CBS News

Student loans for spring 2024: Everything borrowers should know

joan corominas/Getty Images

As 2023 comes to an end, many people are reviewing their finances. For some families, that includes looking at student loans for the upcoming spring 2024 semester. Borrowers may be debating issues like whether to take out federal student loans or private student loans for 2024 as well as trying to figure out issues like how and when to apply for student loans.

In this article, we’ll break down the important differences between federal vs. private student loans and when you might use one over the other.

Student loans for spring 2024: Everything borrowers should know

To understand which student loan is best for you it first helps to understand the differences between loan types.

What are federal student loans and how do they work?

Federal student loans can be a number of different types of fixed-rate loans provided by the federal government, depending on factors such as your financial situation and type of degree you’re getting.

For example, undergraduate students can get either Direct Subsidized Loans or Direct Unsubsidized Loans. Students who meet financial need requirements can get Direct Subsidized Loans, which cost less due to the Department of Education helping out with interest payments.

To apply for federal student loans, you need to submit your Free Application for Federal Student Aid (FAFSA) form. Even if you don’t qualify for financial aid in terms of lowering your financial responsibility for tuition, filling out FAFSA is how you qualify for other types of federal student loans. The deadline for the 2023-2024 academic year is June 30, 2024, though your state and/or college may have an earlier deadline, and it’s generally better to apply sooner than later if you haven’t already.

“With federal loans, even if you do not need the full amount you qualify for, you may want to consider taking it. Congress resets interest rates every June and there is a good chance we’ll see another increase in student loan rates,” says Joseph Reinke, CFA, founder of FitBUX.

“We are seeing a number of students have to take out credit card debt because they underestimated living expenses due to inflation. Therefore, taking a little extra in student loan debt now would be preferable to potentially having credit card debt. If you end up not needing the money, you have 120 days to refund the amount not needed back to the government and you are not charged origination fees or interest during that time,” adds Reinke.

What are private student loans are and how do they work?

Private student loans are provided by financial institutions like banks, as opposed to the federal government. These can similarly be used for education-related expenses. Applying for and qualifying for private student loans, however, differs from the federal student loan process.

“Private student loans are treated like other loans, such as mortgages and car loans. Credit scores, income, length of employment and other factors all matter here, whereas they generally don’t for federal loans,” explains Jack Wang, wealth advisor/college financial aid advisor at Innovative Advisory Group.

Private student loans typically do not have application deadlines the way that federal student loans do, but you likely want to check with your school about payment deadlines to make sure you have the funds to pay for the spring semester on time.

Typically, private student loans have variable interest rates, while federal student loans have fixed interest rates once you take them out. Interest rates and terms can vary significantly among different private student loan companies. Rates also depend on factors like your credit score and how much you want to borrow.

“In the past, I’ve seen some people try to ‘strategically’ take private variable rate loans with the idea that they would refinance post graduation to a fixed rate private loan. However, I do not recommend that. As those individuals found out, rates can go up, and when you go to refinance, the fixed rates may be a lot higher,” says Reinke.

You can easily find a private student loan online here now.

When federal student loans may be better

Federal student loans are often used first by borrowers, as these loans typically have lower interest rates and better repayment terms.

“Federal loans have more flexible repayment options than private student loans. For example, you can choose to use income-driven repayment plans instead of doing a traditional principal and interest loan. Therefore, they should be taken out first,” says Reinke.

Plus, the fixed rate of federal student loans gives you more certainty over costs.

“Private loans tend to be variable which means you can’t predict the cost post graduation and they can become very expensive,” says Reinke. FitBUX data shows that less than 5% of the time private loans are cheaper than federal loans in terms of having lower interest rates, he adds.

Federal student loans can also be preferable for those looking to adjust their repayment plans.

“People tend to focus on forgiveness, especially Public Service Loan Forgiveness, but the ability to change repayment plans at any time, for any reason, to provide financial flexibility is probably the most overlooked feature of federal loans,” says Wang.

When private student loans may be better

While federal loans should often be used first, sometimes students need to borrow more than what they receive from the federal government. For example, if your parents are unable to obtain what’s known as a Direct PLUS Loan, first-year undergraduates are limited to a maximum of $9,500 in federal student loans. So, if that’s the case for the spring 2024 semester, you might turn to private student loans as a supplement.

In some cases, private student loans can also be better than federal student loans, even if you or your parents qualify for enough funds from the federal government.

“Private loans can be preferable if the borrower/co-borrower qualifies for a lower interest rate than the rate on the federal loan. It can also be preferable If the intent is to have the student take over the loan eventually, via co-signer release, without having to refinance the loan later,” says Wang.

Still, it’s important to note that the variable rate of private student loans can create risk, as even if it’s cheaper now, it could get more expensive later on. But it’s possible that if you find a lower interest rate with a private lender you could make it work to your advantage by quickly paying off the loan.

“If you know 100% that you are paying off your loans post graduation and not using an income-driven repayment plan, and you happen to qualify for a lower rate, then you can use a private loan,” says Reinke.

Also, consider what your post-graduation employment will look like. “Private loans tend to be better for those who have stable incomes and finances, and who work and stay in the private sector so loan forgiveness is not a factor,” adds Wang.

Learn more about your private student loan options.

Know what you can borrow

Whether you choose federal or private student loans, or a combination of the two, it’s important to do your research. Your school’s financial aid office can be an important resource in terms of helping you apply for and qualify for student loans and you should also consider clarifying with them how much you can borrow.

“Ask your financial aid office what the certified amount is that you can take,” says Reinke, though note that some schools use a different term. “The certified amount is the dollar amount the university estimates tuition and cost of living will cost. They submit this number to the federal government. That is the most you can borrow from the federal government and private loans combined. Therefore, you should know that number so you can budget accordingly, because if you go over, you no longer have federal or private student loan options until the next year.”

Knowing this number is important because if you can’t borrow enough, you might need to make some adjustments, like finding more affordable housing while in school or working part time to avoid credit card debt. “We’ve seen this be a major problem for people over the past year because the certified amounts aren’t keeping up with real actual inflation. Therefore, know what this is ahead of time so you can plan,” adds Reinke.

CBS News

Rep. Mike Turner says all “candidates need to deescalate” after Trump assassination attempts

Rep. Mike Turner, an Ohio Republican who chairs the House Intelligence Committee, responded Sunday to Eric Trump’s implication that his father’s Democratic opponents were responsible for the attempts on former President Trump’s life, saying the innuendo was “of course” inaccurate but political candidates on both sides of the aisle “need to deescalate” their rhetoric.

“No, of course not,” Turner said in his latest appearance on “Face the Nation with Margaret Brennan,” after being asked whether he believes there was truth to claims made by the former president, his son Eric, and his vice presidential running mate, Sen. JD Vance, at a rally where each either implied or suggested Democrats tried to kill him.

Trump returned Saturday to Butler, Pennsylvania, to speak to supporters gathered at the Butler Farm Show fairgrounds, the site of the July 13 assassination attempt against him. A gunman facing Trump on the podium at that rally opened fire into the crowd, grazing Trump’s ear, killing one attendee and injuring two others, according to authorities. The gunman was killed by a Secret Service sniper, officials said.

Another apparent assassination attempt happened in September when a suspect pointed a gun in Trump’s direction on the Florida course where he was playing golf. The FBI has opened probes into both incidents.

CBS News

Trump, his son and Vance all acknowledged the assassination attempt in Butler at Saturday’s campaign event.

“Over the past eight years, those who want to stop us from achieving this future have slandered me impeached me indicted me tried to throw me off the ballot and, who knows, maybe even tried to kill me,” said the former president, while Eric Trump claimed his father’s political opponents “tried to kill him, and it’s because the Democratic party, they can’t do anything right.”

Vance, in his remarks, addressed Trump’s Democratic challenger in the presidential race, Vice President Kamala Harris, and suggested that the Republican nominee “took a bullet for democracy.”

Brennan asked Turner: “You don’t mean to imply here anything that would suggest Eric Trump’s allegations that Democrats are trying to kill him?”

“No, of course not,” Turner responded. “But I do think that Vice President Harris needs to actively state and acknowledge that her administration is saying a foreign power, which would be an act of war, is actively trying to kill her opponent.”

The attempts on Trump’s life came after a citizen of Pakistan with ties to Iran was arrested and charged with allegedly planning a murder-for-hire scheme targeting Trump, among others. Although the timing of the charges coincided with the first attempt, there was no indication that the two incidents were related.

Turner criticized Harris for what he viewed as a failure to openly condemn the alleged plot.

“I think there’s certainly a role for her to play and for the president to play in this, in both identifying that there are threats against Donald Trump that need to be acknowledged and responded to, to deter,” he said. “I think all the candidates need to de-escalate, certainly in their language.”

But the congressman did acknowledge that a Biden-Harris Justice Department official, Matthew Olsen, the head of the national security division, said the U.S. government has been “intensely tracking Iranian lethal plotting efforts targeting former and current U.S. government officials — and that includes the former president.”

“I would say that we are very concerned — gravely concerned — about Iranian plotting,” Olsen told CBS News in a recent interview.

CBS News

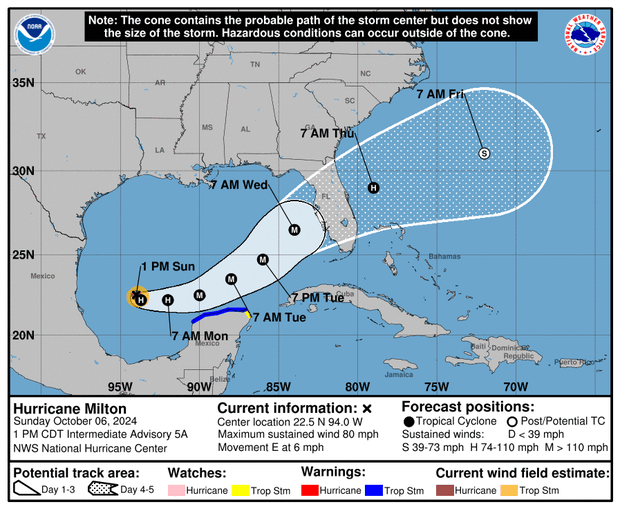

Maps show track of Hurricane Milton as forecasters predict landfall in Florida this week

Hurricane Milton rapidly intensified into a Category 1 storm on Sunday, and it has set its path on Florida’s Gulf Coast.

Forecasters predict Milton will make landfall around the Tampa Bay area on Wednesday, bringing with it upwards of 120 mph winds and drenching an area still reeling from Hurricane Helene.

As of 2 p.m. ET on Sunday, Milton was centered about 290 miles west-northwest of Progreso, Mexico, and about 815 miles west-southwest of Tampa. It had maximum sustained winds of nearly 80 mph and was inching north-northeast at 6 mph.

Path of Hurricane Milton

A map from the National Hurricane Center shows Milton continuing to strengthen into a major hurricane as it approaches Florida’s western coast.

“Milton is forecast to rapidly intensify during the next couple of days and become a major hurricane on Monday,” forecasters said.

NOAA/National Hurricane Center

The storm is expected to remain north of Mexico’s Yucatan peninsula, with heavy rainfall expected as Milton makes its way northeast toward Florida. Tropical storm watches are currently in effect from Celestun to Cancún, Mexico.

NOAA/National Hurricane Center

The hurricane center said hurricane and storm surge watches could be issued for parts of Florida later Sunday.

Florida officials prepare for more impact

Florida Gov. Ron DeSantis said Sunday that while it remains to be seen just where Milton will strike, it’s clear that Florida is going to be hit hard. “I don’t think there’s any scenario where we don’t have major impacts at this point,” he said.

“You have time to prepare — all day today, all day Monday, probably all day Tuesday to be sure your hurricane preparedness plan is in place,” the governor said. “If you’re on that west coast of Florida, barrier islands, just assume you’ll be asked to leave.”

NOAA via AP

DeSantis expanded his state of emergency declaration Sunday to 51 counties and said Floridians should prepare for more power outages and disruptions, making sure they have a week’s worth of food and water and are ready to hit the road.

The Federal Emergency Management Agency, meanwhile, coordinated with the governor and briefed President Biden Sunday on how it has staged lifesaving resources.

“I highly encourage you to evacuate” if you’re in an evacuation zone, said Kevin Guthrie, executive director of the Florida Division of Emergency Management. “We are preparing … for the largest evacuation that we have seen, most likely since 2017, Hurricane Irma. “

As many as 4,000 National Guard troops are helping state crews to remove debris, DeSantis said.

“All available state assets … are being marshaled to help remove debris,” DeSantis said. “We’re going 24-7 … it’s all hands on deck.”

CBS News

American and U.K. climbers rescued after 2 days stranded on Himalayan mountains in India

An American climber was rescued after she and another alpinist from the U.K. were stranded for two days at more than 20,000 feet in the Himalayan mountains.

Michelle Dvorak, 31, and Fay Manners, 37, went missing on Thursday after their equipment and food tumbled down a ravine while trekking up India’s Chaukhamba mountain, CBS News partner BBC reported.

The pair sent an emergency message but search and rescue teams were unable to find them.

INDIAN AIR FORCE/Handout via REUTERS

Manners told the BBC they were “terrified” as they tried to make part of the descent down the treacherous mountains without supplies.

“I watched the bag tumble down the mountain and I immediately knew the consequence of what was to come,” she said. “We had none of our safety equipment left. No tent. No stove to melt snow for water. No warm clothes for the evening.”

The terrifying ordeal intensified when it started to snow. They took cover on a ledge while waiting for rescuers.

“I felt hypothermic, constantly shaking and with the lack of food my body was running out of energy to keep warm,” Manners said.

The rescue was made difficult because of the conditions, including bad weather, fog and high altitude.

“The helicopter flew passed again, couldn’t see us. We were destroyed,” Manners told the BBC.

INDIAN AIR FORCE/Handout via REUTERS

On the second day, the pair began to cautiously abseil down the mountain. They spotted a team of French climbers coming toward them. Manners said they shared their equipment and food and contacted the helicopter company with an exact location.

“I cried with relief knowing we might survive,” she said.

The Indian Air Force said in a post on the X social media platform that their helicopter airlifted the climbers from 17,400 feet after “battling two days of bad weather.”

Chaukhamba is a mountain massif in the Garhwal Himalaya in northern India.