CBS News

Biden budget would cut taxes for millions and restore breaks for families. Here’s what to know.

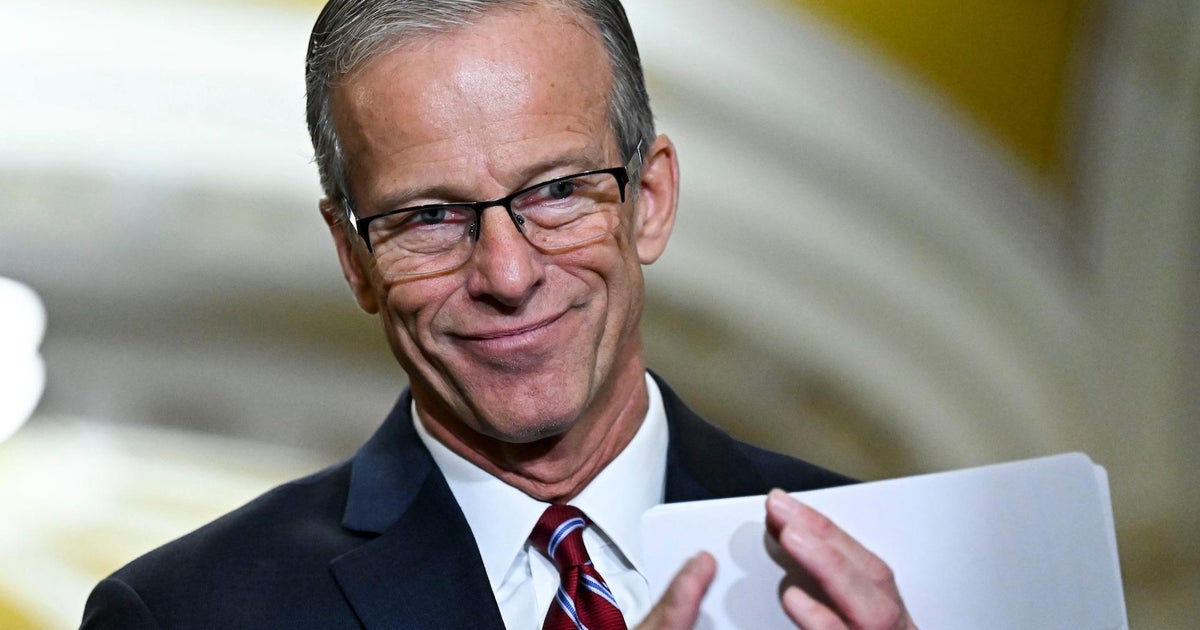

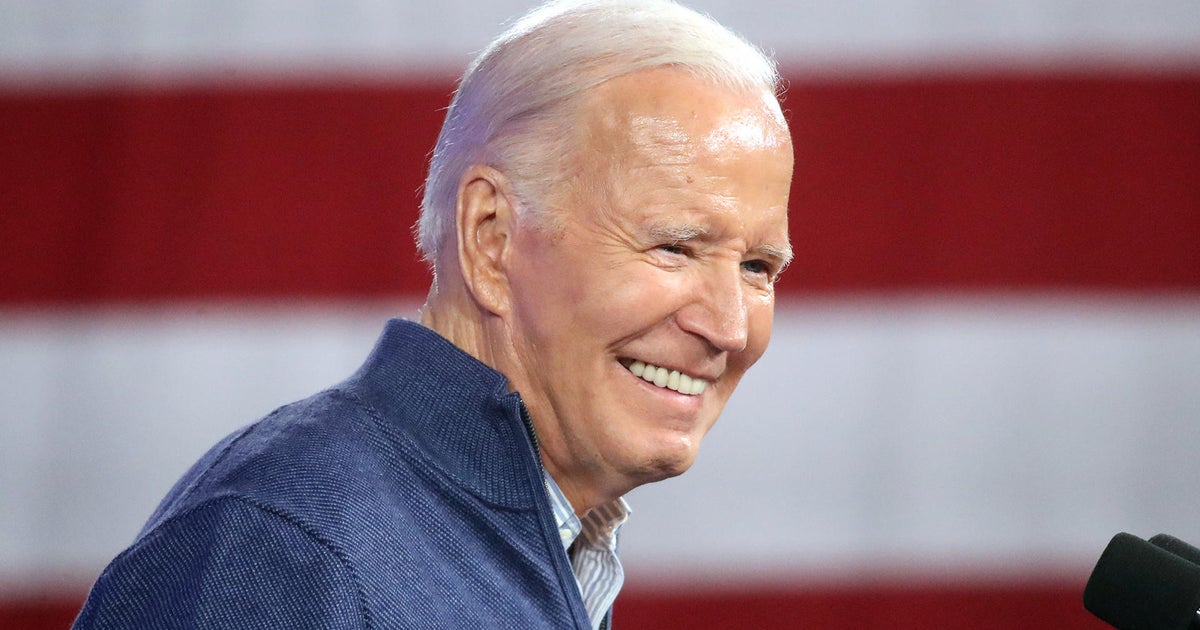

President Joe Biden’s proposed 2025 budget includes some perks for millions of families and low-income workers as well as senior citizens, including reviving a program that lifted millions of children out of poverty during the pandemic.

The budget, released Tuesday, aims to pay for those tax breaks by raising taxes on corporations and the rich. One proposal, for instance, would completely reverse one of the cuts implemented by former President Donald Trump, whose 2017 Tax Cuts and Jobs Act mostly eased the tax burdens on businesses and the nation’s highest earners.

The proposals to provide new tax breaks for low- and middle-income Americans come as many people continue to struggle with the higher cost of living. About 1 in 3 households say they don’t feel financially secure, according to a new study from Northwestern Mutual, which said that represents the highest share since it began its annual study in 2009.

Under Biden’s proposal, deficits would be trimmed by $3 trillion over a decade, with his new taxes raising $4.9 trillion. That new revenue would help pay for the tax cuts for low- to middle-income families and to reduce the deficit, the White House says.

To be sure, presidential budgets are only a wish list, and are crafted to underline the White House’s political goals and messaging. Meanwhile, the 2025 budget is highly unlikely to pass given Republican control of the House. Still, such budget proposals are meaningful in that that they outline Biden’s priorities, and the president would likely continue to press for these tax changes if he wins reelection in November.

Here are the tax policies in the White House’s proposed 2025 budget that could impact millions of Americans.

What is Biden proposing for the Child Tax Credit?

Biden’s budget would revive the expanded Child Tax Credit (CTC), which got a one-year overhaul during the COVID-19 outbreak.

The CTC isn’t a new tax credit — it’s been around since the 1990s. But as the nation struggled to emerge from the pandemic in 2021, lawmakers expanded the $2,000 credit to as much as $3,600. As part of that expansion, families received half of the CTC in monthly checks over six months, providing them with as much as $300 per child for each of those months.

That expanded tax benefit, which proved to be immensely popular with families, also helped lift millions of kids out of poverty. Once it expired in 2022, the poverty rate for children soared.

Under the Biden budget, the expanded CTC would be restored. Like in its pandemic form, the expanded credit would again provide $3,000 per child for kids six years and older and $3,600 for each child under six, instead of its current $2,000 limit.

Parents who qualify for the CTC would also again receive monthly checks from the IRS. Providing monthly checks represents “a more practical solution to ensure that families can receive relief when they need it most instead of in one lump sum at the end of the year,” the Treasury Department said Monday in a statement.

Currently, families receive the CTC once per year, when they claim it on their annual tax return. It’s typically reflected either in a tax refund or by reducing their tax liabilities.

How would low- and middle-income workers get a tax break?

Biden wants to expand the Earned Income Tax Credit, or EITC, a tax credit that is aimed at workers with incomes below about $64,000 annually. Under his proposal, more people without children and senior citizens could receive the credit.

In its current form, the EITC is mostly geared toward low- and middle-income families with children. For instance, workers without children can qualify for the EITC, but they are limited to a maximum credit of $600. By comparison, a family with three kids can get as much as $7,430, according to IRS rules.

The Biden plan also would expand the EITC to include more low-wage workers without kids, as well as older Americans. On average, the expansion would cut taxes by $800 each for 19 million individuals and couples who are working, the White House said. That would include 2 million workers over age 65 and 5 million adults 18- to 25-years-old, it added.

What other breaks would families and workers get?

Here are a few other proposals in the new Biden budget:

- Create a new program for families earning less than $200,000 that would guarantee affordable child care from birth until kindergarten. The White House said most families would pay $10 or less a day and that the program would help parents of more than 16 million kids.

- Create voluntary, free preschool for all 4-year-old kids.

- Provide $10,000 tax credits to first-time homebuyers and current homeowners in so-called “starter homes” that would help offset the cost of buying a home or selling their current property.

- Make permanent the expanded premium tax credits for people who buy health insurance through the Affordable Care Act’s marketplaces. The budget would also provide Medicaid-like coverage to people in states that haven’t adopted the Medicaid expansion.

How would Biden pay for these proposals?

The proposals would be paid for by higher taxes on high-income Americans and corporations, the White House said. The Biden administration stressed that no one earning less than $400,000 would face higher taxes, as the president has previously said.

These proposals include:

- Raising the corporate tax rate to 28%, compared with its current rate of 21% set by the 2017 Tax Cuts and Jobs Act. Prior to the TCJA, the corporate tax rate was 35%.

- Requiring billionaires to pay at least 25% of their income in taxes. People in the highest echelons of income earners can often pay lower rates than middle-income workers because they rely on capital gains and other earnings that enjoy lower tax rates than labor income. The White House said this tax would apply to people with wealth of more than $100 million.

- Increasing the highest individual income tax rate to 39.6%. That would effectively erase the tax cut that the nation’s top earners received under the TCJA, which reduced the top marginal rate from 39.6% to 37%. The Biden administration said the reversal would impact single tax filers earning more than $400,000 and married couples earning more than $450,00 per year.

CBS News

Trump makes more Cabinet picks but some top economic posts remain unfilled

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Open: This is “Face the Nation with Margaret Brennan,” Nov. 24, 2024

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Popular gluten free tortilla strips recalled over possible contamination with wheat

A food company known for popular grocery store condiments has recalled a package of tortilla strips that may be contaminated with wheat, the U.S. Food and Drug Administration said Friday. The product is meant to be gluten-free.

Sugar Foods, a manufacturing and distribution corporation focused mainly on various toppings, artificial sweeteners and snacks, issued the recall for the “Santa Fe Style” version of tortilla strips sold by the brand Fresh Gourmet.

“People who have a wheat allergy or severe sensitivity to wheat run the risk of serious or life-threatening allergic reaction if they consume the product,” said Sugar Foods in an announcement posted by the FDA.

Packages of these tortilla strips with an expiration date as late as June 20, 2025, could contain undeclared wheat, meaning the allergen is not listed as an ingredient on the label. The Fresh Gourmet product is marketed as gluten-free.

Sugar Foods said a customer informed the company on Nov. 19 that packages of the tortilla strips actually contained crispy onions, another Fresh Gourmet product normally sold in a similar container. The brand’s crispy onion product does contain wheat, and that allergen is noted on the label.

U.S. Food and Drug Administration

No illnesses tied to the packaging mistake have been reported, according to the announcement from Sugar Foods. However, the company is still recalling the tortilla strips as a precaution. The contamination issue may have affected products distributed between Sept. 30 and Nov. 11 in 22 states: Arizona, California, Colorado, Florida, Georgia, Iowa, Idaho, Illinois, Indiana, Maryland, Maine, Michigan, Minnesota, North Carolina, New Jersey, Ohio, Oregon, Pennsylvania, Texas, Utah, Virginia and Washington.

Sugar Foods has advised anyone with questions about the recall to contact the company’s consumer care department by email or phone.

CBS News reached out to Sugar Foods for more information but did not receive an immediate reply.

This is the latest in a series of food product recalls affected because of contamination issues, although the others involved harmful bacteria. Some recent, high-profile incidents include an E. coli outbreak from organic carrots that killed at least one person in California, and a listeria outbreak that left an infant dead in California and nine people hospitalized across four different states, according to the Center for Disease Control and Prevention. The E. coli outbreak is linked to multiple different food brands while the listeria outbreak stemmed from a line of ready-to-eat meat and poultry products sold by Yu-Shang Foods.