CBS News

Can a 7-year-old credit card debt still be collected?

Sean Russell/Getty Images

With credit card debt climbing nationwide, many cardholders have found themselves struggling to meet their monthly payment obligations. Right now, the average cardholder owes nearly $8,000 in credit card debt and the financial stress of carrying a balance that high (or higher) is being compounded by rising credit card interest rates, which currently exceed 23% on average. And, as the interest charges accumulate, many cardholders have been unable to balance their regular expenses with their credit card payments, leading to a recent uptick in delinquent credit card payments.

But while more cardholders are falling behind on their card debt, missing a payment on a credit card can have immediate and lasting repercussions. When a payment is missed, creditors will generally report it to credit bureaus after about 30 days. This can cause a decrease in your credit score, and if the missed payments continue, it can further compound the credit damage, lead to extra fees and penalty APRs and signal serious issues with your finances.

If credit card debt goes unpaid, its impact can persist for years. However, debt does not remain on your credit report indefinitely, nor can it be legally pursued by collectors forever. So, what if you have a 7-year-old credit card debt? Can it still be collected, or does the age of the debt mean you’re free from legal obligations?

Compare your top credit card debt relief options here.

Can a 7-year-old credit card debt still be collected?

Whether a seven-year-old credit card debt can still be collected primarily depends on the statute of limitations, which is a legal time frame that limits how long creditors can take legal action to recover unpaid debts. Each state sets its own statute of limitations, which typically ranges from three to 10 years for credit card debt, though some states allow longer periods. The start date for this clock is usually the last date of activity on the account, such as the last payment made. So, a credit card debt that’s seven years old might be either within or beyond the statute of limitations, depending on your state and the account’s payment history.

Once a debt becomes “time-barred,” meaning the statute of limitations has expired, creditors lose their right to sue you for payment. However, this doesn’t mean the debt is erased or forgiven; creditors and collection agencies can still reach out to you through phone calls or letters, as they’re legally allowed to attempt collection informally. You’re not obligated to pay, though, and in most cases, time-barred debts no longer appear on your credit report, as credit reporting agencies generally drop unpaid debts after seven years from the date of the original delinquency.

Still, one crucial point to remember is that in some states, taking specific actions, such as making a partial payment or even acknowledging the debt in writing, could reset the statute of limitations clock. If this happens, your debt would effectively become “fresh” again, making it legally collectible, and creditors could pursue it in court once more. So, if you’re dealing with old debt, it’s important to confirm whether the statute of limitations has expired and know your rights before making any payments or interacting with collectors.

Start getting rid of your old credit card debt today.

What are my options for dealing with old credit card debt?

If you’re dealing with a seven-year-old credit card debt, you have a few options to approach it responsibly, whether you’re seeking to put the matter behind you or simply avoid legal complications. Here are some strategies for handling aged debts while preserving your financial stability:

Confirm the debt’s status

Before taking any action, verify whether the debt is time-barred by requesting a debt validation letter from the creditor or collection agency. This letter clarifies the debt’s details, such as the original amount, age and any recent activity on the account. Reviewing these details helps ensure you’re informed about the debt’s validity and prevents unintentional actions that might reset the statute of limitations.

Consider debt settlement

For those seeking to resolve a time-barred debt without facing additional legal challenges, debt settlement (also known as debt forgiveness) can be a viable option. Debt settlement involves negotiating with the creditor to reduce the amount owed and settle the debt in one payment. Some people choose to negotiate independently while others prefer to work with a debt relief agency instead.

Look into debt management and debt consolidation

If you have multiple aged debts, consider enrolling in a debt management program. These programs consolidate your monthly payments into a single manageable sum, helping to streamline your repayment. Debt consolidation may also be an option if you’re eligible, as it allows you to combine various debts into one loan with a lower interest rate. However, debt consolidation loans may be less accessible for time-barred debts.

The bottom line

Facing a seven-year-old credit card debt may feel overwhelming, but with the right knowledge and approach, you can handle it effectively and avoid potential pitfalls. Understanding the statute of limitations and exploring debt relief options can help you manage your debt responsibly and make informed decisions. But whether you choose to negotiate a settlement, consolidate your debts or avoid making payments on time-barred debt, knowing your rights and taking steps to resolve the issue will help you achieve greater financial peace of mind.

CBS News

Key moments of the 2024 campaign in photos

CBS News projected early Wednesday that Donald Trump will be the president-elect, ending a wild and unprecedented 2024 presidential race.

From President Biden’s sudden exit, Vice President Kamala Harris’ late entry and two assassination attempts against Trump, the path to this Election Day was historic and unpredictable.

Here are some key moments from the campaign:

Trump’s guilty verdict

Mark Peterson/New York Magazine via AP, Pool

Trump was found guilty in May 2024 of 34 felonies by the jury in his hush money trial in New York City, becoming the first former American president in history to be convicted of a crime. He was convicted on allegations of falsifying business records in an effort to hide a $130,000 payment to the adult film star Stormy Daniels prior to the 2016 election.

Trump has denied the charges and maintained his innocence. Addressing the trial after the verdict came down, Trump called the situation “very unfair” and “rigged.”

DeSantis drops out

Charlie Neibergall / AP

Florida Gov. Ron DeSantis had entered the race fresh off a nearly 20-point victory in the Florida’s governor’s race in 2020, and had looked like the future for the party. But he ended his Republican presidential campaign ahead of the New Hampshire primary in January, following his significant loss to Trump in the Iowa caucuses.

Nikki Haley suspends her presidential campaign

Anna Moneymaker / Getty Images

Hours after winning just one state — Vermont — on Super Tuesday, the last remaining Republican in the race, former United Nations ambassador Nikki Haley, suspended her campaign. Her dropping out cleared the path for Trump to get the nomination. Exit polls showed Trump leading Haley among broad segments of the GOP electorate, with voters saying immigration and the economy were their most important issues.

Haley stopped short of endorsing Trump, and later when asked by Margaret Brennan on “Face the Nation with Margaret Brennan” if she thought Trump was a “good candidate,” Haley said “I think he is the Republican nominee.”

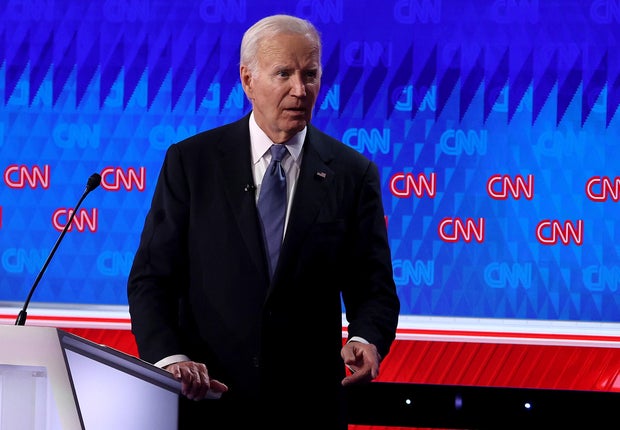

Biden’s fumbling debate performance

Justin Sullivan / Getty Images

Mr. Biden struggled through the first presidential debate against Trump in June, speaking in a hoarse voice and at times appearing to lose his train of thought while answering questions. Officials in Mr. Biden’s camp later attributed the president’s lackluster performance to a cold, which they said he’d had for several days, but Americans and some government leaders questioned whether the debate was a sign the 81-year-old politician would not be fit enough to serve a second term.

The Butler assassination attempt

Evan Vucci / AP

While Mr. Biden faced mounting pressures to end his reelection campaign after the debate, Trump was shot while speaking to a crowd of supporters from the podium of his July rally in Butler, Pennsylvania. The assassination attempt against the former president ultimately killed one spectator at the rally and critically injured two others, and eventually led the now-former director of the Secret Service to resign from her post. A bullet pierced Trump’s ear when the shooter opened fire onto the crowd, and Secret Service agents quickly rushed him from the stage.

Biden exits the race

Michael Nagle/Bloomberg via Getty Images

Mr. Biden announced his decision to drop out of the presidential race on July 21, at the same time endorsing Harris for the Democratic nomination.

“While it has been my intention to seek reelection, I believe it is in the best interest of my party and the country for me to stand down and to focus solely on fulfilling my duties as president for my term,” he posted in a statement on social media. “My very first decision as the party nominee in 2020 was to pick Kamala Harris as my Vice President. And it’s been the best decision I’ve made. Today I want to offer my full support and endorsement for Kamala to be the nominee of our party this year. Democrats — it’s time to come together and beat Trump. Let’s do this.”

Harris launches her presidential campaign

Erin Schaff/The New York Times via AP, Pool

Harris officially launched her campaign July 21, soon after Mr. Biden announced his decision to end his. The vice president’s entry into the into the race following his withdrawal revitalized the energy of their party, with Harris’ campaign raising hundreds of millions in its first week and drawing a medley of endorsements from the nation’s top Democrats.

“I am honored to have the president’s endorsement and my intention is to earn and win this nomination,” Harris said in a statement announcing her campaign. “Over the past year, I have traveled across the country, talking with Americans about the clear choice in this momentous election. And that is what I will continue to do in the days and weeks ahead.

Brat summer

CBS News

Two days after Mr. Biden bowed out and Harris’ bid emerged, the social media account on X previously dedicated to the president’s reelection pursuit transformed to focus instead on her campaign. The transition was marked by a neon green banner at the top of the social media profile bearing the title “kamala hq.” Its style and format imitated the cover of “Brat,” the album by British pop star Charli XCX whose then-recent viral tweet — “Kamala IS brat” — swept the Internet and sparked a frenzy of memes that seemed to engage Gen Z voters in a promising new way.

Harris supporters began to show up at rallies dressed in trademark green

“You think you just fell out of a coconut tree?”

Lisa Lake/Getty Images for MoveOn

With the explosion of “brat”-themed merchandise and viral videos linked to Harris’s campaign came another Internet trend, stemming from a speech where the Democratic nominee recalled something her mother used to say to her.

“‘I don’t know what’s wrong with you young people. You think you just fell out of a coconut tree?'” Harris said, quoting her mother. “You exist in the context of all in which you live and what came before you.”

TikTok edits incorporating the “coconut tree” clip and elements from the Charli XCX album became enormously popular, and many felt the swarm of attention from young people previously unhappy with the election prospects helped kickstart the momentum of Harris’ bid.

JD Vance becomes the Republican vice presidential nominee

Alex Brandon / AP

Trump announced Sen. JD Vance of Ohio as his vice presidential running mate in July, before accepting the Republican presidential nomination at the party’s convention in Milwaukee.

“After lengthy deliberation and thought, and considering the tremendous talents of many others, I have decided that the person best suited to assume the position of Vice President of the United States is Senator J.D. Vance of the Great State of Ohio,” Trump said in a social media post.

Harris chooses Gov. Tim Walz as her running mate

Jae Hong / AP

Harris announced she’d chosen Minnesota Gov. Tim Walz as her vice presidential running mate in August.

“One of the things that stood out to me about Tim is how his convictions on fighting for middle class families run deep. It’s personal,” Harris wrote on social media when she unveiled her pick.

“He grew up in a small town in Nebraska, spending summers working on his family’s farm,” the post continued. “His father died of cancer when he was 19, and his family relied on Social Security survivor benefit checks to make ends meet. At 17, he enlisted in the National Guard, serving for 24 years. He used his GI Bill benefits to go to college, and become a teacher. He served as both the football coach and the adviser of the Gay-Straight Alliance.”

Second apparent assassination attempt

Reuters/Marco Bello

In September, a man was taken into custody after pointing a high-powered rifle at the Florida course where Trump was playing golf. Secret Service agents said at the time they had engaged with the suspect and, with the man’s arrest, opened an investigation into the incident that FBI officials called an apparent attempted assassination of the former president.

A federal grand jury in Miami indicted Ryan Wesley Routh Tuesday on a charge of attempting to kill Trump on Sept. 15.

Harris and Trump’s first, and only, debate

Democracy News Alliance/news aktuell via AP Images / AP

Trump and Harris sparred in a contentious presidential debate in Philadelphia in September. The debate, hosted by ABC, saw the two candidates slashing over key issues like abortion rights, immigration, the economy and foreign policy.

“They’re eating the dogs … they’re eating the cats”

Rebecca Blackwell / AP

Among a medley of blatant falsehoods and baseless claims made by Trump during his debate against Harris was one that stood out from the rest. While speaking about immigration, the former president repeated a story that had been circulating on social media that alleged, confusingly, that Haitian migrants in Springfield, Ohio, were abducting and eating people’s pets.

Trump, Vance and others had already amplified those rumors prior to the debate, where Trump doubled down, saying: “In Springfield, they’re eating the dogs — the people that came in, they’re eating the cats. They’re eating — they’re eating the pets of the people that live there and this is what’s happening in our country, and it’s a shame.”

In response, ABC “World News Tonight” anchor David Muir told Trump during the debate that city officials in Springfield disputed the claims.

Racist Madison Square Garden rally draws outcry

Evan Vucci / AP

As the presidential race neared a close at the end of October, Trump held a campaign rally at Madison Square Garden in New York City and vowed to win his home state in the election. He didn’t, and the campaign event itself drove a wave of criticism after his guest speakers gave remarks that were riddled with offensive, racist comments. In part of the opening remarks that received significant backlash, comedian Tony Hinchcliffe referred to Puerto Rico as a “floating island of garbage” in his speech.

Trump’s garbage truck stunt

Chip Somodevilla / Getty Images

As both Trump and Harris’ campaigns zeroed in on key battlegrounds in the lead-up to the Election Day, the Republican nominee addressed reporters in Green Bay, Wisconsin, while wearing a construction vest from behind the wheel of a garbage truck that was emblazoned with his campaign slogan.

The stunt, he said, was crafted “in honor of Kamala and Joe Biden” after Mr. Biden appeared to call Trump’s supporters “garbage,” although the White House and Mr. Biden clarified that remark was about the Madison Square Garden rally comedian.

Voters turn out in record numbers

John Locher / AP

Polling stations across the country have seen record-breaking turnout from voters in this election, with more than 78 million people casting ballots early, including more than 40 million who voted in person.

Trump was photographed with former first lady Melania Trump on Election Day, after they voted at the Morton and Barbara Mandel Recreation Center in Palm Beach, Florida.

Trump wins the presidency

Evan Vucci / AP

Trump defeated Harris to become the 47th president of the United States, CBS News projected early Wednesday morning. He received support on Election Day from multiple battleground states, which would have been vital to either candidate in order to win.

“I want to thank the American people for the extraordinary honor of being elected your 47th president and your 45th president,” Trump said at his election headquarters in Florida on Wednesday, declaring victory. “And every citizen, I will fight for you, for your family and for your future. Every single day, I will be fighting for you with every breath in my body.”

CBS News

Considering a home equity loan now? Why you should open one before the end of 2024

Getty Images

There are always ways to borrow money, some more cost-effective than others. But in recent years, only one has remained relatively cheap: home equity. As inflation soared and rates on credit cards and personal loans surged alongside it, home equity loans and home equity lines of credit (HELOCs) remained relatively inexpensive. While not immune from this rising trend, they stayed relatively low thanks to the home in question serving as collateral. And now, with inflation significantly lower than it was and with a cut to the federal funds rate issued in September and another poised to be issued this week, home equity loans are becoming even more affordable for borrowers.

But an interest rate that’s lower than most popular alternatives isn’t the only timely benefit right now. There’s another, arguably equally beneficial feature for borrowers, one that could negate much of the concern surrounding rates on these products. That said, borrowers will need to act promptly to exploit this opportunity. Below, we’ll explain why, specifically, it’s worth opening a home equity loan before the end of 2024.

Start by seeing what home equity loan rate you’re eligible for here.

Why you should open a home equity loan before the end of 2024

There are just under eight weeks left in 2024. Considering that the amount of time it takes to have your home equity disbursed varies by lender (it can take a few weeks or even months), the window of opportunity to utilize your home equity loan this year is closing. Here’s why that matters: If you use a home equity loan for IRS-eligible home repairs and renovations, you’ll be able to deduct the interest paid on the loan when you file your taxes in the spring.

“Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy, build, or substantially improve the taxpayer’s home that secures the loan,” the IRS tells taxpayers online. “The loan must be secured by the taxpayer’s main home or second home (qualified residence), and meet other requirements.

“Generally, you can deduct the home mortgage interest and points reported to you on Form 1098 on Schedule A (Form 1040), line 8a,” the IRS explains. “However, any interest showing in box 1 of Form 1098 from a home equity loan, or a line of credit or credit card loan secured by the property, is not deductible if the proceeds were not used to buy, build, or substantially improve a qualified home.”

So if you’re planning on using your home for these reasons (a financial advisor or accountant can delve into exactly what qualifies), then you can add a potentially significant deduction into your taxes before filing next April. But if you wait much longer, you may not even get your funds until January. Or, if you get it before then, the amount you utilize this year will do little to alleviate your overall 2024 tax burden. For all of these reasons, then, if you’re planning on completing home projects – and want to use your home equity to do it – it makes sense to open a home equity loan now, before December 31, 2024.

Get started with a home equity loan now.

The bottom line

If you’re looking for an additional tax deduction and are in the process of finalizing financing for some select home projects, it makes sense to take out a home equity loan now, before the end of the year. But a HELOC will also qualify for the same tax benefits, should you prefer the features of a revolving line of credit versus the lump sum the home equity loan offers. Regardless of which option you choose, however, it’s important to act promptly and strategically. And as your home functions as collateral in these unique borrowing scenarios, you should only withdraw as much as you can afford to repay to avoid losing your home.

CBS News

Why Trump’s win could spur retailers to push up prices

As President-elect Donald Trump readies to return to the Oval Office, retailers that depend on foreign suppliers are prepared to pass along the cost of his proposed import tariffs to consumers, who can expect to pay more for products, from toys to auto parts.

Americans stand to lose between $46 billion and $78 billion in spending power each year on products including apparel, toys, furniture, household appliances, footwear and travel goods due to the new tariffs, the National Retail Federation stated in findings released Monday.

“Retailers rely heavily on imported products and manufacturing components so that they can offer their customers a variety of products at affordable prices,” NRF Vice President of Supply Chain and Customs Policy Jonathan Gold said. “A tariff is a tax paid by the U.S. importer, not a foreign country or the exporter. This tax ultimately comes out of consumers’ pockets through higher prices.”

For example, a $40 toaster oven would retail for $48 to $52 after the tariffs, while a $50 pair of running shoes would jump to to $59 to $64, according to the industry trade group. A $2,000 mattress and box spring set would cost $2,128 to $2,190, the NRF noted.

In his first term, the Trump administration imposed tariffs of up to 25% on more than $360 billion in products from China. President Joe Biden’s White House kept most of those tariffs and added more onto goods including Chinese electric cars and microchips.

Now, the former president has said he plans to impose a 60% tax on goods from China and a 10% to 20% fee on all of the $3 trillion in foreign goods the United States imports annually.

The broad-based tariffs would reignite inflation, as they’d mostly be paid by U.S. consumers, Treasury Secretary Janet Yellen has warned, offering a general view shared by other economists.

“A consistent theoretical and empirical finding in economics is that domestic consumers and domestic firms bear the burden of a tariff, not the foreign country,” the nonpartisan Budget Lab at Yale University stated in an analysis published in mid October.

Trump has repeatedly contended that foreign companies would foot the bill, telling a gathering last month at the Economic Club of Chicago that “the countries will pay” the tariffs, or taxes on imported goods. In reality, American importers pay the tariffs to the U.S. Customs and Border Protection agency when their goods cross the border.

“These policy steps would amount to regressive tax cuts, only partially paid for by regressive tax increases,” and cost a typical middle-income household about $1,700 in increased taxes a year,” according to economists at the Peterson Institute for International Economics. The proposed tariffs would shift tax burdens from the well-off to lower-income Americans, the nonprofit stated in a policy brief published in August.

Harvard professor and former Treasury Secretary Lawrence Summers questioned the wisdom of taxing imports, noting the potential impact on purchasing gifts for children. “For parents, we’re coming up on the holiday season and most of our toys are imported from China,” Summers tweeted on Thanksgiving Day.

Trump has argued that tariffs compel American companies to make goods on U.S. soil rather than purchasing from foreign suppliers.

But companies including auto-parts supplier AutoZone have other plans.

“If we get tariffs, we will pass those tariff costs back to the consumer,” Philip Daniele, CEO of AutoZone, told an earnings call in late September. “We’ll generally raise prices ahead of — we know what the tariffs will be — we generally raise prices ahead of that,” Daniele said.

Asked how he viewed the impact of inflation and tariffs on his business, Daniele stated that “historically, the industry sees 3%-5% inflation in average ticket and 1%-3% decline in transactions.”

Major suppliers to AutoZone include companies based in China, India and Germany, the Memphis, Tennessee-based company said in a June press release.

Stanley Black & Decker CEO Donald Allan Jr. last week said his tool-producing company has been planning for the possibility of a “new tariff regime” since the spring. “Obviously, coming out of the gate, there would be price increases associated with tariffs that we [would] put into the market.”

Allan downplayed the idea of moving manufacturing back to the U.S., saying it would not be cost-effective.

The company’s options could include “moving production and aspects of the supply chain to different parts of the world,” including from China to other parts of Asia and possibly Mexico, the executive said.

Such a shift has already been made by Shelton, Connecticut-based Acme United, which now has its Westcott brand products like rulers made in Thailand and the Philippines, avoiding the tariffs targeting China, CEO Walter Johnsen said in an earnings call.

Acme has also switched production of certain medical products to India, Egypt and U.S. plants in Florida, North Carolina and Washington state, the executive said.

Businesses have also stocked up, placing bigger-than-usual import orders ahead of new tariffs taking hold, as the U.S. imported 11% more Chinese products in July and August than they did during the same two-month period a year ago, according to the Census Bureau.