CBS News

Cucumbers from 3 companies recalled as salmonella sickens 68 people in 19 states

Federal officials are urging people not to eat recalled cucumbers, as well as salads and wraps that could contain the product, amid an investigation into an outbreak of salmonella that has sickened at least 68 people in 19 U.S. states and sent 18 to the hospital.

Three companies have recalled cucumbers grown by Agrotato, S.A. de C.V. in Sonora, Mexico, and sold by importers between October 12 and November 26, according to the Food and Drug Administration.

SunFed Produce, Baloian Farms of Arizona Co. and Russ Davis Wholesale have all recalled cucumbers in recent days, with the latter also recalling multiple products containing them, including ready-to-eat salads and wraps, the FDA noted.

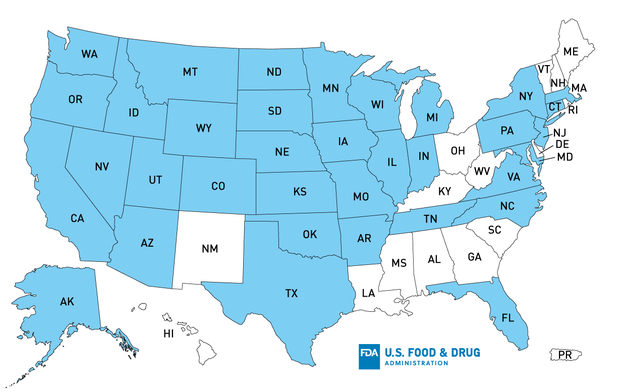

The recalled cucumbers were sold in Alaska, Arkansas, Arizona, California, Colorado, Connecticut, Florida, Idaho, Illinois, Indiana, Iowa, Kansas, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, New Jersey, New York, North Carolina, North Dakota, Oklahoma, Oregon, Pennsylvania, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin and Wyoming.

Food and Drug Administration

Consumers should check their refrigerators and freezers for recalled cucumbers from SunFed Produce, Baloian Farms and Russ Davis. The produce may have a sticker that reads “SunFed Mexico” or are packaged in a clear PamPak branded bag of six individual cucumbers with universal product code 8 2540107010 6, the FDA stated.

Products containing the recalled cucumbers include Crazy Fresh Garden Salad with Ranch Dressing, Quick & Easy Garden Salad with Ranch Dressing, Crazy Fresh Turkey Havarti Wrap, Quick & Easy Bacon Avocado Wrap, Crazy Fresh Bacon Avocado Wrap and Kowalski’s Market Garden Salad.

People who purchased whole, fresh American/slicer cucumbers on or after October 12 and who aren’t sure of their origin should ask the seller if they are part of the recall or throw them out.

Most people infected with salmonella experience diarrhea, fever and stomach cramps, with symptoms usually starting six hours to six days after swallowing the bacteria, according to the Centers for Disease Control and Prevention. Although most recover without treatment within a week, some people, especially the young and the old, may experience more severe illnesses that require treatment or hospitalization.

CBS News

Bitcoin price reaches $100,000-mark for first time ever

Bitcoin has topped the $100,000 mark as a massive rally in the world’s most popular cryptocurrency sparked by the election of Donald Trump rolls on.

The milestone comes just hours after the president-elect signaled a lighter regulatory approach to the crypto industry with his choice of Paul Atkins to be the next chair the Securities and Exchange Commission.

Trump said Wednesday that he intends to nominate Atkins, a former SEC commissioner during the presidency of George W. Bush. In the years since leaving the agency, Atkins has made the case against too much market regulation.

Bitcoin has soared to unprecedented heights since Trump won the election Nov. 5. The cryptocurrency has climbed dramatically from $69,374 on Election Day and rose as high as $101,512 Wednesday, just two years after dropping below $17,000 following the collapse of crypto exchange FTX.

How long bitcoin will stay above the coveted $100,000 mark is uncertain. As with everything in the volatile cryptoverse, the future is impossible to predict. And while some are bullish on future gains, other experts continue to warn of investment risks.

Current SEC chair Gary Gensler, appointed by President Biden, has been aggressive in his oversight of the crypto industry. Speaking at the Bitcoin 2024 conference in July, Trump vowed to fire Gensler if elected, prompting a standing ovation. Gensler has since said he will step down Jan. 20 when Trump takes office, even though his five-year term runs through 2026.

CBS News

Trump to nominate Paul Atkins, a cryptocurrency advocate, for SEC chair

President-elect Donald Trump announced Wednesday that he intends to nominate cryptocurrency advocate Paul Atkins to chair the Securities and Exchange Commission.

Trump said Atkins, the CEO of Patomak Partners and a former SEC commissioner, was a “proven leader for common sense regulations.” In the years since leaving the SEC, Atkins has made the case against too much market regulation.

“He believes in the promise of robust, innovative capital markets that are responsive to the needs of Investors, & that provide capital to make our Economy the best in the World. He also recognizes that digital assets & other innovations are crucial to Making America Greater than Ever Before,” Trump wrote on Truth Social.

The commission oversees U.S. securities markets and investments and is currently led by Gary Gensler, who has been leading the U.S. government’s crackdown on the crypto industry. Gensler, who was nominated by President Joe Biden, announced last month that he would be stepping down from his post on the day that Trump is inaugurated — Jan. 20, 2025.

Trump, once a crypto skeptic, had pledged to make the U.S. “the crypto capital of the planet” and create a “strategic reserve” of bitcoin. Money has poured into crypto assets since he won. Bitcoin, the largest cryptocurrency, is now above $95,000. And shares in crypto platform Coinbase have surged more than 70% since the election.

Paul Grewal, chief legal officer of Coinbase, congratulated Atkins in a post on X.

“We appreciate his commitment to balance in regulating U.S. securities markets and look forward to his fresh leadership at (the SEC),” Grewal wrote. “It’s sorely needed and cannot come a day too soon.”

Congressman Brad Sherman, a California Democrat and a senior member of the House Financial Services Committee, said he worries Atkins would not sufficiently regulate cryptocurrencies as SEC chair.

“He’d probably take the position that no cryptocurrency is a security, and hence no exchange that deals with crypto is a securities exchange,” Sherman said. “The opportunity to defraud investors would be there in a very significant way.”

Atkins began his career as a lawyer and has a long history working in the financial markets sector, both in government and private practice. In the 1990s, he worked on the staffs of two former SEC chairmen, Richard C. Breeden and Arthur Levitt.

His work as an SEC commissioner started in 2002, a time when the fallout from corporate scandals at Enron and WorldCom had turned up the heat on Wall Street and its government regulators.

Atkins was widely considered the most conservative member of the SEC during his tenure at the agency and was known to have a strong free-market bent. As a commissioner, he called for greater transparency in and analysis of the costs and benefits of new SEC rules.

He also emphasized investor education and increased enforcement efforts against those who steal from investors over the internet, manipulate markets, engage in Ponzi schemes and other types of fraud.

At the same time, Atkins objected to stiff penalties imposed on companies accused of fraudulent conduct, contending that they did not deter crime. He caused a stir in the summer of 2006 when he said the practice of granting stock options to executives before the disclosure of news that was certain to increase the share price did not constitute insider trading.

U.S. Rep. Patrick McHenry, a North Carolina Republican and chairman of the House Financial Services Committee, said Atkins has the experience needed to “restore faith in the SEC.”

“I’m confident his leadership will lead to clarity for the digital asset ecosystem and ensure U.S. capital markets remain the envy of the world,” McHenry posted on X.

Atkins already has some experience working for Trump. During Trump’s first term, Atkins was a member of the President’s Strategic and Policy Forum, an advisory group of more than a dozen CEOs and business leaders who offered input on how to create jobs and speed economic growth.

In 2017, Atkins joined the Token Alliance, a cryptocurrency advocacy organization.

Crypto industry players welcomed Trump’s victory in the hopes that he would push through legislative and regulatory changes that they’ve long lobbied for.

Trump himself has launched World Liberty Financial, a new venture with family members to trade cryptocurrencies.

CBS News

12/4: The Daily Report – CBS News

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.