CBS News

Owners saddled with half-empty office buildings as hybrid work trend continues | 60 Minutes

Looking for signs the U.S. economy can continue to stave off a recession? Avert your gaze from commercial real estate. City office buildings are in trouble. For a century, the towers have been propped up by two pillars. One, workers filling the buildings all week. Two, money flowing freely in the form of loans to borrow, buy, and build. Those days are over. As hybrid work hardens from trend to new normal, office occupancy rates have hit all-time lows. Meanwhile interest rates have spiked to historic highs… and now the mortgage comes due: $1.5 trillion in commercial real estate loans expire in the next two years. It’s enough to make you rethink the future of cities. We criss-crossed Manhattan, talking to players big and small, about a sector rocked to its foundations.

What is New York City without its skyline? Monuments to commerce, standing proudly shoulder-to-shoulder. More office space than any city in the world. But peek inside all this vertical real estate and there’s a fundamental question. Where IS everyone? More than 95 million square feet of New York office space currently unoccupied – the equivalent of 30 Empire State Buildings.

Scott Rechler: This building had a lot of law firms, had some government tenants…

Scott Rechler is CEO of RXR, a New York real estate company with more than $20 billion in holdings. We walked through his property at 61 Broadway, near Wall Street. Every other floor—half the building—lies empty.

Scott Rechler: I think this is an existential moment. You know, I call it crossing the chasm.

60 Minutes

Jon Wertheim: What’s the chasm specifically?

Scott Rechler: This post-COVID world of higher interest rates, the changing nature of how people work and live. We’re not going back to where we were. It’s a different world. And it’s gonna be turbulent.

It already is. The return to office has stalled out: Fridays are dead. Mondays aren’t much busier. As tenants shrink their office footprint, office landlords are confronting the fact that some of their buildings have become obsolete, if not worthless…Ever the pragmatist, Rechler decided not to throw good money after bad at 61 Broadway, and defaulted to his bank on a $240 million loan.

Jon Wertheim: I could see people saying, “that’s a lot of money. How did he sleep last night?”

Scott Rechler: We invest a lot of equity. If it works, we make a lot of money. If it doesn’t work, the lender– can take over the building. You gotta face reality, right? Reality’s coming your way.

The reality is the price of office buildings is tanking, as much as 40% since the pandemic. Uptown at Columbia Business School, Stijn Van Nieuwerburgh, a professor of real estate, has modeled out the impact of hybrid work on pricing…and calls it a train wreck in slow motion.

Prof. Stijn Van Nieuwerburgh: And this is just the beginning. And the reason it’s just the beginning is because there’s a lot of office tenants that have not had to make an active space decision yet. “Do I want to renew this space? Do I wanna vacate? Maybe I sign a new lease for half as much space.” This is what tenants have been doing for the last three years. So when you take all of those current and future declines of cash flows into account, we end up with about a 40% reduction in the value of these offices.

Consider this office building near Penn Station – one of a handful of sales in the city last fall. Built in 1920 and showing its age, eight empty floors with a 99-cent store on the ground level.

Real estate partners Tony Park and Elad Dror, told us they’d been eyeing that building for years, and, pre-pandemic, offered the owner $80 million. They didn’t get very far.

Tony Park: He doesn’t answer.

Jon Wertheim: He didn’t even answer you guys?

60 Minutes

Tony Park: He didn’t answer, (laugh) yeah. We didn’t have his attention, at all.

Jon Wertheim: So what do you think happened?

Tony Park: The whole building is now empty.

In September, Park and Dror got the building for less than half their original offer. And they have plans to convert the place.

Jon Wertheim: Did you ever think of just keeping it as an office building?

Tony Park: No. Never.

Jon Wertheim: You laugh.

Tony Park: Anything that is not an office.

Anything that is not an office….

So much for the prestige Hollywood has, for decades, conferred on Manhattan office life. Suffice to say, they didn’t set “Mad Men” and “Succession” above a 99-cent store.

But you might still set a glitzy office drama in a place like this: One Vanderbilt. Part of a crop of so-called trophy buildings – one resilient sliver of this changing real estate market.

Marc Holliday is CEO of SL Green, New York’s biggest office landlord. Also the “60 Minutes” landlord. He took us to the top of his new $3 billion skyscraper.

Jon Wertheim: Probably see half– halfway to Philly from here?

Marc Holliday: Yeah. Oh, for sure. That’s– from here, that’s a chip shot.

There’s a view but, more critically, the building is connected underground to Grand Central Terminal…for an easy commute.

Trophy buildings reflect a flight to quality…corporate tenants with deep pockets flocking to amenity-rich towers.

60 Minutes

This one includes two Michelin-star restaurants. All of it designed to motivate employees to leave their homes. One Vanderbilt is 99% occupied: a hedge fund here, a consulting firm there. But when we talked to him in September, Holliday was obsessing over occupancy across all of SL Green’s properties.

Marc Holliday: Our goal was 92% for this year. Now, we’ve got some work to do– to get there.

Jon Wertheim: Your occupancy rates now are about 89%. You said ideally about 92% would be great. I could see people saying, “Oh, that’s two, three points difference. What’s the big deal?”

Marc Holliday: No, and when you have 30 million square feet like we do, every 1% is a big difference. You know, we pride ourselves in– in keeping our occupancies, historically, at 95% and above.

Jon Wertheim: Do you accept that work from home is this fundamental shift in– in how we work and that it’s here to stay?

Marc Holliday: It’s one of the biggest societal problems we’re facing right now, is work from home. I think that it’s bad for– business. It’s bad for cities. It’s bad for people.

It’s also been bad for his stock price, down 50% since the pandemic. A culture of smooth talk and sharp elbows, commercial real estate is a world built on loans, big ones…and the assumption that those loans will be refinanced, with little friction, every five to 10 years. Not anymore.

Prof. Stijn Van Nieuwerburgh: The bank will look at that– at that building and say, “Well, I used to be willing to lend you $80 million against this building, but I don’t think the building is worth as much anymore as it used to be. So maybe today I’m only willing to lend you $60 million against that same building,” right? And now the office owner…

Jon Wertheim: They -they got a choice to make.

Prof. Stijn Van Nieuwerburgh: You know, “do I come out of pocket for that $20 million difference? Or do I walk away?”

Jon Wertheim: The rubber meets the road when it comes time to refinance?

Prof. Stijn Van Nieuwerburgh: Right. And to make matters worse, interest rates are now much higher. Interest rates have essentially doubled. So the cost of that new mortgage, even if you can get one, will be much higher.

60 Minutes

What happens when that cost becomes too high?

On the lawn in front of a Manhattan courthouse, we saw something you won’t see on a double-decker bus tour: a mortgage foreclosure on an office building.

Here, no one in the crowd is willing to outbid the bank holding the loan on the building. And if the bank rep doesn’t look thrilled, it’s because he has an empty office building dragging down his balance sheets. Professor Van Nieuwerburgh has been meeting with captains of industry—and the Federal Reserve—on this very point.

Prof. Stijn Van Nieuwerburgh: So commercial real estate is a huge part of the book of business of your typical bank. And I’m talking mostly about these smaller and medium size, maybe regional banks. They have a lot of exposure. That is their bread-and-butter activity. About 30% of all their loans are commercial real estate loans. And here we are, sort of seeing weakness in office that is something like– that we have never seen before. And banks need to come to grips with that.

Jon Wertheim: Are you comfortable calling this a crisis?

Prof. Stijn Van Nieuwerburgh: I think we’re at the beginning. There is a potential crisis here.

In December, nationwide office loan delinquency rates crowded 6% – almost four times what they were a year ago. But banks have been reluctant to write down those losses.

Enter David Aviram from Maverick Real Estate, a firm he and his partner founded after the 2008 financial crisis. Their specialty: buying distressed debt on the cheap. Aviram keeps tabs on the debt on every office building in the city. He says New York is awash in billions worth of commercial real estate loans at risk of not being paid.

David Aviram: We know that there’s this buildup of bad debt in the system, but it’s not being dealt with just yet. And it’s in large part because the banks have been kicking the can down the road as best they can, trying to push this off as far as they can.

Jon Wertheim: What does that mean?

David Aviram: It means that banks are entering into extensions on a lot of their bad loans, which essentially– changed their classification from a nonperforming loan, a loan that’s in distress, to a performing loan, a healthy loan, even though they haven’t received a pay down on the loan and the collateral value on that loan continues to drop.

Jon Wertheim: Extend and pretend.

David Aviram: That’s right. And it works really well when interest rates are low because the banks can just keep the status quo going. But once rates are high, it doesn’t really work anymore.

A downturn in real estate…made worse by bad loans… contaminating banks…and – potentially – the entire economy. Echoes of the global financial crisis of 2008 are hard to ignore. But whether the trouble with office buildings ends in a simple pricing correction or becomes a systemic crisis, likely there’s pain coming. Not just for building owners and banks, but for cities themselves.

Prof. Stijn Van Nieuwerburgh: In the long run, property taxes on those buildings will also fall by 40%. And these commercial property tax revenues are an important component of the budget of local governments. Which means less money for police departments, trash collection. And some people are gonna decide that, you know, the quality of life has deteriorated too much and they want out. And, in fact, that’s what we’ve seen. In the last three years, about– our largest ten cities have lost about 2 million residents.

Jon Wertheim: You’re losing that tax base as well.

Prof. Stijn Van Nieuwerburgh: And now you’re losing the tax base. And now the cycle continues. And we end up in something that we have called an urban doom loop.

The urban doom loop – sounds scary and it’s making the rounds, threatening cities beyond New York. Dallas, Chicago, to say nothing of San Francisco. A question posed across the country: especially given the housing shortage, why not convert empty office buildings to apartments?

Some developers are…Tony Park and Elad Dror are turning the former 99-cent store building into 77 units, renting at market price. Developers we talked to say they simply can’t turn a profit converting to affordable housing.

Less than half of New York office space is zoned for conversion. And even then, it’s not so easy. We visited this residential conversion near Wall Street…where developers from Vanbarton Group were making an end-run around a city rule that says you can’t add to existing square footage.

Jon Wertheim: What is this?

Joey Chilelli: [They] call this the void.

They call this The Void, a giant, 30-story hole they cut through the middle of the building.

Joey Chilelli: It’s one of the tricks of the trade.

You take the center section of the office floor—the part that doesn’t get a lot of light and air—seal it up, and preserve that square footage, so you can apply it somewhere more valuable, say, a penthouse.

Jon Wertheim: Residents may not even know it’s here?

Joey Chilelli: They’ll never know.

Maybe not. But The Void offers a larger lesson in urban real estate: where there’s space, there’s potential.

Scott Rechler: This will be the– the tallest commercial building in the western hemisphere by floor.

For Scott Rechler, that means doubling down, even in a down market. Near Grand Central, he’s lined up financing to build his own trophy building – part office, part hotel.

But for Professor Van Nieuwerburgh, the reimagining can—and should—be far more ambitious; a sweeping new deal, combining public and private money and ideas for what to do with old office space.

Prof. Stijn Van Nieuwerburgh: It’s no longer fit for purpose. We gotta redesign it. You know, more space for communities, more space for artists. Maybe pickle ball courts or basketball courts. There’s lots of different uses for these buildings, especially when you can buy them at a– at a depressed price.

If Van Nieuwerburgh gave us the term urban doom loop, he also gives off a certain optimism about the current point of inflection.

Prof. Stijn Van Nieuwerburgh: For all of human history, humankind has been tied to– to work where it lives.We were farming the farms and we lived on our farms. We were working in the factories and living close to the factories. We no longer have to live where we work. And that’s a very transformational idea. And I believe society is only at the beginning of realizing the full potential of that idea.

Produced by Nathalie Sommer. Associate producer, Kaylee Tully. Broadcast associate, Elizabeth Germino. Edited by Craig Crawford.

CBS News

Former Israeli hostages released in truce 1 year ago call for action to release those still held

Former Israeli hostages who were freed from Hamas captivity during a week-long humanitarian pause in fighting exactly one year ago Sunday called for immediate action to secure a deal for the release of those still held.

The only truce in the ongoing Israel-Hamas war on Nov. 24, 2023 – fewer than two months after fighting began – led to the release of 80 Israelis held by militants in Gaza. They were freed in exchange for 240 Palestinians detained in Israeli jails.

Repeated efforts since then by mediators from Qatar, Egypt and the United States to secure another truce and hostage release have failed. Qatar early this month said it was suspending its mediation role until the warring sides show “seriousness.”

Mostafa Alkharouf/Anadolu via Getty Images

Gabriella Leimberg was kidnapped during the Oct. 7, 2023, Hamas attack and was released along with her daughter, Mia, and sister Clara.

“For 53 days, the one thing that kept me going is that we, the people of Israel, the Jewish people, sanctify life — we don’t leave anyone behind,” she said.

Leimberg added: “Everything has already been said and now action is required. We don’t have any more time.”

Around 100 hostages are still in Gaza, and at least a third are believed to be dead.

“I survived and I was fortunate to get my entire family back,” Leimberg said. “I want and demand this for all the families of the hostages.”

Hamas wants Israel to end the war and withdraw all troops from Gaza. Israel has offered only to pause its offensive.

The Palestinian death toll from the war surpassed 44,000 this week, according to Gaza’s Health Ministry, which does not distinguish between civilians and combatants in its count.

Maya Alleruzzo / AP

Danielle Aloni, who was kidnapped with her five-year-old daughter, Emelia, and freed after 49 days, spoke at the ceremony of the “increasing danger” those still being held face every day.

She said those still in captivity “suffer physical, sexual, and psychological abuse, their identity and dignity crushed anew each day”.

“It took the Israeli government about two months to secure a deal for me and 80 other Israeli hostages. Why is it taking over a year to reach another deal to free them from this hell?” asked Aloni, whose brother-in-law, David Cunio, and his brother, Ariel Cunio, are still being held.

She emphasized that, even though she and the other hostages gained their freedom a year ago, “we haven’t really left the tunnels,” — referring to Hamas’ underground tunnels where many of the hostages were held.

“The feeling of suffocation, the terrible humidity, the stench — these sensations still envelop us,” Aloni said.

“If people could truly understand what it means to be held in subhuman conditions in tunnels, surrounded by terrorists for 54 days — there’s no way they would allow hostages to remain there for 415 days!” said Raz Ben Ami, who was released in the deal a year ago.

Her husband, Ohad, is still among those being held.

Ben Ami called for a ceasefire to “bring back all the hostages as quickly as possible”.

CBS News

Couple charged for allegedly stealing $1 million from Lululemon in convoluted retail theft scheme

A couple from Connecticut faces charges for allegedly taking part in an intricate retail theft operation targeting the apparel company Lululemon that may have amounted to $1 million worth of stolen items, according to a criminal complaint.

The couple, Jadion Anthony Richards, 44, and Akwele Nickeisha Lawes-Richards, 45, were arrested Nov. 14 in Woodbury, Minnesota, a suburb of Minneapolis-St. Paul. Richards and Lawes-Richards have been charged with one count each of organized retail theft, which is a felony, the Ramsey County Attorney’s Office said. They are from Danbury, Connecticut.

The alleged operation impacted Lululemon stores in multiple states, including Minnesota.

“Because of the outstanding work of the Roseville Police investigators — including their new Retail Crime Unit — as well as other law enforcement agencies, these individuals accused of this massive retail theft operation have been caught,” a spokesperson for the attorney’s office said in a statement on Nov. 18. “We will do everything in our power to hold these defendants accountable and continue to work with our law enforcement partners and retail merchants to put a stop to retail theft in our community.”

Both Richards and Lawes-Richards have posted bond as of Sunday and agreed to the terms of a court-ordered conditional release, according to the county attorney. For Richards, the court had set bail at $100,000 with conditional release, including weekly check-ins, or $600,000 with unconditional release. For Lawes-Richards, bail was set at $30,000 with conditional release and weekly check-ins or $200,000 with unconditional release. They are scheduled to appear again in court Dec. 16.

Prosecutors had asked for $1 million bond to be placed on each half of the couple, the attorney’s office said.

Richards and Lawes-Richards are accused by authorities of orchestrating a convoluted retail theft scheme that dates back to at least September. Their joint arrests came one day after the couple allegedly set off store alarms while trying to leave a Lululemon in Roseville, Minnesota, and an organized retail crime investigator, identified in charging documents by the initials R.P., recognized them.

The couple were allowed to leave the Roseville store. But the investigator later told an officer who responded to the incident that Richards and Lawes-Richards were seasoned shoplifters, who apparently stole close to $5,000 worth of Lululemon items just that day and were potentially “responsible for hundreds of thousands of dollars in loss to the store across the country,” according to the complaint. That number was eventually estimated by an investigator for the brand to be even higher, with the criminal complaint placing it at as much as $1 million.

Richards and Lawes-Richards allegedly involved other individuals in their shoplifting pursuits, but none were identified by name in the complaint. Authorities said they were able to successfully pull off the thefts by distracting store employees and later committing fraudulent returns with the stolen items at different Lululemon stores.

“Between October 29, 2024 and October 30, 2024, RP documented eight theft incidents in Colorado involving Richards and Lawes-Richards and an unidentified woman,” authorities wrote in the complaint, describing an example of how the operation would allegedly unfold.

“The group worked together using specific organized retail crime tactics such as blocking and distraction of associates to commit large thefts,” the complaint said. “They selected coats and jackets and held them up as if they were looking at them in a manner that blocked the view of staff and other guests while they selected and concealed items. They removed security sensors using a tool of some sort at multiple stores.”

CBS News contacted Lululemon for comment but did not receive an immediate reply.

CBS News

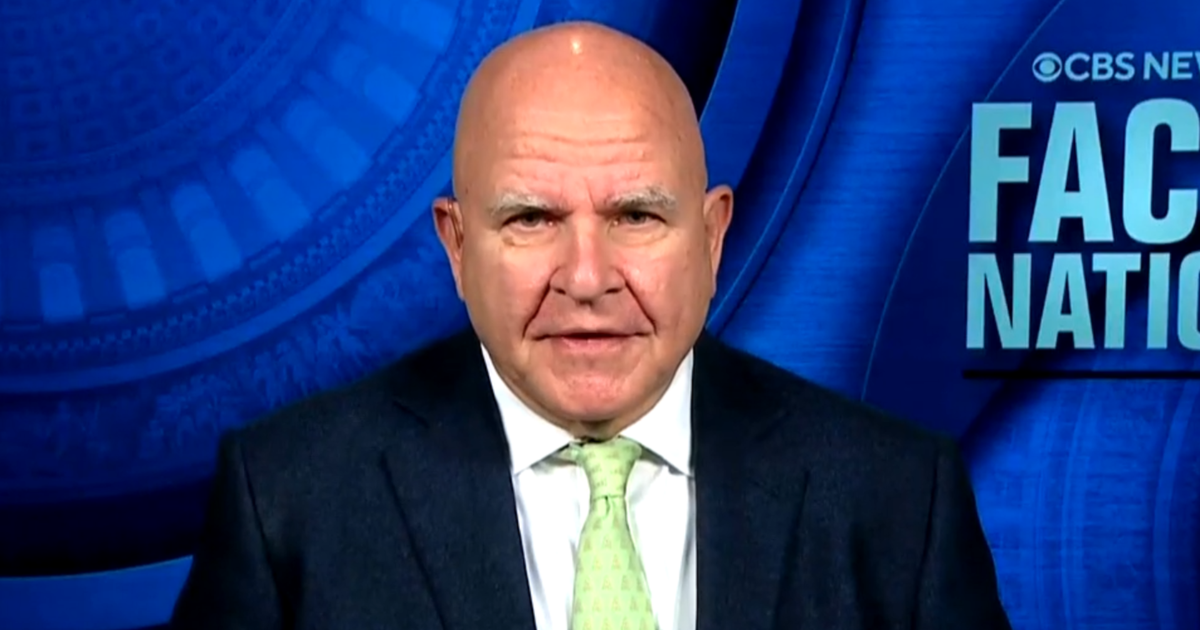

Former Trump national security adviser says next couple months are “really critical” for Ukraine

Washington — Lt. Gen. H.R. McMaster, a former national security adviser to Donald Trump, said Sunday that the upcoming months will be “really critical” in determining the “next phase” of the war in Ukraine as the president-elect is expected to work to force a negotiated settlement when he enters office.

McMaster, a CBS News contributor, said on “Face the Nation with Margaret Brennan” that Russia and Ukraine are both incentivized to make “as many gains on the battlefield as they can before the new Trump administration comes in” as the two countries seek leverage in negotiations.

With an eye toward strengthening Ukraine’s standing before President-elect Donald Trump returns to office in the new year, the Biden administration agreed in recent days to provide anti-personnel land mines for use, while lifting restrictions on Ukraine’s use of U.S.-made longer range missiles to strike within Russian territory. The moves come as Ukraine marked more than 1,000 days since Russia’s invasion in February 2022.

Meanwhile, many of Trump’s key selection for top posts in his administration — Rep. Mike Waltz for national security adviser and Sens. Marco Rubio for secretary of state and JD Vance for Vice President — haven’t been supportive of providing continued assistance to Ukraine, or have advocated for a negotiated end to the war.

CBS News

McMaster said the dynamic is “a real problem” and delivers a “psychological blow to the Ukrainians.”

“Ukrainians are struggling to generate the manpower that they need and to sustain their defensive efforts, and it’s important that they get the weapons they need and the training that they need, but also they have to have the confidence that they can prevail,” he said. “And any sort of messages that we might reduce our aid are quite damaging to them from a moral perspective.”

McMaster said he’s hopeful that Trump’s picks, and the president-elect himself, will “begin to see the quite obvious connections between the war in Ukraine and this axis of aggressors that are doing everything they can to tear down the existing international order.” He cited the North Korean soldiers fighting on European soil in the first major war in Europe since World War II, the efforts China is taking to “sustain Russia’s war-making machine,” and the drones and missiles Iran has provided as part of the broader picture.

“So I think what’s happened is so many people have taken such a myopic view of Ukraine, and they’ve misunderstood Putin’s intentions and how consequential the war is to our interests across the world,” McMaster said.

On Trump’s selections for top national security and defense posts, McMaster stressed the importance of the Senate’s advice and consent role in making sure “the best people are in those positions.”

McMaster outlined that based on his experience, Trump listens to advice and learns from those around him. And he argued that the nominees for director of national intelligence and defense secretary should be asked key questions like how they will “reconcile peace through strength,” and what they think “motivates, drives and constrains” Russian President Vladimir Putin.

Trump has tapped former Rep. Tulsi Gabbard to be director of national intelligence, who has been criticized for her views on Russia and other U.S. adversaries. McMaster said Sunday that Gabbard has a “fundamental misunderstanding” about what motivates Putin.

More broadly, McMaster said he “can’t understand” the Republicans who “tend to parrot Vladimir Putin’s talking points,” saying “they’ve got to disabuse themselves of this strange affection for Vladimir Putin.”

Meanwhile, when asked about Trump’s recent selection of Sebastian Gorka as senior director for counterterrorism and deputy assistant to the president, McMaster said he doesn’t think Gorka is a good person to advise the president-elect on national security. But he noted that “the president, others who are working with him, will probably determine that pretty quickly.”