CBS News

Harris and Trump both want major tax changes. Here’s what they’re proposing — and the impact on you.

Vice President Kamala Harris and former President Donald Trump are both proposing tax changes that would rank among the largest in U.S. history, but their plans would impact very different groups of Americans by providing tax credits and cuts to some taxpayers, while raising taxes on others.

While taxes are always on the ballot during an presidential election, the 2024 race has even more at stake given that many provisions in Trump’s signature tax legislation, the 2017 Tax Cuts & Jobs Act, will expire at the end of 2025. If Trump wins, he’s expected to extend many of those provisions, while Harris has vowed to only keep those that help people earning under $400,000.

At the same time, both candidates have sought to curry favor with some groups of voters by promising specific tax cuts and credits, such as Harris’ plan to introduce a $6,000 Child Tax Credit for parents of newborns. Trump, meanwhile, has dangled a host of tax cuts to everyone from senior citizens (promising to get rid of income taxes on Social Security) to tipped workers (vowing to eliminate taxes on tips).

But Trump is also proposing across-the-board tariffs on all imports, a plan that would effectively act as a sales tax on American consumers. That’s because the countries that manufacture products imported to the U.S. do not pay tariffs; rather, tariffs are added to the prices of imported products that American consumers purchase.

Here’s what to know about how their tax plans stack up.

Would Trump cut or raise your taxes?

Trump’s combination of tariffs and tax cuts — including cutting the corporate tax rate to 15% from its current 21% — would rank as the sixth-biggest tax cut since 1940, according to a recent Tax Foundation analysis.

However, Trump’s tax cuts would require Congressional approval, which could prove to be a hurdle if at least one of the chambers is controlled by Democrats.

If Trump is unable to enact his tax cuts but adds his proposed tariffs — which don’t need a Congressional greenlight — he would instead be introducing the seventh-biggest tax increase since 1940, the Tax Foundation says. That’s because tariffs are essentially sales taxes paid by U.S. consumers, with the typical household paying about $1,700 more each year in additional costs, according to one estimate.

Meanwhile, income taxes would decline under Trump for all income groups, but the biggest beneficiaries would be high-income households, according to the Penn Wharton Budget Model. Their analysis includes Trump’s proposed tax cuts but doesn’t include the impact of tariffs.

Would Harris cut or raise your taxes?

Harris is proposing a mix of tax cuts, tax increases and expanded tax credits that together would rank as the 15th largest tax increase since 1940, according to the Tax Foundation.

However, the impact would be greater on higher-income households, given that she has vowed to not raise taxes on those earning less than $400,000. Her tax increases would also be targeted at businesses, as she wants to boost the corporate tax rate to 28% from its current 21%.

Most low- and middle-income households would actually get a tax break under her proposals, but high-income households would pay substantially more in income taxes than they currently do, according to the Penn Wharton Budget Model.

The top 0.1%, or those earning more than $14 million a year, would see their taxes increase by about $167,000 a year.

What are Harris and Trump proposing for families?

Harris wants to expand the Child Tax Credit from its current $2,000 to $6,000 for children up to a year old, $3,600 for kids between 1 to 6, and $3,000 for those between 6 to 17.

Low-income households with kids would receive an additional $2,750 on average from Harris’ expanded CTC, according to a Tax Policy Center analysis.

Meanwhile, Trump’s vice presidential candidate, JD Vance, has floated the idea of a $5,000 CTC, but the campaign hasn’t introduced more details, according to the Tax Policy Center. If Trump extends the TCJA, the CTC would remain at $2,000 per eligible child.

What are Harris and Trump’s plans for taxes on Social Security?

Harris hasn’t proposed any tax cuts for Social Security beneficiaries, while Trump has floated eliminating federal income taxes on the retirement payments.

Trump’s plan would mostly help middle- and high-income retirees, given that low-income retirees often don’t make enough to pay federal income tax on their benefits, according to tax experts. The biggest boost would go to retirees earning between $63,000 and $200,000, the Tax Policy Center estimates.

At the same time, Trump’s tax cut would likely hasten the insolvency of the Social Security trust fund, which relies on those income taxes for funding, according to the nonpartisan Committee for a Responsible Federal Budget. Retirees would also be facing a bigger benefit cut, up to 33% of their monthly checks rather than the 23% currently forecast, when the trust fund is exhausted, the group estimates.

What are Harris and Trump’s plans for business taxes?

Harris wants to raise the corporate tax rate to 28% from its current 21%.

By comparison, Trump wants to cut the corporate tax rate to 15% from its current 21%.

“Nowhere do the candidates’ tax plans differ more,” noted Howard Gleckman, senior fellow of the Tax Policy Center, in a November 1 blog post.

What are Harris and Trump’s plans for taxes on overtime and tips?

One place where the candidates converge is on cutting taxes for people who work for tips. Both have portrayed the idea as helping workers with families.

But Trump is also proposing other tax cuts for workers, such as a plan to get rid of federal income taxes on overtime income.

What other tax changes are Harris and Trump proposing?

Harris wants to help people buy homes and start businesses by creating a new $25,000 first-time homebuyers credit and expanding the deduction for startup business expenses from $5,000 to $50,000.

Trump has also proposed making the interest for auto loans tax deductible, a move that would primarily help higher-income taxpayers who itemize their deductions.

CBS News

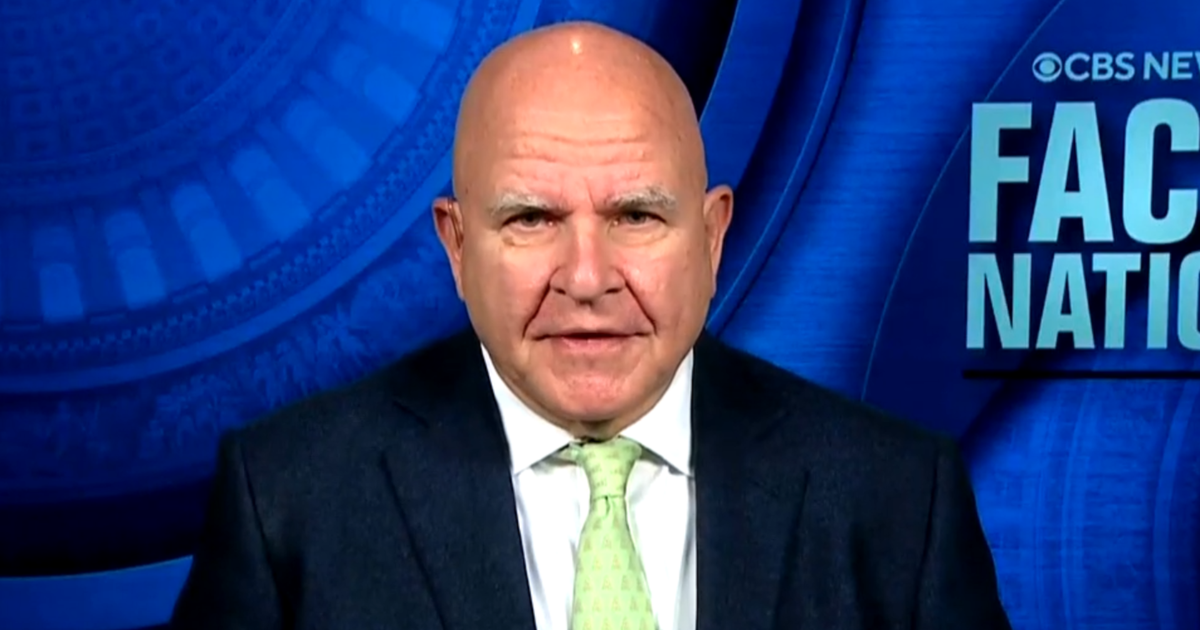

Former Trump national security adviser says next couple months are “really critical” for Ukraine

Washington — Lt. Gen. H.R. McMaster, a former national security adviser to Donald Trump, said Sunday that the upcoming months will be “really critical” in determining the “next phase” of the war in Ukraine as the president-elect is expected to work to force a negotiated settlement when he enters office.

McMaster, a CBS News contributor, said on “Face the Nation with Margaret Brennan” that Russia and Ukraine are both incentivized to make “as many gains on the battlefield as they can before the new Trump administration comes in” as the two countries seek leverage in negotiations.

With an eye toward strengthening Ukraine’s standing before President-elect Donald Trump returns to office in the new year, the Biden administration agreed in recent days to provide anti-personnel land mines for use, while lifting restrictions on Ukraine’s use of U.S.-made longer range missiles to strike within Russian territory. The moves come as Ukraine marked more than 1,000 days since Russia’s invasion in February 2022.

Meanwhile, many of Trump’s key selection for top posts in his administration — Rep. Mike Waltz for national security adviser and Sens. Marco Rubio for secretary of state and JD Vance for Vice President — haven’t been supportive of providing continued assistance to Ukraine, or have advocated for a negotiated end to the war.

CBS News

McMaster said the dynamic is “a real problem” and delivers a “psychological blow to the Ukrainians.”

“Ukrainians are struggling to generate the manpower that they need and to sustain their defensive efforts, and it’s important that they get the weapons they need and the training that they need, but also they have to have the confidence that they can prevail,” he said. “And any sort of messages that we might reduce our aid are quite damaging to them from a moral perspective.”

McMaster said he’s hopeful that Trump’s picks, and the president-elect himself, will “begin to see the quite obvious connections between the war in Ukraine and this axis of aggressors that are doing everything they can to tear down the existing international order.” He cited the North Korean soldiers fighting on European soil in the first major war in Europe since World War II, the efforts China is taking to “sustain Russia’s war-making machine,” and the drones and missiles Iran has provided as part of the broader picture.

“So I think what’s happened is so many people have taken such a myopic view of Ukraine, and they’ve misunderstood Putin’s intentions and how consequential the war is to our interests across the world,” McMaster said.

On Trump’s selections for top national security and defense posts, McMaster stressed the importance of the Senate’s advice and consent role in making sure “the best people are in those positions.”

McMaster outlined that based on his experience, Trump listens to advice and learns from those around him. And he argued that the nominees for director of national intelligence and defense secretary should be asked key questions like how they will “reconcile peace through strength,” and what they think “motivates, drives and constrains” Russian President Vladimir Putin.

Trump has tapped former Rep. Tulsi Gabbard to be director of national intelligence, who has been criticized for her views on Russia and other U.S. adversaries. McMaster said Sunday that Gabbard has a “fundamental misunderstanding” about what motivates Putin.

More broadly, McMaster said he “can’t understand” the Republicans who “tend to parrot Vladimir Putin’s talking points,” saying “they’ve got to disabuse themselves of this strange affection for Vladimir Putin.”

Meanwhile, when asked about Trump’s recent selection of Sebastian Gorka as senior director for counterterrorism and deputy assistant to the president, McMaster said he doesn’t think Gorka is a good person to advise the president-elect on national security. But he noted that “the president, others who are working with him, will probably determine that pretty quickly.”

CBS News

Sen. Van Hollen says Biden is “not fully complying with American law” on Israeli arms shipments

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Rep.-elect Sarah McBride says “I didn’t run” for Congrees “to talk about what bathroom I use”

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.