CBS News

How much will a $150,000 home equity loan cost per month now that rates are falling?

Getty Images

Homeowners currently have a valuable asset at their disposal: their home equity. With home values rising steadily over the last few years, homeowners now have a lot of equity to tap into — about $327,000 on average. The amount of accessible equity — which is the total that can be borrowed against while maintaining a 20% equity cushion — now amounts to $214,000. That high amount of equity, coupled with the recent interest rate cut by the Federal Reserve, has made this an opportune moment to consider a home equity loan.

Home equity loans are generally one of the most cost-effective borrowing options, as these loans are secured by the equity in your home, meaning that the rates are typically lower compared to options like credit cards and personal loans. And the recent 50 basis point reduction in the Fed’s benchmark rate pushed home equity loan rates down further, making them even more attractive. So, if you’ve been planning to borrow money from your home’s equity, this could be a good time to make your move.

Before you take out a home equity loan, though, it’s important to understand the monthly costs associated with this type of borrowing. So, how much would a $150,000 home equity loan cost today now that rates have fallen? Below we’ll break down what those payments could look like based on today’s rates.

Home equity loan rates can change quickly. Compare your top rates and lock one in today.

How much will a $150,000 home equity loan cost per month now that rates are falling?

Unlike home equity lines of credit (HELOCs), which offer variable rates that can change with the wider rate environment, most home equity loans come with fixed rates, so the rate you start your loan with is the rate you’ll end with (unless you refinance your home equity loan at some point). That keeps your payments consistent from month to month.

With a home equity loan, the cost of your monthly payments depends heavily on the loan term and the interest rate you’re offered. There are two common home terms to choose from: 10-year and 15-year loan terms, with today’s 10-year loan terms offering average rates of 8.50% and 15-year loan terms offering average rates of 8.41%. Here’s what the monthly payments would look like on each option using today’s average rates:

- 10-year home equity loan at 8.50%: With this rate and term, the monthly payments would be $1,859.79 per month

- 15-year home equity loan at 8.41%: With this rate and term, the monthly payments would be $1,469.21 per month

As illustrated above, opting for the shorter 10-year home equity loan would result in paying off the loan faster, but you would have higher monthly payments to contend with. On the other hand, if you choose a 15-year term, your monthly payments will be more manageable, but you will pay more in interest over the longer term.

But those are just the monthly costs at today’s rates. There are expectations that the Fed could cut rates even further over the next few months. Here’s what your monthly payments could look like if the Fed slashes rates by another 25 basis points and 50 collective basis points and home equity loan rates fall by the same amount:

If home equity loan rates drop by 25 basis points:

- 10-year home equity loan at 8.25%: With this rate and term, the monthly payments would be $1,839.79 per month

- 15-year home equity loan at 8.16%: With this rate and term, the monthly payments would be $1,447.37 per month

If home equity loan rates drop by 50 basis points:

- 10-year home equity loan at 8.00%: With this rate and term, the monthly payments would be $1,819.91 per month

- 15-year home equity loan at 7.91%: With this rate and term, the monthly payments would be $1,425.70 per month

Given the potential savings, it may be tempting to try and wait for rates to drop before borrowing. However, it can be difficult to time the market, as interest rates are impacted by a lot more than just the Fed — and there’s always a risk that rates could rise in the future. So, if you need to borrow money soon, it may be worth securing a favorable rate now instead.

Find out how affordable the right home equity loan could be now.

The bottom line

If you plan to take out a $150,000 home equity loan at today’s average rates, your monthly payments would range from $1,469.21 to $1,859.79 depending on the loan term you choose. And, the Fed is expected to cut rates further over time, which could help to drive down the costs of a home equity loan even more. But if you’re planning to wait, you may want to think twice about that strategy. While you could potentially save on interest charges by waiting for rates to drop further, it’s a risky bet. For many borrowers, it could make more sense to lock in a good rate now — and if rates fall in the future, there’s always the option to refinance and capitalize on the savings.

CBS News

U.S Air Force says drones spotted near 3 bases in England last week

The U.S. Air Force says a number of small drones were detected last week around three bases in eastern England that are used by American forces.

The drones were spotted between Wednesday and Friday near RAF Lakenheath, RAF Mildenhall and RAF Feltwell. They were actively monitored after they were seen in the vicinity of and over the three bases, U.S. Air Forces Europe said in a statement.

The Air Force didn’t identify who was behind the incursions but said base officials determined there was no impact on residents or critical infrastructure.

CHRIS RADBURN/AFP via Getty Images

Lakenheath is home to the 48th Fighter Wing, which the U.S. Air Force describes as the foundation of its combat capability in Europe. Mildenhall hosts the 100th Air Refueling Wing, and Feltwell is a hub for housing, schools and other services.

“To protect operational security, we do not discuss our specific force protection measures but retain the right to protect the installation,” the Air Force said. “We continue to monitor our airspace and are working with host-nation authorities and mission partners to ensure the safety of base personnel, facilities and assets.”

While it is unclear whether the drones had hostile intent, the incidents came during a week that saw the most significant escalation of hostilities in Ukraine since Russia’s full-scale invasion nearly three years ago.

For the first time, Ukraine struck targets inside Russia with intermediate-range missiles supplied by the U.S. and Britain after President Biden and Prime Minister Keir Starmer authorized the use of the weapons.

In response, Russia launched a new intermediate range ballistic missile at Ukraine, and President Vladimir Putin said his country had the right to strike nations that allow their weapons to be used against Russia.

Lakenheath, Mildenhall and Feltwell, located close to one another in the counties of Suffolk and Norfolk, are Royal Air Force bases used primarily by the U.S. Air Force.

Britain’s Ministry of Defense said “we take threats seriously and maintain robust measures” at military installations.

“This includes counter drone security capabilities. We won’t comment further on security procedures,” it said.

CBS News

90-year-old great-grandmother graduates from New Hampshire college 50 years after finishing degree

MANCHESTER N.H. – Some people may have thought there was a celebrity in the building at Southern New Hampshire University’s graduation on Saturday. Annette Roberge certainly felt like one as she crossed the stage to get her diploma at 90 years old.

“I’m still on cloud nine,” Roberge said. “I can’t even put it into words. It was exhilarating, it was awesome, it was beyond anything I could’ve possibly imagined.”

Southern New Hampshire University

Degree 50 years in the making

This degree has been decades in the making for the mother of five, grandmother of 12, and great-grandmother of 15. She began taking classes at New Hampshire College, now SNHU, in 1972 one year after her husband of 20 years was killed in Vietnam.

Southern New Hampshire University

She completed several night and weekend courses before it took a backseat to her five kids and two jobs. Roberge worked as an insurance agent while she finished up as a lunch lady at a nearby school. Roberge retired at age 75, but she was a woman who loved learning, and she knew something was missing from her life.

“If I started something I just have to finish it,” Roberge said.

But it wasn’t until recently that Roberge’s daughter began poking around and learned her mom had earned enough credits for an associate’s degree in business administration. Barring some health challenges, Roberge finally walked across the stage on Saturday to the roaring cheers from her fellow graduates and a standing ovation.

“Never give up on learning because what you learn can never be taken away from you,” Roberge said.

“It matters so much for the example it sets about what we do for ourselves, to keep learning and stretching and growing,” SNHU President Lisa Marsh Ryerson said.

“Don’t ever give up on a dream”

Roberge even had a parting message for all of her new fellow graduates.

“If you’ve got a dream don’t let it just sit there. Do something, make it work, don’t ever give up on a dream.”

If you thought Roberge would be satisfied with her associate’s degree you’d be wrong. She plans to start working towards her bachelor’s degree in January.

CBS News

Potential winter storms forecast across U.S. on Thanksgiving week could impact holiday travel

Forecasters around the United States have issued severe weather warnings ahead of another wave of winter storms that could potentially affect travel around the upcoming Thanksgiving holiday. Meanwhile, parts of the Pacific Northwest and California continued to recover from storm damage and widespread power outages, as they braced for more impact.

In California, where a person was found dead in a vehicle submerged in floodwaters on Saturday, authorities braced for more precipitation while grappling with flooding and small landslides from a previous storm. Thousands in the Pacific Northwest remained without power after multiple days in the dark.

The National Weather Service office in Sacramento, California, issued a winter storm warning for the state’s Sierra Nevada for Saturday through Tuesday, with heavy snow expected at higher elevations and wind gusts potentially reaching 55 miles per hour. Total snowfall of roughly 4 feet was forecast, with the heaviest accumulations expected Monday and Tuesday.

“A weak low pressure system will continue directing a plume of moisture at the West Coast over the next few days,” the Weather Prediction Center said in an advisory Sunday, which was effective through Tuesday. “This will likely result in coastal and low elevation rain, while moderate to heavy snow proliferates across the coastal ranges of Washington, Oregon and California.”

The heaviest snow was expected to fall over sections of the Sierra Nevada, forecasters said, noting that areas in the Colorado Rockies would likely see snow showers, too, over the next few days. Another atmospheric river event was forecast to arrive in parts of central California on Tuesday.

The Midwest and Great Lakes regions will see rain and snow Monday and the East Coast will be the most impacted on Thanksgiving and Black Friday, forecasters said.

CBS News meteorologist Nikki Nolan said the holiday outlook was still uncertain at the end of last week, but the weather system could bring rain and snow to the northeastern U.S. while causing temperatures to drop across most of the country, outside of the Southeast.

“While models can change in the days ahead, Thanksgiving Day is showing a low-pressure system moving across the East and entering the Northeast by evening hours,” Nolan said Friday.

Noah Berger / AP

A low-pressure system is forecast to bring rain to the Southeast early Thursday before heading to the Northeast. Areas from Boston to New York could see rain and strong winds, with snowfall possible in parts of northern New Hampshire, northern Maine and the Adirondacks. If the system tracks further inland, there could be less snow and more rain in the mountains, forecasters said.

Earlier this week, at least two people died when severe weather struck the Pacific Northwest, bringing powerful wind and rain, closing schools, and causing widespread power outages. The two who died were killed by falling trees in Lynnwood and Bellevue, both in Washington state, officials said. Hundreds of thousands lost power, mostly in the Seattle area, before strong winds moved through Northern California.

Rescue crews in Guerneville, California, recovered a body inside a vehicle bobbing in floodwaters around 11:30 a.m. Saturday, Sonoma County Sheriff’s Deputy Rob Dillion said, noting the deceased was presumed to be a victim of the storm but an autopsy had not yet been conducted.

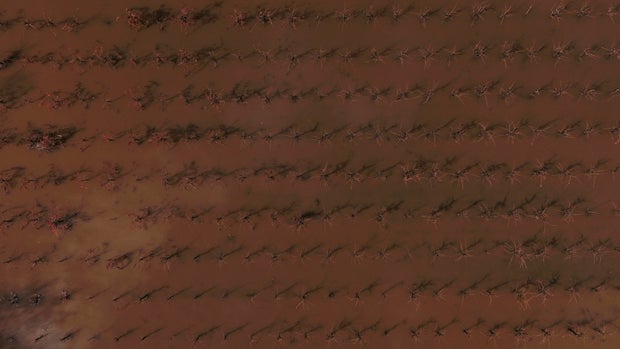

Santa Rosa, California, saw its wettest three-day period on record with about 12.5 inches of rain by Friday evening, the National Weather Service in the Bay Area reported. Vineyards in nearby Windsor, California, were flooded on Saturday.

Some 80,000 people in the Seattle area were still without electricity after this season’s strongest atmospheric river, a long plume of moisture that forms over an ocean and flows over land. The atmospheric river overwhelmed parts of the Pacific Northwest as well as California, and was the strongest weather event of its kind seen all season.

The storm system hit the area Tuesday. It was considered a “bomb cyclone,” which occurs when a cyclone intensifies rapidly. Although the intensity of the atmospheric river peaked later in the week, forecasters had warned that another bout of severe weather was still yet to come.

Godofredo A. Vásquez / AP

The power came back in the afternoon at Katie Skipper’s home in North Bend, about 30 miles east of Seattle, after being out since Tuesday. She was tired from taking cold showers, warming herself with a wood stove and using a generator to run the refrigerator, but Skipper said those inconveniences paled in comparison to the damage other people suffered, such as from fallen trees.

“That’s really sad and scary,” she said.

Another storm brought rain to New York and New Jersey, where rare wildfires have raged in recent weeks, and heavy snow to northeastern Pennsylvania. The precipitation was expected to help ease drought conditions after an exceptionally dry fall.

“It’s not going to be a drought buster, but it’s definitely going to help when all this melts,” said Bryan Greenblatt, a National Weather Service meteorologist in Binghamton, New York.

Heavy snow fell in northeastern Pennsylvania, including the Pocono Mountains. Higher elevations reported up to 17 inches, with lesser accumulations in valley cities including Scranton and Wilkes-Barre. Less than 80,000 customers in 10 counties lost power.

Precipitation in West Virginia helped put a dent in the state’s worst drought in at least two decades and boosted ski resorts preparing to open their slopes in the weeks ahead.