CBS News

Several people killed in knife attack at festival in Germany

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Kansas City Chiefs bring football and romance to Hallmark Channel with new movie

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Personal bankruptcies are on the rise. When does it make sense to file?

No one wants to file for bankruptcy, but if you’re heading in that direction, delaying the inevitable may only make things worse.

Bankruptcies are still significantly below pre-pandemic levels, but have gone up relative to last year. Personal bankruptcies were up 16% in October from a year ago, as more Americans are seeking debt relief. But those struggling to stay financially afloat should consider the option sooner rather than later, advise experts who study when and why people file.

“When a consumer feels financial pressure, the last thing on their mind is seeking bankruptcy protection,” said Michael Hunter, vice president, business development, at Epiq Aacer, a provider of bankruptcy information and partner to the American Bankruptcy Institute, or ABI. Most people don’t file until 18 to 24 months after they’ve incurred financial hardship, Hunter said.

Researchers, over decades of interviewing thousands of people who’ve declared personal bankruptcy, have found that about two-thirds of individual filers struggle with paying their debts for up to five years before seeking help.

“The common response is people are struggling with their debt for more than two years” before seeking a legal remedy, Robert Lawless, a professor at the University of Illinois College of Law, told CBS MoneyWatch.

“People misunderstand bankruptcy and wait too long to see a bankruptcy lawyer. Most people would benefit by going earlier,” said Lawless, a co-principal investigator in the Consumer Bankruptcy Project, launched in 1981 by a group of academics including Senator Elizabeth Warren, D-Mass., a law school professor at the time.

When to file for bankruptcy

Because of the stigma and shame that Americans attach to bankruptcy, people turn to it as a last resort — oftentimes after they have plowed through retirement funds and other assets that would be have been shielded from creditors by filing for debt relief.

“If you are raiding pension or other retirement assets, that is a red flag,” said Lawless, noting those funds are protected from creditors in bankruptcy. Borrowing money to cover current expenses is another warning sign, he offered.

“It makes sense to file if a creditor is going to be able to take away something you need,” said Pamela Foohey, a professor of law at the University of Georgia School of Law in Athens. “If a person is dealing with a wage garnishment that is harming their lives, or if a lender is threatening to repossess your car. If there’s no other way to get a car that will fit your budget, filing could be a way to keep your car, or keep your house.”

Otherwise the broad answer is to first address how they might solve the cause of their financial distress before filing for bankruptcy. “It doesn’t help to find a better-paying job if after bankruptcy more is going out than coming in,” said Lawless.

“If you lost your job, file after you found a new job; if you have a health crisis, you file after you’ve gotten better to discharge all of the medical debt that you’ve racked up,” said Foohey.

If someone undergoes a change in their family situation, whether it’s a divorce or the birth of twins, she advises that they first figure out how they’re going to manage going forward on a budget after the debt is discharged.

“Bankruptcy does one thing, it gets rid of debt. It doesn’t find you a job, it doesn’t put money in your pocket,” said Lawless.

Also, legally speaking, once debt is discharged or a financial repayment plan is approved by a judge, it will be another 5 to 8 years before one can file again.

Chapter 7 versus Chapter 13

It costs about $1,500 to file Chapter 7, and most attorneys require that their fees be paid upfront. Chapter 7 is a liquidation bankruptcy, where one’s nonexempt property and assets — possessions not protected by bankruptcy — are turned over to a trustee, and debt is discharged in 3 to 6 months. According to Lawless, 95% of Chapter 7 don’t have any assets to turn over.

With a Chapter 13, payments can be spread out, however the overall cost is a lot more.

Having to hire and pay an attorney several thousands dollars is also a daunting prospect for those in financial turmoil, but Lawless said a lawyer is a better option than filing for bankruptcy yourself or looking to consumer credit counseling — a service that is typically for-profit and has a long history of problems.

“In Chapter 13, attorneys can allow for nothing upfront, put all their fees in the repayment plan, and on average charge $4,500,” Foohey said.

According to Foohey, only about a third of those who file Chapter 13 make it to the end and have their debts discharged. “Not everyone wants the discharge, but to reset their relationship with their mortgage holder,” she said.

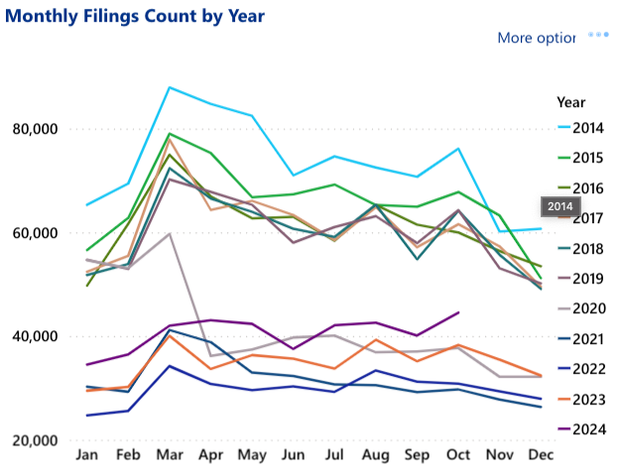

Epiq AACER

A Chapter 13 involves committing to a 3- to 5-year repayment plan. However, many filers that enter the agreements don’t complete them, Lawless relayed. “Homeowners will file 13 so they don’t lose their home. It’s among the tools used to get caught up on mortgage payments,” he said.

Attorneys charge far less for Chapter 7, as it’s a less-complicated process than a Chapter 13. The latter is used for, but a bad idea, to pay for one’s bankruptcy.

“In 7, you have to pay for your bankruptcy upfront. In Chapter 13 you pay your attorney in that 3- to 5-year plan,” said Lawless. “If you’re using 13 to pay your attorney feels that is generally the wrong choice.”

In Lawless’ view, “the No. 1 thing Congress should do is make it possible to pay your Chapter 7 attorney over time, so we don’t have people filing Chapter 13 when they don’t need to.”

Return to pre-COVID numbers

Personal bankruptcy filings averaged about 750,000 a year before COVID-19, but dropped off a cliff during the pandemic, thanks to government aid.

“It was very consistent from 2014 to 2019 — pretty flat, and then the pandemic hit. A lot of us thought volumes would surge,” said Michael Hunter, vice president, business development, at Epiq Aacer. But there was forbearance for student loans, cars and mortgages, he noted.

“Banks were extending olive branches, and we saw bankruptcies plummet to less than half of pre-pandemic levels,” he said.

“There was a lot of money sloshing around,” said Lawless, citing government stimulus programs and other aid. “People paid down their debt,” he stated.

Now, with those financial lifelines largely unplugged, U.S. households are tacking more debt onto household balance sheets. “The biggest surprise is bankruptcy filings haven’t gone up even more,” said Lawless, who expects a return to pre-COVID levels.

Nonbusiness bankruptcy filings fell to under 400,000 before edging back up to 434,000 in 2023, according to statistics published by the Administrative Office of the U.S. Courts. With two months left in 2024, personal bankruptcy filings stood at 405,132 at the end of October.

“We’re still pretty far away from the filing numbers of 2019,” said Foohey. “There was a drastic drop at the time of the pandemic that continued for several years, which is now returning to pre-pandemic levels.”

CBS News

Business pioneers of the Pacific Northwest

Presented by Visit Seattle & CBS News Brand Studio.

There are no shortage of reasons to visit Seattle. Whether you’re drawn to iconic landmarks like the Space Needle, stunning landscapes including Mount Rainier or the innovation-driven economy that keeps the city buzzing, there’s something for everyone. In Seattle, businesses that started here thrive, and that’s reflected in the stories of three of the city’s homegrown brands: Nordstrom, Alaska Airlines and REI.

Nordstrom’s legacy of innovation

Seattle is a magnet for pioneering companies that embody a unique blend of ambition and community. From global corporations like Starbucks, Amazon and Expedia, to beloved local brands, innovation is at the heart of the city’s DNA.

Nordstrom CEO Erik Nordstrom and his family have led one of Seattle’s most iconic brands for over a century.

“My great-grandfather ended up opening up a shoe store that over 123 years has become what our company is today,” he said. “We’ve benefited from everything that the city has become.”

Nordstrom was co-founded in 1901 by Swedish immigrant John Nordstrom. The company has grown into a retail juggernaut with more than 360 locations nationwide. Today, their flagship store remains proudly rooted downtown, just blocks away from their original location.

The business has benefited from how Seattle has evolved over the last century. Nordstrom credits the city’s flourishing technology industry with helping the company keep up with trends.

“We were very early in the e-commerce business, and that was a direct result of having that level of talent here in the city,” he said.

Nordstrom’s story illustrates how Seattle’s forward-thinking culture fuels long-term success.

“Seattle is a no-nonsense hard-working place,” Nordstrom added. “It’s also a very friendly place. And our focus on customer service is something that I think is a reflection of the community here.”

Globally connected with Alaska Airlines

Alaska Airlines takes Seattle’s spirit of adventure to the skies.

The company’s roots go back to 1932 when Mac McGee shuttled customers across the Alaska territory with a single three-seater Stinson plane. More than 70 years ago, the company moved its headquarters to Seattle to take advantage of all the city offers. Alaska Airlines has expanded to over 100 non-stop destinations and connects passengers with over 30 global carriers.

“As Seattle has grown, so have we,” said Constance von Muehlen, Alaska Airlines COO. “I think Seattle is really a gateway to the world and has become more so in the last 20 years.”

The airline’s deep ties to the region also extend to the in-flight experience, where Seattle’s local brands are put on display.

“We offer things like Beecher’s cheese or Evergreens salads or Seattle Chocolate. It’s really a wonderful partnership to showcase the great things that come from this city.”

The great outdoors, the REI way

Seattle is a gateway to adventure, so it’s no surprise the city’s rugged surroundings gave rise to REI. Founders Mary and Lloyd Anderson pooled resources with 21 friends to get better prices on mountain climbing gear in 1938, and Recreational Equipment Incorporated was born.

REI President and CEO Eric Artz credits the region’s natural environment for shaping the brand’s mission.

“The inspiration of REI began with what we have around us here in the Seattle area, which is just the joy of spending time outside in incredible outdoor, natural places,” Artz explained.

With 24 million co-op members and more than 190 locations, REI’s footprint extends far beyond Seattle, yet its core values remain rooted in the Pacific Northwest.

“There is a very entrepreneurial can-do spirit here in the Seattle area. There is a care for one another as well. I think it’s all of those kind of values and attributes that contributed, you know, literally to the idea of the cooperative,“ Artz said.

Collective business ethos is a win for Seattle

Whether it’s Nordstrom’s commitment to service, Alaska Airlines’ adventurous spirit or REI’s passion for stewardship, these businesses demonstrate how Seattle fosters growth and transformation, creating a city where ambition and collaboration shape the future.

Seattle’s hometown companies prove that success extends beyond profit, cultivating a culture of innovation and care that defines the city’s business ecosystem.