CBS News

Who gets to keep a $70,000 engagement ring? Case goes before Massachusetts Supreme Court

BOSTON – When an engagement breaks down, who gets to keep the ring? A case deciding just that is being argued before the Massachusetts Supreme Judicial Court Friday.

The state’s highest court is hearing arguments from lawyers representing Bruce Johnson and Caroline Settino, who were briefly engaged in 2017.

According to court documents, Johnson bought the engagement ring from Tiffany’s in Boston, paying more than $70,000.

Shortly after the pair became engaged, the relationship ended.

So who gets the engagement ring?

Massachusetts law considers an engagement ring a “conditional gift,” saying the gift giver can get the ring back if they are found to be without fault in the relationship ending.

The question before the courts has been just that – who is at fault?

Johnson accused Settino of being verbally abusive and having an affair. He said in a court filing that he found a text message from Settino to a man that said, “My Bruce is going to be in Connecticut for three days. I need some playtime.”

Woman wins the case, man wins the appeal

Settino argued that there was no affair – the man she texted was just a friend. A trial court judge ruled in her favor, saying Johnson was at fault for calling off the engagement and she gets to keep the ring,

Johnson appealed the decision and a Massachusetts Appeals Court ruled in his favor. The appeals court said the existence or non-existence of an affair was not the only factor in the case; Johnson may still have had solid reasons to call off the engagement.

“Sometimes there simply is no fault to be had,” the court said.

The appeals court said the Supreme Judicial Court would have to consider whether Massachusetts should follow other states where engagement rings are returned to the giver if an engagement is called off, regardless of who is at fault.

Supreme Judicial Court arguments on engagement ring

Before the high court on Friday, Johnson’s attorney, Stephanie Taverna Siden, not only requested justices reverse the trial court decision and award the ring back to him, but that they change Massachusetts law regarding how engagement rings are treated after a breakup.

When asked why returning the ring would be the most equitable, Taverna Siden said, “Because the person that has spent money or value on the ring is doing so under the condition that ‘I’m proposing to you, we’re going to get married and we’re going to live a life together.’ If you change the ring to a [between the living] gift, that person that gave the ring loses the value of the ring if the marriage doesn’t happen.”

Settino’s attorney Nick Rosenberg argued against instituting a no-fault conditional gift, saying it requires the court “reading into a private act.”

“We don’t have conditional gifts in Massachusetts,” said Rosenberg.

No word on when a ruling is expected.

CBS News

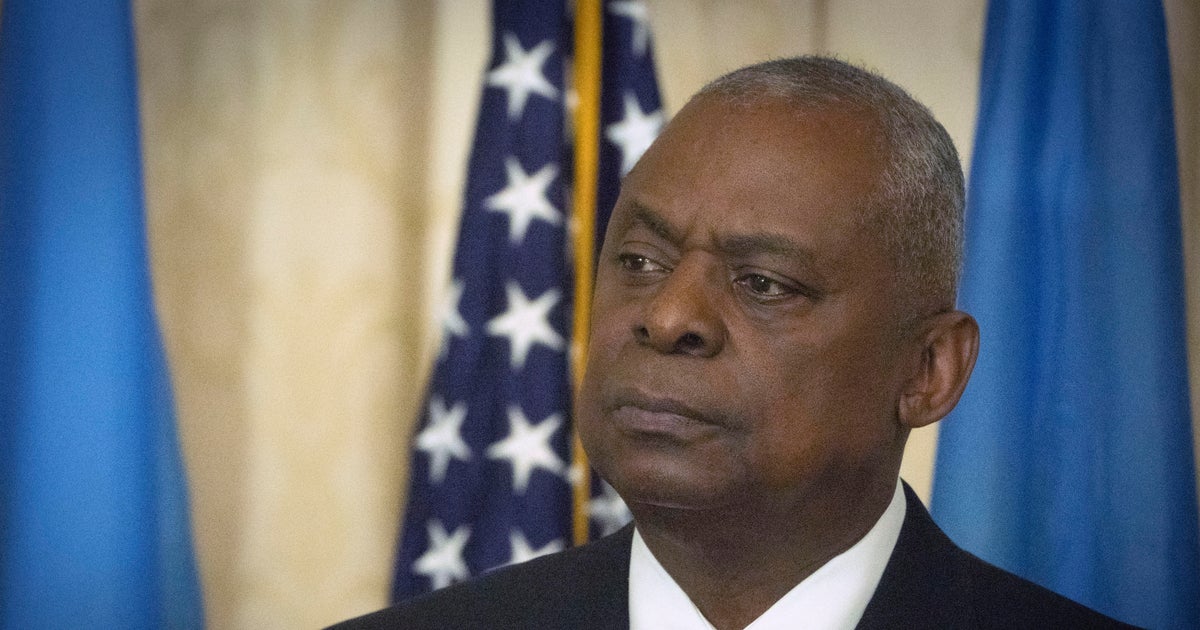

U.S. Marines, Japanese and Australian troops will train together amid heightened concerns over China

U.S. Marines will take part in joint training with Japanese and Australian forces in northern Australia, the three countries’ defense ministers announced Sunday as they expressed concern about a spate of confrontations with China’s increasingly assertive military.

Australia’s acting Prime Minister Richard Marles hosted U.S. Defense Secretary Lloyd Austin and Japanese Defense Minister Nakatani Gen for talks in Darwin, Australia.

The trilateral amphibious training between Australia, Japan and the U.S. Marine rotational force in northern Australia will begin in 2025 with Exercise Talisman Sabre. Australia will also join Exercise Orient Shield in Japan for the first time next year.

“Recognizing the critical role the trilateral partnership plays to uphold regional stability, we commit to trilateral policy coordination and to consult each other on regional security issues and contingencies,” they said in a joint statement.

In their statement, the three defense ministers reiterated “serious concern” about destabilizing actions in the East and South China seas including “dangerous conduct” by the Chinese military against Philippine and other vessels from the region. China claims the South China Sea almost in its entirety.

“We reiterate our strong opposition to any unilateral attempts to change the status quo by force or coercion,” they said, adding that it is “important that all states are free to exercise rights and freedoms consistent with international law.”

The ministers also urged the importance of peace and stability across the Taiwan Strait. China claims self-ruled Taiwan as its own territory and has stepped up military harassment with frequent drills around the island.

Marles, who is also Australia’s defense minister, said following talks with his Japanese counterpart in September that both nations looked to ways to build greater familiarity between their forces. One of the “obvious opportunities” was for Japan to participate in activities during the U.S. Marine rotation in Australia, he said Sunday.

“Having a more forward-leaning opportunity for greater training with Japan and the U.S. together is a really fantastic opportunity,” he said.

Asked if the increased military cooperation would anger Beijing, Marles said the decision was about building “the best relationships possible with like-minded countries, with our friends and with our allies.”

CBS News

Photographing the rooms of kids killed in school shootings

An unmade bed

A library book 12 years overdue

The next day’s outfit

Notes to her future self

Click on the door to enter

CBS News

How do you make a portrait of a child who isn’t there? Photographer Lou Bopp found a way, but it wasn’t easy.

In early 2018, I was deplaning after an 18-hour flight when Steve Hartman called. He had an idea: to photograph the still-intact bedrooms of kids who had been killed in school shootings.

It’s a headful. And six years later, I still don’t have an “elevator pitch” for the project — but then, I don’t often talk about this project. It is by far the most difficult I have ever worked on.

When Steve, my friend of about 25 years, asked me if I would like to be involved, I said yes without hesitation — even though I didn’t think we would get any families to agree. There is no way that I would have said no to partnering with him on this.

Emotionally, I was not sure how I would get through it. Within a few months I was on my way to Parkland, Florida. Alone. I’m not sure that I realized that I would be on my own.

But here I was. An on-location commercial photographer who focuses on people and pets to create compelling, honest, textural and connective moments for large brands, per my LinkedIn professional profile, on a project where there is no one to take photos of — for the most brutal of reasons.

How do you make a portrait of a child who is not there?

In each of these children’s rooms — the most sacred of places for these families — there was the sense that the child had just been there, and was coming right back. It was as if they’d just left their room like that when they went to school in the morning and were returning in the afternoon.

I wanted to capture that essence.

Most kids’ bedrooms are their very own special places, and these were no different. I looked everywhere, without touching anything. I photographed inside trash cans, under beds, behind desks. Their personalities shone through in the smallest of details — hair ties on a doorknob, a toothpaste tube left uncapped, a ripped ticket for a school event — allowing me to uncover glimpses as to who they were.

But there was an emotional challenge in addition to that creative one. Over the course of more than six years, we visited with many families around the country. The parents I spoke with seemed grateful that I was there. But each time I received a call or text from Steve about a new family, my heart sank.

It meant another family had lost a child.

I find it unfathomable that children being killed at school is even an issue. It makes no sense. It’s impossible to process. The night prior to each one of the family visits, I didn’t sleep. And I knew I wouldn’t going into the project. It’s not a self-fulfilling prophecy. It is nerves. And empathy. And sorrow. And fear.

In my notes from early on in the project, back in 2018, writing in seat 6H on the flight back from Nairobi, I reflected on the emotional task ahead.

“This is going to be one of the most difficult things ever, emotionally, for me, and not just work related. As I read my research documents, I get visibly emotional,” I wrote, noting my gratitude that the dark cabin prevented the other passengers from seeing me.

The prospect brought my own fears to the fore, both for myself — “I can’t help thinking about Rose,” my daughter, “and what if. I’ve lost sleep over envisioning the what-ifs well before Parkland” — and about and for meeting the families in the project: “When I read about April & Phillip and Lori’s plight, I somehow, for some reason put myself in their emotional position even though that is impossible, I have no idea, it’s beyond comprehension, I do not know what they feel. I do not know what I am going to say to them, I’m scared beyond belief. And alone.”

But just days later, I was photographing the first assignment for the project: Alyssa Alhadeff’s room. She was just 14 years old when she walked out of that room to head to Marjory Stoneman Douglas High School. I was shaky meeting the family friend who greeted me at the house. Her daughter was Alyssa’s best friend, and a photo of the two girls was on the table.

According to my notes, “The room was a beautiful teenager’s messy room. My emotions were kept in check the way that they usually are; By hiding behind the camera. I removed my shoes before entering. My heart was pounding and it reverberated through my body and soul, I felt like I was in one of the most sacred and special places on Earth. I was so careful not to touch anything.”

I left feeling ready to explode in sadness and anger.

Later that day, I photographed Carmen Schentrup’s room. Her younger sister had survived the Parkland shooting, but 16-year-old Carmen was killed in her AP Psychology class. Meeting her parents, April and Phillip, was what I was most scared of.

“I feel so much pain and compassion for them and I don’t want to say the wrong thing, drop cliches etc.,” I wrote at the time. “I spoke to Steve for guidance. He said, just be you. That’s all I can do. Just be me. He was right, those three words helped carry me through this entire project. Just be me.”

April let me in, and I worked quickly, only meeting Phillip as I was leaving. “The conversation felt like we all three were just trying to hold it together. I cannot imagine what they are going through, my heart hurts for them. This was / is such a painful project, and reconciling it will be impossible.

“I think about how anything can happen at any time to any of us. Literally. You never know,” I wrote.

After only about 16 hours on the ground in Florida, I was done with the first portion. I felt the project was a must, but I also dreaded the next call from Steve about the next family. I didn’t know when that call would come — many years later, or the very next day, possibly never.

But last month, we — and the documentary crew that filmed us working — completed this project. While I haven’t seen it yet, I know Steve’s piece won’t be a typical Steve Hartman segment. How could it be? I know he struggled too, and we both have spent a lot of time processing this.

I remember one August evening, I was devastated as I left the home of one of the families. Within minutes, I passed an ice cream shop crowded with other families — seemingly carefree, full of joy and laughter. The juxtaposition, mere minutes apart, cracked my soul.

I hope some way, somehow, this project can facilitate change — the only possible positive outcome for this I could comprehend. After the news cycle ends, these families will still be living with an incomprehensible nightmare.