CBS News

3 smart debt relief moves to make for October

Getty Images

While inflation has steadily declined over the last year and, now, interest rates have started to be reduced, the economic burdens millions of Americans have felt in recent years are still lingering. The average American owes approximately $8,000 in credit card debt currently and, overall, the total credit card debt nationwide now sits at approximately $1.4 trillion. That’s a lot of money to pay back and it won’t be repaid overnight, either.

Fortunately, if you’re one of those borrowers stuck with credit card or other high-interest debt right now, there are options to pursue to help you dig out. Debt relief companies offer varied services from debt consolidation loans (in which you can consolidate your debt into one, preferably lower-rate loan) to debt management programs to credit card debt forgiveness. To position yourself for success, however, you’ll need to start taking action soon. And with the aforementioned statistics in mind, this October could be the time to act. Below, we’ll detail three smart debt relief moves to make now.

Start by seeing which option can offer you the most debt relief here.

3 smart debt relief moves to make for October

While each borrower’s financial situation and overall debt severity are different, there are some broadly applicable debt relief moves to make for the upcoming month. Here are three:

Review your options

As noted, there are multiple debt relief options to choose from ranging from moderate help to more severe assistance like bankruptcy. The best one for you will depend on factors like how much you owe, your current ability to pay and your credit score.

If you’ve already stopped paying your debt or are delinquent, you may need more help than if you have large but still manageable debt obligations. So review your options carefully and consider speaking to a debt relief specialist who can better help determine your most appropriate course of action.

Contact a debt relief professional online today.

Stop waiting

Choosing the right debt relief option for your unique situation is just one step. The rest, however, will take time to implement and it could be months, if not years, to accomplish your goal. Credit card debt forgiveness, for example, can take two to four years to complete and even then you won’t have your full debt forgiven (it’s usually capped between 30% and 50% of what you owe).

Waiting around, then, for the perfect relief option or for interest rates to fall could be detrimental to your financial well-being. Instead, consider acting aggressively once you’ve determined your best option.

Boost your credit score

If you’re currently in debt you may have already damaged your credit score. But if you have the means to improve it, you should make every effort to do so. This means securing a copy of your credit report to review for any errors or inaccuracies that could be damaging your score. It also means refraining from adding to your existing debts and making payments on time.

Remember that select debt relief options, like debt consolidation loans, will only be beneficial if you can secure a lower rate than what you already have elsewhere. To get that lower rate, then, become a qualified borrow and start working now to boost your credit score. It’ll pay dividends if you pursue select debt relief options.

The bottom line

If you’re stuck in debt then consider using the start of a new month as a fresh start. To truly regain your financial freedom, however, you’ll want to carefully analyze each potential debt relief option available now to best determine which aligns with your financial needs. Once you do, consider acting quickly as delays will only lead to compounded interest on your existing debt. And make sure to do all you can to boost your credit score in the interim, both to position yourself for better rates on products like debt consolidation loans but also as part of the overall process of improving your financial standing. By making these smart debt relief moves this October, you can start digging out of debt and move toward improved, long-term economic health.

CBS News

Breaking down the Trump, Harris closing messages, Election Day expectations

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Latest news on Election Day 2024 from Nevada, Arizona, North Carolina and Georgia

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

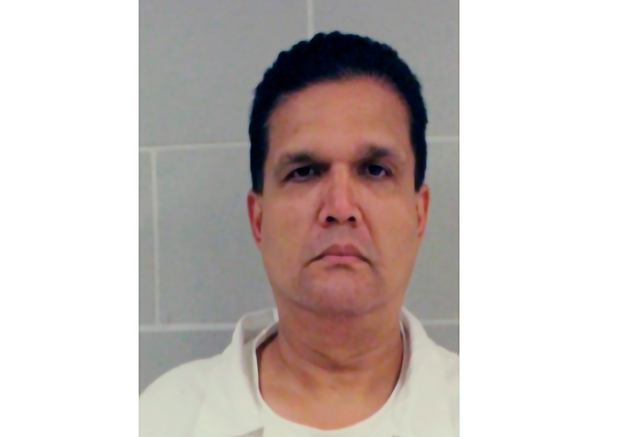

“Fat Leonard” sentenced to 15 years for massive Navy bribery, fraud scheme

Leonard Glenn Francis, a former defense contractor convicted for masterminding an unprecedented bribery and fraud scheme targeting the U.S. Navy, was sentenced Tuesday in federal court to 15 years in prison. He was ordered to pay $20 million in restitution and a $150,000 fine, the Department of Justice announced.

Francis, known as “Fat Leonard,” pled guilty in 2015 to the bribery and fraud charges, but fled the U.S. in 2022 leaving his GPS ankle monitoring bracelet in a water cooler just days before he was to be sentenced. The U.S. Marshals Service told CBS News Francis was detained on an Interpol red notice at Simon Bolivar International Airport in Venezuela while boarding a flight to Cuba.

He was returned to the U.S. last year as part of a large prisoner swap deal with Venezuela. Ten American detainees were released in the 2023 deal in exchange for the Biden administration freeing Alex Saab, a Colombian-born businessman and close ally of Venezuelan President Nicolás Maduro who was facing money laundering charges.

U.S. Marshals Service via AP

In a 2015 plea agreement, Francis, the Malaysian owner of a ship servicing company in Southeast Asia, identified seven Navy officials who had accepted bribes and acknowledged paying off officials with hundreds of thousands in cash, as well as luxury goods worth millions.

He supplied them with prostitutes and Cuban cigars, luxury travel, Spanish suckling pigs and Kobe beef. Officials received spa treatments, top-shelf alcohol, designer handbags, leather goods, designer furniture, watches, fountain pens, ornamental swords and handmade ship models, according to court documents.

In exchange, officers gave him classified information and even redirected military vessels to lucrative ports for his Singapore-based ship servicing company. Francis, according to prosecutors, overcharged the U.S. military by $35 million for his company’s services.

Over 30 Navy officers and contractors have either been convicted or pleaded guilty to charges related to Francis’ services.

On Tuesday, U.S. District Judge Janis L. Sammartino sentenced Francis to a 164-month sentence for bribery and fraud and 16 months for failing to appear, to be served consecutively.

“Leonard Francis lined his pockets with taxpayer dollars while undermining the integrity of U.S. Naval forces,” said U.S. Attorney Tara McGrath in a statement. “The impact of his deceit and manipulation will be long felt, but justice has been served today.”

Francis, 60, was initially arrested in San Diego on September 16, 2013, and remained in pretrial custody until December 18, 2017, when the court granted his request for release pending sentencing due to a medical condition, the Department of Justice said. Francis served four years and three months in custody before he was released on bond and ordered into house arrest. He remained on bond under the supervision of U.S. Pretrial Services for almost five years, from December 17, 2017, until he escaped.

“Mr. Francis’ sentencing brings closure to an expansive fraud scheme that he perpetrated against the U.S. Navy with assistance from various Navy officials. This fraud conspiracy ultimately cost the American taxpayer millions of dollars and weakened the public’s trust in some of our Navy’s senior leaders,” Kelly P. Mayo, the director of the U.S. Department of Defense Office of Inspector General said in a news release on Tuesday.