBS News

Will credit card rates climb in 2025? Experts weigh in

Mark Evans/Getty Images

Credit card debt has been surging nationwide — and with rates where they are, it’s no wonder why. According to the Federal Reserve, the average credit card rate sits at over 23% right now — up from just 14% just a couple of years ago and the highest rate on record.

Today’s sky-high credit card rates have made it incredibly hard for consumers to get out of debt. In fact, delinquencies on credit cards have more than doubled on credit cards since 2021 alone.

But credit card rates are variable, so they — and your monthly payment — can change fast. Will rates on credit cards climb in the new year, though?

Find out how to get rid of your existing credit card debt here.

Will credit card rates climb in 2025? Experts weigh in

Want to know where your rates may be headed in the next year? Here’s what experts had to say.

Credit card rates may remain the same

The Federal Reserve reduced its federal funds rate at its last three meetings — a move that typically results in interest rate dips on variable-rate products like credit cards and HELOCs.

But future rate cuts aren’t certain — especially with recent reports showing inflation ticking back up.

“As the Federal Reserve digests the recent election results and economic reports on inflation, housing, and employment, it appears they may be in a rate pause for 2025,” says Jason Fannon, senior partner at Cornerstone Financial Services. “This neutral stance would keep the average credit card interest rate near 21% annually.”

Compare your credit card debt relief options online now.

…or fall slightly

If the Fed does opt to cut rates, credit card rates could fall too — but likely not significantly.

“I don’t expect any significant change to credit card interest rates,” Fannon says. “If the Fed does cut or raise the Fed Funds rate, it would have to be a sizable move in either direction to change the average credit card interest rate.”

Could credit card rates fall below the 20% mark if the Fed reduces its rate? It’s doubtful, pros say.

“It’s hard to predict beyond 12 months from now but if consumers want to see below-20% rates, then we need a variety of things to align,” says Eric Elkins, founder and CEO of Double E Financial Solutions. “We need inflation to remain below 3% for at least 15 months, we need to see average wage increases above 3%, we probably would need government regulations passed to limit the APR on the credit card institutions, and we’d need the Fed to continue reducing interest rates for borrowers. Lots of things need to occur.”

Other factors that impact your credit card rates

It’s not just the Fed and other economic conditions that weigh on credit card rates. Your credit score can impact what rate you get, too. So, if your score is on the lower end, improving it could help you snag a lower rate on a new card, which you could then transfer your existing credit card balance to.

“Having a good to excellent credit score could make you attractive to other companies,” says Troy Young, founder and president of Destiny Financial Group. “With a high score, you may be able to sell your debt to another company for a lower rate — in other words, refinance it by doing a balance transfer.”

The bottom line

If credit card debt is weighing you down, consider your debt relief options. There are debt consolidation, debt settlement, debt forgiveness and many other strategies that can help you tackle that debt more efficiently. Here are the best debt relief companies to consider if you need professional debt relief guidance.

CBS News

Why Amazon workers are striking days before Christmas

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Luigi Mangione’s extradition to New York expected

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.