CBS News

Social Security’s high earners will get almost $5,000 a month in 2024. Here’s how they got there.

Social Security recipients could face some big changes in 2024, thanks to inflation and tax-related adjustments that will impact everything from monthly benefits to how much recipients owe in taxes. For one, the top benefit in 2024 will approach $5,000 per month.

The old-age and disability program provides monthly payments to more than 70 million people, ranging from children to retirees. Those benefits are credited with keeping millions of Americans from slipping into poverty, with monthly checks adjusted each year to keep up with inflation. In 2024, benefits will increase by 3.2%.

Many of the changes in 2024 are related to cost-of-living adjustments which will not only boost recipients’ monthly income, but potentially subject more of their earnings to taxes, experts say. That can be a surprise to some Social Security beneficiaries who mistakenly believe their checks are tax-free.

“There is a wide misperception, and it’s not helped by social media at all, that Social Security recipients don’t pay taxes, and that’s not at all the case,” said Mary Johnson, Social Security and Medicare policy analyst at the Senior Citizens League.

Understanding your tax liability for Social Security payments is important because otherwise a senior citizen might not have saved enough for their golden years, Johnson added. “You might have to save 20% more than you thought you might need, or 25% more,” she said.

Here are some of the changes to expect in 2024.

Top Social Security benefit will hit almost $5,000 per month

The Social Security Administration announced its annual COLA in October, pegging the 2024 change on the most recent inflation data. Seniors and other recipients will get an increase of 3.2%, a much smaller boost than the 2023 and 2022 increases of 8.7% and 5.9%, respectively.

The average benefit will rise to $1,907 per month in 2024 from $1,848 this year.

But retirees who receive the maximum Social Security payout will see much higher earnings, with their monthly checks jumping to $4,873 in 2024, according to the agency. That’s an additional $318 per month in each paycheck compared with the current year.

So who gets the top payout? Not many people, noted Johnson.

“They only way to get it is if you’re [Apple CEO] Tim Cook and you have been paying the maximum” into your payroll taxes, she joked. “It’s like the 1% to 2%.”

The Social Security Administration says that the top benefit is received by people who have earned the maximum taxable earnings since age 22, and then waited to claim their benefits at age 70. Workers pay Social Security tax up to a maximum income level, which was $160,200 in 2023. Earnings above that threshold aren’t taxed for Social Security.

And while people can claim their Social Security benefits as early as 62 years old, they can increase their monthly checks if they delay claiming, with the maximum payout going to those who wait until they turn 70 years old to claim.

Higher benefits? You may owe more in taxes

More Social Security beneficiaries could see a higher tax bill in 2024 because of a quirk in the Social Security system.

Beneficiaries must pay federal income taxes on their benefits if they earn above a relatively modest threshold. This threshold hasn’t changed since 1984, even though inflation and benefits have risen considerably since then.

More seniors are subject to income tax on their retirement income each year because their benefits generally rise each year with the COLA. And many have incomes from sources other than Social Security, such as IRAs or 401(k)s, which can cause more of their Social Security benefit to face taxes.

Here are the thresholds:

- Individual taxpayer: Between $25,000 to $34,000, you may have income tax on up to 50% of your benefits. Over $34,000, and up to 85% of your benefits may be taxable.

- Joint filers: Between $32,000 to $44,000, you may pay taxes of up to 50% of your benefits. Above $44,000, and up to 85% of your benefits may be taxable.

Fewer than 10% of Social Security recipients paid taxes on their benefits in 1984, but that’s risen to about 40% currently, according to the Social Security Administration.

“We are dealing with the tax side of inflation here, and inflation can drive up your taxes” because the threshold hasn’t changed in almost 40 years, Johnson noted.

Workers may pay more in taxes too

Some workers may also face higher taxes for Social Security in 2024. That’s because the IRS adjusts the maximum earnings threshold for Social Security each year to keep up with inflation.

In 2023, workers paid Social Security taxes on income up to $160,200. For an individual, the tax rate is 6.2% of earnings, with their employer paying another 6.2% into the program.

But that threshold will rise to $168,600 in 2024, which means higher earners are likely to face higher Social Security taxes next year.

CBS News

Tropical Storm Milton forms in Gulf; forecast to strengthen into hurricane headed toward Florida

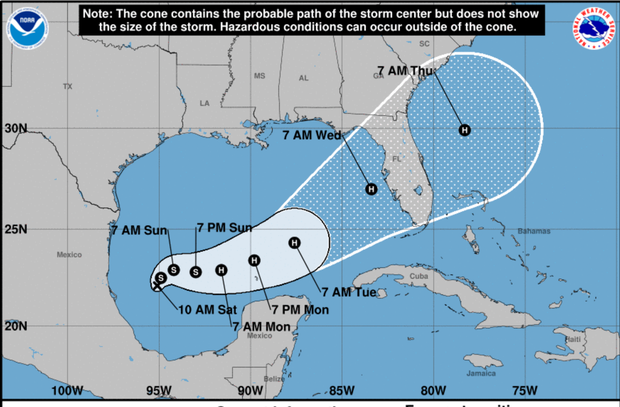

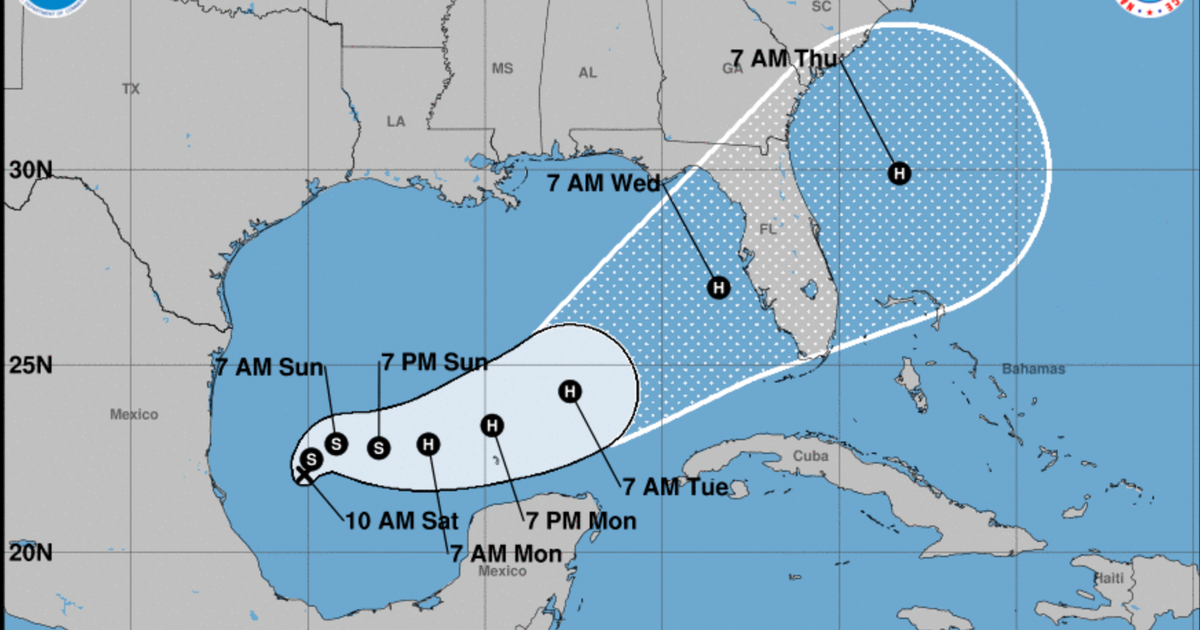

Tropical Storm Milton has formed in the Gulf of Mexico and is forecast to strengthen into a hurricane headed toward Florida with possible impacts to its western coast, the National Hurricane Center said on Saturday. Maximum sustained winds are expected to be at 40 mph with higher gusts and Milton is currently moving north-northeast, NHC said in an advisory.

Milton is forecast to undergo a period of rapid intensification before it makes landfall as a Category 2 hurricane across Florida’s west coast, CBS News Miami reported.

The forecast comes a little more than a week after Hurricane Helene made landfall in Florida and across the Southeast, killing more than 200 people and causing immense destruction. President Biden on Thursday took an aerial tour of Florida’s Big Bend where Helene struck as a Category 4 storm. Hundreds of people are still missing and Mr. Biden said the work to rebuild will cost “billions of dollars” as communities suffer still without power, running water and passable roads.

NOAA

Milton is forecast to move across the southwestern Gulf of Mexico through Sunday night then across the south-central Gulf on Monday and Tuesday before reaching Florida’s west coast by the middle of the week, NHC said. Heavy rain is possible in the region starting Sunday into Monday, CBS Miami reported, and more rain and heavy winds will most likely arrive on Wednesday. Hurricane and storm surge watches will most likely be required for portions of Florida starting Sunday, the National Hurricane Center said.

Along with the heavy rainfall, the hurricane center said to expect risks of flooding.

Residents in the area should ensure they have a hurricane plan in place, the National Hurricane Center said, follow the advice of local officials and check back for forecast updates.

CBS News

10/5: Saturday Morning – CBS News

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Barbie announces first “Diwali doll” ahead of festival of lights

A new Barbie has joined Mattel’s lineup of inclusive dolls. The first “Diwali doll” was announced by the toymaker on Friday, a few weeks shy of the Hindu holiday of Diwali, also known as the festival of lights.

The festival, which lasts for five days, is marked on Western calendars to begin on Nov. 1, but some celebrations start on Oct. 31.

The doll, created in collaboration with fashion designer Anita Dongre, features traditional elements including the lehenga skirt, floral print and golden shoes, according to Mattel’s website. The doll is available at major retailers for $40.

“The look is infused with beauty and symbolism to rejoice in victory of light over darkness with contemporary silhouettes,” the description reads for the Diwali doll.

Lalit Agarwal, country manager for Mattel India, said in a news release that through the Diwali doll, the brand is hoping to showcase “India’s vibrant cultural heritage on a global stage while continuing to celebrate the power and beauty of diversity.”

Earlier this year, Mattel announced the first-ever blind Barbie doll and a Black Barbie with Down syndrome.

In addition, to celebrate International Women’s Day on March 8 and Barbie’s 65th birthday on March 9, the doll brand announced it was adding new dolls to its Role Models collection, based on real-life singers and actresses from around the world. They’re not for sale – a one-of-a-kind doll was made for each of the honored women.

The dolls are meant to introduce “girls to remarkable women’s stories to show them you can be anything,” according to Mattel.