CBS News

Gold’s price surpasses $2,500 an ounce: 4 moves to make now

Getty Images/iStockphoto

The price of gold has been on a remarkable upward trajectory in recent months, shattering numerous price records and attracting the attention of investors across the globe. The trend started early in the year, with gold hitting its first record price of 2024 on March 8. Then, on April 1, less than a month later, gold’s price climbed to another new high, only to be eclipsed again in late May.

The precious metal’s price ascent didn’t end there, either. Gold’s price ascent continued, with the precious metal landing at an unprecedented $2,472 per ounce on July 18. But even that record was short-lived, as gold officially reached its fifth price milestone of the year today (August 13) when it surpassed $2,506 per ounce.

This sustained price increase is helping to draw in a new wave of participants to the gold market. If you want to join in on the gold rush, there are several strategic moves worth considering right now.

Start weighing your gold investing options and get started now.

Gold’s price surpasses $2,500 an ounce: 4 moves to make now

If you want to capitalize on what the gold market can offer you now, here are a few moves to consider:

Add 1-ounce gold bars to your portfolio

As gold prices continue to shatter records, owning physical gold has become an increasingly attractive option — and 1-ounce gold bars, in particular, could be a good bet right now. By adding 1-ounce gold bars to your portfolio, you’ll own a tangible asset, one that can serve as a hedge against inflation and economic uncertainty.

Gold bars are also highly liquid, so it’s typically easy to sell your gold bars and capitalize on future price growth. Plus, these smaller gold bars come with a more affordable price point compared to larger options — and even big box stores, like Costco, now carry them, so they’re widely accessible, too. The compact nature of these bars also means that they’re easier to store and transport.

Find out how the right gold investment could benefit you today.

Buy shares of gold mining companies

Investing in gold doesn’t necessarily mean purchasing physical bullion. There are alternative ways to gain exposure to the gold market, such as investing in gold stocks — which are shares of gold mining companies. This approach offers an indirect but potentially profitable method of capitalizing on the uptick in gold prices.

That’s because, when the value of gold increases, it can have a positive impact on gold mining companies’ profitability. As the price of their primary product rises, these companies often see improved profit margins. In the current market, with gold prices exceeding $2,500 per ounce, even small enhancements in production or output can lead to significant earnings growth for mining operations.

A bull market in gold also tends to stimulate increased activity within the mining sector. Companies are motivated to expand their operations, intensify exploration efforts and develop new projects to take advantage of favorable market conditions. Such developments may boost the value of gold mining stocks, potentially making them an attractive option.

Open a gold IRA to prepare for retirement

Another option for incorporating gold into your investment strategy is through a specialized retirement account known as a gold individual retirement account (IRA). This type of self-directed IRA allows investors to hold physical precious metals, including gold, within a tax-advantaged framework.

By using a gold IRA, you can potentially benefit from the stability and growth of gold investments while enjoying the tax benefits typically associated with traditional retirement accounts. Gold IRAs can also act as a safeguard against economic uncertainty and help diversify your investments beyond traditional stocks and bonds.

That said, setting up and maintaining a gold IRA requires careful consideration and expertise, and working with a qualified and trustworthy custodian is important so that your account complies with IRS regulations. Otherwise, you could face legal or financial complications down the road.

Capitalize on the momentum with gold futures

For investors who are comfortable with higher levels of risk and have significant market experience, gold futures contracts present an intriguing option — one that allows you to potentially benefit from the current high gold prices through leveraged positions. These contracts are essentially agreements between parties to trade gold at a specific price on a future date. This allows you to speculate on gold price movements without having to own physical gold.

One of the main attractions of gold futures is their potential for amplified returns during periods of rising gold prices. Due to the leverage involved, even relatively small price increases can result in considerable profits for those holding futures positions. This means that when gold prices are on an upward trend, investing in futures contracts could potentially yield greater returns compared to other forms of gold.

It’s crucial to understand, though, that trading in futures markets comes with substantial risks. The same leverage that can amplify gains also has the potential to magnify losses if the market moves unfavorably.

The bottom line

The record-breaking surge in gold prices presents a range of opportunities worth considering, including investing in physical gold, gold stocks, gold IRAs and gold futures contracts. But while these gold investments could pay off in today’s climate, remember to conduct thorough research and consider your risk tolerance before making any significant investment decisions. Ultimately, though, the golden opportunity is here — it’s just up to you to decide how to best capitalize on it.

CBS News

Exclusive discounts from CBS Mornings Deals

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Oklahoma attorney general says state schools superintendent cannot mandate students watch prayer video

The Oklahoma attorney general’s office responded after the state’s education superintendent sent an email this week to public school administrators requiring them to show students his video announcement of a new Department of Religious Freedom and Patriotism. In the video, he prays for President-elect Trump.

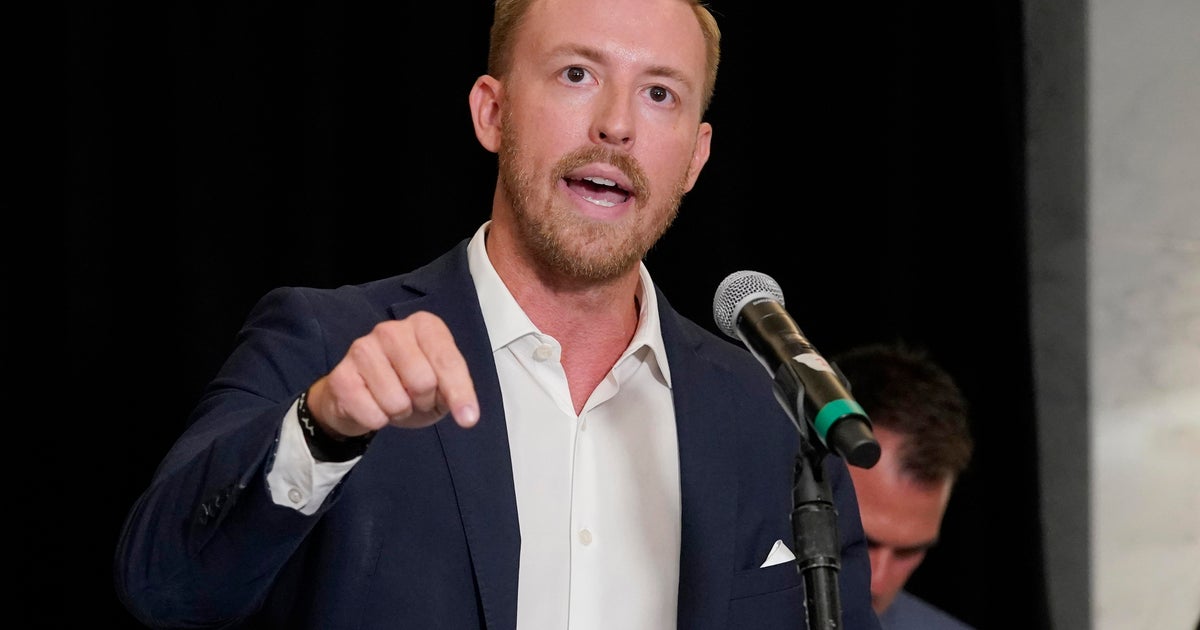

Ryan Walters, a Republican, announced the new office on Wednesday and on Thursday sent the email to school superintendents statewide. The new department will be within the state’s Department of Education. Walters said it would “oversee the investigation of abuses to individual religious freedom or displays of patriotism.”

“In one of the first steps of the newly created department, we are requiring all of Oklahoma schools to play the attached video to all kids that are enrolled,” according to the email. Districts were also told to send the video to all parents of students.

In the video, Walters says religious liberty has been attacked and patriotism mocked “by woke teachers unions,” then prays for the leaders of the United States after saying students do not have to join in the prayer.

Sue Ogrocki / AP

“In particular, I pray for President Donald Trump and his team as they continue to bring about change to the country,” Walters said.

The office of state Attorney General Gentner Drummond issued a statement Friday saying Walters has no authority under state law to issue such a mandate.

“Not only is this edict unenforceable, it is contrary to parents’ rights, local control and individual free-exercise rights,” said the attorney general’s office spokesperson Phil Bacharach.

Multiple school districts have also said they had no plans to show students the video.

Walters, a former public school teacher elected in 2022, ran on a platform of fighting “woke ideology,” banning books from school libraries and getting rid of “radical leftists” who he claims are indoctrinating children in classrooms. He already faces two lawsuits over his June mandate that schools incorporate the Bible into lesson plans for students in grades 5 through 12. Several school districts have previously stated that they will disregard the mandate.

One of the lawsuits also notes that the initial request for proposal released by the State Department of Education to purchase the Bibles appears to have been tailored to match Bibles endorsed by now President-elect Donald Trump that sell for $59.99 each.

Earlier this week, Walters announced he had purchased more than 500 Bibles to be used in Advanced Placement government classes. The education department that the 500 Bibles are “God Bless the USA Bibles” and were ordered Thursday for about $25,000. They will arrive “in the coming weeks,” the department said.

CBS News

Kamala Harris raised more than $1 billion for her campaign. She’s still sending persistent appeals to donors after defeat.

Kamala Harris and the Democratic Party’s prodigious fundraising operation raised more than $1 billion in her loss to Donald Trump, but the vice president is still pushing donors for more money after the election.

Democrats are sending persistent appeals to Harris supporters without expressly asking them to cover any potential debts, enticing would-be donors instead with other matters: the Republican president-elect’s picks for his upcoming administration and a handful of pending congressional contests where ballots are still being tallied.

“The Harris campaign certainly spent more than they raised and is now busy trying to fundraise,” said Adrian Hemond, a Democratic strategist from Michigan. He said he had been asked by the campaign after its loss to Trump to help with fundraising.

The party is flooding Harris’ lucrative email donor list with near-daily appeals aimed at small-dollar donors — those whose contributions are measured in the hundreds of dollars or less. But Hemond said the postelection effort also includes individual calls to larger donors.

One person familiar with the effort and the Democratic National Committee’s finances said the Harris campaign’s expected shortfall is a relatively small sum compared to the breadth of the campaign, which reported having $119 million cash on hand in mid-October before the Nov. 5 election. That person was not authorized to publicly discuss the campaign’s finances and spoke on condition of anonymity.

But the scramble now underscores the expense involved in a losing effort and the immediate challenges facing Democrats as they try to maintain a baseline political operation to counter the Trump administration and prepare for the 2026 midterm elections. It also calls into question how Democrats used their resources, including hosting events with musicians and other celebrities as well as running ads in a variety of nontraditional spaces such as Las Vegas’ domed Sphere.

Patrick Stauffer, chief financial officer for the Harris campaign, said in a statement that “there were no outstanding debts or bills overdue” on Election Day and there “will be no debt” listed for either the campaign or the DNC on their next financial disclosures, which are due to the Federal Election Commission in December.

The person familiar with the campaign and DNC’s finances said it was impossible to know just where Harris’ balance sheet stands currently. The campaign still is getting invoices from vendors for events and other services from near the end of the race. The campaign also has outstanding receipts; for example, from media organizations that must pay for their employees’ spots on Air Force Two as it traveled for the vice president’s campaign activities.

Within hours of Trump picking Florida Republican Matt Gaetz for attorney general on Wednesday, Harris’ supporters got an appeal for more money for “the Harris Fight Fund,” citing the emerging Trump team and its agenda.

Gaetz, who resigned his House seat after the announcement, “will weaponize the Justice Department to protect themselves,” the email said. It said Democrats “must stop them from executing Trump’s plans for revenge and retribution” and noted that “even his Republican allies are shocked by this” Cabinet choice.

Another appeal followed Friday in Harris’ name.

“The light of America’s promise will burn bright as long as we keep fighting,” the email said, adding that “there are still a number of critical races across the country that are either too close to call or with the margin of recounts or certain legal challenges.”

The emails do not mention Harris’ campaign or its finances.

The “Harris Fight Fund” is a postelection label for the “Harris Victory Fund,” which is the joint fundraising operation of Harris’ campaign, the DNC and state Democratic parties. Despite the language in the recent appeals, most rank-and-file donors’ contributions would be routed to the national party, unless a donor took the time to contact DNC directly and have the money go directly to Harris or a state party.

The fine print at the bottom of the solicitation explains that the first $41,300 from a person and first $15,000 from a political action committee would be allocated to the DNC. The next $3,300 from a person or $5,000 from a PAC would go to the Harris for President “Recount Account.” Anything beyond that threshold, up to maximum contribution limits that can reach into the hundreds of thousands of dollars, would be spread across state parties.

Officials at the DNC, which is set to undergo a leadership change early next year, indicated the party has no plans to cover any shortfall for Harris but could not explicitly rule out the party shifting any money to the campaign.