CBS News

Idaho public health department restricted from giving COVID-19 vaccines in 6 counties

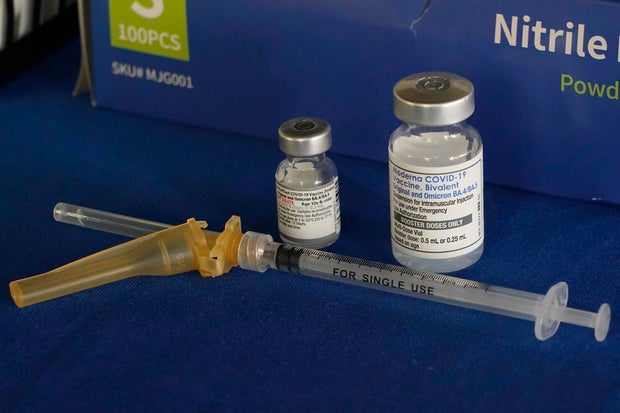

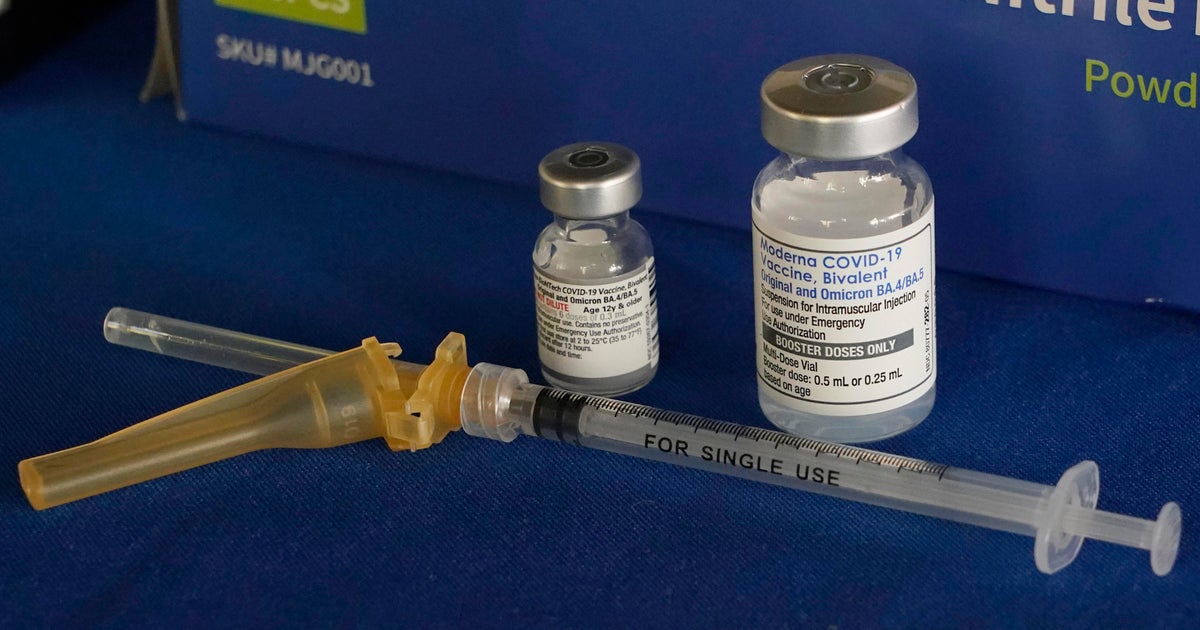

A regional public health department in Idaho is no longer providing COVID-19 vaccines to residents in six counties after a narrow decision by its board.

Southwest District Health appears to be the first in the nation to be restricted from giving COVID-19 vaccines. Vaccinations are an essential function of a public health department.

While policymakers in Texas banned health departments from promoting COVID vaccines and Florida’s surgeon general bucked medical consensus to recommend against the vaccine, governmental bodies across the country haven’t blocked the vaccines outright.

“I’m not aware of anything else like this,” said Adriane Casalotti, chief of government and public affairs for the National Association of County and City Health Officials. She said health departments have stopped offering the vaccine because of cost or low demand, but not based on “a judgment of the medical product itself.”

The six-county district along the Idaho-Oregon border includes three counties in the Boise metropolitan area. Demand for COVID vaccines in the health district has declined — with 1,601 given in 2021 to 64 so far in 2024. The same is true for other vaccines: Idaho has the highest childhood vaccination exemption rate in the nation, and last year, the Southwest District Health Department rushed to contain a rare measles outbreak that sickened 10.

Rogelio V. Solis / AP

On Oct. 22, the health department’s board voted 4-3 in favor of the ban — despite Southwest’s medical director testifying to the vaccine’s necessity.

“Our request of the board is that we would be able to carry and offer those (vaccines), recognizing that we always have these discussions of risks and benefits,” Dr. Perry Jansen said at the meeting. “This is not a blind, everybody-gets-a-shot approach. This is a thoughtful approach.”

Opposite Jansen’s plea were more than 290 public comments, many of which called for an end to vaccine mandates or taxpayer funding of the vaccines, neither of which are happening in the district. At the meeting, many people who spoke are nationally known for making the rounds to testify against COVID vaccines, including Dr. Peter McCullough, a Texas cardiologist who sells “contagion emergency kits” that include ivermectin and hydroxychloroquine — drugs that have not been approved to treat COVID-19 and can have dangerous side effects.

Board Chairman Kelly Aberasturi was familiar with many of the voices who wanted the ban, especially from earlier local protests of pandemic measures.

Aberasturi, who told The Associated Press that he’s skeptical of COVID-19 vaccines and national public health leaders, said in the meeting and in an interview with the AP that he was supportive of but “disappointed” in the board’s decision.

He said the board had overstepped the relationship between patients and their doctors — and possibly opened a door to blocking other vaccines or treatments.

Board members in favor of the decision argued people can get vaccinated elsewhere, and that providing the shots was equivalent to signing off on their safety. (Some people may be reluctant to get vaccinated or boosted because of misinformation about the shots despite evidence that they’re safe and have saved millions of lives.)

The people getting vaccinated at the health department — including people without housing, people who are homebound and those in long-term care facilities or in the immigration process — had no other options, Jansen and Aberasturi said.

“I’ve been homeless in my lifetime, so I understand how difficult it can be when you’re … trying to get by and get ahead,” Aberasturi said. “This is where we should be stepping in and helping.

“But we have some board members who have never been there, so they don’t understand what it’s like.”

State health officials have said that they “recommend that people consider the COVID-19 vaccine.” Idaho health department spokesperson AJ McWhorter declined to comment on “public health district business,” but noted that COVID-19 vaccines are still available at community health centers for people who are uninsured.

Aberasturi said he plans to ask at the next board meeting if the health department can at least be allowed to vaccinate older patients and residents of long-term care facilities, adding that the board is supposed to be caring for the “health and well-being” of the district’s residents. “But I believe the way we went about this thing is we didn’t do that due diligence.”

CBS News

Is it ever OK to ignore credit card debt collectors?

Getty Images

With credit card interest rates sitting at historically high levels right now, millions of cardholders are struggling to pay off what they owe. After all, as the compounding interest charges rack up, it’s easy for even a small card balance to balloon quickly. As a result, about 9% of cardholders are now delinquent on their credit card payments, meaning that they’re facing late fees, increased interest rates and other repercussions.

If a credit card balance goes unpaid for an extended period, the card issuer may deem it uncollectible. At this stage, the debt is typically sold to a debt collection agency, which purchases it for a fraction of the original balance. This agency then becomes responsible for attempting to recover the debt by using tactics like frequent calls, letters and even legal action. These aggressive and persistent tactics can add a significant amount of stress to an already tough situation.

For many people, facing debt collectors feels intimidating, which can lead to them ignoring their attempts to collect, hoping the issue might disappear. But is ignoring a debt collector a good idea, or could it make matters worse?

Take action and tackle your credit card debt today.

Is it ever OK to ignore credit card debt collectors?

Ignoring credit card debt collectors is generally not a good idea. Debt collectors have a legal right to try to recover the debt, and ignoring their calls and letters doesn’t make the debt go away. It often leads to even more aggressive collection efforts, including lawsuits, which could result in a court judgment against you. This judgment can allow collectors to garnish your wages or seize other assets, creating even more financial pressure.

However, there are a few scenarios where you might consider holding off on engaging a debt collector or taking a different approach to protect yourself. For example, one situation where ignoring a debt collector could be strategically beneficial is when the debt is “time-barred.” Each state has a statute of limitations on debt collection, typically ranging from three to 10 years, though it can be longer in some states.

If a credit card debt is past this time frame, collectors can no longer sue you to collect it. However, if you acknowledge the debt, promise to pay or even make a partial payment, you may restart the clock on the statute of limitations, allowing them to pursue legal action again. If you suspect a debt is time-barred, it’s wise to confirm your state’s statute of limitations period and carefully assess your options before engaging with a collector.

If you believe a debt is incorrect or doesn’t belong to you, it’s also important to validate it before responding. In some cases, debt collectors will pursue debts that are inaccurate, double-counted or outdated. In these cases, you have the right to request written verification within 30 days of their initial contact. Requesting verification can help you confirm whether the debt is legitimate, but ignoring a debt you don’t recognize can lead to ongoing collection efforts.

Under the Fair Debt Collection Practices Act (FDCPA), you also have the right to limit when and how a collector contacts you. You can send a letter requesting that the collector only communicate in writing or stop contacting you entirely. Be aware, though, that this won’t erase the debt. However, it can give you some breathing room and help you focus on finding a solution.

Start comparing your debt relief options here.

How to deal with credit card debt that’s in collections

If your credit card debt is in collections, you have several options to help you resolve it. First, consider negotiating with the debt collector, either on your own or by enrolling in a debt forgiveness program. After all, many collections agencies are open to settling debts for less than the full amount owed, especially if they acquired the debt for a lower price, so taking this approach could result in serious savings.

Other types of debt relief programs may also be worth considering. Debt consolidation programs, for example, can help you combine your debts into a single monthly payment, often at a lower interest rate. A debt management plan is another option, and enrolling in one could help you secure lower monthly payments by negotiating reduced interest rates with your creditors.

Another strategy for handling debt is filing for bankruptcy, which can sometimes provide relief from overwhelming debt — but it also comes with long-term consequences for your credit. As a result, bankruptcy should generally be considered a last resort, but if your debts are too high to pay off, it could be an option to weigh.

The bottom line

While the temptation to ignore credit card debt collectors is understandable, doing so rarely solves the problem. Ignoring debt collectors can lead to escalating issues, including potential lawsuits or further damage to your credit. In some cases, such as with time-barred debts, non-engagement might make sense to avoid accidentally reviving a collector’s legal claim. However, managing debt through negotiation, debt relief programs or other options is typically a more effective long-term solution.

CBS News

House candidate Kristen McDonald Rivet on race for seat in Michigan

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Remembering Quincy Jones’ legacy – CBS News

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.