CBS News

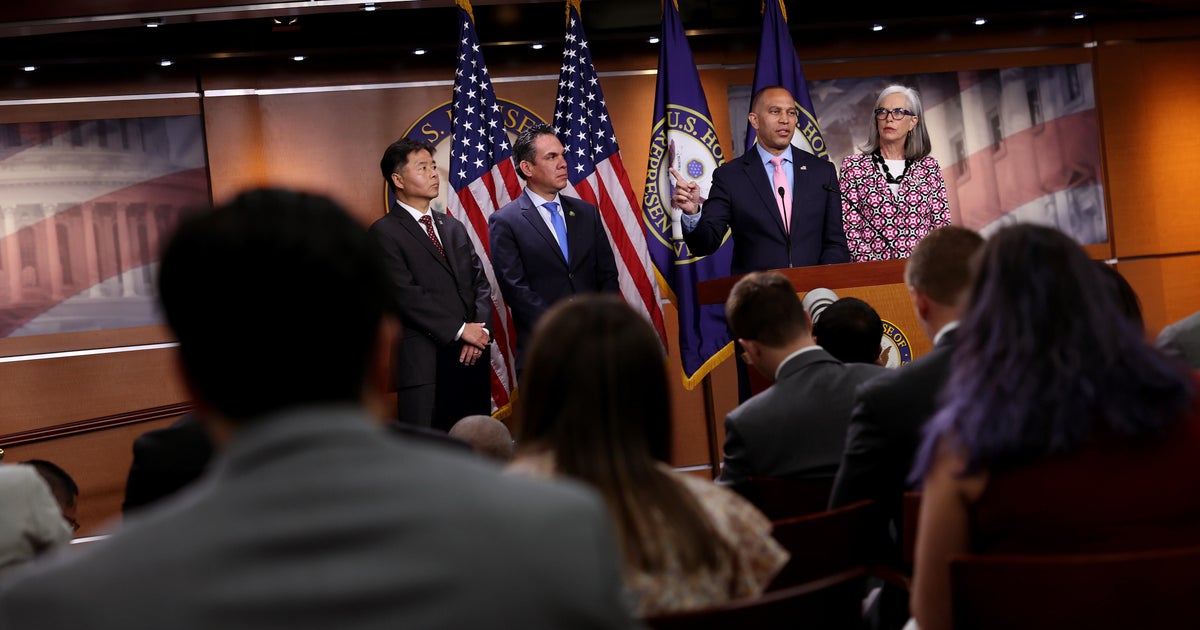

Hakeem Jeffries elected House Democratic leader as GOP is set to retain control of lower chamber

Washington — House Minority Leader Hakeem Jeffries was elected Tuesday to lead Democrats for another two years in the minority despite the party failing to flip control of the lower chamber in the 2024 election.

Democrats are holding their leadership elections on Tuesday as the party seeks to keep its leadership intact as it reels from the bruising losses in the 2024 elections.

Democratic caucus chair Rep. Pete Aguilar of California was reelected Tuesday morning, and House Minority Whip Katherine Clark of Massachusetts is also expected to continue in her role in the 119th Congress, beginning in January.

Still, one race was injected with some uncertainty, as Rep. Jasmine Crockett of Texas launched an eleventh-hour challenge against Rep. Debbie Dingell of Michigan for chair of Democratic Policy and Communications Committee. Dingell was still viewed as the favorite heading into Tuesday’s elections.

Jeffries made history in 2023 when he became the first Black lawmaker to lead a party in Congress, succeeding former House Speaker Nancy Pelosi as the top Democrat in the lower chamber. He was set to again make history as the first Black speaker had Democrats gained control of the House.

Kevin Dietsch/Getty Images

Heading into Election Day, Democrats needed a net gain of four seats to win the majority. Though Democrats won more than a handful of Republican-held seats in this month’s election, they lost just as many. The party also suffered the loss of the Senate and the White House. As House Democrats conduct the leadership elections Tuesday, they’re still reeling from the results — and reckoning with the path forward.

Republicans are expected to have a narrow majority in the next Congress. President-elect Donald Trump’s selection of several House members to serve in his administration will also temporarily squeeze the majority even further until those seats are filled in special elections.

Jeffries, in an interview with NPR last week, said the narrow margins and divisions among House Republicans have effectively made Democrats the majority in several instances.

“Democrats, because of the closeness of the margins, have effectively governed in the majority, though we are in the minority. And the same dynamic will exist as we move forward,” Jeffries said, pointing to a number of votes to avoid government shutdowns over the past two years in which Democrats provided a majority of the votes.

House Speaker Mike Johnson, a Louisiana Republican, said last week that he has “begged and pleaded” with Trump to stop poaching House members for his administration.

Republicans held their leadership elections last week, backing Johnson for another term as speaker. Johnson expressed confidence that he will win the speakership in the first round of voting on the House floor in January.

CBS News

Will enrolling in a credit card debt management program hurt your credit?

Getty Images

With average credit card interest rates recently surpassing 23% and retail credit card rates sitting above 30% on average, many Americans have found themselves trapped in a cycle of minimum payments and mounting balances. That can be a tough road to navigate in any economic environment, but in today’s landscape, where prices on essentials continue to climb and household budgets remain stretched, it can be even more difficult to conquer. As a result, more cardholders are maxing out their credit cards and becoming delinquent on their credit card payments.

Late payments and maxed-out credit cards can have a real impact on your credit and your financial health, so if you’re facing this issue, it’s important to find ways to get relief. Fortunately, there are many potential debt relief strategies to consider, including credit card debt management programs. These programs were created to help cardholders consolidate multiple credit card payments into a single monthly payment while potentially securing lower interest rates and fees. The appeal is obvious: simplified payments, reduced rates and a clear path to becoming debt-free.

However, some cardholders may be hesitant to enroll in one of these programs due to concerns about the impact it could have on their credit. But will enrolling in a credit card debt management program actually hurt your credit? The answer isn’t entirely straightforward.

Explore the debt relief options available to you now.

Will enrolling in a credit card debt management program hurt your credit?

Enrolling in a debt management program can have both positive and negative effects on your credit score. One of the immediate impacts is that your creditors may add a notation to your credit report indicating that you are participating in a debt management program. While this notation itself doesn’t lower your score, it could raise red flags for lenders, as it signals that you’re receiving help to manage your debts.

Another consideration is how the program affects your credit utilization ratio and credit age. Your creditors will likely close your credit card accounts when you enter the program. This action can negatively impact your credit score in two ways. First, it reduces your available credit, which increases your credit utilization ratio. Second, it can slightly shorten your average credit age if these are long-standing accounts, which could lower your score temporarily.

However, the program’s positive effects often outweigh these initial setbacks. As you make consistent payments through the program, your payment history – which accounts for 35% of your FICO score – strengthens. As your balances decrease, your credit utilization also improves, positively impacting another 30% of your score.

It’s also worth noting that debt management programs don’t carry the same negative credit implications as more drastic measures like bankruptcy or debt settlement. While your credit report will show that you’re paying through a debt management program, this notation itself doesn’t factor into your credit score calculations.

So, the short answer is that ultimately, the effect a debt management plan has on your credit depends heavily on your starting point. If your credit score is already suffering due to late payments or high balances, a debt management program may help stabilize and eventually improve your credit over time. If your score is in good shape but you’re struggling with mounting debt, the short-term impact of closing accounts and creditor notations might bring a noticeable dip in your score.

Tackle your expensive credit card debt today.

What other credit card debt relief options are worth considering?

Debt management programs are just one tool in the debt relief toolbox. Depending on your financial situation, you might want to consider these other alternatives:

- Debt consolidation: With debt consolidation, you take out a single loan to pay off all your credit card balances. This simplifies your payments and can lower your interest rate if you qualify for a competitive loan. However, you’ll need good credit to access the best rates.

- Balance transfer: If you have a solid credit score, a balance transfer card with an introductory 0% APR period can help you save on interest and pay down debt faster. Just be cautious of transfer fees and ensure you can pay off the balance before the promotional period ends.

- Debt settlement: You can contact your creditors, either with the help of a debt relief company or on your own, to try and negotiate a settlement for less than you owe. While this requires negotiation skills, it’s a more direct approach that can yield favorable results.

- Bankruptcy: If you’re facing overwhelming debt with no feasible way to repay it, bankruptcy may provide a clean slate. However, it comes with significant long-term consequences for your credit and should be a last resort.

The bottom line

Enrolling in a credit card debt management program can impact your credit in both positive and negative ways. While the immediate effects — such as account closures and creditor notations — might cause a temporary dip in your score, the long-term benefits of consistent payments and reduced interest rates can outweigh these drawbacks. For many, the opportunity to regain control over their finances and work toward becoming debt-free is worth the trade-off.

CBS News

“Gladiator II” actors on preparing for the highly anticipated sequel, movie’s legacy

It’s been almost 25 years since the movie “Gladiator” took the world by storm.

“I saw it in the movie theater when it came out,” said actor Pedro Pascal, who plays the Roman general Marcus Acacius in “Gladiators II.” “I saw it twice.”

In “Gladiator II,” the highly anticipated sequel that comes out on Friday, Rome is led by two emperor brothers. Caracala is played by Joseph Quinn, who was just 6 years old when the original “Gladiator” came out.

“I think there was a legacy from the first film that demanded reverence and respect,” Quinn told “CBS Mornings.”

To prepare for the film and understand his environment better, Quinn spent two weeks wandering around Rome.

“I think it’s just something so humbling about Rome, and inspiring, and the fact that this civilization that was so ahead of its time collapsed, it’s kind of a little haunting,” he said.

For the actors who had fighting roles in the movie, they said training was grueling as not all of it was performed by stunt actors.

Caracala’s co-emperor in the movie is his brother Geta, played by Fred Hechinger, who said he always wanted to work for director Ridley Scott, who also directed the original movie.

“I remember finding out that the same person made all of these different movies that I love. ‘Thelma & Louise’ and ‘Alien’ were made by the same person, and it kind of expanded my sense of what a director can be,” Hechinger said.

Unlike others, Scott will shoot certain sequences from start to finish without cutting. On some movie sets, actors have to react to things off camera that aren’t really happening, but not with Scott.

“The action was all there and it’s all off camera. Normally, under any other circumstance, you would be looking at a tennis ball or two pieces of tape as a cross for your eyeline and imagining what’s happening, but no, Ridley will place that in front of you and have it play,” said Pascal. “It’s like nothing I’ve ever experienced before. And it’s likely not something I’ll ever experience again.”

“Gladiator II” opens in theaters Nov. 22.

CBS News

Trump assassination task force issues subpoenas for ATF testimony

WASHINGTON, D.C. (KDKA) — The House task force investigating the July 13 assassination attempt on President-elect Donald Trump issued subpoenas on Monday to the Bureau of Alcohol, Tobacco, Firearms and Explosives for testimony from two ATF employees regarding the response to the Butler, Pennsylvania, shooting.

The subpoenas follow letters from the task force’s chairman, Rep. Mike Kelly, Republican of Pennsylvania, and Ranking Member Jason Crow, Democrat of Colorado, seeking documents and testimony on Oct. 3 and Nov. 6.

A shooter opened fire at Trump’s July 13th rally in Butler, wounding Trump when a bullet grazed his ear. A rally-goer was killed and two others were wounded before Secret Service snipers shot and killed the gunman, later identified as a 20-year-old Pennsylvania man. Since then, Trump won the presidential election and will be headed to the White House in January.

In a release from Kelly’s office, the task force said the ATF had not produced any requested documents or made any personnel available for interviews with the task force, and the ATF made its first set of documents available less than an hour after served the subpoenas for depositions.

One of the two subpoenas for depositions was issued to an agent who participated in the agency’s response to the shooting in Butler, the release said. The other is for testimony from a supervisory agent, according to the media release.

Excerpts from Kelly’s letters to the two ATF employees stated that the task force “specifically outlined seventeen requests for document production, even going so far as to note which were the priority items. In addition, the Task Force identified three categories of requests for transcribed interviews with relevant ATF agents.”

The bipartisan House task force said last month that the incident was “preventable,” detailing in a report that there were communication and planning shortcomings.