CBS News

Not sure if a credit card debt forgiveness program is legitimate? Look for these 5 signs

Getty Images

If you’ve taken out a personal loan, used a credit card or bought a home with a mortgage at any point in the last couple of years, you’re likely well aware of how challenging today’s borrowing landscape is. But while today’s borrowing costs are high across the board, it’s credit card users, in particular, who are feeling the burn.

After all, the average credit card rate is about 23% — a record high. So, if you’re carrying a balance from month to month, the interest charges are accruing quickly on what you owe. The ripple effects of inflation, which have resulted in higher prices for groceries, housing and other essentials, have also stretched many people’s budgets thin. And with less money to go around, it can be tough to fit your credit card payments into the equation.

Given today’s challenges, it can make sense to consider the credit card debt relief options available to you, like credit card debt forgiveness (or debt settlement). These programs can provide some relief from your high-rate card debt by negotiating lower, lump-sum settlements with your creditors. Before enrolling, though, it’s important to ensure that any debt forgiveness program you’re considering is legitimate.

Ready to get rid of your high-rate card debt? Compare your debt relief options now.

5 signs a debt forgiveness company is legitimate

These key signs can help you identify a legitimate credit card debt forgiveness program:

There are no upfront fees

One of the most telling indicators of a reputable debt forgiveness program is the absence of upfront fees. After all, it’s not just unethical for companies to charge fees for these services before the work is done — it’s also illegal. The Federal Trade Commission (FTC) does not allow debt settlement companies to charge fees prior to your debts being resolved, so you should avoid any company that asks for payment upfront.

Legitimate debt forgiveness programs operate on a performance-based model instead, collecting fees only after successfully negotiating and settling a debt on your behalf. For example, most debt forgiveness companies charge fees that range from 15% to 25% of the total enrolled debt. These fees can vary, of course, but what won’t differ is that legitimate programs only charge them after negotiations are complete.

Find out how the right debt relief strategy could benefit you today.

Information is readily available

A hallmark of trustworthy debt forgiveness programs is transparency. Any debt forgiveness program you consider should be more than willing to provide comprehensive information about its services, processes and potential outcomes, so look for organizations that offer:

The experts who work with legitimate debt forgiveness programs will encourage you to make an informed decision rather than rushing you into their program. There’s a lot at stake in these situations — and a lot of information to process — so they should be patient when answering your questions.

The company employs experienced experts

The effectiveness of a debt forgiveness program largely hinges on the skill and experience of its negotiators, as the entire goal of these programs is to negotiate settlements on what you owe. In turn, reputable companies will employ professionals who have proven track records in debt negotiation to optimize the chances of success.

These experts should have:

- Extensive knowledge of credit card debt laws and regulations

- Strong relationships with major credit card companies and collection agencies

- A history of successful settlements for their clients

Don’t hesitate to ask about the qualifications and experience of the negotiators who will be handling your case. A legitimate company will be proud to showcase its team’s expertise and may even provide case studies or testimonials from satisfied clients.

There are no outcome guarantees

While it may seem counterintuitive, one sign of a legitimate debt forgiveness program is the refusal to make guarantees about outcomes. Ethical companies understand that each case is unique, and results can vary based on factors such as the creditor’s policies, your financial situation and the negotiation process itself.

Be skeptical of any company that promises to settle your debt for a specific percentage or within a guaranteed timeframe. Instead, look for organizations that provide realistic expectations based on their past experiences and current market conditions.

The program is accredited and in good standing

A final indicator of a legitimate debt forgiveness program is its standing within the industry. Look for companies that are:

- Accredited by reputable organizations such as the American Fair Credit Council (AFCC) or the International Association of Professional Debt Arbitrators (IAPDA)

- Members of industry associations that promote ethical practices

- In good standing with consumer protection agencies like the Better Business Bureau (BBB)

- Compliant with state and federal regulations governing debt relief services

Take the time to research the company’s background, including any complaints or legal actions against them. A history of satisfied clients and positive industry recognition can provide additional peace of mind when choosing a debt forgiveness program.

The bottom line

While credit card debt forgiveness programs can offer a path to financial recovery for many struggling cardholders, it’s crucial to approach them with caution and discernment. By looking for these signs, you can better protect yourself from potential scams and find a legitimate program that truly aligns with your needs.

CBS News

After Tyre Nichols’ fatal beating, Memphis officer texted photo of bloodied man to ex-girlfriend, she testifies

A former Memphis police officer charged in the fatal beating of Tyre Nichols sent his ex-girlfriend a photo of the badly injured man on the night he was punched, kicked and hit with a police baton following a traffic stop, according to trial testimony Wednesday.

Brittany Leake, a Memphis officer and Demetrius Haley’s former girlfriend, testified during the criminal trial that she was on the phone with Haley when officers pulled Nichols over for a traffic stop. She said she heard a “commotion,” including verbal orders for someone to give officers his hands.

The call ended, but Haley later texted the photo in a group chat comprising Haley, Leake and her godsister, she testified. Prosecutors displayed the photo for the jury. It showed Nichols with his eyes closed, on the ground with what appeared to be blood near his mouth and his hands behind his back.

Leake said that when she saw the photo, her reaction was: “Oh my God, he definitely needs to go to the Med.”

The Med is shorthand for Memphis’ trauma hospital.

The fatal beating, caught on police bodycams and street surveillance cameras, has sparked protests and calls for police reform. Officers said they pulled over Nichols for reckless driving, but Memphis’ police chief said there was no evidence to substantiate that claim.

Haley, Tadarrius Bean and Justin Smith are on trial after pleading not guilty to charges that they deprived Nichols of his civil rights through excessive force and failure to intervene, and obstructed justice through witness tampering. Their trial began Sept. 9 and is expected to run three to four weeks.

George Walker IV / AP

The Memphis Police Department fired the three men, along with Emmitt Martin III and Desmond Mills Jr., after Nichols’ death. The beating was caught on police video, which was released publicly. The officers were later indicted on the federal charges. Martin and Mills have taken plea deals.

During her testimony Wednesday, Leake said she deleted the photo after she saw it and that sending such a photo is against police policy.

“I wasn’t offended, but it was difficult to look at,” she said.

Leake said Haley had sent her photos before of drugs, and of a person who had been injured in a car accident.

Earlier Wednesday, Martin was on the witness stand for a third day. Defense attorneys tried to show inconsistencies between Martin’s statements to investigators and his court testimony. Martin acknowledged lying about what happened to Memphis Police Department internal investigators, to try to cover up and “justify what I did.”

But Martin said he told the truth to FBI investigators after he pleaded guilty in August, including statements about feeling pressure on his duty belt where his gun was located during the traffic stop, but not being able to see if Nichols was trying to get his gun. Martin has testified that he said “let go of my gun” during the traffic stop.

Martin Zummach, the attorney for Justin Smith, asked Martin if he knew of any reasons why Nichols did not simply say, “I give up.”

“He’s out of it,” Martin said. “Disoriented.”

Martin testified that the situation escalated quickly when Haley pulled his gun and violently yanked Nichols from his car, using expletives and failing to tell Nichols why he had been pulled over and removed from the vehicle.

“He never got a chance to comply,” Martin said.

Nichols, who was Black, was pepper sprayed and hit with a stun gun during the traffic stop, but ran away, police video shows. The five officers, who also are Black, then beat him about a block from his home, as he called out for his mother.

Video shows the officers milling about and talking as Nichols struggled with his injuries. Nichols died Jan. 10, 2023, three days after the beating.

An autopsy report shows Nichols – the father of a boy who is now 7 – died from blows to the head. The report describes brain injuries, and cuts and bruises on his head and elsewhere on his body.

Jesse Guy testified that he was working as a paramedic for the Memphis Fire Department the night of the beating. He arrived at the location after two emergency medical technicians, Robert Long and JaMichael Sandridge.

Guy said he was not told about the medical problems Nichols had experienced before he arrived, and that Nichols was injured, seated on the ground and unresponsive.

Nichols had no pulse and was not breathing, and it “felt like he was lifeless,” Guy said.

In the ambulance, Guy performed CPR and provided mechanical ventilation, and Nichols had a pulse by the time he arrived at the hospital, the paramedic said.

Guy said Long and Sandridge did not say if they had checked Nichols’ pulse and heart rate, and they did not report if they had given him oxygen. When asked by one of Bean’s lawyers whether that information would have been helpful in treating Nichols, Guy said yes.

Long and Sandridge were fired for violating fire department policies after Nichols died. They have not been criminally charged.

The five officers also have been charged with second-degree murder in state court, where they pleaded not guilty. Mills and Martin are expected to change their pleas.

Federal prosecutors have previously recommended a 40-year sentence for Martin. A date has not been set in state court yet.

Nichols worked for FedEx, and he enjoyed skateboarding and photography. The city of Sacramento, where Nichols grew up, named a skatepark in his honor. “Tyre fell in love with skateboarding at a young age and it wasn’t long before it became a part of his lifestyle,” states the resolution approved by the city council. He had a tattoo of his mother’s name.

“Tyre Nichols’ family have been praying for justice and accountability from the very beginning of this tragedy,” Ben Crump and Antonio Romanucci, the civil rights attorneys representing Nichols’ family, said in a statement when the trial began.

CBS News

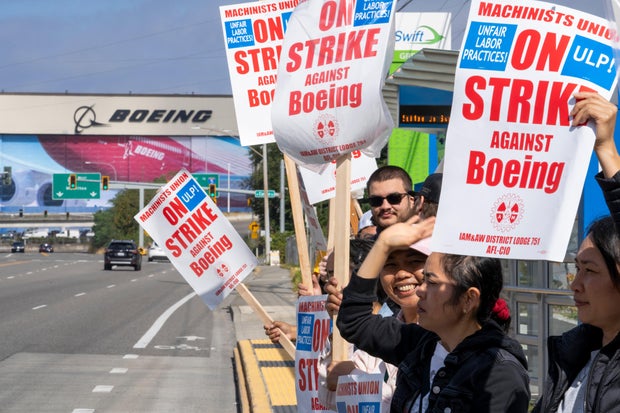

Boeing set to start large-scale furloughs due to machinists strike

Boeing’s CEO said Wednesday that the company will begin furloughing “a large number” of employees to conserve cash during the strike by union machinists that began last week.

Chief Executive Kelly Ortberg said the people who would be required to take time off without pay starting in coming days include executives, managers and other employees based in the U.S.

“While this is a tough decision that impacts everybody, it is in an effort to preserve our long-term future and help us navigate through this very difficult time,” Ortberg said in a company-wide message to staff.

Boeing didn’t say how many people will face rolling furloughs, but the number is expected to run into the tens of thousands. The aerospace giant had 171,000 employees at the start of the year.

About 33,000 Boeing factory workers in the Pacific Northwest began a strike Friday after rejecting a proposal to raise pay by 25% over four years. They want raises of at least 40%, the return of a traditional pension plan and other improvements in the contract offer they voted down.

Scott Brauer / Bloomberg via Getty Images

The strike is halting production of several airplane models including Boeing’s best-selling plane, the 737 Max. The company gets more than half of the purchase price when new planes are delivered to buyers, so the strike will quickly hurt Boeing’s cash flow.

Ortberg said selected employees will be furloughed for one week every four weeks while retaining their benefits. The CEO and other senior executives will take pay cuts during the duration of the strike, he said, without stating how deep the cuts will be.

All work related to safety, quality, customer support and certification of new planes will continue during the furloughs, he said, including production of 787 Dreamliner jets, which are built by nonunion workers in South Carolina.

Ortberg said in a memo to employees that the company is talking to the International Association of Machinists and Aerospace Workers about a new contract agreement that could be ratified.

“However, with production paused across many key programs in the Pacific Northwest, our business faces substantial challenges and it is important that we take difficult steps to preserve cash and ensure that Boeing is able to successfully recover,” he said.

Boeing’s chief financial officer warned employees earlier this week that temporary layoffs were possible.

The company, which is based in Arlington, Virginia, but has most of its commercial-airplanes business located in the Pacific Northwest, is also cutting spending on suppliers, freezing hiring and eliminating most travel.

Despite two full days of talks assisted by the Federal Mediation and Conciliation Service, the union said Wednesday that no resolution had been reached and no additional negotiations were scheduled, according to CBS Seattle affiliate KIRO-TV.

Striking workers are picketing at several locations in the Seattle area, Oregon and California. The union, which recommended the offer that members later rejected by a 96% vote, is surveying the workers to learn what they want in a new contract. The union’s last strike at Boeing, in 2008, lasted about two months.

If the walkout doesn’t end soon, Boeing’s credit rating could be downgraded to non-investment or junk status, which would make borrowing more expensive. Shortly after the walkout began Friday, Moody’s put Boeing on review for a possible downgrade, and Fitch said a strike longer than two weeks would make a downgrade more likely.

CBS News

A Moment With: Viswa Colluru

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.