CBS News

Can’t pay back your personal loan? 5 options to consider

Getty Images

When it comes to borrowing money, a personal loan is one of the most affordable options right now. After all, the high-rate environment has increased the cost of nearly every borrowing option — and while the average rate on a personal loan (about 12.4%) isn’t ideal, it’s certainly more appealing than the average credit card rate, which is nearly twice as high.

But while taking out a personal loan can be a helpful (and somewhat affordable) financial tool in today’s economic environment, circumstances may arise that make it difficult to keep up with payments. Any major hardship you face, whether it’s an illness, injury or job loss, can have a big impact on your income. And when coupled with today’s economic issues, like higher-than-ideal inflation, it can be a recipe for financial disaster.

There are options to consider in these types of situations, though. For example, if you’ve borrowed money in the past and now find yourself struggling to repay your personal loan, one of the solutions outlined below may help you avoid defaulting on your repayment obligations.

Need help with your debts? Compare your top debt relief options now.

Can’t pay back your personal loan? 5 options to consider

Here are a few different approaches to consider if you can’t pay back your personal loan:

Contact your lender right away

As soon as you think you may have trouble making payments, reach out to your lender, as many will offer hardship programs or be willing to work with borrowers who are experiencing temporary financial difficulties. The potential outcomes from contacting your lender could include:

- Temporary payment deferment

- Reduced interest rate

- Extended loan term to lower monthly payments

- Waived late fees

Lenders generally prefer to work with borrowers rather than deal with defaults or collections, so don’t wait until the issue compounds. Be honest about your situation and be prepared to provide documentation of your financial hardship if required.

Find out how the right debt relief company can help you today.

Try to refinance your loan

If your credit score has improved since you originally took out the loan, or if market interest rates have dropped, refinancing could be a viable option to make your loan more affordable. When you refinance your personal loan, you take out a new loan that pays off your existing one, ideally with better terms such as a lower interest rate or longer repayment period.

However, you should be cautious of extending your loan term significantly, as this could result in paying more interest in the long run. And be sure to do the math on any prepayment penalties on your current loan or origination fees on the new loan to ensure it makes sense financially.

Consolidate your debt

If you’re struggling with multiple debts, including your personal loan, debt consolidation might be worth exploring. This involves combining several debts into a single loan. The goal is to simplify your payments and potentially secure a lower overall interest rate. Debt consolidation options include:

While consolidation can be an effective strategy, you’ll typically need a good credit score and borrower profile to qualify (especially for a loan with a lower rate). So be sure to consider this option before falling behind on your payments, or you may have trouble getting approved.

Enroll in a debt management plan

Credit counseling agencies and some debt relief companies offer programs that can help you develop a debt management plan. When you enroll in this type of program, a credit counselor reviews your finances, helps you create a budget and potentially negotiates with creditors to get better repayment terms on your behalf. Through a debt management plan, you may be able to:

- Lower your interest rates

- Have certain fees waived

- Create a structured repayment plan

If you’re going to pursue this option, just be sure to do your homework and choose a reputable debt relief company or credit counseling agency to get the most out of it.

Negotiate a settlement

If you’re unable to repay your loan through other options, you may be able to negotiate a settlement with your lender. This involves offering a lump sum that’s less than the full amount owed to settle the debt.

While you can try to negotiate with your creditors on your own, many debt relief companies offer debt settlement services. The benefit of working with a debt relief agency is that their experts are skilled in these types of negotiations, so it could lead to better outcomes.

In some cases, you may be able to reduce the total amount you owe by as much as 20% to 50% (or perhaps even more). That said, debt settlement can also have serious consequences, including credit score damage and tax liabilities.

The bottom line

Falling behind on personal loan payments can be stressful, but there are multiple strategies available to help you regain control of your finances. If you’re going to take action, though, you need to act quickly and communicate openly with your lender. And, as you work through this challenge, take the opportunity to thoroughly review your finances and develop better financial habits to prevent similar issues in the future.

CBS News

Bird flu reaches Hawaii, the last state that had escaped it

Authorities in Hawaii are warning residents who attended a local pet fair to watch for symptoms of avian influenza after a local flock of ducks and other birds tested positive for the H5N1 virus that has fueled a global outbreak of infections.

Officials suspect wild migrating birds are likely to blame for the first known infection of a flock in Hawaii, which had been the last state in the country with no reported cases in poultry or wild birds during the current outbreak.

Sequencing done by the U.S. Department of Agriculture’s national lab in Iowa confirmed the infection, federal officials announced Monday.

The specific genotype of the virus that infected the birds is known as A3, said Lyndsay Cole, a spokesperson for the federal Animal Plant Health Inspection Services.

This is different from the B3.13 genotype that has been fueling this year’s unprecedented outbreak on dairy and poultry farms and suggests the virus spilled over into the flock in Hawaii from migrating wild birds.

Investigators have not turned up any links so far between the flock and imported animals or travel, a spokesperson for Hawaii’s Agriculture Department said. The island has “strict importing regulations for birds and other animals,” the spokesperson said.

All the infected birds were housed at the same site, though investigations are ongoing to root out other potential cases. The birds were also not symptomatic until several days after the fair, the state Health Department said, lowering the risk to humans.

“As the birds were not showing signs of infection at the time of the fair, the likelihood of spreading H5N1 to humans is low. However, out of an abundance of caution, DOH recommends that individuals who attended the fair and touched a duck or goose monitor for influenza-like illness (ILI) and conjunctivitis,” the state said in a release.

A quarantine order was issued for the property where the birds lived and all will be required to be “depopulated and the premises cleaned and disinfected,” the state Agriculture Department said. An order was also issued to prevent any animals from being moved in or out of the site.

At least 10 birds, which included ducks, a goose and a zebra dove, had been reported dead at the property on Nov. 12. Samples from the dead birds were sent to be tested for the virus.

Closely watching for human cases

Confirmation of the infected flock in Hawaii follows a detection of the virus in the area from wastewater samples collected by the state earlier this month.

Health officials around the country have been closely watching for signs of H5N1 spreading in their communities amid mounting cases in humans across North America.

At least 53 cases have been confirmed across seven states so far this year, the federal Centers for Disease Control and Prevention (CDC) says. Most are linked to the B3.13 version of the virus that has been infecting workers at dairy farms and nearby poultry farms in recent months. None of them are known to have been severely ill.

Health officials in Canada announced this month that they had detected a case of H5N1 bird flu in a critically ill hospitalized teenager. That patient had been infected by the D1.1 genotype of H5N1, which is related to another ongoing poultry outbreak in British Columbia, the Canadian province where they lived.

Experts say the virus that infected the teenager does appear to have some worrying mutations, which might explain why the case was more severe.

“The preliminary sequence from the H5N1 human case in British Columbia has been posted and it is not good news,” Scott Hensley, a professor of microbiology at the University of Pennsylvania, posted on Nov. 16.

Genetic sequencing data from human cases so far in the U.S. have not found any signs of the virus mutating to spread more efficiently between humans or to be significantly more dangerous, the CDC says.

But the agency also recently found evidence that several cases had been asymptomatic and gone undetected during the outbreak so far, prompting stepped up testing recommendations.

CBS News

Laken Riley murder suspect was grilled by wife after arrest, jail phone call reveals: “What happened with the girl?”

An FBI special agent testified Monday that electronic location data seems to place Georgia nursing student Laken Riley and the man accused of killing her in the same wooded area at the time of her death. Meanwhile, prosecutors also played a recording of Ibarra being grilled by his wife about the case during a jail phone call.

Jose Ibarra, 26, is charged with murder and other crimes in Riley’s death in February. He waived his right to a jury trial, meaning Athens-Clarke County Superior Court Judge H. Patrick Haggard is hearing the case and will alone decide on Ibarra’s guilt or innocence.

The killing of the 22-year-old woman added fuel to the national debate over immigration during this year’s presidential campaign when federal authorities said Ibarra illegally entered the U.S. in 2022 and was allowed to stay in the country while he pursued his immigration case.

FBI Special Agent James Burnie told the court Monday that he reviewed location data from Ibarra’s cellphone and Riley’s cellphone and smart watch. GPS data from Riley’s watch very precisely puts her inside the wooded area with running trails where her body was found on Feb. 22. Pings between Ibarra’s phone and cell towers and the fact his phone wasn’t making any Wi-Fi connections at the time indicate he was also likely in the woods, Burnie said.

Prosecutors also played a recording of a jail phone call from May between Ibarra and his wife, Layling Franco. FBI specialist Abeisis Ramirez, who translated the call from Spanish, testified that Ibarra told Franco that he had been at the University of Georgia looking for work, and that his wife repeatedly said she was fed up and that she wanted him to tell the truth.

Franco “continues to ask, ‘What happened with the girl?'” and said Ibarra “must know something,” Ramirez said. He responds: “Layling, enough.” Ramirez said Franco told Ibarra that it’s crazy that police only found his DNA.

Miguel Martinez/Atlanta Journal-Constitution via AP, Pool

Ibarra is charged with one count of malice murder, three counts of felony murder and one count each of kidnapping, aggravated assault, aggravated battery, hindering an emergency telephone call, tampering with evidence and being a peeping Tom.

Ibarra took selfies of himself early on the day Riley was killed, according to testimony from an FBI agent who analyzed data from cellphones seized from the apartment where Ibarra lived with his two brothers and two other people. In the photos, Ibarra is wearing a black Adidas baseball cap and a dark hooded jacket.

A few hours before Riley was killed, a man in a black Adidas baseball cap was captured on surveillance video at the door of a first-floor apartment in a University of Georgia housing complex. A female graduate student who lived there testified Monday that she heard someone trying to get inside her apartment when she was in the shower. As she looked through the peephole, the person ducked and walked away, but then she saw the same person peering into her window, she said.

Police officers using a grainy screen shot from the surveillance video approached a man wearing a black Adidas cap the day after the killing. That turned out to be Diego Ibarra, one of Jose Ibarra’s brothers.

University of Georgia police Sgt. Joshua Epps testified that he was called to question Diego Ibarra outside the apartment where the Ibarras lived. Epps testified that the brother had no obvious recent injuries.

Outside the apartment, police also questioned Argenis Ibarra, Jose Ibarra and Rosbeli Elisbar Flores Bello. Epps and Corporal Rafael Sayan, who speaks Spanish and helped with the questioning, testified that they noticed scratches on Jose Ibarra.

When asked why his knuckles were red, Jose Ibarra told them it was because of the cold but didn’t really explain several scratches on his arms, Sayan said.

Security video from the apartment complex showed a man wearing a shirt with a distinctive pattern throwing something into a trash bin. A crime scene specialist from the Georgia Bureau of Investigation testified there was a lot of clothing in the one-room apartment but that she didn’t find that shirt in the apartment and didn’t find any bloody clothing.

A police officer testified Friday that he found a dark hooded jacket in the trash bin seen in the video and that testing revealed Riley’s blood on the hoodie.

Flores Bello identified the man in the video as Jose Ibarra and confirmed that identification on the witness stand Monday. She said she had previously seen him wearing the dark hooded jacket and thought it was strange that he threw it away.

Testifying through of an interpreter, Bello said she met Ibarra in Queens, New York. Ibarra’s brother, Diego, lived in Athens and had been urging Ibarra to move there, saying they would find work. She traveled with Ibarra to join his brother in Georgia. She said they went to the Roosevelt Hotel, which served as an intake center for migrants, to ask for a “humanitarian flight” to Georgia in September 2023. When they arrived in Atlanta, a friend of Diego Ibarra picked them up and drove them to Athens.

Riley was a student at Augusta University College of Nursing, which also has a campus in Athens, about 70 miles east of Atlanta.

Republicans, including President-elect Donald Trump, blamed Democratic President Joe Biden’s border policies for her death. As he spoke about border security during his State of the Union address weeks after the killing, Biden mentioned Riley by name.

In March, FBI Director Christopher Wray offered unusually expansive comments on Riley’s murder.

“I want to tell you how heartbroken I am — not just for the family, friends, classmates, and staff who are grieving Laken’s loss,” Wray told a group gathered at the University of Georgia. “I’m saddened to see that sense of peace shattered by Laken’s murder and the subsequent arrest of a Venezuelan national who’d illegally entered the country in 2022.”

He said the FBI was doing “everything [it] can to help achieve justice for Laken.”

CBS News

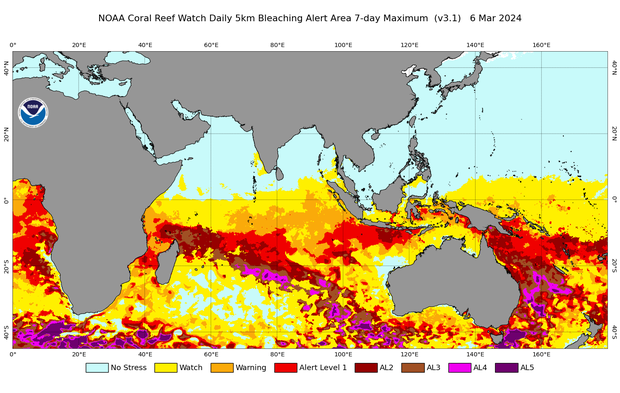

Parts of Great Barrier Reef dying at record rate, alarmed researchers say; “worst fears” confirmed

Parts of the Great Barrer Reef have suffered the highest coral mortality on record, Australian research showed Tuesday, with scientists fearing the rest of it has suffered a similar fate.

The Australian Institute of Marine Science said surveys of 12 reefs found up to 72 percent coral mortality, thanks to a summer of mass bleaching, two cyclones, and flooding.

In one northern section of the reef, about a third of hard coral had died, the “largest annual decline” in 39 years of government monitoring, the agency said.

Brett Monroe Garner / Getty Images

Often dubbed the world’s largest living structure, the Great Barrier Reef is a 1,400-mile expanse of tropical corals that house a stunning array of biodiversity.

But repeated mass bleaching events have threatened to rob the tourist drawcard of its wonder, turning banks of once-vibrant corals into a sickly shade of white.

Bleaching occurs when water temperatures rise and the coral expels microscopic algae, known as zooxanthellae, to survive.

If high temperatures persist, the coral can eventually turn white and die.

This year had already been confirmed as the fifth mass bleaching on the reef in the past eight years.

NOAA Coral Reef Watch

But this latest survey also found a rapid-growing type of coral — known as acropora — had suffered the highest rate of death.

This coral is quick to grow, but one of the first to bleach.

Lead researcher Mike Emslie told public broadcaster ABC the past summer was “one of the most severe events” across the Great Barrier Reef, with heat stress levels surpassing previous events.

“These are serious impacts. These are serious losses,” he said.

World Wildlife Fund-Australia‘s head of oceans, Richard Leck, said the initial surveys confirmed his “worst fears.”

“The Great Barrier Reef can bounce back but there are limits to its resilience,” he said. “It can’t get repeatedly hammered like this. We are fast approaching a tipping point.”

Leck added the area surveyed was “relatively small” and feared that when the full report was released next year “similar levels of mortality” would be observed.

He said the findings reinforced Australia’s need to commit to stronger emission reduction targets of at least 90 percent below 2005 levels by 2035 and move away from fossil fuels.

The country is one of the world’s largest gas and coal exporters and has only recently set targets to become carbon neutral.