CBS News

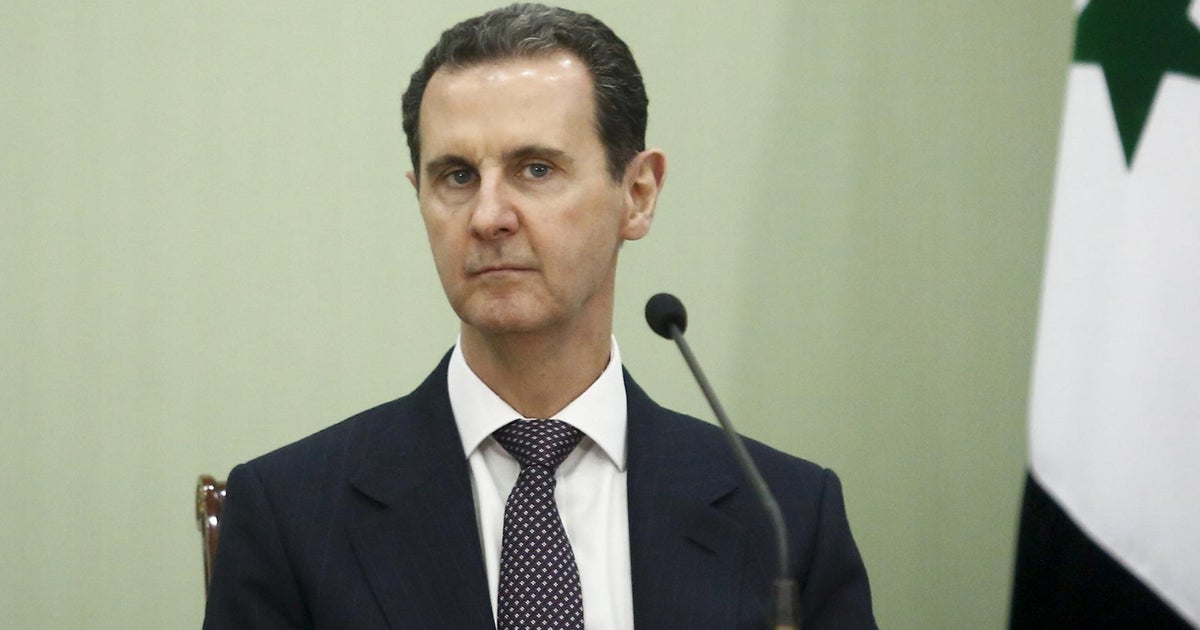

Israeli strikes destroy Syria’s weapons of war as ousted Assad laments country’s fall into “hands of terrorism”

Damascus — A CBS News team drove through a Syrian military airbase on the outskirts of capital city Damascus Monday, and the devastation caused by Israeli air strikes was abundantly clear. Israel has said it’s determined to destroy weapons and other military hardware that ousted dictator Bashar al-Assad and his father spent half of a century accumulating, before it can fall into the hands of extremists.

The Israeli military has pounded Syrian military infrastructure relentlessly since Assad fled to Russia earlier this month — forced out by a shock rebel offensive after a decade of civil war that had, until about two weeks ago, largely ground to an apparent stalemate.

The damage inflicted on Assad’s old war machine has been staggering. One strike overnight in the coastal city of Tartus, for instance, was so massive that the Syrian Observatory for Human Rights monitoring group quoted a scientist in Turkey as saying it had registered on the Richter scale as the equivalent of a category-3 earthquake.

Until Moscow’s ally Assad fled from Syria, Russia maintained its only major naval base outside of Russian territory in Tartus. Satellite imagery (below) showed most of the Russian ships disappearing from the Tartus port quickly after Assad fell, but the Russian Ministry of Defense said Monday that it was still figuring out what to do about its military hardware and personnel in the country, in talks with the country’s new de-facto rebel rulers.

Israel’s military, meanwhile, says it has laid waste to most of Assad’s heavy weapons and air defenses. In a statement on Monday, the Israel Defense Forces said that in recent days its fighter jets had “inflicted severe damage on Syria’s most strategic weapons: fighter jets and helicopters, Scud missiles, UAVs, cruise missiles, surface-to-sea precision-guided missiles, surface-to-air missiles, surface-to-surface missiles, radars, rockets, and more.”

The IDF said its strikes had destroyed “over 90% of the identified strategic surface-to-air missiles” of the ousted regime.

The lightning takeover of Syria one week ago by the rebel group Hayat Tahrir al Sham, or HTS, has also seen Israeli forces carry out a land incursion that stretches past the occupied Golan Heights region into a previously demilitarized buffer zone inside Syria.

Ahmed al-Sharaa, the head of HTS and Syria’s new de-facto leader, has criticized what he described as Israel’s “uncalculated military adventures,” and said he and his group — which, before publicly distancing itself from extremist ideology was an al-Qaeda affiliate — was more interested in state-building than opening another conflict with Israel.

Scott Peterson/Getty

The targeting of Syria’s military sites has also revealed deep neglect by Assad. Years of corruption and a decade of civil war had hollowed out the nation’s armed forces, contributing to his regime’s collapse. Much of the hardware left behind by his forces when they surrendered to the rebels or simply shed their uniforms and ran away is old and clearly lacking maintenance.

Assad’s office issued the first statement attributed to the deposed leader since he was forced to flee from his country, meanwhile. In it, he claims he never considered resigning nor fleeing, but that he took shelter in the Russian-run air base at Hmeimim as the rebels closed in, and when that facility came under a sustained drone attack, he says an evacuation was ordered on Dec. 8, the day after the HTS rebels took the capital Damascus.

He said he eventually left for Russia as there was nothing else he could do in Syria, lamenting the country’s fall “into the hands of terrorism.”

The statement was posted to the Syrian Presidency’s official channel on the Telegram messaging app, with a note saying it had been posted after several unsuccessful attempts to release it through Arabic and international media outlets. The statement was deleted relatively quickly from the Telegram channel, however, without any explanation, before reappearing there and on the presidency’s Facebook page.

ABDULAZIZ KETAZ/AFP/Getty

While the wider international community is still trying to figure out how to deal with HTS, which has said it will respect Syrians all of religions and appears determined to be viewed as a secular interim administration — though it has not said what will come next for the country after a three-month transitional period — Israel and the U.S. have remained focused largely on securing Assad’s stockpiled weapons.

For Israel, that has meant the most ferocious airstrikes carried out in Syria in years, and they continued on Monday, just over a week after Assad’s sudden departure.

Whoever does end up in control of Syria will inherit a military infrastructure largely in tatters. Judging by the IDF’s statement on Monday, claiming its strikes amounted to “a significant achievement for the Israeli Air Force’s superiority in the region,” that could be exactly as intended.

CBS News

Trump denounces Biden decision to let Ukraine fire American missiles toward Russia

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

TikTok asks Supreme Court to block ban as January deadline nears

Washington — TikTok and its parent company ByteDance have asked the Supreme Court to temporarily pause a law that would ban the app in the U.S. as soon as Jan. 19.

“A modest delay in enforcing the Act will create breathing room for this Court to conduct an orderly review and the new Administration to evaluate this matter — before this vital channel for Americans to communicate with their fellow citizens and the world is closed,” the emergency application said.

The move comes days after the U.S. Court of Appeals for the District of Columbia Circuit denied TikTok’s bid to delay the ban from taking effect pending a Supreme Court review.

TikTok and ByteDance asked the Supreme Court to make a decision on its request to delay the law by Jan. 6 so they can “coordinate with their service providers to perform the complex task of shutting down the TikTok platform only in the United States” if the justices decline.

This is a developing story and will be updated.

CBS News

Home equity loan vs. mortgage refinance: Which will be better in 2025?

Getty Images

Homeowners have multiple ways to access their accumulated home equity. From home equity lines of credit (HELOCs) to reverse mortgages and home equity loans and mortgage refinancing, there’s likely a safe and effective way to borrow your home equity now, regardless of your financial circumstances. And with the average amount of home equity sitting around $320,000 now, there’s likely plenty to utilize, too.

Two of the more conventional options — home equity loans and mortgage refinancing — may be worth exploring now, going into 2025. But with the interest rate climate changing again, homeowners may be wondering which of these two will be better worth pursuing in the new year. Below, we’ll detail the considerations.

Start by seeing what home equity loan interest rate you could qualify for here.

Home equity loan vs. mortgage refinance: Which will be better in 2025?

Each homeowner’s financial needs and circumstances are unique. Here, then, is when a home equity loan may be more favorable in the new year (and when a mortgage refinance may be):

Why a home equity loan could be better in 2025

A home equity loan is likely to be better for the vast majority of homeowners in 2025 for a simple but powerful reason: They won’t need to give up their currently low mortgage interest rate to secure the extra financing. While home equity loan rates at 8.38% (on average) are higher than mortgage refinance rates at 6.80% for a 30-year refinance, home equity loans will allow you to keep your current mortgage rate. These loans function separately from your existing mortgage repayment schedule. Because of this, you don’t need to use your current mortgage lender to secure a home equity loan. Instead, shop around amid competitors to see what other offers are available.

The primary reason for your home equity use is also important. While a mortgage refinance or home equity loan may be interchangeable in terms of the benefits it can offer for some expenses, others, like home repairs and renovations, are better paid for with a home equity loan. That’s because the interest on the loan will be tax-deductible if used for eligible home repairs. For all of these reasons, then, a home equity loan may be the better way to utilize your home’s value in 2025.

Get started with a home equity loan online today.

Why a mortgage refinance could be better in 2025

While home equity loans may be advantageous for the majority of homeowners next year, they may be quite right for all. If you purchased a home in 2023, for example, when mortgage interest rates were approaching 8%, a refinance can be the better way to put some extra money back into your pocket now.

With refinance rates on a 30-year mortgage at 6.80% and 6.15% for 15-year refinance loans, you could wind up saving a substantial sum by refinancing into the lower rate. The conventional wisdom is that a refinance of a full percentage point below your current one is worth pursuing. So, if you have a rate between 7.15% and 7.80% now, this may be the better option. Not only will you save on your monthly payments, but you won’t need to worry about making any repayments (plus interest) back to the lender like you would with a home equity loan. Again, this option isn’t for all homeowners or even most right now. But a select few could see some real benefits if they fall into this category.

See how much you could potentially save with a refinance loan here.

The bottom line

When trying to determine the best home equity borrowing path for 2025, your personal financial needs will come first. For many, a home equity loan, with its ability to offer a low-rate borrowing option without having to exchange an existing low mortgage interest rate, may be beneficial. Others, however, may seem more substantial relief (and lower payments) by refinancing to today’s lower mortgage interest rates, even if they’re still higher than what was available in recent years. Close exploration of both options is critical to ensure that any equity or loan terms adjusted for your current situation are financially tolerable, both now and in the future.