CBS News

Kamala Harris addresses Biden’s “garbage” comment

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Here Comes the Sun: Jack Antonoff and more

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Capturing Moriah Wilson’s Killer – CBS News

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

How to watch the Minnesota Vikings vs. Chicago Bears NFL game today: Livestream options, more

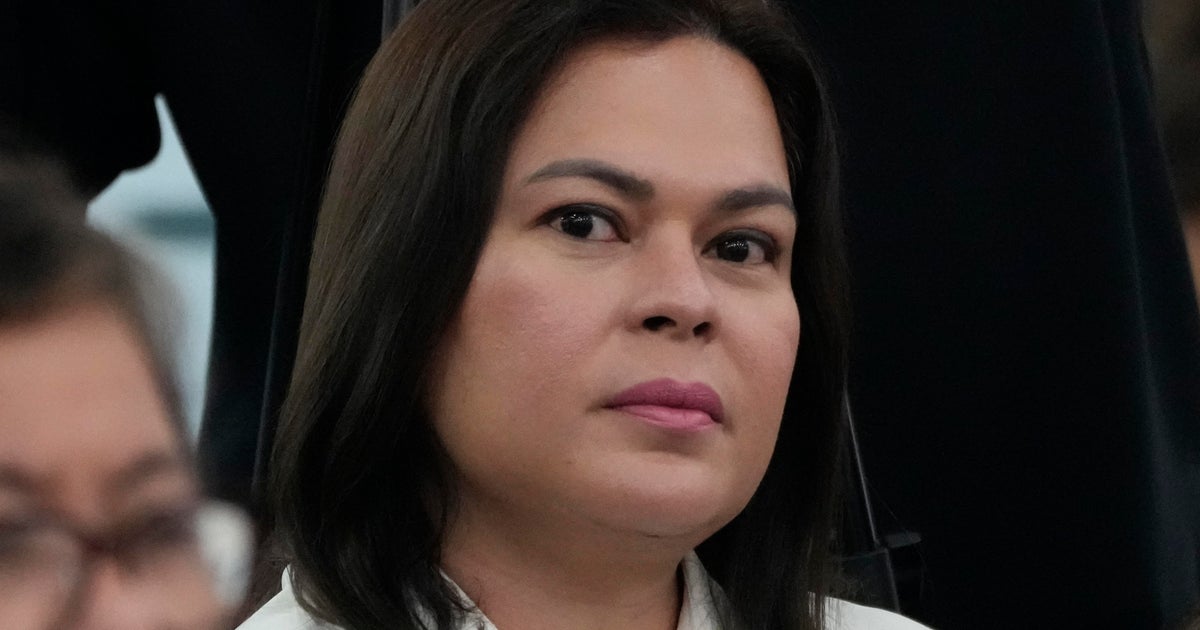

Getty Images

The Minnesota Vikings will take on the Chicago Bears today. The Vikings are currently 8-2, an impressive run so far this season, and will be looking to add a fourth win to their current streak after last Sunday’s 23-13 win against the Tennessee Titans. The Bears, on the other hand, are entering this game on the heels of a four-game losing streak after a tough 20-19 loss against the Green Bay Packers last Sunday.

Here’s how and when you can watch the Vikings vs. Bears game today, whether or not you have cable.

How and when to watch the Minnesota Vikings vs. Chicago Bears

The Vikings vs. Bears game will be played on Sunday, November 24, 2024 at 1:00 p.m. ET (11:00 a.m. PT). The game will air on Fox and stream on Fubo and the platforms featured below.

How and when to watch the Minnesota Vikings vs. Chicago Bears game without cable

You can watch this week’s NFL game on Fox via several streaming services. All you need is an internet connection and one of the top options outlined below.

Fubo offers you an easy, user-friendly way to watch NFL games on CBS, Fox, NBC, ABC, ESPN, and NFL Network, plus NCAA football channels. The Pro tier includes 200+ channels and unlimited DVR, while the Elite with Sports Plus tier adds NFL RedZone and 4K resolution. New subscribers get a seven-day free trial and all plans allow streaming on up to 10 screens simultaneously.

You can watch today’s game with a subscription to Sling’s Orange + Blue tier, which includes ESPN, ABC, NBC, and Fox. The plan offers 46 channels with local NFL games, nationally broadcast games and 50 hours of DVR storage. For complete NFL coverage, add Paramount+ to get CBS games, or upgrade with the Sports Extra add-on for additional sports channels like Golf Channel, NBA TV and NFL RedZone.

Watching NFL games, including Fox broadcasts, is simple with Hulu + Live TV, which includes 90 channels, unlimited DVR storage, and access to NFL preseason games, live regular season games and studio shows. The service includes ESPN+ and Disney+ in the subscription.

Want to watch today’s game live on your smartphone? If so, NFL+ streaming service is the solution you’re looking for. It lets you watch NFL Network and out-of-market games on mobile devices, with an upgrade option to NFL+ Premium that includes NFL RedZone for watching up to eight games simultaneously. Note that NFL+ only works on phones and tablets, not TVs.