CBS News

Should you convert your cash savings to gold?

Getty Images

Gold as an investment vehicle has withstood the test of time. Human beings have sought out the precious metal for thousands of years, and the interest in gold investing only seems to be growing. If demand for gold continues to tick upward, the price of gold is also likely to increase.

Right now, though, inflationary conditions are also driving down the value of the dollar. So, it can be difficult to protect your cash from losing buying power.

Considering that inflation remains persistent in today’s economic environment, you may be wondering if it’s smart to convert all of your cash savings into gold. In short, the answer is probably not, but it could be wise to invest some of your money in the precious metal. Here’s what you need to know.

Compare your gold investing options now.

Should you convert your cash savings to gold?

There are a few reasons you may want to think twice about converting all of your cash savings to gold. For starters, your cash is an important source of funding when emergencies happen. Although gold is liquid, you may not be able to turn it into cash immediately — limiting your funding options when emergencies do happen. And, financial markets are cyclical. That means there are positive and negative cycles to consider. If you need your money when gold is on a downward trend, you could face significant losses.

Then again, it can be smart to invest some of your money in the yellow metal. But, “less than 5-10% of a portfolio should be gold,” says Alex Blackwood, CEO and co-founder of Mogul Club. “You can hedge inflation, but when looking for higher returns, look to something with equity value.”

Find out how easy it is to add gold to your portfolio today.

Reasons to add gold to your investment portfolio

You probably shouldn’t convert all of your cash to gold, but there are also clear reasons why you may want to add some of the precious metal to your investment portfolio. These include:

Gold is a diversification tool

Gold has little in common with assets you would normally find in an investment portfolio – assets like stocks and bonds. As a result, when stocks and bonds fall in value, investors tend to rush to gold in an effort to keep their portfolios safe. That uptick in demand usually sends gold’s price up – making it possible for gains in the precious metal to offset losses in other assets.

This diversification value often means that when you invest in gold, you’re able to increase your portfolio’s risk-adjusted returns.

Gold offers a hedge against inflation

Inflation can be detrimental to your investment portfolio. After all, if your money doesn’t produce a return that’s at least equal to the rate at which prices are rising, it could be losing buying power. Unfortunately, many safe-haven investments — especially those with interest-based returns — fail to keep up with inflation.

Gold is a unique safe haven asset because it acts as an inflation hedge. This is due to gold’s historical tendency to climb in value when the dollar falls. So, the precious metal may help you maintain the value in your portfolio during periods of high inflation.

Gold’s price could tick higher ahead

With prices hovering around $2,030 per ounce, gold is trading near record highs. That’s a clear indicator that there’s demand for the precious metal. And, that’s important because the economic principle of supply and demand is a leading factor in the growth of the price of gold.

Should demand continue to tick upward, the price of gold is likely to follow. So, adding the precious metal to your portfolio now allows you to take advantage of any potential gains ahead.

The bottom line

It’s probably not a good idea to convert all of your cash savings to gold. After all, doing so could make accessing cash a challenge if and when an emergency arises. On the other hand, chances are that you could benefit from allocating at least some of your investment assets to the precious metal. Compare your gold investing options to add the precious metal to your investment portfolio now.

CBS News

Social Security Fairness Act passes U.S. Senate

Legislation to expand Social Security benefits to millions of Americans passed the U.S. Senate early Saturday and is now headed to the desk of President Joe Biden, who is expected to sign the measure into law.

Senators voted 76-20 for the Social Security Fairness Act, which would eliminate two federal policies that prevent nearly 3 million people, including police officers, firefighters, postal workers, teachers and others with a public pension, from collecting their full Social Security benefits. The legislation has been decades in the making, as the Senate held its first hearings into the policies in 2003.

“The Senate finally corrects a 50-year mistake,” proclaimed Senate Majority Leader Chuck Schumer, a Democrat from New York, after senators approved the legislation at 12:15 a.m. Saturday.

The bill’s passage is “a monumental victory for millions of public service workers who have been denied the full benefits they’ve rightfully earned,” said Shannon Benton, executive director for the Senior Citizens League, which advocates for retirees and which has long pushed for the expansion of Social Security benefits. “This legislation finally restores fairness to the system and ensures the hard work of teachers, first responders and countless public employees is truly recognized.”

The vote came down to the wire, as the Senate looked to wrap up its current session. Senators rejected four amendments and a budgetary point of order late Friday night that would have derailed the measure, given the small window of time left to pass it.

Vice President-elect JD Vance of Ohio was among the 24 Republican senators to join 49 Democrats to advance the measure in an initial procedural vote that took place Wednesday.

“Social Security is a bedrock of our middle class. You pay into it for 40 quarters, you earned it, it should be there when you retire,” Ohio Senator Sherrod Brown, a Democrat who lost his seat in the November election, told the chamber ahead of Wednesday’s vote. “All these workers are asking for is for what they earned.”

What is the Social Security Fairness Act?

The Social Security Fairness Act would repeal two federal policies — the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) — that reduce Social Security payments to nearly 3 million retirees.

That includes those who also collect pensions from state and federal jobs that aren’t covered by Social Security, including teachers, police officers and U.S. postal workers. The bill would also end a second provision that reduces Social Security benefits for those workers’ surviving spouses and family members. The WEP impacts about 2 million Social Security beneficiaries and the GPO nearly 800,000 retirees.

The measure, which passed the House in November, had 62 cosponsors when it was introduced in the Senate last year. Yet the bill’s bipartisan support eroded in recent days, with some Republican lawmakers voicing doubts due to its cost. According to the Congressional Budget Office, the proposed legislation would add a projected $195 billion to federal deficits over a decade.

Without Senate approval, the bill’s fate would have ended with the current session of Congress and would have needed to be re-introduced in the next Congress.

CBS News

12/20: CBS Evening News – CBS News

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Saturday is the winter solstice and 2024’s shortest day. Here’s what to know about the official start of winter.

The 2024 winter solstice, the shortest day of the year, happens on Saturday, Dec. 21, in the Northern Hemisphere. The celestial event signifies the first day of winter, astronomically.

What is the winter solstice?

The winter solstice is the day each year that has the shortest period of daylight between sunrise and sunset, and therefore the longest night. It happens when the sun is directly above the Tropic of Capricorn, a line of latitude that circles the globe south of the equator, the National Weather Service explains.

The farther north you are, the shorter the day will be, and in the Arctic Circle, the sun won’t rise at all.

How is the day of the winter solstice determined?

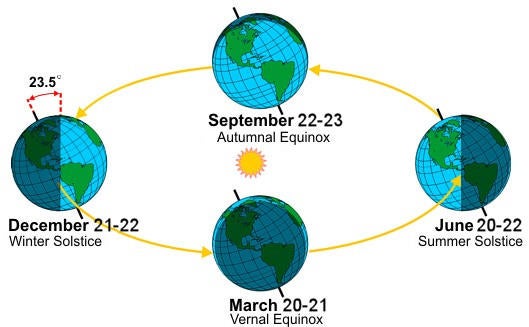

The winter solstice occurs because of the Earth’s tilt as it rotates around the sun.

When the Northern Hemisphere tilts away from the sun, the nights last longer. The longest night happens on the solstice because the hemisphere is in its furthest position from the sun. That occurs each year on Dec. 21 or 22.

This year, it falls on Dec. 21 at 4:21 a.m ET, to be precise.

On the summer solstice, when the northern tilt is closest to the sun, we have the longest day, usually June 20 or 21.

National Weather Service

The solstices are not always exactly on the 21st every year because the earth’s rotation around the sun is 365.25 days, instead of 365 even.

Will days start getting longer after the winter solstice?

Yes. Each day after the solstice, we get one minute more of sunlight. It doesn’t sound like much, but after just two months, or around 60 days, we’ll be seeing about an hour more of sunlight.

When will winter officially be over in 2025?

The meteorological winter ends on March 20, 2025. Then, spring will last until June 20, when the summer solstice arrives.

How is the winter solstice celebrated around the world?

Nations and cultures around the world have celebrated the solstice since ancient times with varying rituals and traditions. The influence of those solstice traditions can still be seen in our celebrations of holidays like Christmas and Hanukkah, Britannica notes.

The ancient Roman Saturnalia festival celebrated the end of the planting season and has close ties with modern-day Christmas. It honored Saturn, the god of harvest and farming. The multiple-day affair had lots of food, games and celebrations. Presents were given to children and the poor, and slaves were allowed to stop working.

Gatherings are held every year at Stonehenge, a monumental circle of massive stones in England that dates back about 5,000 years. The origins of Stonehenge are shrouded in mystery, but it was built to align with the sun on solstice days.

Andrew Matthews/PA Images via Getty Images

The Hopi, a Native American tribe in the northern Arizona area, celebrate the winter solstice with dancing, purification and sometimes gift-giving. A sacred ritual known as the Soyal Ceremony marks the annual milestone.

In Peru, people honor the return of the sun god on the winter solstice. The ancient tradition would be to hold sacrificial ceremonies, but today, people hold mock sacrifices to celebrate. Because Peru is in the Southern Hemisphere, their winter solstice happens in June, when the Northern Hemisphere is marking its summer solstice.

Scandinavia celebrates St. Lucia’s Day, a festival of lights.

The “arrival of winter,” or Dong Zhi, is a Chinese festival where family gathers to celebrate the year so far. Traditional foods include tang yuan, sweet rice balls with a black sesame filling. It’s believed to have its origins in post-harvest celebrations.

Researchers stationed in in Antarctica even have their own traditions, which may include an icy plunge into the polar waters. They celebrate “midwinter” with festive meals, movies and sometimes homemade gifts.