CBS News

Sonar shows car underwater after speeding off Virginia Beach pier; no body recovered yet

Police have yet to recover a body from inside a car submerged in waters off Virginia Beach, officials said, more than three days after witnesses reported seeing the vehicle drive off of a pier and sonar technology pinpointed its location on the ocean floor.

The accident happened before 7 a.m. on Saturday morning, the city of Virginia Beach said in a news release. When police and fire officials arrived at the scene, they found a sunken vehicle that was “completely submerged” near the oceanfront pier. But rough conditions in the water obscured visibility and meant divers could not be deployed to conduct a search, according to the release.

Instead, authorities relied on sonar imaging to confirm the vehicle’s position. Sonar — which is short for Sound Navigation and Ranging — is a mapping technique that uses sound waves for various purposes, including to detect objects beneath the surface of the water. CBS News obtained from the Virginia Beach Police Department a copy of one sonar image that showed the car on the ocean floor. Authorities determined that it was between 17 and 20 feet below the surface, according to police.

Virginia Beach Police Department

An initial attempt to recover the car was made on Sunday afternoon, using a salvage barge and a professional salvage dive team from a private company, city officials said. It was unsuccessful because of ongoing dangerous water conditions, which rendered the barge unstable and continued to pose threats to divers’ safety.

The Virginia Beach Police Department has shared updates on social media about their response and the recovery plan. Sgt. Sergeant Brian Ricardo, from the police department’s special operations bureau, explained at a briefing Tuesday that part of the reason why they have hesitated to remove a body or bodies from the submerged car is because doing that would mean losing evidence from inside the vehicle that investigators might be able to use later.

“Generally, because it is a crime scene, we want to leave it encapsulated as best we can. Because when you open up that portal to the ocean, we’re going to lose evidence. And that’s what we don’t really want to do, is lose evidence,” Ricardo said.

“If we have to, then that’s what we do,” he continued. “I mean it’s the awful part of our job. But we know as investigators that we have to make those tough decisions.”

Video footage taken at the crash site by the Chesapeake Fire Department, using a remote-operated vehicle, showed the tire of the submerged car through dark and murky water. The footage helped authorities determine that the vehicle was upside down and “rocking with the current,” police said.

The second of two video clips recorded by the ROV appeared to show a flicker of the color red. Virginia Beach police noted that, at the time that footage was recorded, ocean currents were four times stronger than the safety limits set for the department’s diving team.

“Strong currents & extremely low visibility made it too dangerous for divers to navigate & assess the area safely, especially near a submerged SUV rocking on its roof in the turbulent current,” police said on social media, adding that its divers “are trained in water rescue, not underwater recovery” as specialized salvage divers are.

Crofton, the private company contracted to carry out the salvage operation, had to pause and postpone its intended recovery plan after tumultuous waters damaged the salvage equipment, police said. The department said it is working together with the company to form a new plan for the recovery operation as soon as conditions allow.

“The goal of this mission remains to safely retrieve the vehicle, reunite any & all occupants with their loved ones, & maintain the integrity of all evidence,” police said in a social media post. “We appreciate our community’s concern about this incident. This is an ongoing investigation & we will continue to share updates as we are able. We are working diligently to bring closure to those affected through our investigative & recovery process.”

The police department said Tuesday that officers were contacted by a family with a missing relative, and noted that the case “has many similarities to facts and circumstances our detectives have identified as part of the investigation” into the incident at the pier.

“Though we have indicators these cases are related, at this time, we are unable to confirm this missing person is associated with the car that has yet to be recovered. The ROV HAS NOT been able to discern if the submerged vehicle has a license plate attached,” the police department wrote on social media.

CBS News

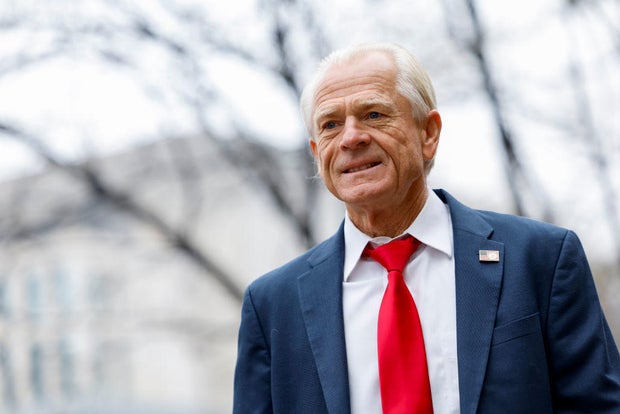

Trump taps Peter Navarro, convicted of contempt of Congress, as trade counselor

Washington — President-elect Donald Trump announced Wednesday that he has named longtime aide Peter Navarro, who served on the White House Trade Council in the first Trump administration, to be “senior counselor for trade and manufacturing.”

The announcement comes just months after Navarro, 75, was released from prison after serving a four-month sentence for defying a congressional subpoena. Navarro was subpoenaed for records and testimony in 2022 by the now-defunct House select committee investigating the Jan. 6, 2021, attack on the U.S. Capitol, and he refused to comply, claiming that Trump had asserted executive privilege over the material sought by the committee.

A federal judge in Washington convicted Navarro of two counts of contempt, and he reported to a Florida federal correctional facility in March to serve a four-month sentence. He spoke at the Republican National Convention in July the same day he was released from prison, slamming the “Department of Injustice” in his speech.

Trump praised Navarro in the announcement Wednesday as a “man who was treated horribly by the Deep State, or whatever else.”

As a trade adviser in the first Trump administration, Navarro endorsed “America First” trade policies, including steep tariffs to protect domestic industries.

Anna Moneymaker/Getty Images

In the social media post announcing Navarro’s selection, Trump praised Navarro’s time as a trade adviser. “The Senior Counselor position leverages Peter’s broad range of White House experience, while harnessing his extensive Policy analytic and Media skills,” Trump wrote. “His mission will be to help successfully advance and communicate the Trump Manufacturing, Tariff, and Trade Agendas.”

Trump announced in 2016 that Navarro would be serving at the helm of the newly formed White House Trade Council and as director of trade and industrial policy. Prior to that, he had written a book called “Death by China” that endorsed a hardline toward trade with China.

In March 2020, Trump named Navarro as policy coordinator of the Defense Production Act, which Trump invoked on March 18, 2020, amid the COVID-19 pandemic, to manufacture medical supplies and PPE. On “60 Minutes” in April 2020, Navarro fiercely defended protectionist trade policies despite the shortage of that equipment before the pandemic.

“It’s the globalization of production through multinational corporations, who salute no flag, who love cheap sweatshop labor, and who love the massive subsidies that the Chinese government throws at production to bring it from here to there,” Navarro told “60 Minutes” correspondent Bill Whitaker.

Congressional subpoena and prison time

The House Jan. 6 committee subpoenaed records and testimony from Navarro, alleging that he developed plans to overturn the outcome of the 2020 election. “Mr. Navarro appears to have information directly relevant to the Select Committee’s investigation into the causes of the January 6th attack on the Capitol,” said the committee’s chairman, Rep. Bennie Thompson, at the time.

In 2021, Navarro wrote a book in which he wrote that he and other Trump advisers constructed a plan called the “Green Bay Sweep” as the “last, best chance to snatch a stolen election from the Democrats’ jaws of deceit.” Additionally, in the weeks leading up to the Jan. 6 attack, Navarro promoted a document he called the “Navarro Report” that asserted baseless and discredited claims of election fraud.

Navarro refused to comply with the subpoena, saying that Trump had invoked executive privilege. The committee recommended in a unanimous vote to recommend contempt charges, with the Justice Department ultimately agreeing, charging him with two counts of contempt.

Navarro testified at an evidentiary hearing that Trump invoked executive privilege in a Feb. 2022 conversation, 11 days after he was subpoenaed. But U.S. District Judge Amit Mehta barred that defense, saying there was no evidence that any official assertion was made, and Navarro did not testify at his one-day trial.

In his sentencing, Mehta noted Navarro’s public statements after the attack and said there was no evidence of executive privilege. While Mehta said that it appeared that Navarro at least believed he was operating under the guise of executive privilege, he said executive privilege is not a “magical dust” or “a get-out-of-jail free card.”

Navarro attempted to appeal his conviction, even requesting after he surrendered to prison his case be heard by the Supreme Court, which declined. He reported to prison in March and served four months at the Federal Correctional Institute in Miami, which is reserved for older inmates.

He is not the only person who was charged by the Justice Department for refusing to comply with the House subpoenas. Top Trump aide Steve Bannon also served four months this year.

Robert Legare and

contributed to this report.

CBS News

3 credit card debt relief strategies to consider for 2025

Getty Images/iStockphoto

As Americans grapple with unprecedented credit card debt levels heading into 2025, finding effective relief strategies has become more crucial than ever. Recent Federal Reserve data shows credit card balances surpassed $1.17 trillion in the third quarter of 2024, up from $1.14 trillion the prior quarter, with the average household now carrying nearly $8,000 in credit card debt. This financial burden has been exacerbated by card interest rates climbing to historic highs, with the average credit card APR now exceeding 23%.

Part of the issue is that the lingering high prices due to years of inflation have stretched many household budgets thin and created a perfect storm for credit card debt accumulation. Many households have had to rely on credit cards to weather these financial challenges, but are now trapped in a cycle of minimum payments and mounting interest charges. As a result, traditional debt management approaches, like paying off your balance monthly or using the debt snowball or avalanche methods, may no longer be sufficient.

Luckily, those aren’t the only approaches that those seeking to break free from credit card debt in 2025 can take. There are a few other options that deserve consideration, and if you’re dealing with this type of issue, understanding these alternatives can help you make informed decisions about your financial future.

Compare the debt relief options available to you here.

3 credit card debt relief strategies to consider for 2025

The debt relief approaches outlined below could come in handy as you prepare for the challenging economic landscape ahead.

Streamlining multiple debts with debt consolidation

Debt consolidation is one of the most straightforward approaches to managing high-rate credit card debt, and this type of debt relief is generally available in two primary forms: traditional debt consolidation through banks, credit unions and other lenders and debt consolidation programs offered through debt relief companies.

With traditional debt consolidation, the goal is to take out a new loan through a traditional lender, typically with a lower interest rate, to pay off multiple credit card balances. This strategy allows you to roll multiple credit card balances into one loan, streamlining and lowering your payments, and it can be particularly effective for borrowers with good credit scores who qualify for loans with rates significantly below their current credit card rates.

Debt consolidation programs, on the other hand, provide a structured approach to debt consolidation. These programs function similarly to traditional debt consolidation, but the main difference is that you’re borrowing money via a debt consolidation loan through the debt relief company’s third-party partner lenders. These lenders tend to be more experienced in working with borrowers who have a few blemishes on their credit, so they may be more flexible in terms of borrowing requirements.

Find out how the right debt relief strategy could benefit you now.

Getting professional guidance and structure with debt management

Debt management programs, which are offered through credit counseling agencies, are a comprehensive solution for those struggling with credit card debt. These programs provide professional financial guidance to you while working directly with your creditors to reduce interest rates and establish manageable repayment terms. When you enroll in this program, you’re typically required to close your credit card accounts and make a single monthly payment to the counseling agency, which then distributes the funds to your creditors.

The structured nature of this type of program helps ensure consistent progress toward debt elimination while providing valuable financial education and budgeting support. Most plans also aim to eliminate debt within three to four years, making them an attractive option for those committed to long-term financial recovery. So if you start this process early in 2025 and stick with it, you’ll be on your way to becoming debt-free in just a couple of years.

Settle your debts for less than you owe with debt forgiveness

Credit card rates have steadily climbed over the last decade, and it’s likely they’ll remain high throughout 2025 — no matter what happens with the overall rate environment. As a result, credit card debt forgiveness, also known as debt settlement, could be the best route to take next year for severely overwhelmed borrowers. This approach involves negotiating with creditors to accept less than the full balance and typically results in 30% to 50% of the original debt being forgiven.

You can pursue debt forgiveness on your own, but many people opt to work with debt relief companies instead, as the experience they offer comes in handy during negotiations. Note, though, that this strategy does have some downsides, like credit damage and tax repercussions. There’s also no guarantee that you can settle your card debt for less than what you owe, as card issuers aren’t required to negotiate. But if successful, it can offer serious relief from credit card debt.

The bottom line

As credit card rates continue climbing, many borrowers may need to consider more aggressive approaches to their card debt. Debt consolidation, debt management and debt forgiveness can all be worth considering, but the choice between these strategies often depends on factors such as total debt load, income stability, credit score and long-term financial goals. Whatever strategy you choose, though, addressing your credit card debt proactively is typically the key to long-term financial health.

CBS News

Mitt Romney warns of those who “tear at our unity” in Senate farewell speech

Washington — Sen. Mitt Romney, a Utah Republican who is nearing the end of his Senate term, warned in his farewell address on Wednesday of those who “tear at our unity,” urging America to uphold the nation’s values as he capped more than two decades in public service.

“I have learned that politics alone cannot measure up to the challenges we face,” Romney said. “A country’s character is a reflection not just of its elected officials, but also of its people. I leave Washington to return to be one among them.”

Romney announced in September 2023 that he would not seek reelection after his first term in the upper chamber, noting at the time that “it’s time for a new generation of leaders.” The 77-year-old Utah Republican was the GOP nominee for president in 2012 and also served as the governor of Massachusetts from 2003 to 2007.

In his farewell speech Wednesday, Romney said that “Americans have always been fundamentally good.” He argued that while there have been mistakes, “some grievous,” the nation has from its earliest days rushed to help neighbors in need, welcomed the poor and the huddled masses and respected different faiths.

Mostafa Bassim/Anadolu via Getty Images

Romney said as his time in office comes to an end, he hopes to be “a voice of unity and virtue,” saying that “it is only if the American people merit his benevolence, that God will continue to bless America.”

The Utah Republican, known as a moderate in the upper chamber who has been openly critical of President-elect Donald Trump, became the first senator in U.S. history to vote to convict a member of his own party in 2020 during Trump’s first impeachment trial. And he also voted to convict Trump of inciting an insurrection at the U.S. Capitol on Jan. 6, 2021. At the time he announced his retirement, Romney told reporters that the possibility of Trump returning to the White House did not weigh into his decision.

Senate Minority Leader Mitch McConnell praised Romney’s “long and honorable career on the national political stage” on the Senate floor Wednesday.

“Mitt Romney’s repeated success in public office is a testament to his transcendent appeal of his character,” McConnell said, citing his work as Massachusetts governor and Utah senator. “As it turns out, uncompromising honesty, earnest humility and evident devotion to faith and family are as compelling in Cedar City as they are in Concord.”

“Of course, a certain telegenic quality, dare I say, a presidential aura, doesn’t hurt either,” McConnell continued.

McConnell said Romney made himself a “linchpin” for bipartisan negotiations, and “managed to cram more into six years than many colleagues fit in in 12 or 18.”

Romney, too, celebrated his work on the Bipartisan Infrastructure Law, the Electoral Count Reform Act, gun safety legislation and religious protections in marriage legislation, saying that he “will leave this chamber with a sense of achievement.” But he acknowledged that he will “also leave with a recognition that I did not achieve everything I had hoped.”

Romney said “the scourge of partisan politics” has prevented efforts to stabilize the nation’s debt, stressing that without the “burden” of the interest on the debt, the nation could spend three times as much military procurement, or twice as much on Social Security benefits every month.

McConnell noted that observers might have wondered after Romney’s governorship and bid for the presidency what more he had to prove as he came to the Senate.

“It wasn’t about what he had left to prove, but what he had left to give,” the GOP leader said.