CBS News

How to avoid ticket scams during concert and holiday show season

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

Continue Reading

CBS News

Wildfire prompts evacuations in Southern California

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

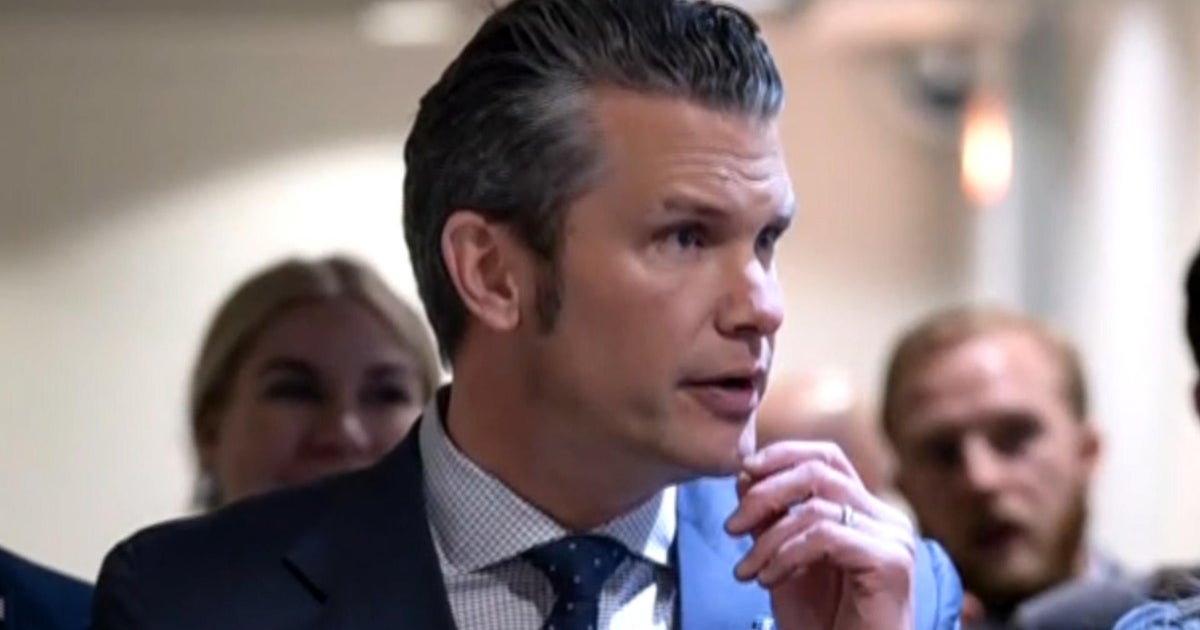

Hegseth faces questions about women’s role in the military

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Nurse makes pricey medical shirts for patients for free

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.