CBS News

4 home equity borrowing risks to know (and how to protect against them)

Getty Images/iStockphoto

The economic climate has been challenging for many Americans. Inflation and the elevated costs of goods, services, and labor have been troublesome and some have found themselves in need of extra help financially.

While credit cards are an option, those come with double-digit interest rates right now. For homeowners, a home equity loan or home equity line of credit (HELOC) may be a better option. With lower rates and the ability to large sums of financing, these options can often help consumers pay off debt, cover home repairs, or just pay for unexpected expenses or medical bills.

But this type of borrowing isn’t perfect. In fact, there are some major risks to consider, too. We asked some experts about the potential risks, along with the ways to protect against them.

Are you considering a home equity loan now? See what rate and terms you can qualify for here.

4 home equity borrowing risks to know (and how to protect against them)

Ready to access your home equity? Before you proceed, be sure to thoroughly understand these four potential risks:

Your home serves as collateral

With a home equity loan or HELOC, your home is the collateral. That means if you skip payments, the lender has the right to claim your home and sell it to cover those missing payments.

“If a person defaults on a credit card, that doesn’t have any ramifications for their home,” says Shmuel Shayowitz, president of Approved Funding, a mortgage lender in Bergen County, N.J. “A HELOC default can jeopardize a person’s residence.”

The potential losses are big with these types of loans — and it could mean giving up your home if you’re not careful. To protect against this risk, make sure you have plenty of cash in the bank, and get a clear estimate of what your payments will look like.

“The best approach is careful budgeting and analysis,” says Matt Dunbar, senior vice president of the Southeast Region at Churchill Mortgage. “Break down your monthly budget to consider the payment and any future variability in payments due to interest rate changes. Budgeting conservatively is also key.”

Start calculating your potential home equity loan costs online now.

You could end up upside down on your mortgage

Home equity loans can also put you at risk of going upside down on your loan if your home loses value. This means you’d owe more on the loans against the house than the home is actually worth — a problem, because if you need to sell the house, your sale won’t net you enough cash to cover those loan balances.

That’s why it’s crucial you “leave enough equity to withstand any market shifts,” Dunbar says.

“Real estate values have risen dramatically in recent years, but it’s important to consider that this surge was largely driven by high demand fueled by historically low interest rates and inventory that did not adequately satiate demand,” Dunbar says. “Values may decrease at some point.”

Before you borrow against your equity, then, research property value trends in your area and look at sales of homes comparable to yours. If you spot recent jumps in value that don’t make sense or you see prices moving downward, “set a limit on how much equity you’re willing to leverage,” Dunbar says. This will offer a buffer in case your home loses value in the future.

You will reduce what you can leave to beneficiaries

Using your equity now also stops you from using it later on. That might mean you’ll have less to pass on to your children or heirs once you pass away, or it could eat into your retirement opportunities, too.

As Jennifer Beeston, branch manager and senior vice president of mortgage lending at Guaranteed Rate, explains, “I have seen way too many people over the years treat their home like a piggy bank and then when retirement comes, they can’t afford their home.”

Make sure you have your future goals in mind before you borrow from your home equity. Know what you plan to leave to heirs and how much you need from your home for retirement. If there’s no equity left to borrow from, you may want to consider other financial solutions.

You might face more financial stress

Home equity loans can also contribute to financial stress, as they add an additional monthly payment. With HELOCs, you’ll typically have a variable interest rate, so your payment may not be easy to estimate or plan for either. Again, good budgeting is critical.

“For households with multiple incomes,” Dunbar says, “relying on the most consistent and conservative income for budgeting is a safer approach than counting on multiple, seasonal, commission, or bonus incomes.”

Make sure you only borrow what you need, too. If you’re borrowing cash to cover a home renovation, for instance, you’ll want to have a contractor provide an estimate you can base your loan amount off of.

“I would not advise taking equity out for a home project until you had the property fully bid out — meaning you know exactly what it will cost,” Beeston says.

Home equity alternatives to explore

Home equity loans and HELOCs aren’t your only option if you need cash as a homeowner. You could also sell your home and move to renting (or a smaller property), and leverage the sale proceeds however you wish.

A cash-out refinance is an option, too, though this would require replacing your existing mortgage loan with a new one — including a new rate, term and payment. This might not be wise if you’ve locked in one of the record low rates offered during the pandemic.

As Beeston puts it, “If you have an interest rate below 5.5% I would encourage you to do everything you can to keep it.”

CBS News

Meta donates $1 million to Trump’s inaugural fund

Meta, the parent company of Facebook and Instagram, has donated $1 million to President-elect Donald Trump’s inaugural fund, a spokesperson for the social media giant confirmed to CBS News Wednesday night.

The news was first reported by the Wall Street Journal.

The move comes two weeks after Meta CEO Mark Zuckerberg traveled to Florida and dined with Trump at his Mar-a-Lago estate.

At the time, Trump adviser Stephen Miller told Fox News that Zuckerberg had “made clear that he wants to support the national renewal of America under Trump’s leadership.”

Trump was removed from Facebook following the Jan. 6, 2021, attack on the U.S. Capitol when it determined that his posts had potentially encouraged the violence that occurred that day.

The company restored his account in early 2023, but with certain “guardrails.” In July, those restrictions were lifted by Meta.

Trump has a combined 65 million followers on Facebook and Instagram.

In August, Zuckerberg submitted a letter to Congress claiming that the Biden administration in 2021 “repeatedly pressured our teams for months to censor certain COVID-19 content, including humor and satire.” He called “the government pressure wrong” and said he would push back against any similar efforts in the future.

Silicon Valley has been uneasy about the kind of the treatment it may get from a second Trump administration, and the donation may signal an attempt by Zuckerberg to thaw those tensions.

Trump’s choice of Brendan Carr, a prominent critic of big tech, to lead the Federal Communications Commission has potentially heightened those concerns.

CBS News has reached out to the Trump transition team for comment on the donation.

CBS News

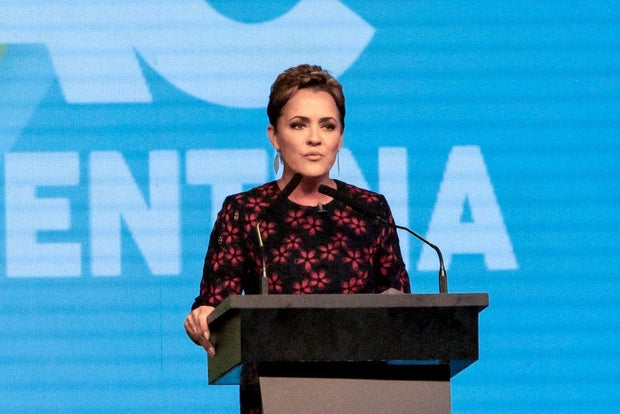

Trump chooses Kari Lake as director for Voice of America

President-elect Donald Trump announced Wednesday that he has tapped Kari Lake as director of the government-funded Voice of America, the nation’s largest international broadcaster.

The move comes after the 55-year-old Lake lost her Arizona Senate bid to Democratic Rep. Ruben Gallego in November.

“She will be appointed by, and work closely with, our next head of the U.S. Agency for Global Media, who I will announce soon,” Trump said in a post to his Truth Social platform.

Lake, a former longtime TV news anchor in Phoenix, is a fierce Trump loyalist who also lost her campaign for Arizona governor in 2022. During her campaigns, she often echoed Trump’s false claims about the 2020 election.

Anita Pouchard Serra/Bloomberg via Getty Images

Voice of America, which is part of the U.S. Agency for Global Media, broadcasts news internationally in 49 languages on radio, television and online to an audience of an estimated 354 million people per week, according to its website.

It has about 2,000 employees and an annual budget of approximately $260 million.

Lake’s appointment must still be confirmed by the Senate.

During Trump’s first term in 2020, USAGM’s editorial independence came into question after Trump named Michael Pack — a conservative filmmaker and close ally of one-time Trump adviser Steve Bannon — its CEO.

Pack subsequently made the decision not to renew the visas of 10 VOA journalists and dozens of others who work at networks under USAGM, increasing concerns by members of Congress and the international community alike over the potential of diminished editorial independence of the VOA news outlet.

John Lippman is currently the acting director of VOA, a post he’s held since October 2023, while Amanda Bennett is CEO of USAGM.

contributed to this report.

CBS News

UnitedHealthcare CEO’s killing prompts polarized response

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.