CBS News

China sweeps diving gold medals at Paris Olympics, edging out the U.S. for the top spot

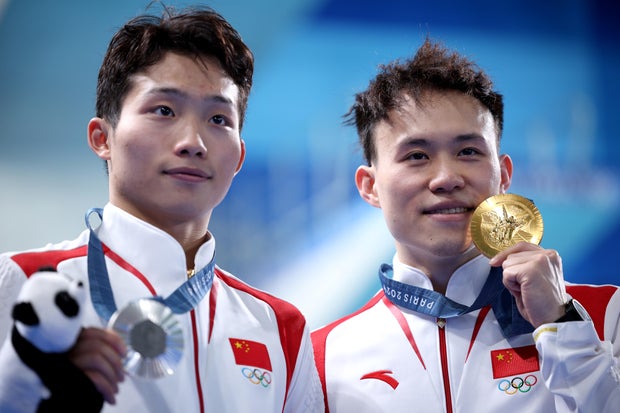

Cao Yuan defended his title in the men’s 10-meter platform on Saturday and gave his nation an unprecedented sweep of the diving gold medals at the Paris Olympics.

The Big Red Machine won all eight golds handed out at the Olympic Aquatics Centre, most of them with dominating victories.

That wasn’t the case in the final diving event of the Games. With teammate Yang Hao having an uncharacteristically poor day and Rikuto Tamai of Japan keeping the pressure on until a botched dive in the next-to-last round, the burden of completing the Chinese sweep fell entirely on Cao’s slender shoulders.

He was up to the task.

The 29-year-old Cao essentially locked up the gold with big scores on his toughest dive of the competition, a forward 4 1/2 somersaults in the fifth of six rounds. He finished with 547.50 points to become the first male diver since Greg Louganis in 1988 to win a second straight gold off the big tower.

“I believe in myself,” Cao said through an interpreter. “I am very, very confident.”

Cao now has four golds in his career, tying Louganis for the most ever by a male Olympic diver. The Chinese star also won the springboard at Rio de Janeiro in 2016 and a 10-meter synchro gold at London in 2012.

In an appropriate twist, Louganis was on hand to open the competition by pounding a tall, wooden staff three times on the deck – the ritual known as “les trois coups” that ties the Olympics to Paris’ theatrical heritage.

Cao said it was an honor to be mentioned alongside diving greats such as Louganis and Wu Minxia, the Chinese women’s star who won five golds over four straight Olympics from 2004-16.

/ Getty Images

“I appreciate my efforts and my training,” Cao said. “I’m very proud of this.”

Tamai bounced back on his final dive to lock up the silver with 507.65 – the first diving medal ever for Japan. The bronze went to Noah Williams of Britain at 497.35.

“Of course, I was nervous,” Tamai said. “The next Games, I want to get the gold.”

Cao and Yang were 1-2 in the morning semifinals, and the latter already had captured a gold at these Games when he teamed with Lian Junjie to win the platform synchro title.

But Yang totally fell apart after a big splash in the second round and finished last in the 12-man final. So it was left to Cao to ensure China became the first nation to claim every gold since the diving program was expanded from four to eight events at the 2000 Sydney Olympics.

Three times China has won seven of eight golds, including at the last two Summer Games, but never all eight.

Until now.

“If you ask anybody, they know China is the best,” Williams said. “To finally get a clean sweep and win eight gold medals, in my eyes, that’s what they deserve at every Olympics.”

The last sweep of any kind was the United States taking all four golds at Helsinki in 1952.

Tamai actually grabbed a slim lead over Cao with his second dive – only the second time in the entire meet that a China diver or synchro team was not atop the leaderboard at the end of a round.

Cao edged back ahead in the third round and was still on top by a mere 2.75 points after the fourth set of dives. But Tamai badly over-rotated his next dive – actually one of his easiest in a very tough list – and a big splatter of water shot up from the pool as he disappeared under the surface.

A groan went up from the crowd. Tamai’s gold medal hopes were essentially over after he received marks of ranging from 3.5 to 4.0.

The U.S. once dominated the diving events, but China began its rise to prominence with its first gold in 1984 at Los Angeles. Beginning in 2000, the Asian powerhouse has captured an astonishing 46 of 56 gold medals in diving.

STEFAN WERMUTH/POOL/AFP via Getty Images

With teams limited to two divers in the individual events, China claimed gold and silver in women’s platform and men’s springboard. Before Yang’s dismal performance, the only slipup, so to speak, was Chang Yani settling for a bronze behind Maddison Keeney of Australia in women’s springboard.

China finished with 11 medals overall, one shy of its record-tying total at the Tokyo Games. The only other nation to win a dozen diving medals at a single Games was the U.S. in 1932, when American athletes made up the bulk of the field and swept the podium in all four events at Los Angeles.

The Americans finished these Games with only a single medal, a silver won by Sarah Bacon and Kassidy Cook in women’s synchronized 3-meter. It was their worst Olympic performance since they were shut out of the medals at the 2008 Beijing Games.

Over the last three Olympics, the U.S. claimed a total of 10 medals.

CBS News

Here Comes the Sun: Jack Antonoff and more

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Capturing Moriah Wilson’s Killer – CBS News

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

How to watch the Minnesota Vikings vs. Chicago Bears NFL game today: Livestream options, more

Getty Images

The Minnesota Vikings will take on the Chicago Bears today. The Vikings are currently 8-2, an impressive run so far this season, and will be looking to add a fourth win to their current streak after last Sunday’s 23-13 win against the Tennessee Titans. The Bears, on the other hand, are entering this game on the heels of a four-game losing streak after a tough 20-19 loss against the Green Bay Packers last Sunday.

Here’s how and when you can watch the Vikings vs. Bears game today, whether or not you have cable.

How and when to watch the Minnesota Vikings vs. Chicago Bears

The Vikings vs. Bears game will be played on Sunday, November 24, 2024 at 1:00 p.m. ET (11:00 a.m. PT). The game will air on Fox and stream on Fubo and the platforms featured below.

How and when to watch the Minnesota Vikings vs. Chicago Bears game without cable

You can watch this week’s NFL game on Fox via several streaming services. All you need is an internet connection and one of the top options outlined below.

Fubo offers you an easy, user-friendly way to watch NFL games on CBS, Fox, NBC, ABC, ESPN, and NFL Network, plus NCAA football channels. The Pro tier includes 200+ channels and unlimited DVR, while the Elite with Sports Plus tier adds NFL RedZone and 4K resolution. New subscribers get a seven-day free trial and all plans allow streaming on up to 10 screens simultaneously.

You can watch today’s game with a subscription to Sling’s Orange + Blue tier, which includes ESPN, ABC, NBC, and Fox. The plan offers 46 channels with local NFL games, nationally broadcast games and 50 hours of DVR storage. For complete NFL coverage, add Paramount+ to get CBS games, or upgrade with the Sports Extra add-on for additional sports channels like Golf Channel, NBA TV and NFL RedZone.

Watching NFL games, including Fox broadcasts, is simple with Hulu + Live TV, which includes 90 channels, unlimited DVR storage, and access to NFL preseason games, live regular season games and studio shows. The service includes ESPN+ and Disney+ in the subscription.

Want to watch today’s game live on your smartphone? If so, NFL+ streaming service is the solution you’re looking for. It lets you watch NFL Network and out-of-market games on mobile devices, with an upgrade option to NFL+ Premium that includes NFL RedZone for watching up to eight games simultaneously. Note that NFL+ only works on phones and tablets, not TVs.